The GST council has recently introduced a new GST return filing System. The new return system filing includes single return filing with annexures of outward and inward supplies. The taxpayer needs to attach this annexure while filing his regular GST RET 1 Return. Thus, here you will learn the meaning of GST Anx 1, Download GST Anx 1 format in Excel for offline filing and how to complete this annexure. This return is not yet implemented.

ot=”1100687935″>Jump To:

- Meaning of GST ANX 1 >> Download Offline Tool

- Offline Tool Video >>Download pdf format

- Due Date of Filing >>Point to Read

- Filing Instructions >>Amendment

What is GST ANX 1 under GST?

GST ANX 1 is an annexure of the GST RET 1 Return. GST Annexure 1 is a replacement for GSTR 1 Return, which is currently filed monthly by the taxpayers. It contains all the details related to outward supplies and inward supplies attracting a reverse charge. Thus, the taxpayer has to fill submit these details to the GSTN on GST portal. The GST Anx 1 can be prepared in mode to generate a JSON file. Later, the taxpayer can upload this file on the GST portal to submit the details.

Similarly, the taxpayer can also fill the above details in online mode on the GST portal.

Download GST ANX 1 Format

You can click below to download the offline tool which contains the complete utility for adding GST Anx 1 records. Kindly install this tool on your computer. After installing this tool you will able to import the records from the excel template and generate a

How to use Offline tool video

Here is the official video by GSTN, on how to use the above offline tool to prepare GST ANX 1. This video will explain how one can import data from an excel file and generate a J

Download pdf

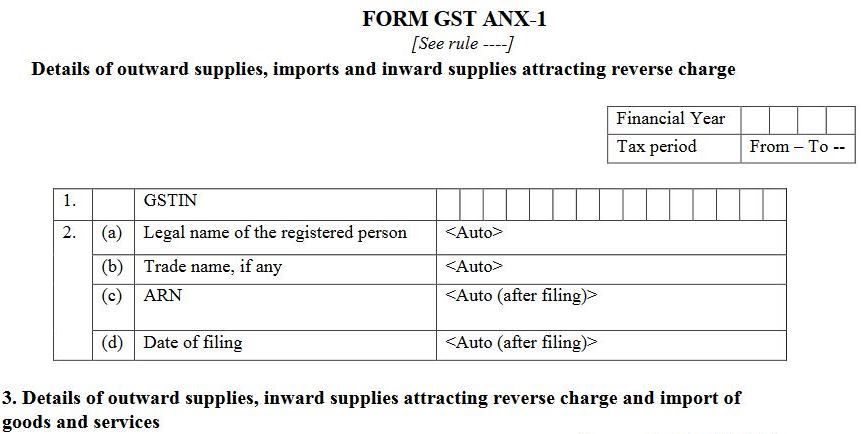

Here is the pdf format of GST ANX 1 return. The taxpayer can use the pdf format of GST ANX 1 to see the overall format of this return. This format of GST ANX 1 is the official format by the government.

Due date of filing

The GST ANX 1 will be made compulsory to small taxpayers from April 2020 as per the 37th GST Council meeting Decision. However, the previous date was from October 2019 onwards.

Small taxpayers are the taxpayers whose turnover in the previous financial year is up to Rs. 5 crores. They should make a monthly payment through GST PMT 08 by 20th of Next month following the tax period. Further, taxpayers will not be able to upload Documents in GST ANX 1 from 23rd to 25th of Next month following the tax period.

Similarly, the due date of filing of GST Anx 1 by the large taxpayers will be from April 2020 onwards. This is applicable for those whose aggregate turnover in the previous financial year is more than 5 crore rupees.

Since GST ANX 1 is a replacement to GSTR 1, taxpayers shall file GST ANX 1 from April 2020 onwards. The due date of Anx will be a continuous process. However, taxpayers will not able to upload the documents from 18th to 20th of next month. They should make GST payment through GSTR 3B Return by the 20th of Next month. Read more about Sahaj and Sugam return under GST.

Top 8 points to Remember

- A Taxpayer who files a monthly return will not be able to upload invoices from 18 to 20th following the tax period.

- A Taxpayer who files Quarterly return will not be able to upload invoices from 23rd to 25th following the tax quarter.

- you will have to pay the tax liability in the current month If you report previous months supplies during the current month.

- One shall not report here advance received on services.

- The Recipient will able to claim the credit on supplies reported by the supplier up to the 10th of following tax period.

- The only recipient will enter the supplies attracting reverse charge transactions. Supplier shall not report such entries in GST ANX 1.

- Taxpayers whose turnover in a previous financial year is more than 5 crores shall report 6 digit HSN wise details. Other Taxpayers whose Turnover is up

crore has an option to enter or leave it blank. - Place of supply is mandatory for GST ANX 1.

GST ANX 1 Filing Instructions

The taxpayer needs to fill the following Tables of GST ANX-1 to upload it on GST portal. Here are the table

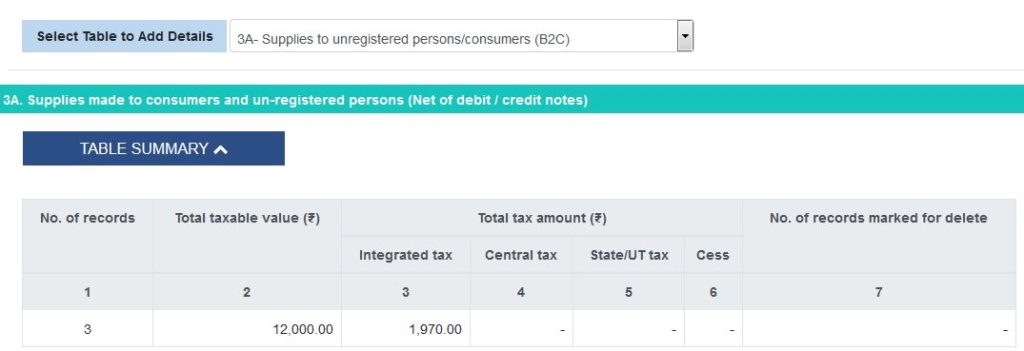

3A- Supplies to unregistered persons/consumers (B2C)

The taxpayer needs to enter here all supplies made to consumers and un-registered persons(i.e. B2C). Please note that you need to report here tax rate wise supplies and net of debit/ credit notes. However, the taxpayer need not require to fill the HSN Code in this table.

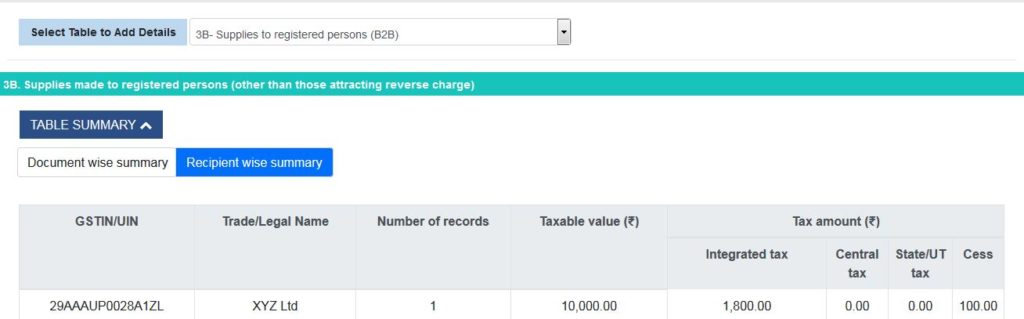

3B- Supplies to registered persons (B2B)

Table 3B of GST Anx 1 shall include all supplies (other than those attracting reverse charge) made to registered persons (GSTIN/UIN holders

Further, the taxpayer shall report here supplies made to the

Thus, this will include amendments, if any. However, t

Further, SEZ units/developers shall report here the Supply of services to persons in t

Also, the taxpayer shall not report here the supply of goods or services to SEZ units/ developers. Thus, they shall report it in table 3E or 3F,

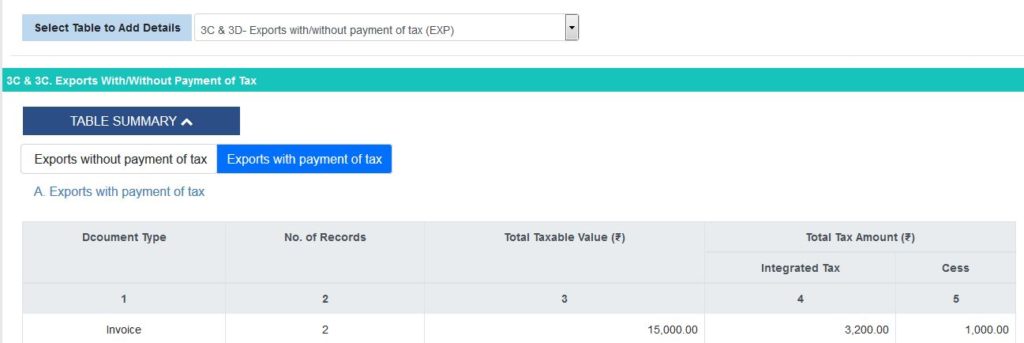

3C & 3D- Exports with/without payment of tax (EXP WP/WOP)

Taxpayers shall enter export details with payment of tax(Integrated tax) in table 3C. On the other hand, one needs to enter export without payment of tax in table 3D.

The taxpayer can fill shipping bill/bill of export number as available against export invoices till the date of filing of return.

The remaining details of shipping bills can be reported after filing the return. The GSTN will provide a separate tool to update the details of shipping bill/bill of export in table 3C or table 3D on the GST portal.

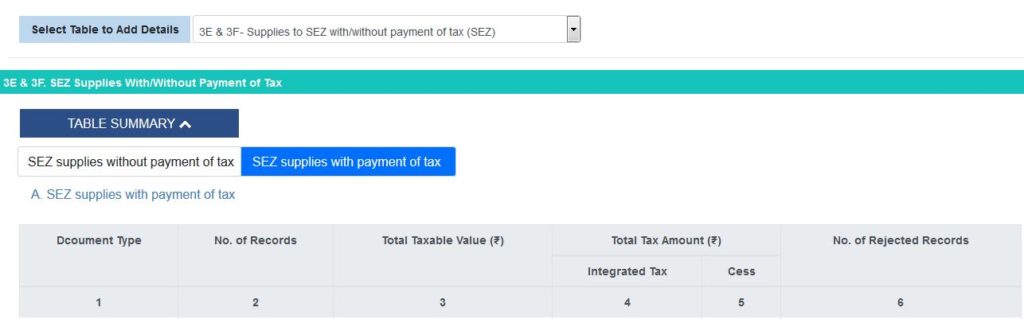

3E & 3F- Supplies to SEZ with/without payment of tax (SEZ WP/WOP)

A Taxpayer shall report all supplies to SEZ units in table 3E and 3F. This will depend upon the supplies are made with payment or without payment of tax.

This table includes amendments if any. Here the supplier has an option to choose if the supplier or SEZ unit will claim a refund or not. On the other hand, SEZ units can claim input tax credit and refund if the supplier is not asking for a

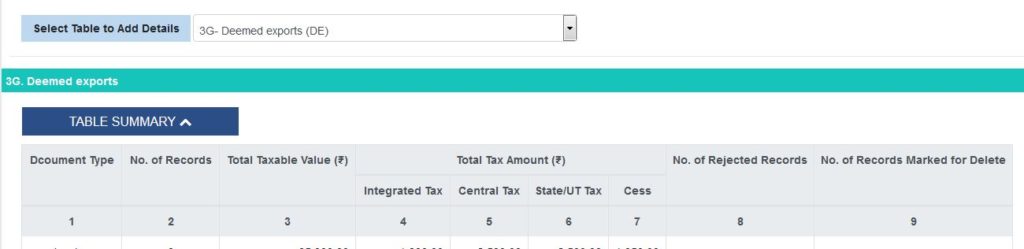

3G- Deemed exports (DE)

This table is for entering deemed exports with amendments. Similarly, the supplier shall declare whether the supplier or recipient will avail input tax credit on such exports. Thus, if t

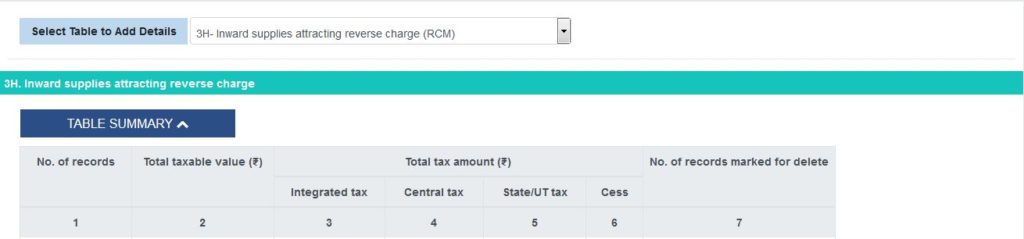

3H- Inward supplies attracting reverse charge (RCM)

This is the new feature of GST ANX 1. Here, only the recipient shall report all the inward supplies GSTIN wise, which attracts a reverse charge. However, the recipient need not have to report invoice wise details.

Similarly, all the advances paid for such supplies shall be declared in the month in which the same is paid. Also, the value of supplies shall be net of debit/credit notes and advances.

Further, if t

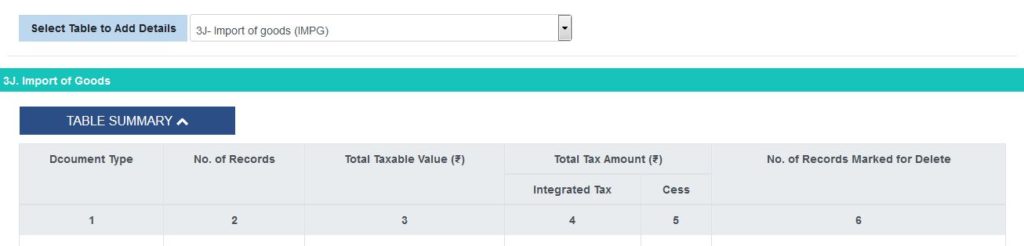

3I- Import of goods (IMPG)

Table 3I of GST Anx 1 is meant to enter details of tax paid on import of goods. However, this will not subject to taxation because the importer pays the IGST amount at the time of its import. Thus, the importer shall declare the actual IGST and cess paid at the port of import to avail input tax credit. Also, in

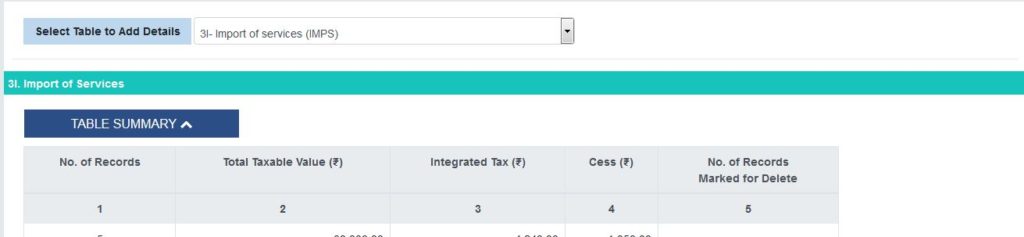

3J- Import of services (IMPS)

The Taxpayer needs to enter here all import of services. Also, the value of supplies shall be net of debit note and credit note including advances paid. However, you need not have to enter invoice wise details here.

Further, the taxpayer need not have to enter services received from SEZ units/developers here.

3K- Import of goods from SEZ units/developers (IMPG SEZ)

The recipient of goods, on the bill of entry from SEZ, shall report here. Further SEZ units or SEZ developers who make export on the bill of entry shall not include outward supplies in table 3B.

Such reporting in table 3J and 3K is necessary until the data from ICEGATE and SEZ to GSTN starts flowing online.

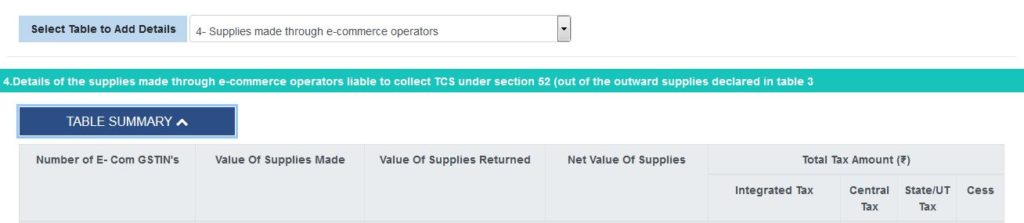

4- Supplies made through e-commerce operators

Table 4 of GST ANNEX I contains e-commerce supplies. This is for those operators who collect tax as per section 52 under the CGST Act. The person shall report such supplies in this table even he reports it in table 3B.

How to amend GST ANX 1 Details

The GST ANX 1 has a provision to amend the uploaded details. However, there are some conditions one needs to follow to amend these details. If you are looking to amend the details of GST ANX 1 then you must identify the date of the amendment. This is because once you cross the below date then you will have to follow the

The below GST ANX 1 amendment process is applicable to GST RET 1/2 and 3 only. Similarly, the supplier can amend the documents at any time for supplies taking place to composition taxpayers, Input service distributors and UIN holder. Thus, he does not require accept,

Amendment process before 10th of Next Month

The supplier can amend the details till the 10th of Next month following the tax period. However, the supplier can not amend these details, if the recipient accepts such details before 10th of next month.

The only exception is that the recipient needs to reset or unlock such transactions if he accepts it before 10th of Next month.

Amendment process after 10th of Next Month

As soon as the supplier files GST RET 1 Return, the records of ANX 1 will be available to the recipient in form GST ANX 2. Thus, the recipient can accept, reject or keep them pending.

However, the rejected documents will be conveyed to the supplier only after filing the return by the recipient.

Later, the supplier can edit the rejected documents before filing next month’s return. However, after editing the credit of these documents will be available in next GST ANX 2 for the recipient.

Further, the supplier has to bear the liability of such invoices for the period when he uploaded them. If the liability is more, after editing the document then the supplier will have to pay the interest for the differential amount from the date of its upload/payment.

General Queries on GST ANX 1

In General, the Annexure is any attachment, attached to the main letter. It can also be called as enclosures.

Thus, In GST new return filing system there are two types of Annexures. The first one is ANX 1 and the second is ANX 2. Therefore, both annexures will be attached to the RET 1/RET2/RET3 at the time of filing any one of these returns.

The new return trial in GST is a process of making the practice of filling GST ANX 1 and ANX 2 on a trial basis. The records uploaded in trial returns will not be accounted for the tax liability.

The purpose of filing a trial return is to make aware to the taxpayer of this new filing system. Thus, in the trial process, the taxpayer can report the queries to the GSTN, in case he faces any issues.

The inward supplies are the purchases made by the recipient of goods or services received. Whereas sales or services provided by the supplier are called outward in GST.

Related Topic Links

Our GSTIN is 19AADCP0104A1Z8

We have filled GSTR-1 for the month of October within 10th November 2019 instead of GST ANX-1, Will it be visible in the GST Portal ?

Hi Alok

Yes, As of now GST Anx 1 is not made compulsory. Therefore, you need to file your regular returns as per the due dates.