This is the multi-bank home loan EMI Calculator. By using this simple and easy EMI calculator, you can find the interest payable on your home loan. GST India New’s EMI calculators support various banks’ calculations like SBI, HDFC, ICICI, Axis, LIC, and more. You have to enter the principal loan amount that you require and the rate of interest charged by your bank. That’s it, our Home loan EMI calculator will give you the breakup of total interest and the monthly EMI payable to the bank.

SBI Home Loan & EMI

This is the quick and handy guide for availing SBI home loan. The state bank of India has a bucket of various schemes for home loans. This includes SBI Regular Home loan, Balance Transfer Home loan, NRI home loan, Flexipay home loan, Privilege home loan, and the list long.

How to make a Home loan calculation?

Calculating a home loan involves determining the monthly payments, total interest paid over the loan term, and total repayment amount. Here’s a basic overview of how to calculate a home loan:

- Gather Loan Details: You’ll need the following information:

- Loan amount (principal)

- Interest rate (annual)

- Loan term (number of years)

- Calculate Monthly Interest Rate: Convert the annual interest rate to a monthly rate by dividing it by 12. For example, if the annual interest rate is 6%, the monthly interest rate would be 6%/12 = 0.5%.

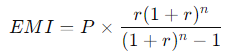

- Calculate Monthly Payment (EMI): Use the formula for calculating the Equated Monthly Installment (EMI):

- P = Loan amount (principal)

- r = Monthly interest rate (decimal)

- n = Loan term in months

- Calculate Total Interest Paid: Multiply the monthly payment by the total number of payments and subtract the principal amount. The result will be the total interest paid over the loan term.

- Calculate Total Repayment Amount: Add the principal amount to the total interest paid to find the total repayment amount.

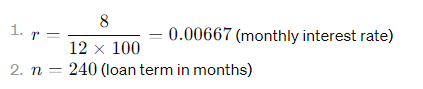

Let’s go through an example: Suppose you take out a home loan of ₹50,00,000 (principal) at an annual interest rate of 8% for a term of 20 years (240 months).

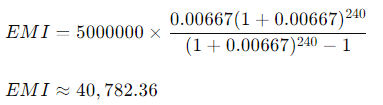

Plugging these values into the EMI formula:

So, the Equated Monthly Installment (EMI) would be approximately ₹40,782.36.

To calculate the total interest paid and the total repayment amount, you’d multiply the EMI by the total number of payments (240) and then subtract the principal amount (₹50,00,000).

Finally, you’d add the principal amount to the total interest paid to find the total repayment amount.

Keep in mind that this is a simplified calculation, and actual loan terms may vary based on factors such as compounding frequency, prepayment options, and processing fees. It’s always a good idea to consult with a financial advisor or use online loan calculators for more accurate results.

Eligibility for SBI Regular Home loan

In order to apply for an SBI Home loan, the applicant must be Resident Indian, Minimum Age should be 18 years and

The maximum is 70 years. The Loan Tenure can be up to 30 years. You can find out more about the eligibility from here.

Rate of interest on SBI Home loan

The SBI has announced a concessional Rate of Interest for the period from 01.01.2022 to 31.03.2022. Thus, the rate of interest of SBI starts from 6.70% onwards with a CIBIL score of > =750. The processing fees seem to be nil for approved projects.

Also, see >> Car loan EMI calculator

Documents required for SBI Home loan

Here is the list of possible required documents to be kept ready before applying for the SBI home loan.

List of documents applicable to all applicants:

- Employer Identity Card

- Loan Application: Completed loan application form duly filled in affixed with 3 Passport size photographs

- Proof of Identity (Any one): PAN/ Passport/ Driver’s License/ Voter ID card

- Proof of Residence/ Address (Any one): Recent copy of Telephone Bill/ Electricity Bill/Water Bill/ Piped Gas Bill or copy of Passport/ Driving License/ Aadhar Card

Property Papers:

- Permission for construction wherever applicable

- Registered Agreement for Sale (only for Maharashtra)/Allotment Letter/Stamped Agreement for Sale

- Occupancy Certificate in the case of ready to move property

- Share Certificate (only for Maharashtra), Maintenance Bill, Electricity Bill, Property Tax Receipt

- Approved Plan copy (Xerox Blueprint) & Registered Development Agreement of the builder, Conveyance Deed For New Property

- Payment Receipts or bank A/C statement showing all the payments made to Builder/Seller

Bank Account Statement:

- The bank statemnet of Last 6 months for all Bank Accounts held by the applicant/s

- Loan A/C statement for last 1 year, If any previous loan from other Banks/Lenders

Income Proof for Salaried Applicant/ Co-applicant/ Guarantor:

- Salary Slip or Salary Certificate of last 3 months

- Copy of Form 16 for last 2 years or copy of IT Returns for last 2 financial years with due acknowledgement by Income Tax Deptartment.

Income Proof for Non-Salaried Applicant/ Co-applicant/ Guarantor:

- Business address proof

- IT returns for last 3 years

- Balance Sheet & Profit & Loss A/c for last 3 years

- Business License Details(or equivalent)

- TDS Certificate (Form 16A, if applicable)

- Certificate of qualification (for C.A./ Doctor and other professionals)

How to apply for SBI Home loan?

You can apply for the SBI home loan online from their website link > Apply Now