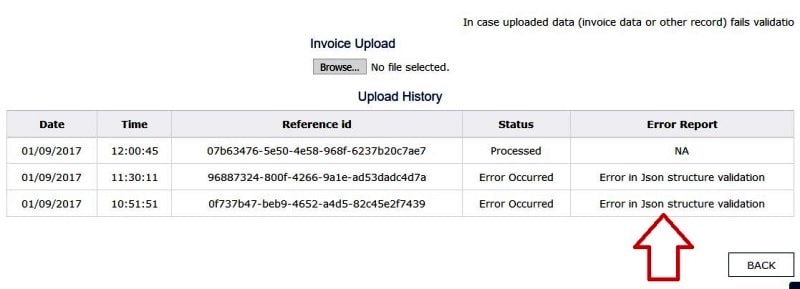

Many of you must have received the below error “Error in Json structure validation” while uploading Json file on GST portal. This error signifies that the structure of Json file, where in you have inserted the data is not generated as per the requirement of GST portal.

Solution:

1) First of all Download the latest utility from the GST portal related to your particular GST return.

Utility for GSTR – 1 & GSTR 2 Return

Utility for GSTR 3B Return

Utility for GSTR 4 Return

Utility for ITC 04 Return

2) Extract the utility and Install the GST offline tool.exe.

3) Open your excel return template and fill in all the required data.

4) Open the offline tool, select import files and import your excel return file.

5) if you still get error then next alternate option is to “select Section” under import Excel and then choose to “Copy Excel”.

6) After clicking on “Copy excel” another window will open, wherein you have to copy your whole section of that particular return and paste in the above window. Please note that you must copy the headers also of that particular section from your excel template.

I hope the above solution will resolve the issue. If you still face this error, please leave a comment below and we will try to resolve it further from our side.

DO Not Edit JSON File Manually

If you are manually opening and editing the JSON file, you will face a similar error. Therefore, follow the above procedure to correct your data in the uploaded JSON file rather than modifying the JSON manually. Here is the official video from GSTN.

Related Links:

privacy and security https://127.0.0.1:1585 – Solved

If you find the error “Failed to establish a connection to the server. Restart emsigner when signing in your GST return or application to DSC, then try the following. more

GST Return filing Due dates Extension

Are you filing your GST returns on time?. If not check out here to know when to file your GST returns. Do not ignore filing GST returns on time. more

GST Number Search and verify

The GST number of your customer and vendor plays a very important role in the GST system. You must ensure the number given to you is correct. more

GST Annual Return Filing steps

As a GST registered person, your frequent question will be how to file GSTR9 online. There is a complete step-by-step guide to filing your GSTR9 annual return under GST. more

Can I take Input Tax Credit in GST Guide

Know about the Input Tax Credit system in GST before you avail of GST credit on all your goods and services. more

I am trying to submit my uploaded Excel file of GSTR1 and I am getting the message that “your submit request is received, please check your status after some time”. However, even after 3 hours, it is not submitted. Please help.

yes ..facing same problem..any 1 with a solution?

When we are filling up the online HSN summary of inward supplies in GSTR2, it shows “error in json structure validation”

How to resolve it and submit the return, please advise.

Try downloading and installing New GST offline tool from GST portal

When we are filling up the online HSN summary of inward supplies in GSTR2, it shows “error in json structure validation”

kindly advice me.

when we are filling up the online HSN summary of inward supplies in GSTR2, it shows “error in json structure validation”

kindly advice me.

When we are filling up the online HSN summary of inward supplies in GSTR2, it shows “error in json structure validation”

How to resolve it and submit the return, please advise

Please send reply urgent for HSN Summery in GSTR2

Please always download latest offline utility form GST portal to generate Json File. if still doesn’t work then its better to enter the data in online mode till the error gets resolve From GSTN.

we have more than 500 invoices then how is it easy to enter on online mode.

Mr. kumar, well in that case its difficult. “error in json structure validation” means your offline utility does not generate the compatible json file to match with the GSTN system after uploading. The possibilities can be you need to download latest utility or you need to check the system requirement before proceeding with data entry in offline utility.

When we are filling up the online HSN summary of inward supplies in GSTR2, it shows “error in json structure validation”

kindly advice me.

We are trying to upload json file for ITC04 return, but always it gives error of “Error in Json structure validation in GST ITC04 Return”

Please guide us to file the same.

Vishal, we have updated latest offline utilities in above article. kindly download form the above link and let me know.

0eadf2c3-7352-45da-bcd7-8b48732a414a Error Occurred File could not be uploaded! Download the latest version of Offline tool to generate the JSON file or ensure to validate your uploaded file against the template published at Specification Portal.

For which return you are facing this issue?

i am face query for uploading of itc04 return showing query of “json stracture validation error.

Iam facing query in uploading itc04 return on gst portal “json file strcture validation error.

please do following:

1.download fresh utility from above link.

2.Validate all sheets before generating json

3.do not direct copy and paste data in excel utility. Instead copy and paste as values in utility.

Let us know if you still face issue.

Sir,i m paste as value in itc 04 but same error occured.

There is no option to copy excel in ITC-04, we are using version 2.0, still it is showing as JSON structure validation

Try the updated version now and let us know.

i am trying to submit the ITC 04 Jan to march qtr but error show there is some error pls upload again.

– Try downloading latest utility, enable macros. if your are copying data from other software/excel and pasting into itc 04 utility then do not directly paste it. instead paste as special and then select text. let us know if you still get error .

after downloded new utitity same error occur

Hi Deep.. which utility are you downloading..if it was ITC4, than please try downloading again the new utility, we just updated the link.

Please download this utility..Click here to download

This error is repeatedly occuring in GSTR-6 while trying to upload the Json file into the portal. Plz help. Even if i am trying to generate using the latest utility, it is generating a Runtime error. Any Ideas?

hi

i am trying to upload itc 04 but we got the same error such as Error in json structure validation.

as i was used to updated file and used only paste special then also that error was came.

please help me

Hello Suresh

Thanks for writing. Please read ReadMe.txt file in the utility after extracting. you may be facing any issue mentioned in the said file.

Where do we get this ReadMe.txt file , I am not finding the same.

Please Help. Its urgent.

Hello Madhav

Readme.txt file does not exist in all tools. Which tool are you downloading? and why you need readme.txt? let me know so that i can help you out.

I am trying to upload the GSTR3B JSON file from Tally ERP 9.

Upon uploading in GST portal, it is showing the following error.

19/02/2019 16:06:18 3a6abba8-925c-45f1-ac3e-8634f49ae216 Error Occurred Error in Json structure validation. If error persists quote error number RT-SCVU101 when you contact customer care for quick resolution.

There are no mismatch in Tally file.

I contacted the Tally Help but they could not do it.

Request kindly help.

Hello Mr. Singh

Please check to see if any tally updates are available, ensure that you have latest tally version before generating json from tally.

ITC4 OCT-DEC 2018 PERIOD , “json stracture validation error.” WHILE UPLOADING THE OFFLINE JSON FILE.

We are using latest offline xl tool 2.2 to generate as json file . it is a valid json file. but we are not able to upload to gstn portal . pl help. it is urgently required.

Please let me know the error description..

My B2B invoices are not able to upload in GST portal.”JSON Structure Validation” this error message is coming in portal. I am using latest offline utility but it does not identifies any error in my .csv file and the same is uploaded in tool also.But the jason file converted by the utility is showing error in portal.kindly help to resolve this

HI, I hope you have downloaded the latest offline tool from the GST portal only. Secondly, ensure below things are followed.

1. macros are enabled in excel file if you are preparing with excel.

2. Do not copy & paste the data in excel utility directly instead right click and paste special >> Values

If you are still facing issues, let me know with which type of return you are having issues with and are you facing this issue first time?

Thanks.

We are trying to upload json file for ITC04 return, but always it gives error of “Error in Json structure validation in GST ITC04 Return”

Please guide us to file the same.

Hi Shubham,

The said error means there are errors in the data you entered in offline mode. kindly see you have downloaded the latest utility and not using the old one. Also, ensure macros are enabled after opening the file.

regards

hello sir, i am facing some issue while uploading itc-04, when i am uploading itc04 json file, its shows some error, after that i downloaded the error report and then after correction, when i am trying to upload json again, its shown error that challan no already exist, but it is not updating tha data on portal, in faq its mention that, when you upload json again, its update their existing data as well as upload new data

Hi Shubham,

It might be possible that your new json file generated have errors, hence the previous file does not get update on the GST portal. kindly choose prepare online option and try entering the details manually and see if that helps.

regards

Showing error as Schema Validation failed after uploading gstr 7 json file, but file is absolutely ok because it is showing summary also, please give your advise

hi,

please download the latest offline utility from the GST Portal, if you are using the old one. Also, ensure to enable all the macros in the excel while entering the data. Similarly, do not copy paste the data directly, instead paste as values. I hope this will help.

regards

I’m uploading GSTR-6 (ISD) and the error appears “Json structure validation failed”. Its continuously appears.