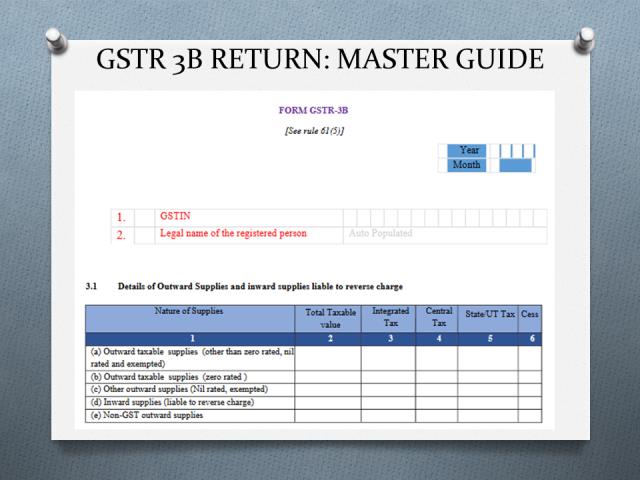

The GSTR 3B is a monthly summary of outward sales including taxable and non-taxable. Thus, it includes the summary of the various input tax credit, late fees, interest payable if any, and payment details of liabilities paid for the given tax period.

Further, the details of outward supplies declared in GSTR3B must match with the details of outward supplies declared in GSTR 1 Return. However, there are no details to be submitted of the input tax credit shown in GSTR 3B. But one needs to be sure that the ITC declared in GSTR3b is correct in all aspects.

Quick Navigation Index

- Introduction

- Due date of Filing >> New Dates

- Excel format >> pdf format download

- Late fees >> Revision of Return >> Amendments

- Online Filing steps >> Video >> Offline Filing

- Nil Return Filing >> Filing through SMS >> >>Conditions >> Mistakes to avoid

- FAQ >> Other Important Links

Due Date of Filing

The due date or the last date of filing GSTR 3B is the 20th of succeeding in the tax period. For eg., the return for the month of November 2022 shall be filed on or before 20th December 2022. However, the government may extend the last date of filing as and when required in certain conditions.

Further, the taxpayer needs to make the tax payment and file the return on the date of filing. One can not file the return without making the tax payment.

Read: GST Return Due Dates

Excel format Download

The GSTR 3B Excel format is exclusively provided by the GSTN. Therefore, one must download the excel format from the GST portal to prepare the return in offline mode. However, you may download the offline utility from the below link. The offline utility contains the excel format which you require to prepare the return in offline mode.

In order to use the Excel format, you must extract the downloaded file using Winzip or Winrar extractor.

Pdf Format Download

Download the PDF format of GSTR 3B from the below link. This pdf format is an extract of GST rules. Thus, you can use the pdf format for your reference purpose.

Late Fees for GSTR 3B

The late filing fee for GSTR 3B is Rs. 50/- per day. For e.g, the last date for filing a return is 20th November 2022 for the month of October 2022. You filed the return on 25th November 2022. This, there is a delay of 5 days. Hence, you need to pay Rs. 250/- as late fees.

However, if the return is ‘Nil’ then the late fee per day is Rs. 20/-. This has reference to notification no. 64/2017 dt.15.11.2017.

GSTR 3B late fee waiver scheme

The government has brought many times a late fee waiver scheme for GSTR 3B. You may check out our late fees chart to know more details.

GSTR 3B Revision

The taxpayer can not revise the GSTR 3B return after its filing. Thus, if you have committed any mistakes in the past returns filed then you should adjust such changes while filing the next period’s return.

Amendment of GSTR 3B

The taxpayer can not amend the return after filing. Thus you need to rectify any errors of past returns filed in the next return.

GSTR 3B Return Online Filing Steps

The regularly registered taxpayer is required to file GSTR 3B monthly. The current due date for filing the return is the 20th of next month immediately after the preceding month of the tax period. This post will explain how to File the return online on the GST portal. We follow step-by-step procedures so that it will become easy to understand in a better way. Let us see the detailed steps to File GSTR 3b return online:

1. Open your browser and visit www.gst.gov.in website > Login with your registered user name and password.

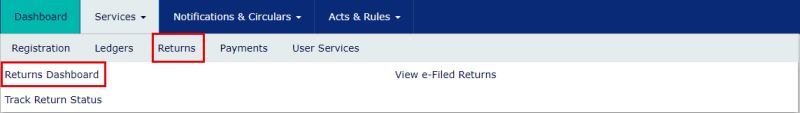

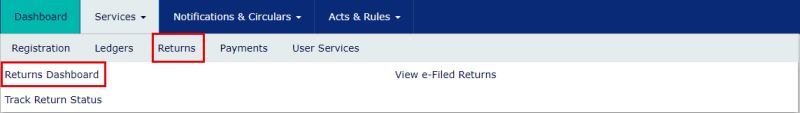

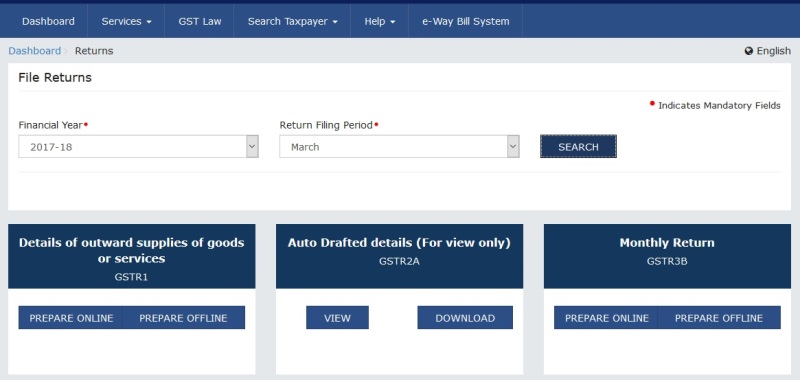

2. Click on Services > Returns > Returns Dashboard

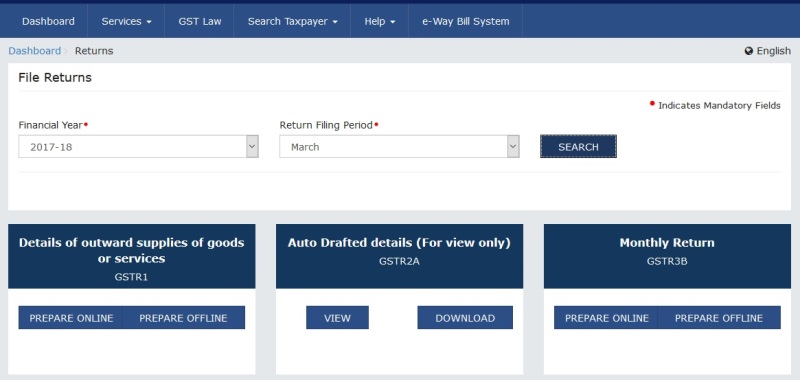

3. Select the Financial Year & Return Filing Period from the drop-down list > Click the search

4. Select the Financial Year & Return Filing Period from the drop-down list > Click the search

5. Click on PREPARE ONLINE

Option to select NIL Return Filing

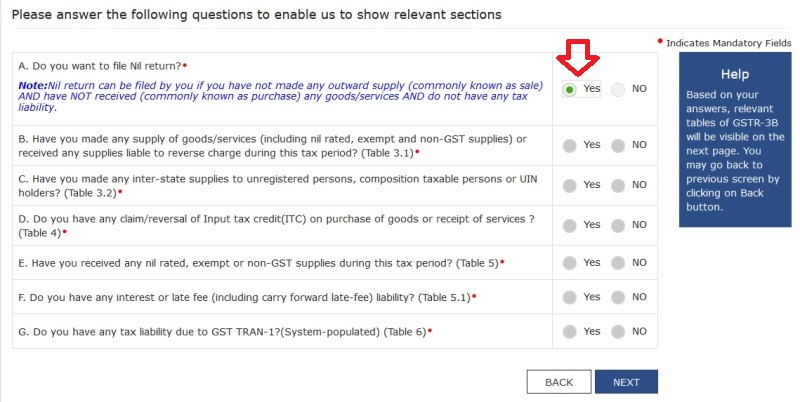

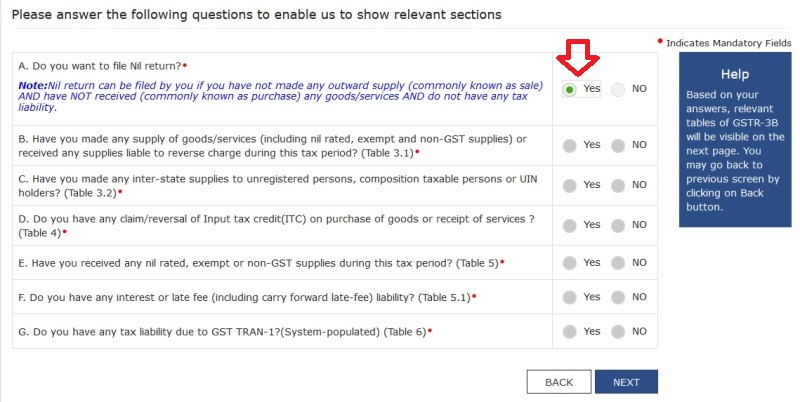

6. The below window will open. If you want to file a NIL return then select yes and click next.

7. If you do not want to file a NIL return then click NO. After selecting NO you have to answer the rest options. You will get to fill in data only for the selected options. Don’t worry you can change it later on also if you did not select any option. After selecting options > Click Next.

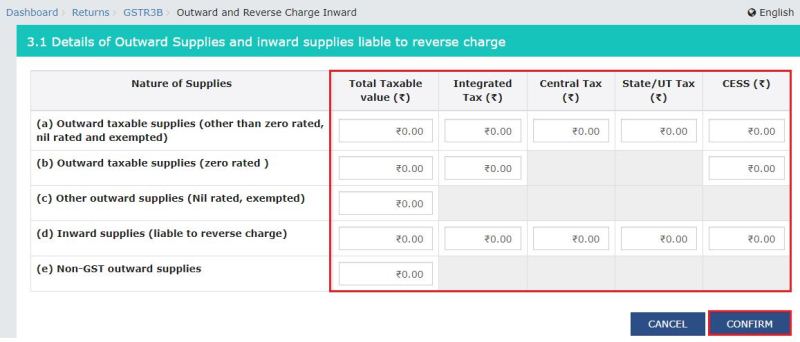

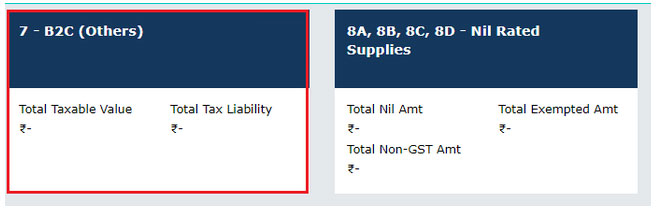

8. On the basis of your previous selection, all the tiles will be available on the screen. you need to click on each tile and fill in the details. for eg., we take Tile 3.1 – Tax on outward and reverse charge supplies.

9. click on the below tile > Enter the Taxable Value, and Type of Tax on each line if required.

10. Fill in the details > Click Confirm

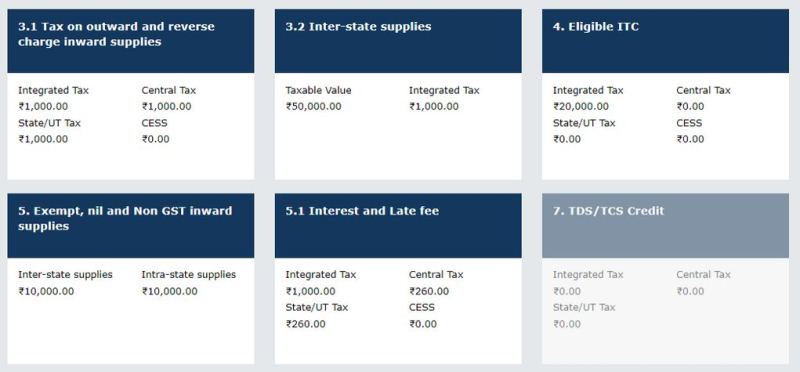

11. Once you are sure of the accuracy of the details > Click on SAVE GSTR 3B tab.

12. After filling in details in all required tiles as above, click PREVIEW DRAFT GSTR -3 tab to check your filled details.

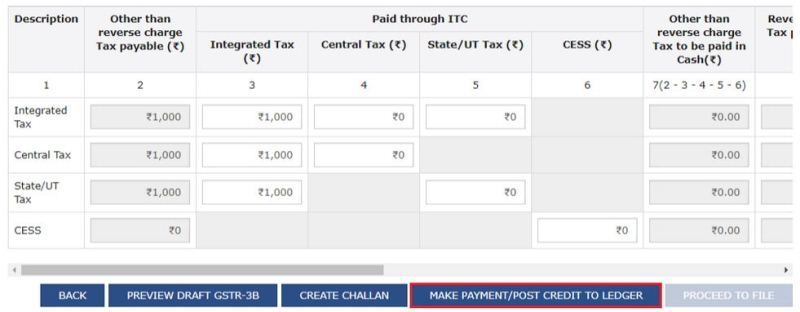

13. Click on PROCEED TO PAYMENT tab to set off the liabilities.

14. Set off your liabilities with available ITC. If ITC is not enough to meet your liability you must deposit in your cash ledger to have enough balance. Click below to know Utilization/set off tax liabilities:

Through ITC Through Cash

15. Once you settle your liabilities > Click on to FILE RETURN tab.

GSTR 3B Online Filing Video

Below is the official video of GSTN explaining how to file GSTR 3B online. This includes preparation of GSTR3b, Creating Challan, payment of challan, submission, and file Return.

GSTR 3b Offline Filing Procedure

This is a step-by-step guide to filing GSTR 3B offline on the GST portal by using GSTR 3b offline uploader tool. Thus, this procedure will make your GSTR3b offline filing easy. In order to fill the data in return in the offline mode, you do need an internet connection or the GSTN site to work.

Similarly, you will need an internet connection only when you finish your below process and are ready to upload your saved data in an excel file. Therefore, kindly follow the below steps to File GSTR3b and return offline by using your desktop computer/laptop.

In order to file GSTR 3B offline, you need to download the Excel utility provided by GSTN. (Download from here)

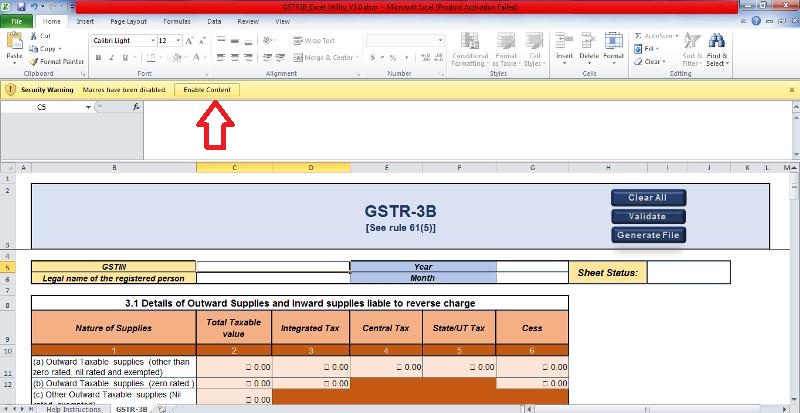

- Open your downloaded excel utility namely called GSTR3B_Excel_Utility_xx.x.xlsm

2. Click the Enable Editing/Enable content button in the excel sheet.

3. There are two sheets in this file. 1st sheet contains Help Instructions and 2nd one is GSTR-3 wherein you need to fill in your details.

4. Enter your 15-digit GSTIN, Legal name, Select Tax period year, and month from the drop-down list.

Table 3.1 down. – Details of Outward Supplies and inward supplies liable to reverse charge

5. Enter the taxable value in front of “Name of supplies”, > Enter Integrated Tax if the outward supplies are interstate. If the supplies are intra-state then enter Central Tax, State Tax/UT tax, and cess if applicable.

6. Similarly, fill up all rest rows in the said table if required as per your type of outward supplies.

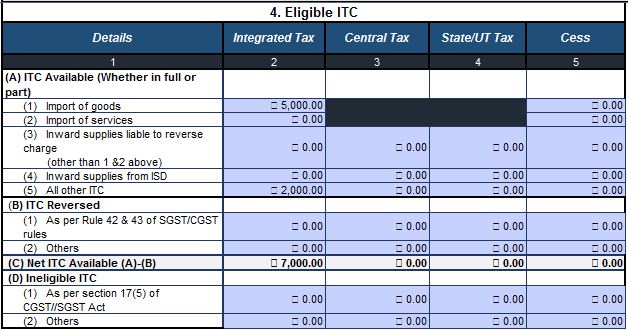

Table 4 – Eligible ITC (Input Tax Credit)

7. Enter ITC availed on import of goods, and import of services. Use the “All other ITC” field to enter the ITC availed from above.

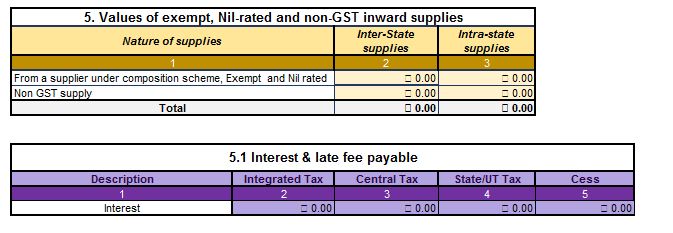

Table 5 – Values of Exempt, Nil rated, non-GST inward supplies

8. Enter values of Exempted supplies, nil-rated supplies, and non-GST inward supplies.

Table 5.1 – Enter details as applicable in Table 5.1 Interest & late fee payable. You need to enter only the interest amount.

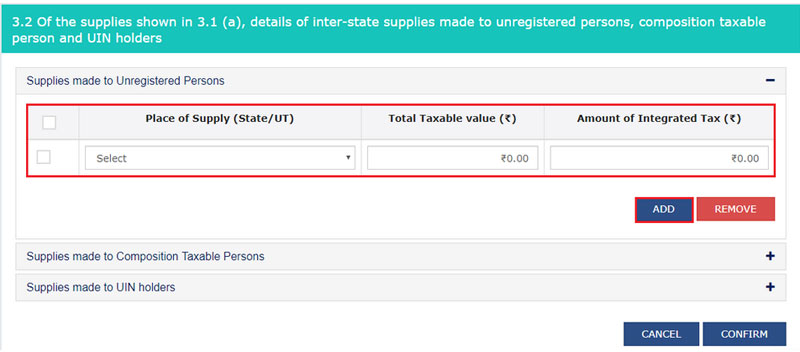

Table 3.2 Of the supplies shown in 3.1 (a), details of inter-state supplies made to unregistered persons, composition taxable persons, and UIN holders

9. Enter details of inter-state supplies if made to an unregistered person, composition taxable person, and UIN holder. (These are only details of tax liability included in table 3.1 (a) and not an additional liability)

10. After entering all the details, click the Validate button to validate the GSTR-3B worksheet.

11. A pop-up message will be displayed that the sheet is validated and you can proceed to generate the JSON file. Click the OK button.

12. Upon successful validation; click the Generate File button to generate JSON for upload on GST Portal.

13. A confirmation message will be displayed that the JSON file has been generated on your desktop. Click the OK button. (the system will generate the JSON only if the worksheet is valid.)

14. A folder GSTR is created on your desktop. Double-click the GSTR folder. You will JSON File created.

Upload Generated JSON on GST Portal

1. Now connect to the internet and Visit https://gst.gov.in/ URL.

2. Click the Services > Returns > Returns Dashboard command.

3. You will see the File Returns page. Further, select the financial year for which you want to file the return from the drop-down list.

4. In the Return Filing Period drop-down list, select the return filing period for which you want to upload the return.

5. Click the SEARCH button.

6. Applicable returns of the selected tax period are displayed. In the GSTR-3B tile, click the PREPARE OFFLINE button.

7. The Upload page will be displayed. Click the Choose File button.

8. Browse and navigate the JSON file to be uploaded from your desktop folder. Click the Open button.

The uploaded JSON file will be validated and processed. Thus, upon successful validation and processing the details entered would be populated in respective Tables.

GSTR 3B NIL Return

GSTR 3B nil return is a return wherein you do not fill any inward or outward supply data. Thus, this return is just to be filed without any values. According to GST law, every registered person must file GST returns as applicable to him at the end of every tax period. Therefore if you do not have any transactions also for the given period you must file a nil return.

File GSTR 3B NIL Return online Procedure in GST portal

1. Visit www.gst.gov.in. The GST portal Home page is displayed.

2. Log in to the GST Portal with valid credentials.

3. Click the Services > Returns > Returns Dashboard

4. The File Returns page is displayed. Select the Financial Year & Return Filing Period (Month) for which you want to file the return from the drop-down list.

5. Click the SEARCH button.

6. The File Returns page is displayed.

In the GSTR-3B tile, click the PREPARE ONLINE button.

7. A list of questions is displayed. You need to answer the questions to show the relevant sections applicable to you. Select Yes for option A ‘Do you want to file Nil return?’.

Note: Once you select ‘Yes’ in question A the system will disable the rest options.

8. Click the NEXT button.

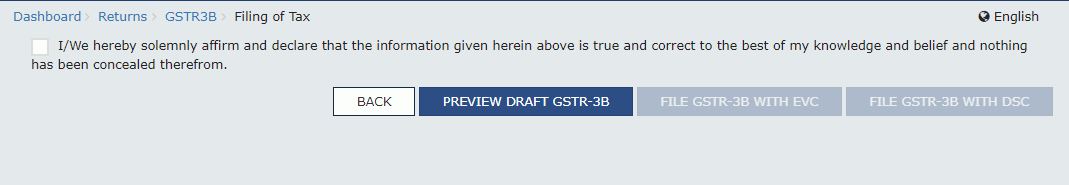

9) The GSTR-3B declaration screen will appear to accept the agreement.

10. Click the PREVIEW DRAFT GSTR-3B button to view the summary page of GSTR-3B for review.

11. Select the checkbox for declaration once you are confirmed with the preview.

12. From the Authorised Signatory drop-down list, select the authorized signatory.

13. Click the FILE GSTR-3B WITH DSC or FILE GSTR-3B WITH EVC button.

14. If you are filing with EVC you will receive the OTP on the registered mobile. Enter the OTP and click verify. if you are filing with DSC, insert DSC, Select the certificate and click the SIGN button and Click the PROCEED button.

15. You will see the filing a Successful message on the screen. Click the OK button.

Related: How to connect https://127.0.0.1:1585 emsigner to resolve dsc error.

GSTR 3B Nil Return Filing Through SMS

The GSTN has started now the facility to file the Nil GSTR 3B return through SMS. Here are the simple steps by which the taxpayer can file the NIL GSTR 3B return by sending an SMS. However, the taxpayer shall ensure that he meets the below conditions before initiating filing GSTR 3B Nil return by sending SMS.

To file Nil Form GSTR-3B through SMS, follow the below-mentioned steps. We take an example to file Nil Form GSTR-3B through SMS for a GSTIN 33AACAA1121EAZE for the tax period May 2020.

- Send an SMS to 14409 number to file Nil Form GSTR-3B.

- SMS Format: NIL space<Return Type>space<GSTIN>space<Return Period>

- Example: NIL 3B 33AACAA1121EAZE 052020

- The GST portal will validate the SMS sent

- Send an SMS again on 14409 with the Verification Code. (For Example Verification Code received here is 107544) to confirm the filing of Nil Form GSTR-3B.

- Format: CNF space<Return Type>space<Code>

- Example: CNF 3B 107544

- On validation of the “Verification Code”, GST Portal will send you the ARN to the registered mobile number and on the e-mail ID of the taxpayer confirming the Filed status.

Conditions For Filing Nil Return

- Must be registered as a Normal taxpayer/ Casual taxpayer/ SEZ Unit / SEZ Developer.

- Shall have valid GSTIN.

- The phone number of the Authorized signatory is registered on the GST Portal.

- No pending tax liability for previous tax periods including interest or late fees.

- All previous periods’ GSTR-3B returns are filed.

- Saved data should not be present on the GST portal for that particular month

- Taxpayer Has NOT made any Outward Supplies

- There is no reverse charge liability

- No Input tax credit transactions are to be reported

- No tax liability for that particular or previous Tax Period.

Top mistakes in GSTR 3B to avoid penal action

Here is the clarification on GSTR 3B Filing mistakes done by Interstate suppliers and Return filing errors.

The government has noticed that many registered taxpayers are not filing GST returns correctly. This is especially in respect of supplies made to unregistered persons in other states. Therefore we clarify here the top Filing mistakes by Interstate suppliers and Return filing thereto.

Similarly, the Central Board of Indirect Taxes and Customs has issued a circular in this regard vide circular no. Circular No. 89/08/2019-GST dt.18.02.2019.

Further, the Government has clearly said that violation of these provisions by the suppliers of goods or services or both will have to face penal actions from the government. Let us see in detail how to avoid these mistakes in your return.

Interstate transactions in GSTR 3B Return

According to GST law, the GST-registered suppliers are required to specify below details of interstate transactions in GSTR 3B.

- Supplies made to an unregistered person

- Goods and services are supplied to a composite taxable dealer.

- Unique identification number (UIN) holder

The registered supplies must specify these details in table 3.2 of GSTR 3B. therefore if you are not specifying such details then you are not filing your return correctly.

Interstate transactions in GSTR 1 Return

Similarly, the details of inter-state supplies made to the unregistered person must be declared in Table 7B of GSTR 1. However, this is subject to where the invoice value Is up to 2.5 lakh. Also, the supplier is required to provide GST rate wise details in the above table.

Therefore it is compulsory to specify these details in GSTR 3B to know the IGST collected on inter-state supplies made to unregistered persons. Further, non-mentioning of such details will result in:

- Non-payment of IGST revenue to states where the supply takes place.

- Mismatch in the supply of goods or services or both actually supplied in the state or not.

- Non-compliance with sub-section (2) of section 17 Of IGST ACT 2017.

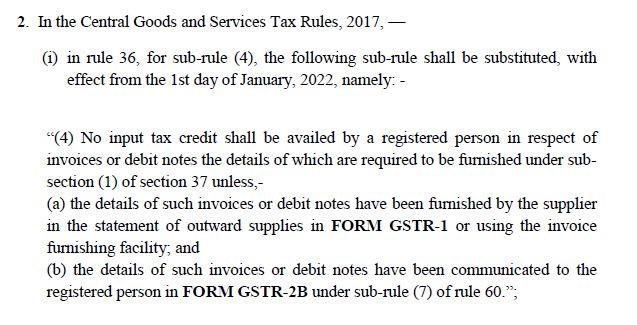

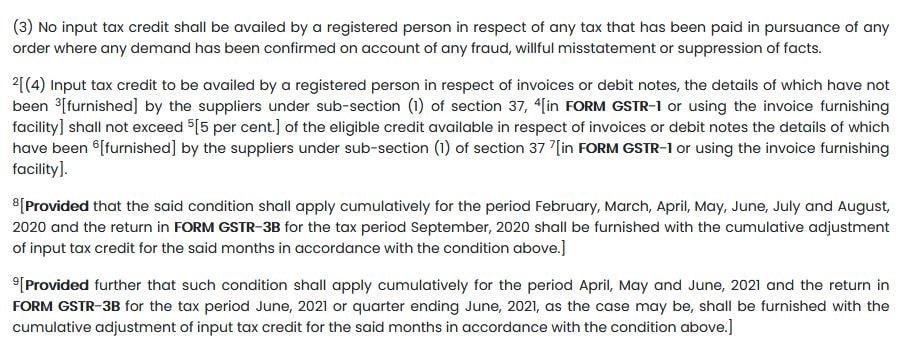

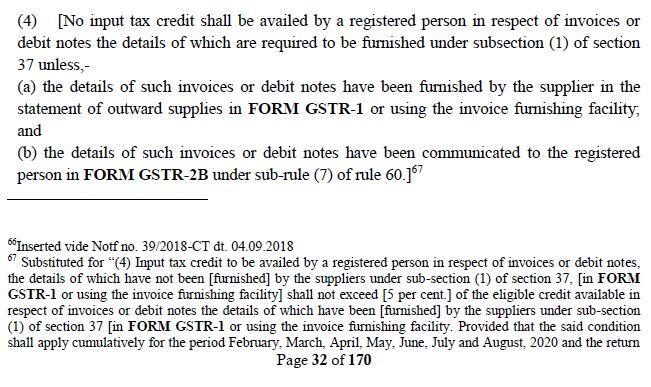

New GST Rules 2022 for an Input Tax credit

26.01.2022: The major changes in CGST rules in 2022, will be applicable from 01st January 2022. This is in the manner of availing input tax credit in GSTR 3B. The taxpayer must avail of 100% input tax credit only when it is available in GSTR 2b mandatorily w.e.f 01.01.2022. This is as per notification no. 40/2021 – Central Tax Dt.29.12.2021. Here are the changes that will be binding on the taxpayer.

- The previous provision allowing to take 5% more input tax credit, than what is available in GSTR 2A, has been withdrawn w.e.f 1.1.2022.

- No input tax to be availed unless outward supply returns are filed by the supplier, and it is appearing in GSTR 2B.

- The condition at point no. 2 is not applicable for availing ITC on imports and RCM as per circular no. 123/42/2019– GST (attached)

- The condition at point no. 2 cannot be specific only to the current month, as ITC can be availed of the previous year till filing the Annual return or September Return of the next FY whichever is earlier as per subsection 4 of 16. Therefore, if the supplier raises an invoice on 24.01.2022 then he/she will include the invoice GSTR 1 of January 2021. However, the recipient may receive it in the first week of February 2022 in his books. Therefore, if the invoice is appearing in GSTR 2B of January 2022 then there should not be a query to avail the ITC against that invoice in GSTR 3B of February or March 2022, or there onwards.

- In our opinion, The GST portal may not put a lock on the extent of the amount to take the input tax credit and the taxpayer shall take care of notification 40/2021 while availing of the ITC.

Understanding Notification No. 40/2021 & CGST Rule

1. Extract of notification 40/2021

2. Sub-rule (4) of rule 36 before applying notification no. 40/2021

3. Sub-rule (4) of rule 36 after applying notification no. 40/2021

General Q & A

Question 1: How to file GSTR 3B nil return?

Answer 1 : Log in to GST portal >> Go to returns > Select the period > Choose Nil Return

Question 2: What are GSTR-3b and gstr1?

Answer 2: GSTR-3B is a monthly summary statement. Whereas GSTR 1 is a detail of outward supplies return.

Question 3: Who should file GSTR-3B?

Answer 3: A Regular supplier of Goods or services or both shall file GSTR-3B on monthly basis.

Question 4: Why GSTR3B is filed?

Answer 4: To declare the outward supplies, input the tax credit availed, and make the payment of net tax liability.

Question 5: What is the gstr3b due date?

Answer 5: 20th of Next month.

Question 6: How to file GSTR3b in tally ERP 9?

Answer 6: From the gateway of the tally, Go to > Reports > Statutory Reports > GSTR-3B.

Question 7: Is GSTR3b to be filed monthly or quarterly?

Answer 7: Monthly basis.

Question 8: Sales Return in GSTR 3B?

Answer 8: You have to deduct the credit note(sales return) value from the Total taxable value under table 3.1 (Details of Outward Supplies and inward supplies liable to reverse charge) in GSTR 3B.

GSTR 3B Questions and Answers

The GSTR 3B is a summary return of all outward and inward supplies.

The taxpayer shall file the details of outward and inward supplies that take place during the given period in Form GSTR 3B.

जीएसटीआर 3 बी सभी बाहरी बिक्री और माल या सेवाओं या दोनों की आवक खरीद का सारांश रिटर्न है।

ஜி.எஸ்.டி.ஆர் 3 பி என்பது அனைத்து வெளிப்புற விற்பனை மற்றும் பொருட்கள் அல்லது சேவைகளின் உள் வாங்கல்கள் அல்லது இரண்டின் சுருக்கமான வருவாய் ஆகும்.

Go to GST portal >> Downloads>> offline tools >> Click on “GSTR3B Offline Utility” to download GSTR 3b.

On the GST portal at www.gst.gov.in

No.

Check our GST Return dates chart to see the extension if any.

I have received the notice under section 68 of not furnishing my gstr 3b return of November-20

On 26.01.2021, But i had filed it on 26 jan 2021

What to do now…please help me

Hello, reply the notice by providing the acknowledgment number of the return filed for the given month. you can get the ack. no. by visiting gst portal >> returns >> view filed returns.

I hope this helps.

regards

A new Flat is sold and delivered to the buyer in January, 2021. Also full payment has been received by cheque in January, 2021. But registry has not been done by buyers. However, the flat has a Certificate of Completion.

Can I show the said transaction in ” NON GST OUTWARD SUPPLY” of Seller’s GSTR 1 & GSTR-3B for the month of January, 2021?

Thanks in advance !

hello,

If the flat is sold after obtaining the completion certificate from the concerned authority, it is neither supply of goods nor supply of services ( whether GST or non GST ) under schedule III of CGST Act . Therefore , this transaction need not be shown in any column of GSTR1 or 3B return.

regards