21.12.2023: The GSTR 3B return has ben extended until 27.12.2023 whose principal place of business is in the districts of Chennai, Tiruvallur, Chengalpattu and Kancheepuram in the state of Tamil Nadu. This has reference to the CGST Notification No. 55/2023 –CENTRAL TAX Dt. 20.12.2023.

The extension must have been given due to Heavy rain has paralysed several parts of India’s southern state of Tamil Nadu, inundating roads, affecting train services, and leaving authorities scrambling to rescue those stranded.

Previous Extensions

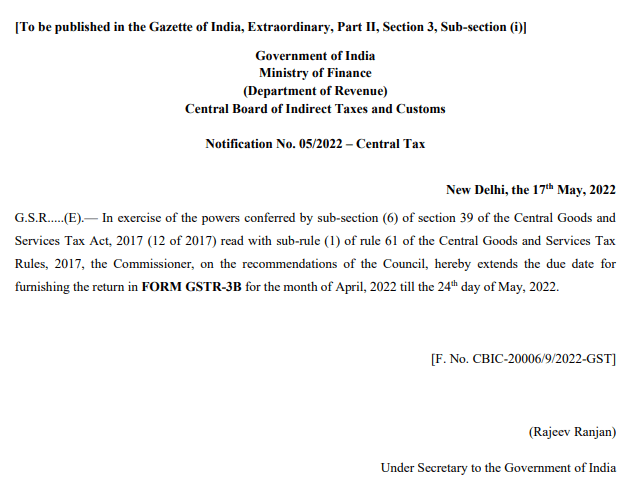

18.05.2022: The GSTR 3B the last date of filing for the month of April 2022 has been extended till 24th May 2022. This has reference to notification no. 05/2022-Central Tax dated 17.05.2022. Thus, the taxpayers who need to file their returns by the 20th of this month will get an additional timeline of 4 days.

Similarly, the payment under the QRMP scheme has also been extended till 27th May 2022, having notification reference no. 06/2022– Central Tax dated 17.05.2022.

GSTR 3B Late Fees Waiver Condition: Notification No. 57/2020 dt.30.06.2020

03.07.2020: The government has issued Notification No. 51/2020 –Central Tax dt.24.06.2020 to notify the lower rate of interest i.e 9% for delay filing in GSTR 3B. The lower rate of interest will be applicable for the tax period from February to April 2020. Here is how it will be calculated. Let us understand what is the due of filing of GSTR 3B for the above given period.

Read Latest GSTR 3B Due and Extensions

Example for Turnover more than 5 crore

The default due date is 20th of next month. For example the return for the month of February shall be filed on or before 20th March 2020. Now due to the covid 19 pandemic situation, this due date is extended by another 15 days. Therefore the new last date for February 2020 is 04th April 2020.

Therefore, if you file GSTR 3B by 04th April 2020, no interest will be applicable to you on GST payment. Similarly, the last date for the month of March 2020 is 05th the May 2020 and 04th June 2020 for the month of April 2020 respectively.

Further, there will be 9% interest per day on GST payment for returns filed beyond the below dates. The rate of interest is given in the table.

Turnover more than 5 crore

| Month | Last Date (without interest) | 9% Interest till below date, after that 18% interest / day |

| February 2020 | 04th April 2020 | 24th June 2020 |

| March 2020 | 05th May 2020 | 24th June 2020 |

| April 2020 | 04th June 2020 | 24th June 2020 |

| May 2020 | 27th June 2020 | N/A |

Turnover upto 5crore – (Group I States)

States: Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana or Andhra Pradesh or the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands and Lakshadweep.

| Month | Last Date (without interest) | 9% Interest till below date, after that 18% interest / day |

| February 2020 | 30th June 2020 | 30th September 2020 |

| March 2020 | 03rd July 2020 | 30th September 2020 |

| April 2020 | 06th July 2020 | 30th September 2020 |

| May 2020 | 12th September 2020 | 30th September 2020 |

| June 2020 | 23rd September 2020 | 30th September 2020 |

| July 2020 | 27th September 2020 | 30th September 2020 |

Turnover upto 5crore – (Group II States)

Sates: Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam,West Bengal, Jharkhand or Odisha or the Union territories of Jammu and Kashmir, Ladakh, Chandigarh and Delhi

| Month | Last Date (without interest) | 9% Interest till below date, after that 18% interest / day |

| February 2020 | 30th June 2020 | 30th September 2020 |

| March 2020 | 05th July 2020 | 30th September 2020 |

| April 2020 | 09th July 2020 | 30th September 2020 |

| May 2020 | 15th September 2020 | 30th September 2020 |

| June 2020 | 25th September 2020 | 30th September 2020 |

| July 2020 | 29th September 2020 | 30th September 2020 |

Late fees Waiver

Late filing fees of GSTR 3B are waived according to the Notification No. 52/2020 –Central Tax dt.24.06.2020. Further, the government has issued notification no. 57/2020 –Central Tax dt.30.06.2020 to put conditions as stated below.

Turnover more then 5Crore.

| Month | Nil late fees till 30.09.2020 for Without Tax Liability. After below date and before 30.09.2020, Rs.500/- per return is applicable with tax liability. |

| February 2020 | 24th June 2020 |

| March 2020 | 24th June 2020 |

| April 2020 | 24th June 2020 |

| May 2020 | 27th June 2020 |

| June 2020 | 20th July 2020 |

| July 2020 | 20th August 2020 |

Turnover upto 5crore – (Group I States)

| Month | Nil late fees till 30.09.2020 for Without Tax Liability. After below date and before 30.09.2020, Rs.500/- per return is applicable with tax liability. |

| February 2020 | 30th June 2020 |

| March 2020 | 03rd July 2020 |

| April 2020 | 06th July 2020 |

| May 2020 | 12th September 2020 |

| June 2020 | 23rd September 2020 |

| July 2020 | 27th September 2020 |

Turnover upto 5crore – (Group II States)

| Month | Nil late fees till 30.09.2020 for Without Tax Liability. After below date and before 30.09.2020, Rs.500/- per return is applicable with tax liability. |

| February 2020 | 30th June 2020 |

| March 2020 | 05th July 2020 |

| April 2020 | 09th July 2020 |

| May 2020 | 15th September 2020 |

| June 2020 | 25th September 2020 |

| July 2020 | 29th September 2020 |

Who Should file GSTR 3B by 20th, 22nd and 24th?

The due date of filing GSTR 3B is 20th of Next Month for aggregate turnover of more than 5 crores in the previous financial year.

Whereas for the turnover below 5 crores shall follow the below Staggered Manner pattern for filing this return. You may also read the detail notification to know about these dates.

Please read the below section to know the group of states to whom the last date 22nd and 24th are applicable.

CBIC Prescribe GSTR 3B Due Dates in Staggered Manner

05.02.2020: The CBIC has issued a notification having reference no. 07/2020–Central Tax dt.03.02.2020 to prescribe due date of GSTR 3B. These dates are prescribed in a staggered manner.

08.04.2020: The CBIC has notified the due dates of filing GSTR 3B for the month from April to September 2020 in the following manner. This has reference to the Notification No. 29/2020–Central Tax dt.23.03.2020.

In other words, the taxpayers whose turnover in the previous financial year was up to Rs. 5 Crore can file the returns on or before the below dates. Also, only the specific given states are eligible to file these returns as per the prescribed dates. The period of return filing is applicable for the month of January to September 2020 only. Here are the details:

List of States – Group I

Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana or Andhra Pradesh or the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman, and the Nicobar Islands and Lakshadweep.

List of States – Group II

Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha or the Union territories of Jammu and Kashmir, Ladakh, Chandigarh, and Delhi.

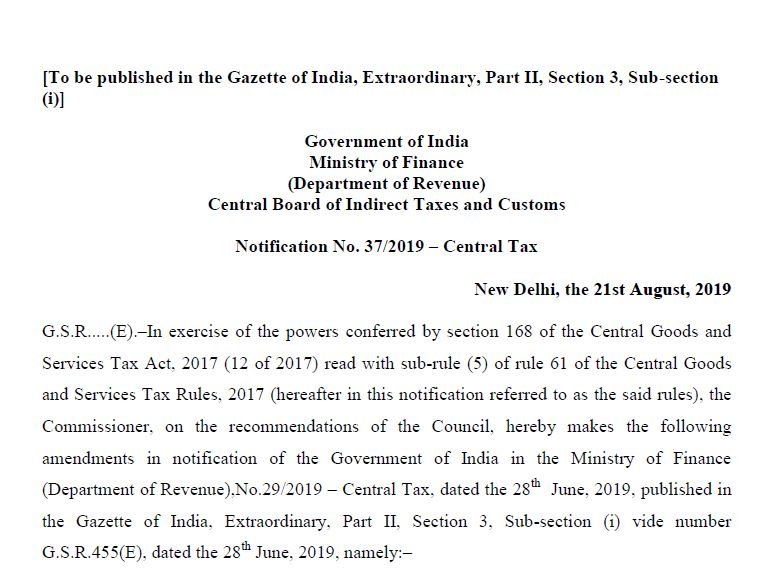

Extension of GSTR 3B for July 2019 | Notification update

22.08.2019: CBIC extends the due date of filing GSTR 3B Return for the month of July 2019 by an additional two days. Therefore, the taxpayers can file GSTR 3B return till 22.08.2019 without paying late fees. This has a reference to GST Notification no. 37/2019 – Central Tax

Further, the government gives the additional one-month extension to file GSTR 3B to flood

| Sl. No. | Name of State | Name of District |

| (1) | (2) | (3) |

| 1. | Bihar | Araria, Kishanganj, Madhubani, East Champaran, Sitamarhi, Sheohar, Supaul, Darbhanga, Muzaffarpur, Saharsa, Katihar, Purnia, West Champaran |

| 2. | Gujarat | Vadodara |

| 3. | Karnataka | Bagalkot, Ballari, Belagavi, Chamarajanagar, Chikkamagalur, Dakshina Kannada, Davanagere, Dharwad, Gadag, Hassan, Haveri, Kalaburagi, Kodagu, Koppal, Mandya, Mysuru, Raichur, Shivamogga, Udupi, Uttara Kannada, Vijayapura, Yadgir |

| 4. | Kerala | Idukki, Malappuram, Wayanad, Kozhikode |

| 5. | Maharashtra | Kolhapur, Sangli, Satara, Ratnagiri, Sindhudurg, Palghar, Nashik, Ahmednagar |

| 6. | Odisha | Balangir, Sonepur, Kalahandi, Nuapada, Koraput, Malkangiri, Rayagada, Nawarangpur |

| 7. | Uttarakhand | Uttarkashi and Chamoli |

Last Day to file GSTR 3B for March 2019 |Notification update

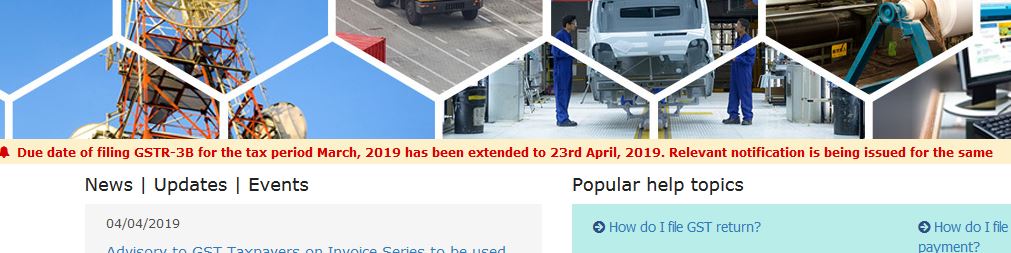

20.04.2019: Today is the last day to file GSTR 3B for the month of March 2019. Many taxpayers were not able to file GSTR 3B by 20th April due to overload on the

Therefore, the date has been extended for another 3 days by the department. That means you can file your GSTR 3B by 23rd April 2019.

Click here for the official notification. Keep visiting GST India News to read official notifications and other updates.

Due date of GSTR 3B For January 2019

The Due date of filing GSTR-3B for the month of January, 2019 has been extended up to 22nd February, 2019.

Only state of J&K it is extended up to 28th Feb 2019. The last date of GSTR 3B is already appearing on GST portal in the ticker section.

This is effective as per Notification No.09/2019–Central Tax dt.20.02.2019. Read GSTR 3B extension notification in English. Click here for Notification in Hindi language.

Extension of GSTR 3B for September and October 2018 for AP and Tamil Nadu

1.Extension of due dates for filing GSTR 1 and GSTR 3B

In view of the instabilities caused to daily life by Cyclone Titli in the district of Srikakulam, Andhra Pradesh, and by Cyclone Gaza in eleven districts of Tamil Nadu viz.,

| 1. Cuddalore | 2. Thiruvarur | 3. Puddukottai | 4. Dindigul |

| 5. Nagapatinam | 6. Theni | 7. Thanjavur | 8. Sivagangai |

| 9. Tiruchirappalli | 10. Karur | 11. Ramanathapuram |

The competent authority has decided to extend the due dates for filing various GST returns as detailed below:

| Sl. No. | Return/Form | Extended due date | Taxpayers eligible for extension |

| 1 | FORM GSTR-3B for the months of September and October, 2018 | 30th November, 2018 | Taxpayers whose principal place of business is in the district of Srikakulam in Andhra Pradesh |

| 2 | FORM GSTR-3B for the month of October, 2018 | 20th December, 2018 | Taxpayers whose principal place of business is in the 11 specified districts of Tamil Nadu |

| 3 | FORM GSTR-1 for the months of September and October, 2018 | 30th November, 2018 | Taxpayers having aggregate turnover of more than 1.5 crore rupees and whose principal place of business is in the district of Srikakulam in Andhra Pradesh |

| 4 | FORM GSTR-1 for the month of October, 2018 | 20th December, 2018 | Taxpayers having aggregate turnover of more than 1.5 crore rupees and whose principal place of business is in the eleven specified districts of Tamil Nadu |

| 5 | FORM GSTR-1 for the quarter July- September, 2018 | 30th November, 2018 | Taxpayers having aggregate turnover of up to 1.5 crore rupees and whose principal place of business is in the district of Srikakulam in Andhra Pradesh |

| 6 | FORM GSTR-4 for the quarter July to September, 2018 | 30th November, 2018 | Taxpayers whose principal place of business is in the district of Srikakulam in Andhra Pradesh |

| 7 | FORM GSTR-7 for the months October to December, 2018 | 31st January, 2019 | All taxpayers |

—end—

2. Extension of GSTR 3B for September 2018 till 25th October 2018

Last date to avail ITC of 2017-18 and GSTR 3B filing for September – 25th October 2018

In order to remove worries, it is clarified that as per the law, the last date for availing ITC for the period from July 2017 to March 2018 is the last date for the filing of GSTR-3B return for the month of September 2018.

In view of the said worries and with a view to give some more time to the trade and industry, the last date for filing GSTR 3B return for the month of September 2018 is being extended up to 25th October 2018.

Therefore, this extension of the said due date also applicable for availing ITC for the period July 2017 to March 2018 and also gets extended up to 25th October 2018.

3. Government has issued below press reference to extend GSTR 3B filing date by 22nd May 2018.

Press Release

18th May 2018

Extension of date for filing return in FORM GSTR-3B for the month of April, 2018

It has been brought to the notice of the competent authority that certain technical issues are being faced by the taxpayers during the filing of FORM GSTR-3B for the month of April, 2018. In order to resolve the same, emergency maintenance is being carried out on the system.

Therefore, in the interest of taxpayers, it has been decided to extend the last date for filing of return in FORM GSTR-3B for the month of April, 2018 for two days, i.e., till 22nd May, 2018. The notification in this regard shall be published shortly.

Top 5 Important GST Links

GSTR 3B Return Due dates updated

The GSTR 3B due date of filing is 20th of Next month. Check out the GSTR 3B due dates with extension of year 2021. more

Solve https //127.0.0.1:1585 DSC Error

Many taxpayers see the failure to establish errors while filing the GST returns. The error can be fixed by typing https://127.0.0.1:1585 in the browser. more

How to Check online GST Number

Learn how to check, verify and know the status of the GST number of your customers and suppliers online. more

GSTR 9 online filing steps on GST portal

Have you filed your GST annual return of FY 2019-20?. if not check out here how to file GSTR 9 online on the GST portal. more.

ITC in GST: A complete Guide

Availing the right input tax credit in GST is a crucial task. Learn the various conditions and rules that are applicable to the input tax credit. more

Thanks for sharing this press release regarding GSTR 3B Return.

Hi, I read your article thanks for sharing this information.

THANKS FOR YOUR INFORMATION REGARDING GST NEWS.