This guide will explain to you how to download GSTR 1 Excel format to upload on the GST portal. GSTR 1 offline utility is provided by GSTN to facilitate users to feed the data in Excel utility in offline mode without the need for an internet connection. Further, you can check out the GSTR 1 due date with extension, how to file it online, and late filing fees. Also, see the meaning of GSTR 1 and download the pdf format.

Main Topics

- Introduction

- SMS Filing

- Download Format and offline tool> > Installation >> PDF format >>Queries

- How to file offline >> Online Filing >> Video >> Json To Excel

- Frequently Asked Questions

Related: Monthly GST payment and Quarterly Return filing

GSTR 1 Filing Through SMS

The Taxpayers will now be able to file NIL GSTR 1 Return through SMS. In this method, if there are outward sales during the given period, then the taxpayer can simply send one SMS and file the nil return. Here are the steps to file the NIL GSTR 1 through SMS from the registered mobile number.

- Type SMS NILR1GSTIN number Tax period (in MMYYYY) and send it to 14409.

- Example: NIL R1 09XXXXXXXXXXXZC 052020 for monthly filers of May 2020.

- Example: NIL R1 09XXXXXXXXXXXZC 062020 for Quarterly filers of April – June 2020.

As soon as the taxpayer sends the above SMS, the system will send a six-digit code with a validity of up to 30 minutes. Thereafter, the taxpayer will have to provide their confirmation for filing the NIL statement by sending: CNFR1 CODE to 14409. Thus, after successful code validation, the GSTR 1 return will be filed and taxpayers will receive an Acknowledgment number through SMS.

GSTR 1 Excel Format Download

1. To Download Visit www.gst.gov.in

2. Go to Downloads > Offline tools > Returns Offline tool > Click Download button

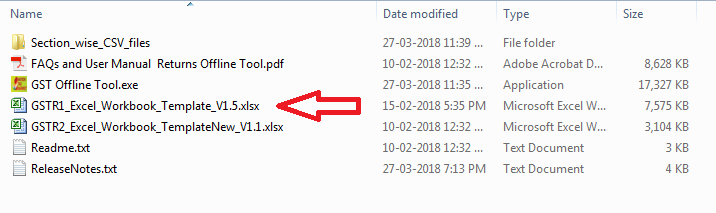

3. Extract the downloaded folder.

Your downloaded (Returns Offline Tool) zip file contains:

- GST Offline tool (Application)

- Section Wise CSV files

- GSTR1 & GSTR2 Excel Workbook Template (To be used to fill section-wise details)

- User Manual

- Readme

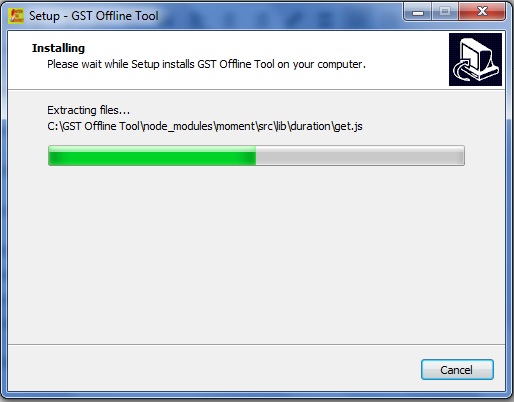

GSTR 1 Offline Tool Installation Guide

These GSTR 1 Excel format instructions will install the GSTR 1offline utility on your local computer. Please see the below procedure to install the offline tool on your computer.

1. Unzip the downloaded Zip file which contains the GST Offline-Tool.exe setup file.

2. Double-click on the GST Offline Tool.exe file and run the installation.

3. After installation, Go to your desktop and Click on the GST offline tool icon to open the software.

Note: By default, this software will open in Internet Explorer. If you want to open it in other browsers like Mozilla Firefox or in Google Chrome you can do so. Right-click on the GST offline tool icon > Open file location > Right-click on index.html file > Click on open with > Select type of browser.

After going through the above steps you will able to know GSTR 1 offline utility and how to use it in offline mode.

GSTR 1 Excel Tested Format

It is noted that the formats given on the GST portal are showing errors while importing the data into the offline tool. Also, it is seen that the portal shows errors after uploading the JSON file generated through the offline tool provided on the portal. Therefore, we will try to resolve such issues and provide the workable Excel file here to the taxpayers.

GSTR 1 CSV Tested Formats

We have noted that the CSV formats given on the GST portal are showing errors while importing the data into the offline tool. Secondly, it is seen that the portal shows errors after uploading the JSON file generated through the offline tool provided on the portal. Hence, we will try to resolve such issues and provide the workable CSV files here to the taxpayers. (The download link is not yet active)

GSTR 1 PDF Format Download

You may download the GSTR 1 pdf format for your offline use. However, this is the format of GSTR 1 as per the GST rules. Thus, this format should be used only for reference. You may refer to the instructions in this pdf format. Also, note that the above-downloaded tool contains the instructions sheet in the GSTR 1 template.

Further, in order to feed data in Excel and upload it on the GST portal, you must download the offline tool as explained above.

Miscellaneous Queries

Type of tools available for preparing GSTR 1

GSTR 1 can be prepared using the following manners:

1. Online entry on the GST Portal.

2. Uploading of invoice and other GSTR 1 data using Returns Offline Tool.

3. Using third-party applications of Application Software Providers (ASPs) through GST Suvidha Providers (GSPs).

Details to be supplied

The following details of a tax period have to be provided in GSTR 1:

- Invoice-wise details of supplies to registered persons including those having UIN;

- Invoice-wise details of Inter-State supplies of invoice value greater than Rs. 2,50,000 to unregistered persons (consumers);

- Details of Credit/Debit Notes issued by the supplier against invoices;

- Details of export of goods and services including deemed exports (SEZ);

- Summarised state-level details of supplies to unregistered persons (consumers);

- Summary Details of Advances received in relation to future supply and their adjustment;

- Details of any amendments effected to the reported information for either of the above categories;

- Nil-rated, exempted, and non-GST supplies; and

- HSN/SAC wise summary of outward supplies.

Taxpayers are not required to file the GSTR 1

The following type of taxpayers are not required to file this return:

- Taxpayers under the Composition Scheme. They have to file to GSTR 4;

- Non-resident foreign taxpayers (Return to be filled by them in GSTR 5);

- Online information database and access retrieval service provider (Return to be filled by them in GSTR 5A);

- Input Service Distributors (ISD) (Return to be filled by them in GSTR-6);

- Tax Deducted at Source (TDS) (deductors) (Return to be filled by them in GSTR-7)

- E-commerce operators collecting TCS (Return to be filled by them in GSTR-8)

The pre-requisites For Filing

- The taxpayer should be a registered taxpayer and should have an active GSTIN during the tax period for which GSTR 1 has to be filed;

- He should have valid login authorizations (i.e., User ID and password) to login into GST Portal;

- The taxpayer should have an active and non-expired/ revoked digital signature (DSC), in case the digital signature is mandatory;

- In case taxpayer wants to use EVC, they must have access to the registered mobile number of the Primary Authorized Signatory

The entry of the Value of turnover in the Compulsory field

The turnover value in Table 3 of GSTR 1 has to be entered manually for the first year as the information is not available with the GST system. From the second year of implementation of GST, the system will auto-calculate the turnover based on all the annual returns filed for all the GSTINs associated with a given PAN (PAN-based turnover). However, the turnover value will be editable and you will have the selection to amend it.

B2B Supplies

B2B supply refers to supply transactions between registered taxable entities/persons (Business-to-Business supplies).

B2C Supplies

B2C supply refers to supply transactions between a Registered Supplier and an Unregistered Buyer (Business-to-Consumer).

Reporting of Debit note and Credit note

Debit Notes are to be reported in the return of the month in which they are issued by the supplier.

Further, the Credit Notes are to be reported in the return of the month in which they are issued but not later than the return of the September month following the end of the financial year in which such supply was made, or the date of furnishing of the relevant annual return, whichever is earlier.

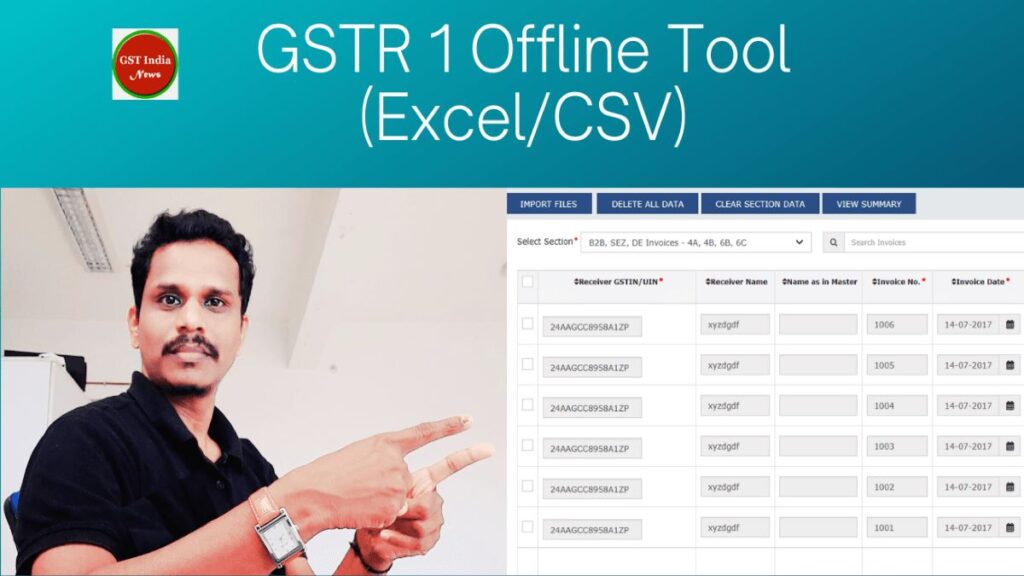

How to file GSTR 1 Offline?

This is a step-by-step guide to filing GST 1 offline on the GST portal by using the GSTR 1 offline uploader tool. The offline filing system will make it easy even to file the GSTR1 quarterly Return. Also, you can file a GSTR 1 nil return with the offline facility. This guide is for the GSTR 1 Excel upload procedure by using your desktop computer/laptop. In order to follow the offline filing process, you need to download the GSTR 1 offline utility provided by GSTN.

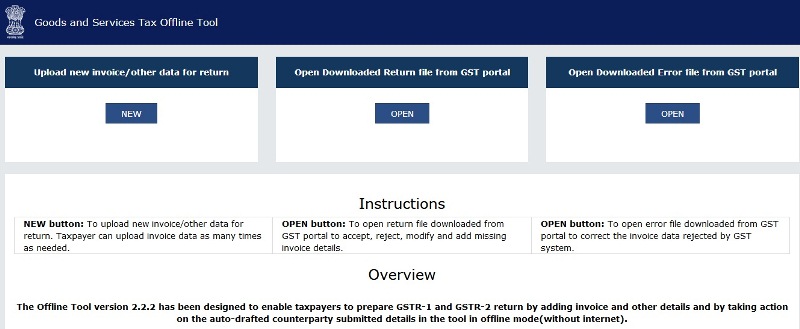

- Double-click the GST Offline tool icon on your desktop > The below window will open

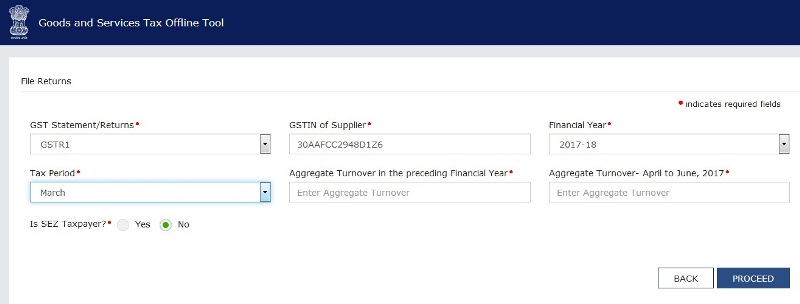

2. Click the NEW button under upload invoice details for filing the return.

3. From the GST Statement/Returns list, select the GSTR 1 option

4. Enter your GSTIN > Select the financial year > Select Tax period > Enter your previous year turnover> Click on yes If you are SEZ supplier > Click proceed.

Invoice Details Entry

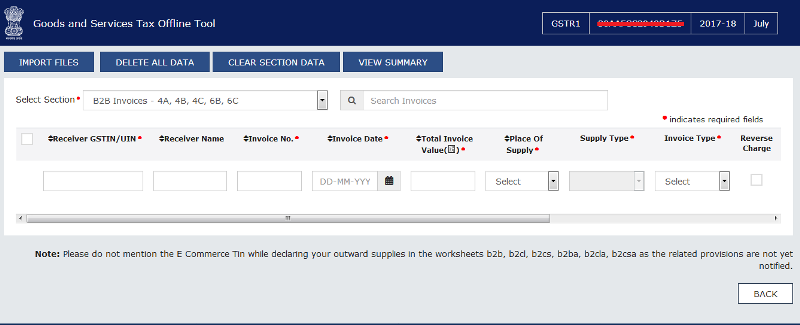

5. The Next step is to upload the invoice data. There are four options to upload the data in this window. (Explained one by 1)

5. Option 1: Manual Entry of Invoice Data. Straight forward you can add one by one all invoices,

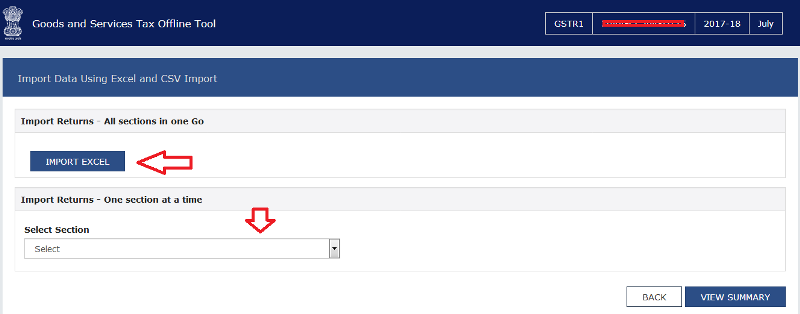

5. Option 2: Import a full Excel Workbook consisting of multiple sheets

In order to use this option click on the Import files option. With this option, you can import all section’s data in one go. Therefore your GSTR 1 Excel workbook should be ready with data to import here. You can find the GSTR 1 Excel workbook here. Go to your downloaded and extracted gst_offline_tool folder.

Open the GSTR1_Excel_Workbook_Template_Vxx file and enter data in all sections as required.

Once your GSTR 1 Excel workbook is ready you can click on the above import Excel and import all data in one go.

5. Option 3: Copy and Paste from GSTR 1 Excel Workbook

You can also use import returns – one section at a time by choosing from the drop-down list above. You can copy the data from your GSTR 1 Excel template and directly paste it through the above option.

5. Option 4: Import the CSV file. You can also import data from CSV templates. The said CSV templates you can find in your extracted GSTR 1 offline utility folder.

JSON File Generation Process

6. Once you import all sections > Click on view summary. Once you have checked the summary, you are ready to generate the GST Compliant format of all invoices imported in the GSTR 1 Returns Offline tool to be uploaded on the GST Portal. For this, click the GENERATE FILE button.

7. The above process will generate the JSON file to be uploaded to the GST Portal.

8. Visit GST portal > Go to returns > Click on PREPARE OFFLINE option > Choose generated JSON file. The system then will check your return. If your uploaded data is correct then after some time go to the B2B invoices in the GSTR1 tile. Notice the B2B invoices are uploaded.

9. If you encounter any errors in uploaded data then you can rectify it in offline mode > generate JSON file and upload the file again. You can upload the JSON file multiple times. Once you are done with your uploaded data you may then proceed to file the return.

How to file GSTR 1 online?

The regular registered taxpayer is required to file GSTR 1 monthly or quarterly basis. If there are no transactions also one can file a GSTR 1 nil return online. Also, this post will explain the online filing process and offline too.

We follow a step-by-step procedure so that the online filing will become easy to understand in a better way. You shall also follow the same steps to file gstr1 quarterly online. Let us see the detailed steps of the online filing process:

Step-by-Step Guide

1. Open your browser and visit www.gst.gov.in website > Login with your registered username and password.

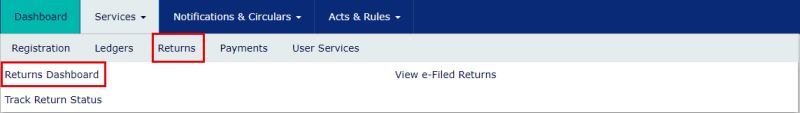

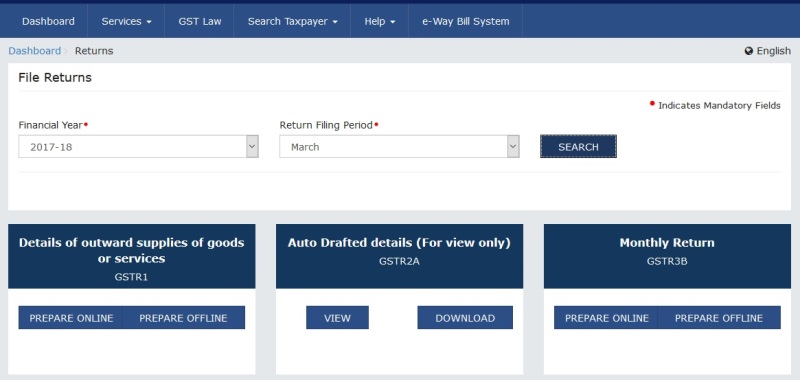

2. Click on Services > Returns > Returns Dashboard

3. Select the Financial Year, Return Filing Period from the drop-down list > Click SEARCH

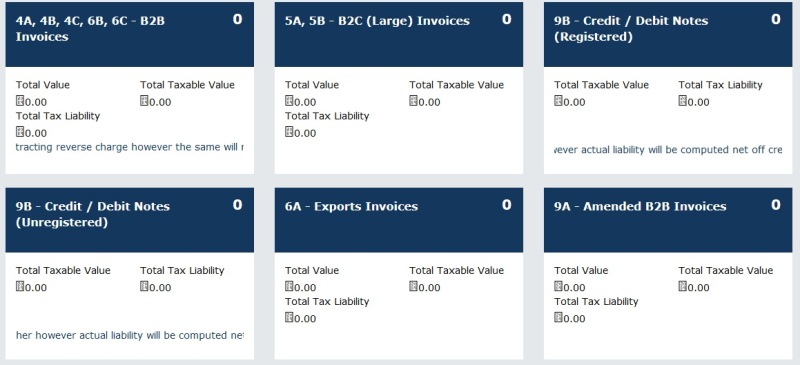

4. Click on PREPARE ONLINE under GSTR1 Tile

5. Here you can see different tiles where you need to enter your outward supply details, credit note/debit note, etc. under the respective tile.

6. For eg. Click on B2B Invoices Tile to enter outward supplies made to the Business to Business vertical.

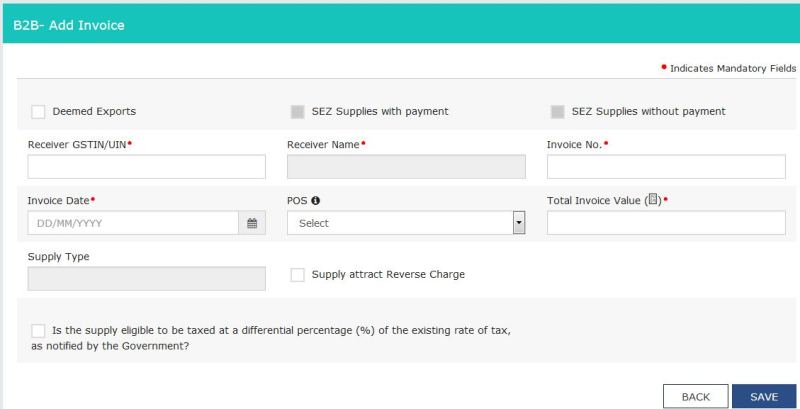

7. Click on the ADD DETAILS tab

8. Enter Outward Invoice details like GSTIN, NAME, INVOICE NO., INVOICE DATE, PLACE OF SUPPLY, etc.

9. Thereafter enter a Taxable value on the respective row as per your tax rate. The tax will get an auto to calculate.

10. Click on SAVE to save your 1st record. Likewise, you can enter all transactions for the given period.

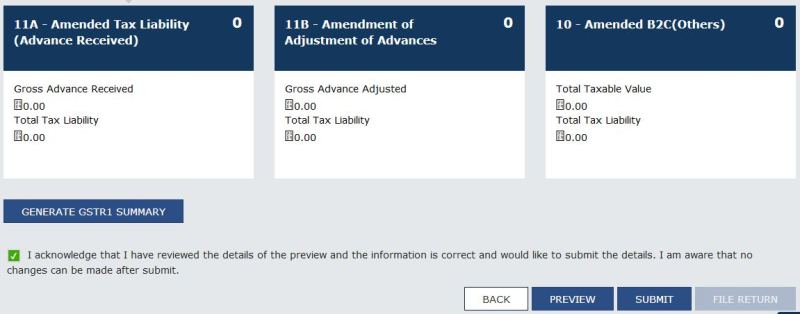

11. Once you enter all the details > Click on GENERATE GSTR 1 SUMMARY tab. This will show the total summary on the respective tile wherever you entered the details.

12. Click PREVIEW to check your entered details.

13. Once you are sure about the details entered ( Be 100% sure here about this step) > Proceed to click Accept the declaration.

14. Click Submit (Once you click on the submit button, you will no longer be allowed to modify the return)

15. Click on FILE RETURN

GSTR1 Filing Video

This webinar video contains how one can file online & offline GSTR 1 returns on GSTN(Goods and Service Tax Network). After watching this video you will able to upload the outward supplies on GSTN in form GSTR 1. Before watching this please read this section so that you will have an overall idea of how practical this whole process works. This will help you to resolve any technical errors that occur while doing your own return.

Computer Skill Requirement

First of all, you should note that One need not be an expert in computers to do this return. If you have general knowledge about computers then it is enough to do this job. You also need not require any software also to generate this return, if you are a small dealer and do not have many transactions.

Technical Process

There is no direct link from your software to the GSTN network. What the software program does is, generate the required compatible file to upload on the GSTN. One needs a .json file generated from Java-based software. Therefore what software programs normally do is, convert their software-generated data from Excel, text, HTML, PHP, etc. to a .json file which is accepted by the GSTN, so that is the advantage of having software rather than entering all transactions manually on the network or in the excel and then generate .json file.

Now let us understand how GSTN helps taxpayers convert their business data maintained in Excel or in any other format to the .json file. GSTN has provided three options namely:

- One can enter all the data in online mode;

- Download the Excel utility and fill in the data in offline mode;

- Copy the Excel data and paste it directly on the GSTN screen.

For more details, you should see this video and generate your return. I hope this article will definitely ease your job in filing this return.

How to convert gstr1 JSON to Excel?

As of now, the GST portal does not have an option to download the GSTR 1 data in Excel format. Therefore, you need to use a third-party tool to convert gstr1 JSON to Excel. Here are the steps through which you can download the JSON file of GSTR 1 from the GST portal and then convert it into an Excel file.

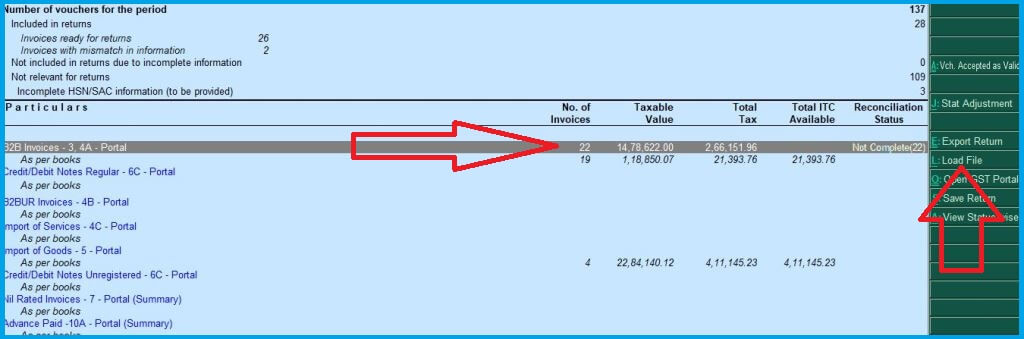

The first thing you can do this by importing the JSON file into your software, from where you have exported the JSON file. For eg. in Tally ERP you can load the JSON file and then export it into Excel. Here are the steps:

- Go to the Gateway of Tally >> Display >>Statutory Reports >>GST >> GSTR -2

- Click on the “Load File” >> Select the file location of the downloaded JSON file.

- Do not click on the “update reconciliation of invoice Status” popup

- You will see the imported invoices and per-book records. Click to enter the transactions/invoices.

- Click on Export option >> Choose format as Excel

Further, you can also download the gstr1 JSON to excel converter online free tool. Click here to download. By using this tool you can convert your JSON file into Excel format.

HSN Summary – Who should give HSN summary-wise details in GSTR 1 and Is it Mandatory?

As per Notification No. 12 /2017 – Central Tax dtd.28.06.2017, a registered person having annual turnover in the preceding financial year as specified below should mention the HSN code on the Invoice. Therefore it’s my opinion that one should provide the HSN-wise details in GSTR 1 also.

- Up to 1.5 Crore = Nill ( NO need to mention HSN code)

- More than 1.5 Crore and up to 5 Crore = 2 HSN codes must be specified.

- More than 5 Crore = 4 Digits should be specified.

Irrespective of the above conditions one can show all 8-digit HSN codes for goods and 4-digit HSN codes for services on the Invoice or in Returns.

Does a taxpayer need to check the validity of the registration of the recipients furnished in GSTR-1?

Yes, the taxpayer should check the validity of the recipient’s GSTIN and upload the invoice details only if the recipient was active on the date of issue of the invoice, otherwise, the system will throw a validation error and will not accept invoice details pertaining to that GSTIN.

When can changes be made to the uploaded invoice details?

Taxpayers can modify/delete invoices any number of times till they submit the GSTR-1 of that particular tax period. The uploaded invoice details are in a draft version and can be changed irrespective of the due date until the GSTR-1 is submitted.

Do I need to upload the invoice(s) while filing GSTR-1?

Taxpayers can upload invoice details at any time during the tax period and not just at the time of filing of GSTR-1. For example, let’s take September 2021 as the tax period – the taxpayer can upload invoices from 1st September to 10th October and after 15th October in case of late filing of GSTR-1.

How exempt supplies through E-Commerce be reported in GSTR-1?

It should be reported in a consolidated manner in the nil-rated and exempt supply section of the GSTR-1.

Is it required to submit the details of E-Commerce?

Yes. The return provides for the declaration of the details of all taxable Supplies effected through E-Commerce along with the GSTIN of the e-commerce portal in GSTR-1. However, this would be implemented once the relevant provisions of GST law are notified.

How submit supplies to SEZ units or SEZ developers in GSTR-1?

As the SEZ unit or SEZ developer is registered and has GSTIN, the invoice details of supplies to them need to be reported in the section of supplies to registered taxpayers (B2B invoice details) with the appropriate SEZ flag.

How the shipping bill number be updated after the filing of GSTR-1?

If the shipping bill details are received by the taxpayer after the filing of the GSTR-1, he needs to declare it in the GSTR-1 of the month in which he receives it through the amendment section of GSTR-1.

Is the shipping bill number mandatory for export invoices in GSTR-1?

No, a taxpayer can furnish details of the export invoices in GSTR-1 and file the return without mentioning the shipping bill number and date, if the shipping bill details are not readily available to him.

How is the tax paid on advance payments adjusted against the invoice(s) issued in the subsequent tax period(s)?

The taxpayer has to declare the advance that has to be adjusted in the tax period in which the advance is received. Subsequently, when an invoice is issued, the taxpayer can adjust the tax liability of the invoice issued of that tax period, in the GSTR-1 of that period. This can be shown in the advance adjustment table of GSTR-1.

Receipt of advance by the Supplier from a Receiver

The Supplier is liable to pay tax on advances received from Receivers for the supply of goods and services and report the consolidated advance received details in the month in which payment is received. An amount of advance to be reported in GSTR-1 is net of the amount for which invoices have already been issued and the value reported in the same return in other sections.

Top 7 Frequently Asked Questions

GSTR 1 Return is a monthly Statement of Outward Supplies to be filed by all normal and casual registered taxpayers.

Every registered taxable person, other than an input service distributor/ composition taxpayer/persons legally responsible for deducting tax u/s 51 / persons liable to collect tax u/s 52 is required to file GSTR 1, the details of outward supplies of goods and/or services during a tax period, electronically on the GST Portal.

You can choose for Quarterly filing of GSTR 1 return under the following conditions:

If your turnover during the previous financial year was up to Rs. 1.5 Crore; or if you are registered during the current financial year and assume your aggregated turnover during FY 2023-2024 to be up to Rs. 1.5 Crores

No. You must choose this option during the starting month of the Financial year. However, the facility to change the frequency is available if you have not filed any return during the financial year according to the original frequency.

Yes, GSTR 1 needs to be filed even if there is no business activity (Nil Return) in the given tax period.

The ‘Total Invoice Value’ column in GSTR 1 is for the invoice value inclusive of taxes.

Yes, you can enter details of Goods and Services in the same invoices under GST.

Similar GSTR 1 Links

Process of QRMP Scheme in GST

Learn what is QRMP Scheme under GST. Also, know how to and upload file GSTR 1 after opting for QRMP scheme.

GSTR 1 Return Format in Excel

Read GSTR 1 excel format details. You can read to know what data should be entered under which tile on the GST portal. Know more about GSTR 1 Excel template.

GST Offline Tool Download for Free

The taxpayer can download the latest offline tools for preparing the GST returns like GSTR 3B, GSTR 1, GSTR 9, etc. Read to know the solution if GST offline tool is not working with the white screen.

Table 9 of GSTR 1 Amendment

See how to fill up the details in GSTR 1 for Claiming Input tax credit refund. Read more about table 9 and refund.