What is Aadhar PAN link deadline?

The deadline or last date to link

Therefore, now 30.06.2023 is the last date to link your aadhar with pan card. If you see this page on a later date then your aadhar pan link and the last date must have already gone. So, first of

Is aadhar linking is mandatory or not?

Aadhar linking to pan card is mandatory for filing your Income tax return and other purposes like opening a bank account. Also, the bank may put a restriction on withdrawals and depositing money, if the PAN is not valid. According to the order dt.30.06.2018 and Section 139aa of the Income Tax Act, 1961 of Central Board of Direct Taxes, it is mandatory to link the Aadhaar-PAN, where PAN card holders requiring to file the income tax return.

About Linking Process

Still not linked your aadhar card with Pan card ?

First, we check the status of your pan card whether it is linked or not. Thereafter, if the aadhar is not linked with pan card then we see how to connect it online.

Aadhar PAN Link Status Check

It takes less than 30 seconds to check your

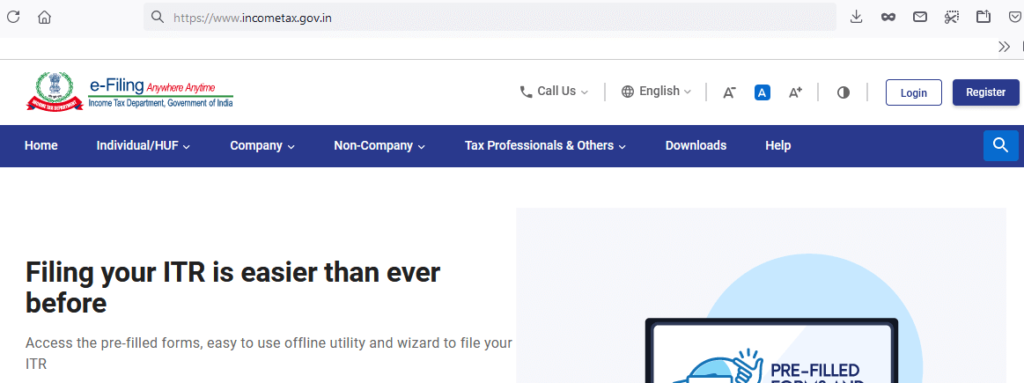

- Type https://www.incometax.gov.in in your internet browser and hit enter

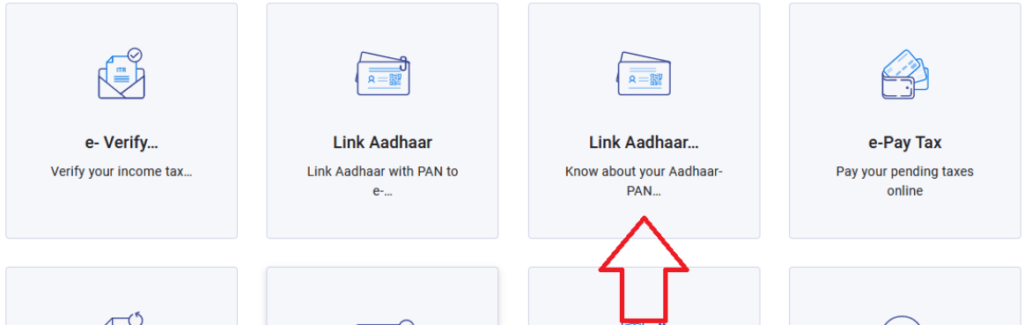

2. Click on Link Aadhar as shown below

3. On the Next Screen Enter your 11 digit PAN(Permanent Account Number) as it appears on the PAN card.

3. Enter your 12 digit Aadhar Number as it appears on Aadhar Card.

4. Click on “View Link Aadhar Status”

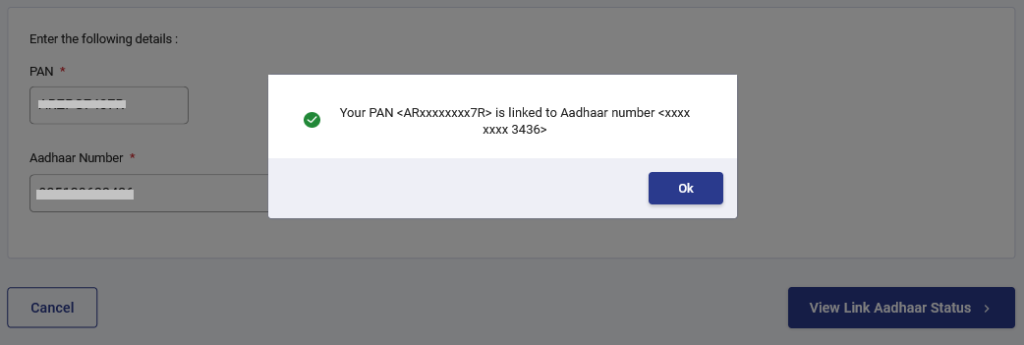

That’s

However, if aadhar is not linked with PAN then you will see “not linked” message. You can follow below steps to connect “Aadhar link to PAN Card” in just 5 minutes.

Aadhar Link to PAN Card Online

Please follow these fast steps to link your aadhar card with PAN on the new efilng portal. Thus, you will have aadhar linking to PAN card in no time. Similarly, linking process without login is now possible. Kindly ensure that you have valid PAN, Aadhar Number and Active mobile number before proceeding to these steps.

1

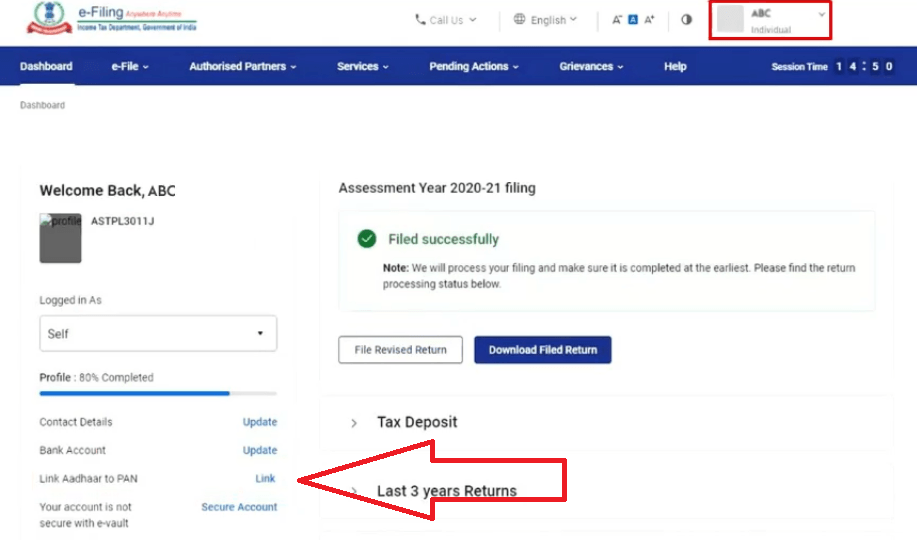

2. Click on “Login” button and sign in into your account.

3. You will see an option “Link Aadhar to PAN” on your dashboard. You can also find this link by clicking on “My profile” link.

4. After Clicking on the link, enter the details like PAN, aadhar number, name as per aadhar, mobile number, date of birth as per PAN, gender as per PAN, etc.

5. Click to select option “I have only year of birth in Aadhar Card“, only if you have only year of birth in your Aadhar Card. If you complete date of birth, you should not select this option.

6. Click on “I agree to validate my Aadhar details“(Mandatory)

7. Click on “Link Aadhar” button.

8. You will receive 6 digit OTP on your mobile. Enter the OTP and Click on Validate button. If you are following the linking process after login then you will not be asked for OTP. This is only if you are performing the linking process without login into the efiling portal.

You will see a success message, that your aadhar will be successfully linked with PAN.

Unable to Link?

In few cases where Aadhaar name is completely different from the name in PAN, then the linking aadhar with PAN will fail. Also, the system will prompt you to change the name in either Aadhaar or in PAN database. You may refer our article to understand the meaning of ” PAN not matched with CBDT” database.

If you face this error you may have to either change your name in Aadhar card or in PAN card to resolve Aadhar linking issue with PAN.

Adhar & PAN Related Articles

New Income Tax portal Login

Visit the new income tax portal at www.incometax.gov.in and link your aadhar with PAN in simple and easy steps. Know more about www.incometax.gov.in

How to open aadhar card password?

Have you downloaded the aadhar card in pdf format and want to know how to open it?. Check it out here more about aadhar password.

How to download aadhar card?

Learn how you can download your registered aadhar card online. Here is the step-by-step process for getting your aadhar card.

Aadhar Card Status checking online

Applied for Aadhar Card?. Here is the step-by-step process to check your existing adhar status by mobile number.