The government has introduced New GST Return in Form GST ANX 2 for inward supplies. GST Anx 2 is an annexure to the main return i.e GST RET 1, RET 2 or RET 3. In GST ANNEXURE 2 the recipient of goods or services or both has to take action on the entries uploaded by the supplier. Thus, in order to avail input tax credit, the recipient must accept the entries in GST ANX 2 and file it on the GST portal. You may download GST ANX 2 format in excel and pdf from here. The Anx 2 filing process is still not implemented.

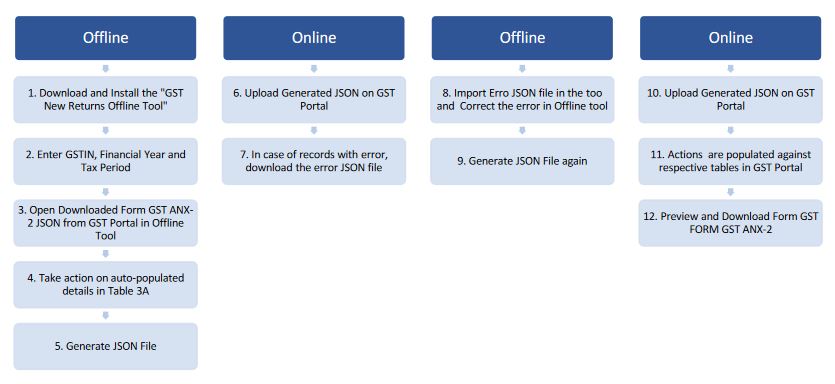

GST ANX 2 filing Process Chart

Further, GST ANX 2 will be made compulsory from April 2020. Therefore, it becomes very important to know all about this return. In this article, you will learn what is the meaning of GST ANX 2?. Also, how to download GST Anx 2 format in excel?. Similarly, we explain how to file GSTR Anx 2 in offline and online mode?.

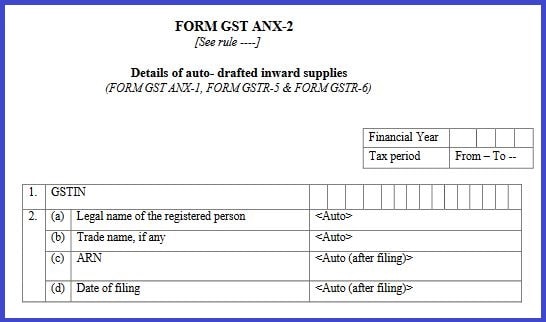

GST ANX-2 Format in Excel

There is no Excel format/offline utility where you can enter purchase details and upload it on the GST portal. This is because the taxpayer or the recipient of inward supply shall only take action on the entries available in GST ANX 2. You can not upload your own to file the GST Annexure 2.

GST ANX-2 format in PDF

You can download the pdf format of GST ANX 2 by clicking on the below button. The pdf format includes instructions on ANX 2 filing. You may use the format for offline usage.

What is the meaning of Taking actions in GST ANX 2?

You must have received many invoices from your supplier for the purchase done during the month. Therefore, now you want to take the input tax credit on such purchase/inward supplies. Here you will able to take the input tax credit on invoices received only when your supplier uploads the supplies made to you.

Therefore, as soon as your supplier uploads the sales in GST ANX 1, you will see that entries in your GST ANX 2. Thereafter, you have the option either to “ACCEPT”, “REJECT” or keep “PENDING”. Thus, you will get the input tax credit only for the accepted entries for that particular given period. You may be able to take the input tax credit in the next month for those entries which you kept pending or rejected in the past. Thus, if you keep any invoice pending there may be a reason that the uploaded invoice by the supplier is not correct. Hence, you should ask your supplier to rectify the error so that you can take input tax credit while filing next month’s return.

How to download GST ANX 2 offline Tool?

- Visit www.gst.gov.in

- Go to Downloads > Offline Tools > New Returns Offline Tool(Beta)option and click on it

- Select the download option and proceed

- Extract the downloaded Zip file

- Open the New Returns GST Offline Tool.exe

- Select the folder to install New Returns GST Offline Tool

- Click Next > Install > Finish

- Click to open GST New Return Offline Tool

How to file GST ANX 2 offline?

You can only take action on the details appearing in GST ANX 2. Thus, either you can “Accept”, “Reject” or keep “pending” the GST Anx 2 details. Also, you can not edit the details of any transactions. Therefore, you need to download the first JSON file from the JSON portal containing the details of ANX 2.

Download JSON file of ANX 2 details from GST portal

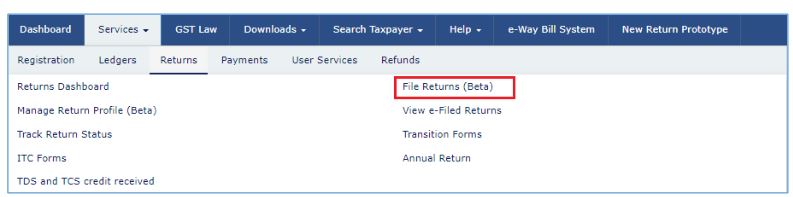

1. Login into GST portal with your user name and password

2. Navigate to Services> Returns> File Returns (Beta) option

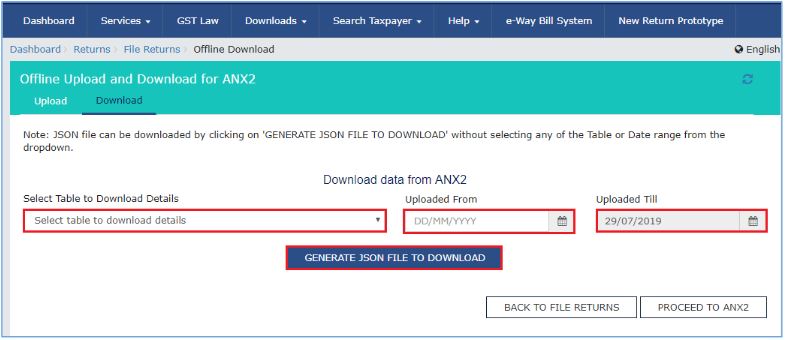

3. Select the Financial Year, Period, Form/Return, Preparation Mode from the drop-down list

4. Click the GENERATE JSON FILE TO DOWNLOAD to download the details of all tables in one go. You may also, choose a specific table and select the download option.

5. Open the downloaded JSON file in offline tool

6. Take action on auto-populated details

7. Generate JSON File to upload.

8. Go to GST portal

9. Import the generated JSON file and submit.

How to Reconcile entries of GST ANX 2 with purchase Register?

One can reconcile the entries quickly by using the “Purchase register template” from the downloaded offline tool. Open the “Register_Template V1.0 .xlsx” file>> Enter your purchases >>Import in offline line tool >>Match the entries. Thus, whichever entries match you can choose to “ACCEPT” and rest you may keep PENDING or REJECT.

How to take action in GST ANX 2 in Online mode?

Before taking the action in GST ANX 2 details, you can make use of the matching tool. Thus, in order to match the details of your purchase register with the details uploaded by the supplier can be matched with the matching tool.

01. Click the IMPORT EXCEL/CSVto import the Purchase Register

Frequently Asked Questions

GST Anx 2 Return is a statement of inward supplies of the recipient for goods or services or both. It contains the outward supply details uploaded by the supplier in form GST Anx 1, GSTR 5 and GSTR 6. The recipient needs to take action on these entries.

You can not edit the details of the GST Anx 2 return.

yes, you change your action as many times before filing GST RET 1, RET 2 or RET 3.