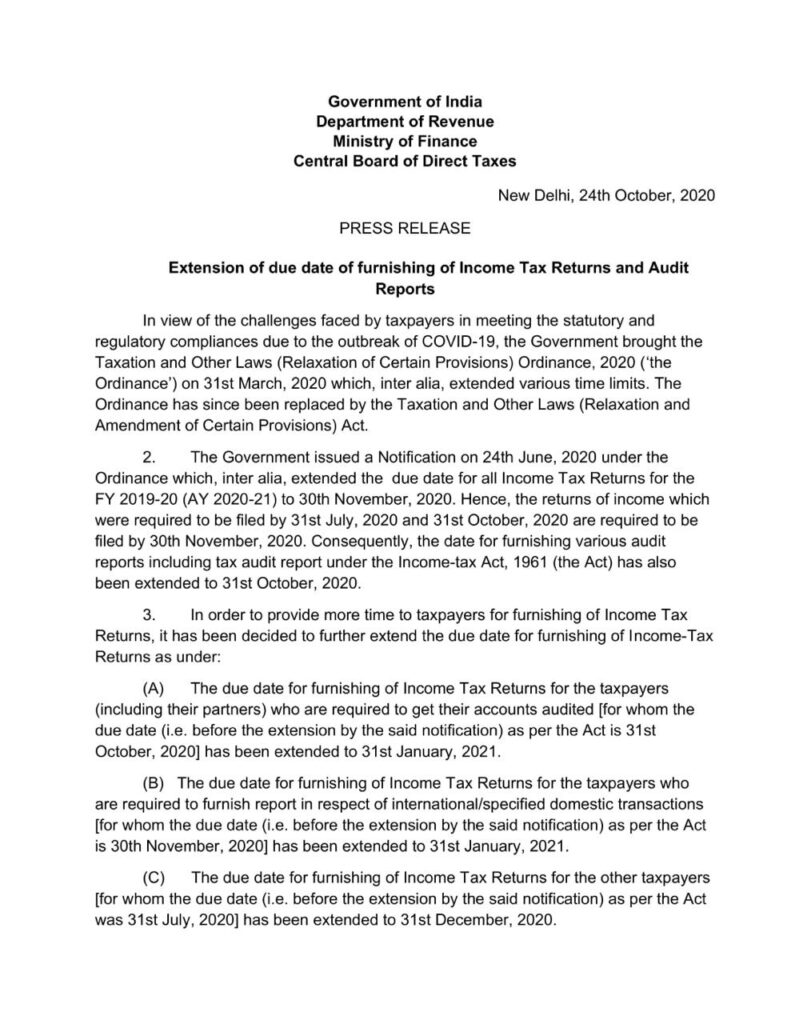

24.10.2020: Due to Covid Situation in the country, CBDT further extends the due dates for various compliance of FY 2019-2020. It includes Tax Audit Extension Date till 31st January 2021.

- The due date for filing income tax returns for taxpayers who need an accounts audit is 31 January 2021.

- Due date for filing ITRs for taxpayers submitting reports on international/specific domestic transactions is 31 January 2021.

- Income Tax Return due date for other taxpayers is 31st December 2020.

- Submission date of various audit reports, including tax audit reports and reports on international/specific domestic transactions, is now till 31 December 2020.

Here is the press release copy for more details.

Read Income Tax Return Filing & Due Date

Income Tax Update: Extension of Tax Audit Report Due date For AY 2018-19

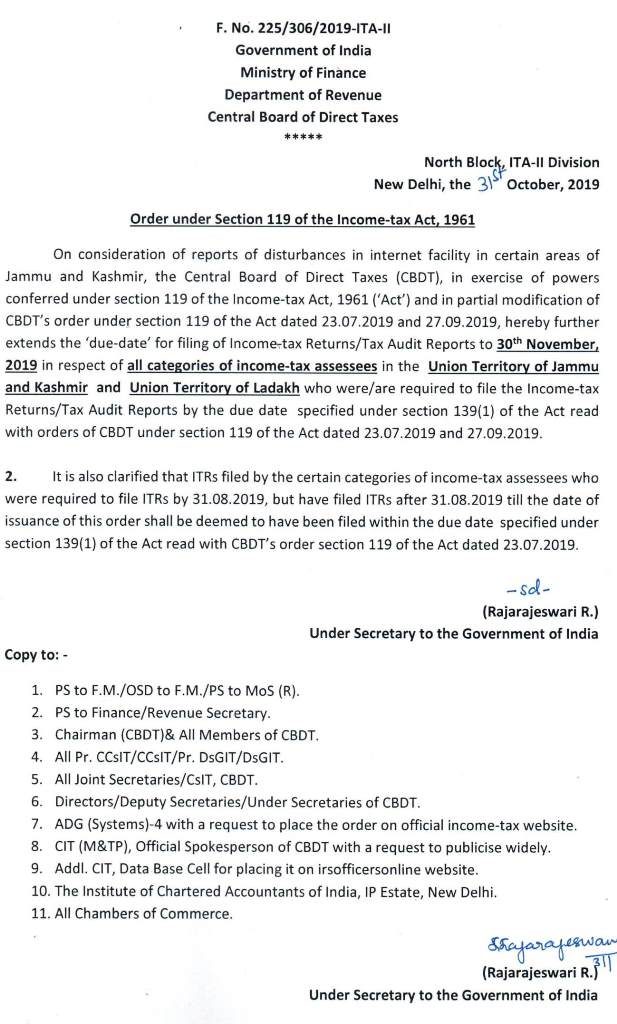

01.11.2019: The income tax returns/Tax audit reports get a further extension till 30.11.2019 for specific districts. This is applicable to all categories of income tax assesses.

However, the above extension is applicable only in the union territory of Jammu and Kashmir and Ladakh. Also, if the assesses have already filed the returns as on 31.10.2019 then it is deemed to be filed. Below is the official notification from the Ministry of Finance.

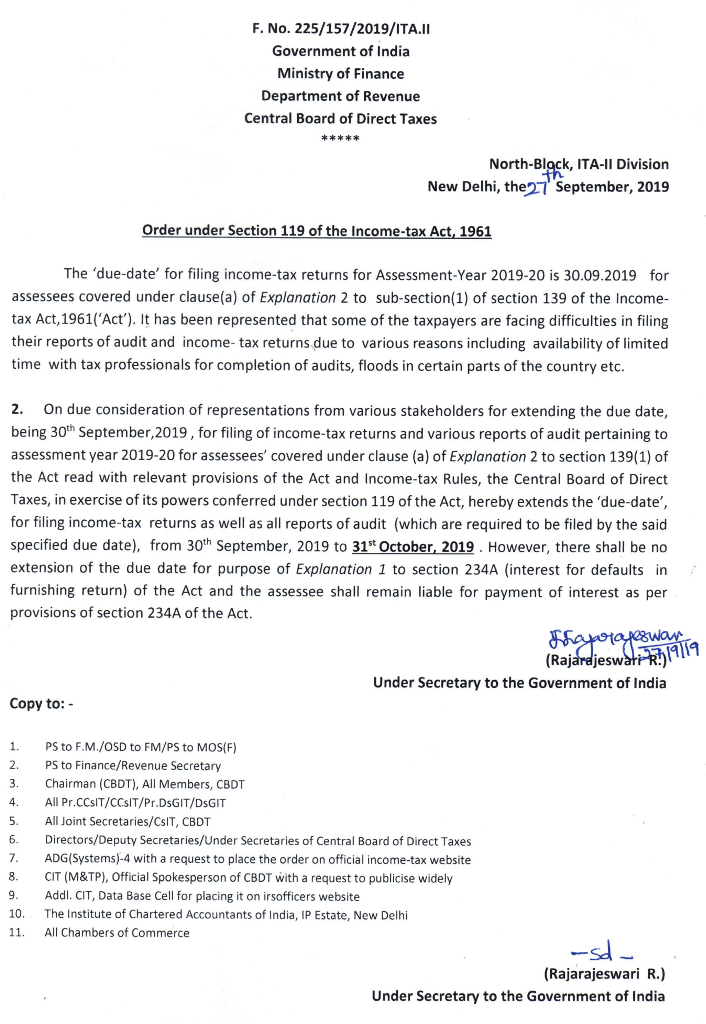

27.09.2019: The Central Board of Direct Taxes has extended the due date for filing of ITRs & Tax Audit Reports from 30th September 2019 to 31st of Oct,2019. This is in respect of persons whose accounts are required to be audited.

The earlier due date of filing was 30th September 2019. Here the official tweet from the Income Tax Department.

Here is the official income tax audit due date extension notification.

Since now the income tax audit due date is extended from 30.09.2019 to 31st October 2019, taxpayers get an additional 1 month to file the report.

The due date is extended because of various representation received from th