GST India News has written this special article to generate a GST Compliant bill under the Goods and Service Tax system in India. You must read this article to make your Invoice format GST compliant as per GST rules in India. Also, you can download GST bill format in excel for free from our website now.

Table of Contents

- Introduction

- About GST Invoice >> Types >> Who Needs Invoice?

- Not Issuing Invoice >> QR Code >> Invoice Rules

- PDF format >> Excel Format >> RCM Format

- Word format >> Copies of Invoices >> How to create?

- FAQ >> GST Related Links

What is GST Invoice?

GST Invoice is an Invoice or bill which contains Tax payment details under Goods and Service Tax(GST). If you are new to GST then this will be completely new for you. Further, any invoice is not a GST Invoice because the government has provided some guidelines as to how the invoice format should be. You will see invoice sample formats in excel and pdf in the below section.

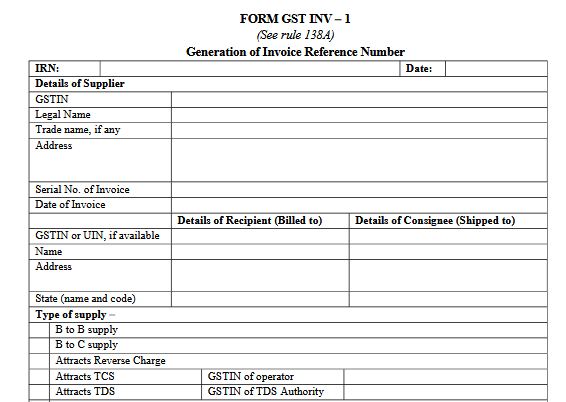

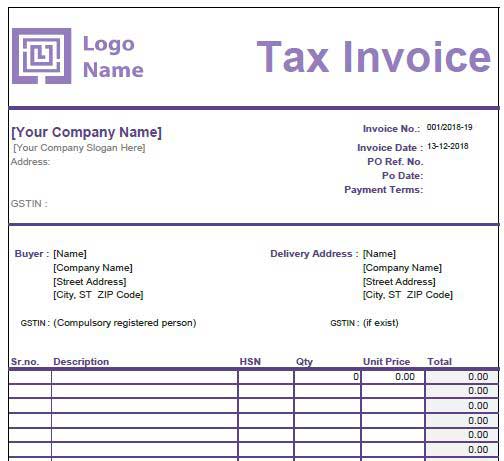

Below given is GST Invoice sample as per GST Rules. You can download the copy of the GST Invoice as in the rule from here. However, you need not have to use the same Invoice to issue an actual Invoice. You can download the below given excel formats to prepare the actual GST compliance invoice.

Related: Electronic invoicing in GST(e-invoice)

What are the different types of Invoice formats Under GST?

If you are registered under GST and you are a regular Taxpayer then you should issue a “Tax invoice” which should contain details of items or services, price, and GST breakup.

Secondly, if you are a composition dealer under GST then you should issue a “Bill of supply” to your customer. You can easily customize the below format for the GST composition invoice format in word or excel as per your requirement.

Lastly, if you are not registered under GST then you can issue an “Invoice” which may not contain any tax amount or may contain your local taxes if applicable. This is the major difference between retail invoices and the tax invoice issued by the suppliers under Goods and Service Tax in India.

Who should print or issue?

As per GST law, every registered person must issue a tax invoice whenever he takes out material from his godown/warehouse. Also, if he supplies any service, he needs to issue a tax invoice to his customer with the due breakup of tax and service details.

What if GST Invoice is not issued?

GST registered person cannot send material to his customer without issuing a Tax Invoice. If such cases are noticed by the department, they may ask you to pay taxes and penalties involved in such goods or services. Also, there is a provision under GST that if you do not pay the taxes or are found doing malpractices they may put you behind the bars.

Quick Response (QR) code

The taxpayer shall issue an Invoice with a QR code whose aggregate turnover exceeds five hundred crore rupees, to an unregistered person (B2C invoice). This is mandatory from 1st December 2020 as per notification no. 71/2020-Central Tax, dt. 30-09-2020. Thus, the QR code generation on invoices will be applicable from 01st December 2020.

Exemption to QR Generation

The below type of person does not require to generate a QR code. Thus, please refer to the 39th GST council meeting recommendations supporting these classes of persons. This has reference to notification no. 14/2020-Central Tax,dt. 23-03-2020.

- The supplier of taxable services like an insurer or a banking company or a financial institution, including a non-banking financial company.

- The supplier of taxable services like goods transport agency supplying services in relation to transportation of goods by road in a goods carriage.

- A supplier of passenger transportation services.

- A person supplying services by way of admission to an exhibition of cinematography films in multiplex screens.

Related: Everything you want to know about E-Invoice portal

What are GST Invoice Rules?

As per invoice rules 2018, below are the guidelines for issuing Invoices under Goods and service tax in India. These include serial number rules because as per the invoice guidelines it should not be more than 16 digits long. Also, a GST invoice signature rule says that it must be signed physically or digitally by the authorized representative.

CGST Section 31, 32,33 & 34 deal with rules for issuing Tax invoices and debit notes under GST. These rules are called GST invoice rules 2017 or 2018. Whereas Chapter VI of CGST rules deals with details to be mentioned in GST Invoice by GST registered person.

The GST invoice format rules contain the following particulars, namely:

- Name, address, and Goods and Services Tax Identification Number(GSTIN) of the supplier of goods or services or both.

- Unique Invoice serial number not exceeding 16 characters in a given financial year.

- Date of Invoice

- Name, address, and Goods and Services Tax Identification Number(GSTIN) or Unique Identity Number(UID), if registered, of the recipient.

- Name and address of the recipient and the address of delivery. Also, the name of the State and its code shall be included, if the recipient is un-registered and where the value of the taxable supply is fifty thousand rupees or more.

Item Level Particulars

- Harmonized System of Nomenclature(HSN) code for goods or services or both.

- Description of goods or services or both.

- Quantity in case of goods and unit of measure or Unique Quantity Code.

- The total value of the supply of goods or services or both;

- The taxable value of the supply of goods or services or both after discount or abatement, if any;

- The rate of tax (central tax, State tax, integrated tax, Union territory tax, or cess) as per GST rules.

- The bifurcation of an amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax, or cess);

- Address of delivery if the buyer is not the consignee.

- whether the tax is payable on a reverse charge basis; ie. By the recipient of goods or services or both.

- The signature or digital signature of the supplier or his authorized representative as declared in the GST Registration.

You should read properly above GST invoice rules and format guidelines before preparing it for actual usage. You may also convert the above GST invoice rules into the Hindi language by selecting a language from the menu bar. Keep visiting GST India News For more updates on GST invoice rules notification.

Related: checklist of GST Invoice

Expenses and Taxable Value

All expenses like freight/transport/packing which are charged in the Sales Invoice are taxable in GST? How to charge in the bill?

Yes, all expenses will have to be included in the value and the invoice needs to be issued accordingly. Please refer to Section 15 of the CGST Act and Invoice Rules.

Section 15 of the CGST Act reads as:

“(b) any amount that the supplier is liable to pay in relation to such supply but which has been incurred by the recipient of the supply and not included in the price actually paid or payable for the goods or services or both; ( c ) incidental expenses, including commission and packing, charged by the supplier to the recipient of a supply and any amount charged for anything done by the supplier in respect of the supply of goods or services or both at the time of, or before delivery of goods or supply of services; (d) interest or late fee or penalty for delayed payment of any consideration for any supply; and ”

Only the discount given can be excluded from the Taxable value.

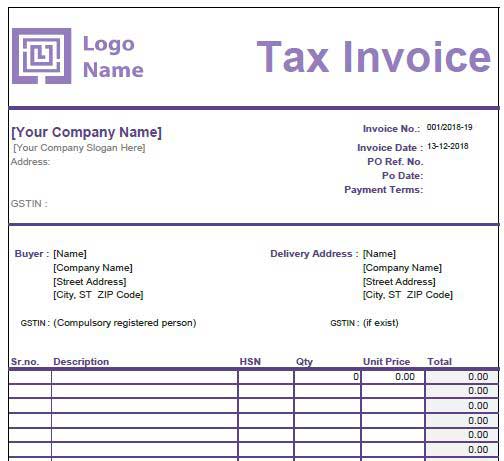

Invoice/Bill Format in pdf

Below GST bill format is provided as per the latest GST Rules. This GST Invoice template is as per the latest GST rules and notification if any. Also, GST Invoice in pdf is a free invoice sample for your usage. You can easily create a bill under GST by using these invoice formats. You may also google and you will find many more examples of the GST tax bill. This format is also called a GST bill format in India in the pdf file.

Above GST tax invoice format pdf is only for information and one may use the same format for issuing an actual invoice. You need to see all the details in the above invoice rules to fill in the invoice. Therefore the details mentioned above shall be the conditions for issuing GST Invoice to your end customer. This is also useful for availing Input tax credit on the GST bill issued by you. Therefore you should issue ITC compliant invoice to your customer so that he can avail of ITC based on your invoice.

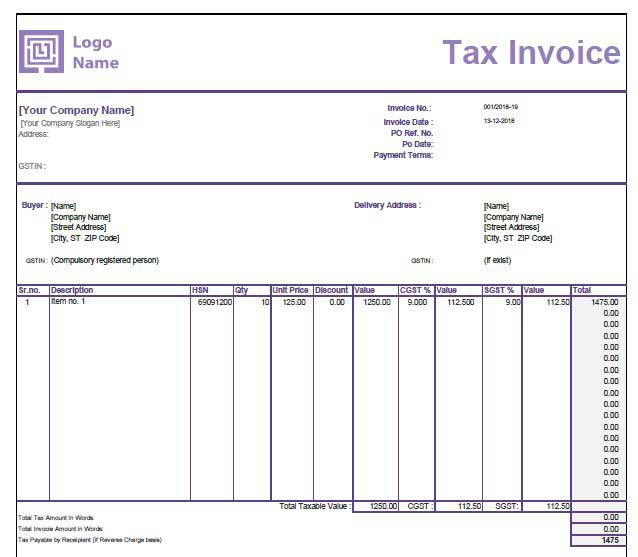

GST Invoice/Bill format in Excel

Here you can download the GST tax invoice format in an excel sheet to generate GST compliance invoices under GST. Since this is an excel file You can customize this format at your convenience. Similarly, do not forget to see the GST rules as specified above. After merging the necessary details in this excel format you can issue the invoice to your customer as per the GST rules.

Also, you can use this invoice format for services in excel, if you are a service provider under GST. The download invoice format in excel for the GST compliance invoice. Thus, use this tax invoice format in excel to generate your GST compliance invoice under Goods and service tax. Similarly, this is a GST tax invoice format in excel available for free download on the GST India News site. This is our online invoice format available for download completely free of cost.

Download GST Invoice formats in Excel sheet from below links:

The above download link contains the GST invoice format in excel with a formula to calculate automatic CGST, SGST, and IGST. Further, the GST tax invoice format in excel with formula is prepared in such a way that it takes care of the discount given and tax break-up calculation. You may also insert an additional column to insert the “Cess” column If necessary.

Related: Delivery Challan Format in Excel

RCM Invoice or Bill Format

If you are looking for an RCM invoice or self-invoice format under GST then you are at the right place. As per CGST section 9(3),(4), the recipient of goods or services needs to raise self invoice under GST. Therefore, here you can download the format of self invoice under RCM in GST. This bill format can be used for making a reverse charge invoice under GST. Click on the below button to download the self-invoice format in Excel for RCM purposes.

The Invoice Format in Word File

Below GST invoice sample format in a word can make your job easy under GST. Here you can download below sample formats of GST Tax Invoice in Microsoft word. GST tax invoice format in a word may not be that useful to issue an actual invoice as this can be a tedious job for you. However, you can customize these formats as per your needs. For eg. You can put your business logo, and add more contact details like phone no., email, website address, registered office, etc.

In Microsoft word, you can make your invoice more presentable by adding stylish fonts, customize images, etc. Below are some Word formats available for download.

Related: Free GST Billing Software download

GST Invoice Related Queries

How many copies Invoice are to be issued?

- In the case of a supply of goods, you need to print three invoice copies.

- Secondly, you need to mark the original invoice copy as “ORIGINAL FOR RECIPIENT“.

- The duplicate copy is marked as “DUPLICATE FOR TRANSPORTER”.

- Triplicate copy being marked as “TRIPLICATE FOR SUPPLIER“.

- You can print additional copies to give to the transporter or courier company marked as “Gate pass” or “Extra copy“.

Is Carrying Physical Invoice copies compulsory?

yes, it is mandatory to carry the invoice, if it is not generated by uploading the data on the e-invoice portal of GST. It is not required to carry physically if the invoice is E-invoice. Also, the e-invoice should have the QR code for verification by the office if needed. For more details, you may refer to Circular No. 160/16/2021-GST dt.20.09.2021.

How to create an invoice?

There are multiple options for you to generate GST invoices under the Goods and Service Tax system. First of all, you can create an invoice by using the above pdf, word, or excel formats without any cost. Further, you can also create invoices by using third-party software available online like Tally ERP, Zoho books, etc.

Lastly, you may also prepare the GST Tax invoice manually on the pre-printed paper in triplicate and issue it to your customer.

Can a registered taxpayer have multiple series of tax invoices?

Yes, a taxpayer can have multiple series of tax invoices in a financial year. There is no limit on the number of series of tax invoices that one can have in a financial year.

Can there be duplicate invoice series?

For a particular GSTIN, there cannot be duplicate invoice series in a particular financial year. The GST system will not accept duplicate supply invoices in a return and will provide errors on validation.

Can I enter details of Goods and Services in the same invoice?

Yes, you can enter details of Goods and Services in the same invoices.

Will there be any validation between Invoice value and Taxable Value?

Taxable value is the value as per the provisions of GST law. There will be no validation that the invoice value is equivalent to the taxable value plus the tax amount.

A shop sells taxable & exempt products to the same person (B2C), is it required to issue tax invoice and bill of supply separately?

In such a case the person can issue one tax invoice for the taxable invoice and also declare exempted supply in the same invoice.

General Questions and Answers

The GST Invoice is a Tax invoice that contains the breakup of tax payable to the government on the goods or services by the supplier.

The QR code generation is applicable from 01st October 2020

You need to register your business at Amazon. You can do it right now by visiting https://www.amazon.in/gp/help/customer/display.html?nodeId=202117560

Our research shows that there is no option to get a GST invoice from Flip kart.

The Authorized signatories declared in the GST registration can sign the GST invoice.

You can make a GST invoice by using any software that supports GST invoices. Also, you can make a manual GST invoice with continuous serial numbers on it.