What is GSTR 9 Annual Return Filing?

GSTR 9 is a consolidated annual return under GST. GSTR9 annual return consists of details like outward taxable supplies, input tax credit availed, advance received, etc. In other words, it is a summary of the entire year you have declared monthly in the form of GSTR 1, GSTR 2, and GSTR 3B.

GSTR 9 should be filed by every regular taxpayer who is filing monthly/Quarterly Returns like GSTR 1 and GSTR 3B. However, GSTR 9 Annual Return Filing is a one-time process for every year.

Topics Index

- GSTR 9 Meaning > Who need not require filing GSTR 9

- Due date for GSTR 9 > GSTR 9 format in pdf > GSTR 9 format in Excel

- Filing Instructions > Top 8 Points to Consider

- How to file GSTR 9 online > GSTR 9 Checklist

- GSTR 9 Annual Return filing Video

- GSTR 9 Latest News

There are three types of GSTR 9 Annual Returns

a) GSTR 9A – A composition dealer shall file an annual return in form GSTR 9A.

b) GSTR 9B – An E-commerce operator needs to file Annual Return in Form GSTR 9B (Not applicable for FY – 2017-18)

c) GSTR 9C – A registered person whose aggregate turnover exceeds 2 crore rupees during the financial year shall get his accounts audited. He needs to file GSTR 9 audited annual accounts in the form of GSTR 9C through the electronic common portal.

Who need not require filing a GSTR 9 Return?

- Input service distributor

- Deductor under section 46.

- E-commerce operator

- Casual taxable person

- Non-resident taxable person

- Suppliers of OIDAR services [Inserted vide CGST Notification No. 30/2019 Central Tax ,dt. 28-06-2019.

Optional Filing for Small Taxpayers

The 37th GST Council meeting headed by Nirmala Sitharaman decided that small taxpayers may not file GSTR 9 Annual Return. Small taxpayers are the payers whose aggregate turnover is 2 crore rupees. However, it is applicable only to Fy 2017-18 and 2018-19. Thus, the above type of taxpayers may file or may not file the GSTR 9 Return for the above period. Please read GST Notification no. 47/2019-Central Tax,

Annual Return of FY 2020-21

The taxpayers with turnover up to Rs. 2 crores in FY 2020-21, need not require filing GSTR 9 annual return. This has reference to notification no. 31/2021-Central Tax dated 30.07.2021.

It is further clarified through circular no. 124/2019 dt.18.11.2019 that, if the taxpayer opts to file GSTR 9 for the above period then he must file it before the due date. The GST portal will not allow filing this return after its due date. Also, the return will be deemed to be filed if not filed on or before its due date according to the above notification.

GSTR 9 Annual return due date

GSTR 9 Annual return should be filed on or before 31st December following the end of such fiscal year. Therefore the due date of GSTR 9 for FY 2022-23 is 31st December 2023. Check here for GSTR 9 Due date Extension notification.

Late Filing Fees

A late fee will be applicable for late return filing, i.e. after the due date.

GSTR 9 format in pdf

GST India News has uploaded GSTR 9 format in pdf on this site. You can download the same by clicking on the below link. Thus, the GSTR 9 pdf format can be used for offline reference while filing your GSTR 9 online.

Similarly, you can refer to the instructions in the attached format to know how to fill every table of GST Annual Return. The instructions are given in the format are as per the existing GST law. You may also see below the notification details against which the revised GSTR 9 draft format is prepared. The revised pdf format is updated as per the latest GST notification No. 56/2019-Central Tax dt. 14-11-2019.

GSTR 9 format in excel

We have uploaded GSTR 9 format in excel on this site. You may download this format in excel by clicking on the below download link. you may search for it in the future from our search page by typing GST annual return format in excel, gstr 9 excel format, and gstr 9 format in excel.

Therefore, now you can use this excel template to upload the data on the GST portal. Recently GSTN has provided this Excel offline tool for filing GSTR 9 annual returns. Therefore, you can now file GSTR 9 through an online process or by preparing it offline and generate JSON files ready for upload on the GST portal. The revised excel utility will be ready to download from the GST portal by 21.12.2019.

GSTR 9 Annual Return Filing instructions:

Let us see how to fill the data in annual return in different tables, tiles or parts.

Filling Instructions for Offline utility

Here are the filling instructions for the offline excel file. you can download the excel format of GSTR 9 and fill in the details, generate a JSON file and upload it on the GST portal.

The taxpayer must import the JSON file into an offline tool to see the auto-filled details in Table no. 4(A) to 4(G) and Table no. 4(I) to 4(L) of GSTR 9 based on the outward and inward supplies reported during the relevant financial year in GSTR 1 Return. However, these details can be edited by the taxpayer.

Further, If you have edit/modify any auto-filled value, then that value will be considered as final after successful uploading of JSON file on the GST portal.

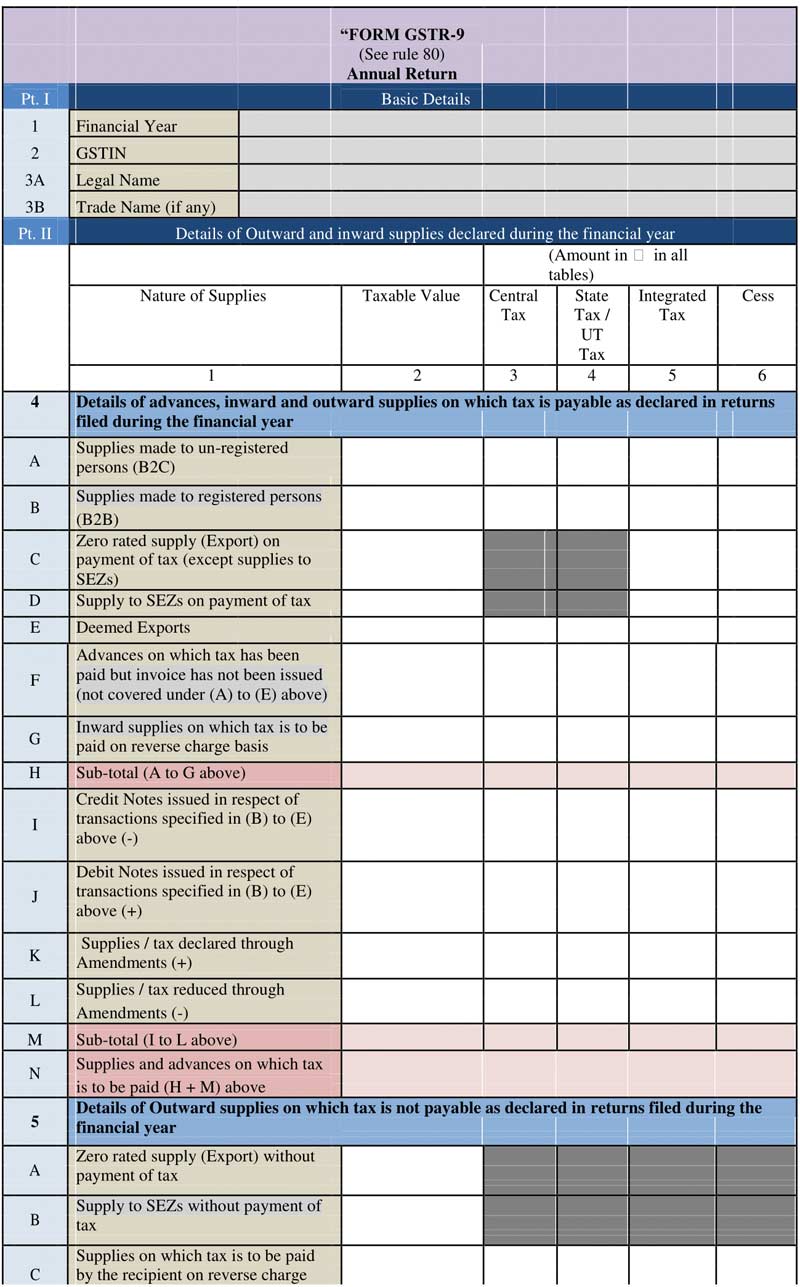

Part I – Basic Details

You need to enter basic details like “Financial year”, your “GSTIN”, legal name of business, and trade name if any. Please note that you need to provide details from 01s April to March 31 of the particular financial year,

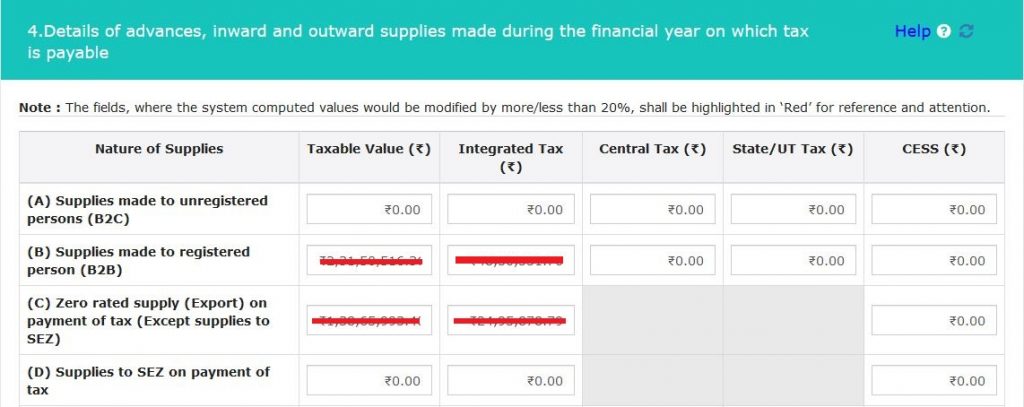

4.Details of advances, inward and outward supplies made during the financial year on which tax is payable

PT. II Details of Outward and inward supplies made during the financial year

4A. Supplies made to un-registered persons (B2C)

Here are the details to be entered in this field. The taxpayer shall enter the Aggregate value of supplies made to consumers and unregistered persons (B2C supplies) on which tax has been paid in this field.

Also, This will include details of outward supplies made to unregistered persons/consumers through E-Commerce operators, if any.

One needs to enter the details as net of credit notes or debit notes issued during the Financial Year.

Please note that Table 5, Table 7 along with respective amendments in Table 9 and Table 10 of FORM GSTR-1 may be used for filling up these details. Also, This table shall be auto-filled based on the outward supplies reported by the taxpayer in GSTR 1 return.

4B. Supplies made to registered persons (B2B)

Enter here the Aggregate value of supplies made to registered persons (including supplies made to UINs) on which tax has been paid. These figures include supplies made through E-Commerce operators. However, it will not include the supplies on which tax is to be paid by the recipient on a reverse charge basis.

You need to mention the Details of debit and credit notes separately in Table 4A and Table 4C of GSTR 1 return.

4C. Zero-rated supply (Export) on payment of tax (except supplies to SEZs)

In this field, you need to enter the Aggregate value of exports (except supplies to SEZs) on which tax has been paid. You may use these figures from Table 6A of GSTR 1 return for filling up these details.

4D. Supply to SEZs on payment of tax

Enter the Aggregate value of supplies to SEZs on which tax has been paid. Also, you may use Table 6B of GSTR 1 to fill up these details.

4E. Deemed Exports

Fill in the Aggregate value of supplies which are in the nature of deemed exports on which tax has been paid. You can get the data from Table 6C of FORM GSTR 1 return for filling up these details.

4F. Advances on which tax has been paid but invoice has not been issued (not covered under (A) to (E) above)

You need to enter the Details of all unadjusted advances i.e. advance has been received and tax has been paid but the invoice has not been issued in the current. You can use Table 11A of FORM GSTR 1 for filling up these details.

4G. Inward supplies on which tax is to be paid on reverse charge basis

Enter the Aggregate value of all inward supplies (including advances and net of credit and debit notes) on which tax is to be paid by the recipient (i.e.by the person filing the annual return) on a reverse charge basis.

These figures shall include supplies received from registered and unregistered persons on which tax is charged on a reverse charge basis. Also, it includes the aggregate value of all imports of services. Similarly, you may use Table 3.1(d) of FORM GSTR-3B for filling up these details.

4H. Sub-total (A to G above)

Auto calculation of Sub Totals

4I. Credit Notes issued in respect of transactions specified in (B) to (E) above (-)

This field shall be filled with the Aggregate value of credit notes issued for B to B supplies (4B), exports (4C), supplies to SEZs (4D), and deemed exports (4E). Once can use Table 9B of FORM GSTR 1 for filling up these details.

4J. Debit Notes issued in respect of transactions specified in (B) to (E) above (+)

Enter the Aggregate value of debit notes issued to B to B supplies (4B), exports (4C), supplies to SEZs (4D), and deemed exports (4E). Thus, you may get this data from Table 9B of GSTR 1 return.

4K. Supplies/tax declared through Amendments (+).

4L. Supplies/tax reduced through Amendments (-)

The taxpayer shall enter the Details of amendments made to B to B supplies (4B), exports (4C), supplies to SEZs (4D) and deemed exports (4E), credit notes (4I), debit notes (4J), and refund. One can get these figures form Table 9A and Table 9C of FORM GSTR-1 return and fill it here.

4M. Sub-total (I to L above)

4N. Supplies and advances on which tax is to be paid (H + M) above

This field will get calculated automatically.

PART II. 5: Enter here the details of taxable Outward supplies as declared in returns filed during the financial year.

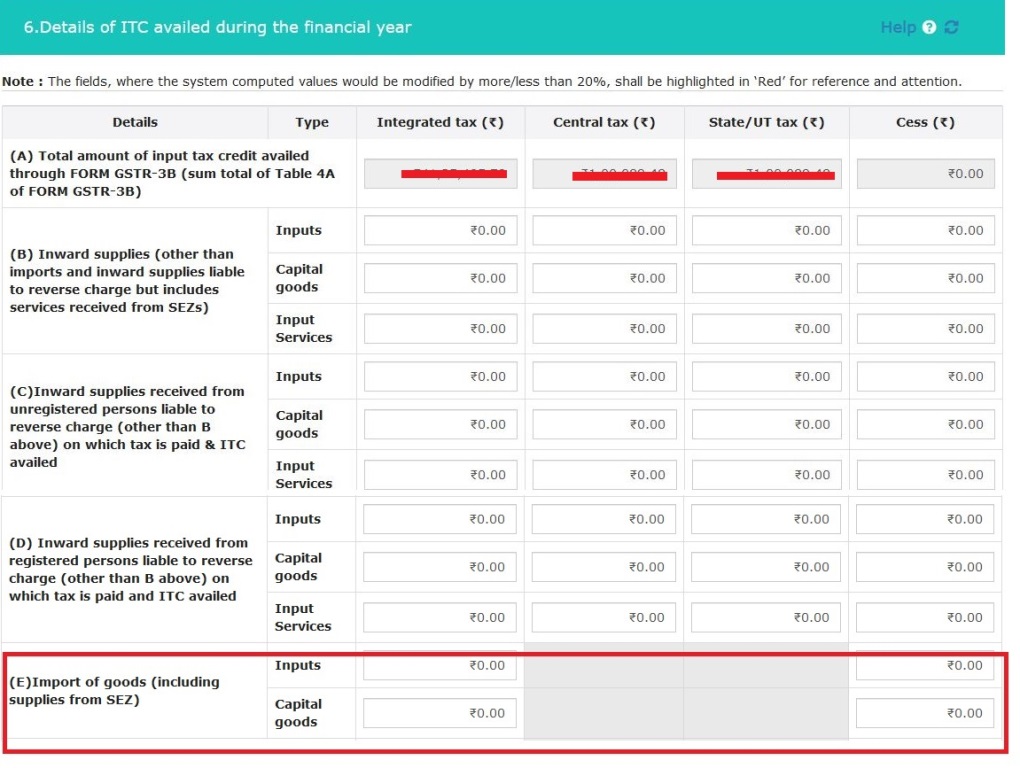

PART III – Input Tax credit availed and reversed

This particular part consist of details of input tax credit(ITC) availed and reversed as declared in returns filed during the financial year.

6: Details of ITC availed as declared in returns filed during the financial year.

7: consist of details of ITC Reversed and Ineligible ITC as declared in returns.

8: To enter Other ITC related information

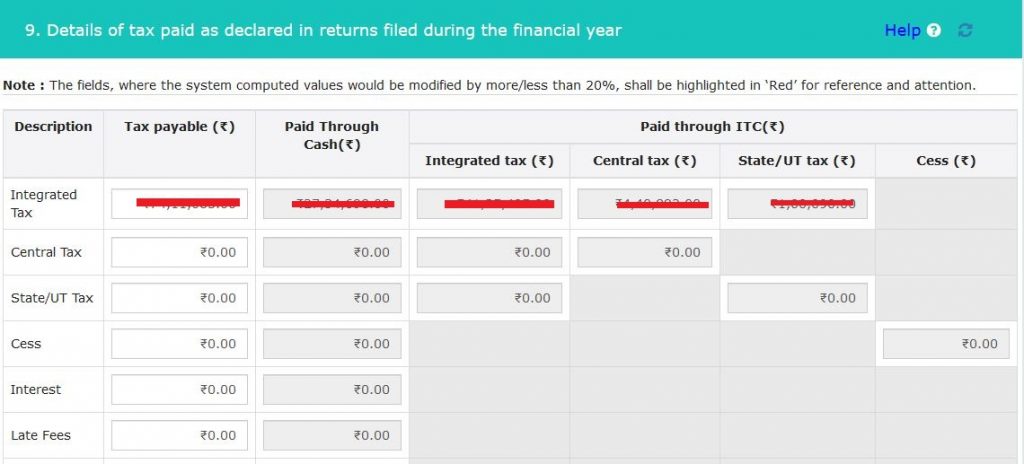

Part IV: Tax paid as shown in Returns

PART V:

Details of the transactions for the previous FY declared in returns of April to September of current FY or up to the date of filing of annual return of previous FY whichever is earlier.

Part VI:

Other Information like Particulars of Demands and Refunds, Information on supplies received from composition taxpayers, deemed supply and goods sent on an approval basis. Also, it consists of HSN Wise Summary of outward supplies and inward supplies.

Top 8 points to consider While Filing GSTR 9

1. Records from GSTR 2A

Information of GSTR 2A as of 31.05.2019, will automatically populate in Table 8A of Form GSTR 9. Therefore, if your supplier did not upload any/part invoices previously, there may be a possibility that he might have entered them recently.

2. ITC availed later

You need to show ITC received on inward supply during 2017-18 but availed during April to

3. Treatment for Old Transactions declared in Future Returns

The transactions for FY 2017-18 declared in later returns from April 2018 to March 2019 shall be declared in Pt. V of FORM GSTR-9. (See above offline format for point/part of Returns). This Contains information like:

- Supplies/tax declared through Amendments (+) (net of

debit notes) - Supplies/tax reduced through Amendments (-) (net of credit notes)

- Reversal of ITC availed during the

previous financial year - ITC availed for the previous financial year

4. Treatment for Tax paid Later

You need to declare supplies at Pt. II, If the tax is paid through Form GSTR 3B on outward supplies between July 2017 to March 2018. On the other hand, if the tax is paid through GSTR 3B between April 2018 to March 2019, you need to show such supplies in Pt. V of form GSTR 9.

It does not matter in which month you have declared the above supplies in your GSTR 1 Return. Hence you need to see in which month liability occurred and when you paid through GSTR 3B.

5. Left out liability for the Given period

Additional liability if any, on outward supplies which

Here one can declare missed invoices on which tax was not paid in Fy 2017-18. The final difference between the “tax payable” and “paid through cash” column in GSTR 9 must be paid through From DRC -03. Learn how to file DRC 03 for making voluntary payments.

6. Difference in Auto-populated of Data

It is learned that many taxpayers wrongly reported mismatched data, that was arrived between auto-populated and the entry in their book of account or in return. It is possible that you may have missed some details in GSTR 1 but the

Thus, you may

7. IGST Credit on import of goods

It is noticed that there is confusion because there is no row in Table 8 to fill in the credit of IGST paid for the Fy 2017-18, but availed in return of April 2018 to March 2019 period.

Many taxpayers have represented that Table 8 has no row to fill in the credit of IGST paid at the time of import of goods but availed in the return of April 2018 to March 2019.

Because of this, there is a worry among the taxpayers that credit that was availed between April 2018 to March 2019 but not reported in the annual return may lapse.

Therefore, the government has advised taxpayers to fill in their entire credit availed on import of goods from July 2017 to March 2019 in Table 6(E) of FORM GSTR-9 itself.

8. Payment made through From DRC 03

The Payments made through FORM DRC-03 for supplies relating to

Payment of any unpaid GST Tax

According to Section 73 of the CGST Act taxpayer can correct the below mistakes before receiving the notice from the department.

- Tax not paid

- Short payment of GST Amount

- Refund of Tax taken wrongly

- Wrong refund granted by the department

- wrongly availed or utilized input tax credit

Thus he can pay such tax amount with interest for the above dues if any. Therefore, no penalty shall be leviable, if the taxpayer pays it anytime through Form GST DRC 03.

In other words, if you forgot to show some information in past returns i.e GSTR 1 and GSTR 3B return, then you may pay such shortage through Form GST DRC 03 with interest.

Similarly, The GSTR 9 annual return gives you an additional opportunity to show the summary of such supplies, against you make the payment through Form GST DRC 03.

Primary Source of data for Annual Return

There is confusion regarding, what will be the primary source of data for GSTR 9 Annual Return and GSTR 9C. Whether the primary source shall be the GSTR 1 return, GSTR 3B Return, or from the books of accounts data.

The taxpayer needs to note that both GSTR 1 and GSTR 3B serve different purposes. On one hand, GSTR 1 is the account of outward supplies, where GSTR 3B is a summary of all transactions like ITC, Interest, outward supplies, and payments.

Therefore, the answer for this is the information in GSTR 1 and GSTR 3B and books of account shall match with each other.

However, there may be some instances where these values will not match with each other. Thus there can be two scenarios:

- Tax not paid to the Government

- Tax paid in Excess

In the first case, the taxpayer shall declare such tax in GSTR 9 and shall pay while/before filing Annual Return in GSTR DRC 03.

On the other hand, if the paid tax is excess than the actual liability then the taxpayer can declare such information in GSTR9. Similarly, if eligible he can apply for a refund through GST RFD 01A.

A taxpayer can not reverse input tax credit nor he can avail of it through GSTR 9 Annual Return. If you find yourself liable for reversing any input tax credit, you may pay the same back through GST DRC 03 separately.

Purpose of Table 8D of Annual Return

There is further confusion regarding input tax credit appearing in Table 8 of Annual Return. Thus, the Taxpayer shall note that the input tax credit appearing in table 8D is available to a taxpayer in his GSTR 2A Return. However, the taxpayer did not avail of this credit between July 2017 to March 2019.

Thus, the deadline to avail of this credit is already gone. Therefore, the taxpayer can not avail of such credit now. Hence, there is no question of lapsing such credit because the taxpayer did not avail of this credit. Thus, an input tax credit is said to be availed only when the taxpayer shows it in his electronic credit ledger as per CGST rules.

There shall not be a concern about the values reflecting in this table. Thus, it is information that the government needs for settlement purposes only. Therefore, the figures in Table 8A in GSTR 9 Return are available to facilitate the taxpayer.

The system is capturing these figures from the GSTR 1 return filed by the different suppliers by the due date. Thus, it does not mean that all invoices which the supplier uploads in his GSTR 1 return are applicable for the receiver to take the input tax credit.

Thus, Table 8A of GSTR 9 will not auto-populate invoices, if your supplier uploads such invoices After March 2019, pertaining to the Financial year 2017-18. However, if the supplier uploads the invoices in GSTR 1 Return even after march 2019 of 2017-18 then the same will be visible in GSTR 2A.

Thus, there will be differences in the values of GSTR 2A and Table 8A of GSTR 9. Hence, one shall note that records in Table 8A of GSTR 9 return will be visible from GSTR 2A as of 01st May 2019.

Purpose of Table 8J of GSTR 9

According to the earlier press release, the taxpayer needs to show all credit of IGST paid at the time of imports in Table 6E. Similarly, this can be of the period between July 2017 to March 2019.

Thus, if the above details correctly exist in Table, 6E then Table 8I and 8J will contain the information of credit available to the taxpayer and the taxpayer chose not to avail such credit.

Now the deadline is over to avail such credit. Therefore taxpayers can not avail of such credit which does not exist in your Electronic credit ledger till 31.03.2019 of Fy 2017-18.

Difficulty in reporting of information not reported in regular returns:

There have been a number of representations regarding the non-availability of information in Table16A or 18 of Annual return in FORM GSTR-9. It has been observed that smaller taxpayers are facing a lot of challenges in reporting information that was not being explicitly reported in their regular statement/returns (FORM GSTR-1 and FORM GSTR-3B).

Therefore, taxpayers are advised to declare all such data/details (which are not part of their regular statement/returns) to the best of their knowledge and records.

This data is only for information purposes and reasonable/explainable variations in the information reported in these tables will not be viewed adversely.

Information in Table 5D (Exempted), Table 5E (Nil Rated) and Table 5F (Non-GST Supply):

It has been represented by various trade bodies/associations that there appears to be some confusion over what values are to be entered in Table 5D,5E, and 5F of FORM GSTR-9.

Since, there is some overlap between supplies that are classifiable as exempted and nil rated and since there is no tax payable on such supplies, if there is a reasonable/explainable overlap of the information reported across these tables, such overlap will not be viewed adversely.

The other concern raised by taxpayers is the inclusion of no supply in the category of Non-GST supplies in Table 5F. For the purposes of reporting, non-GST supplies include the supply of alcoholic liquor for human consumption, motor spirit (commonly known as petrol), high-speed diesel, aviation turbine fuel, petroleum crude, and natural gas, and transactions specified in Schedule III of the CGST Act.

Reverse charge in respect of Financial Year 2017-18 paid during Financial Year 2018-19:

Many taxpayers have requested clarification on the appropriate column or table in which tax was to be paid on a reverse charge basis for FY 2017-18 but was paid during FY 2018-19.

It may be noted that since the payment was made during FY 2018-19, the input tax credit on such payment of tax would have been availed in FY 2018-19 only.

Therefore, such details will not be declared in the annual return for FY 2017-18 and will be declared in the annual return for FY 2018-19. If there are any variations in the calculation of turnover on account of this adjustment, the same may be reported with reasons in the reconciliation statement (FORM GSTR-9C).

Role of chartered accountant or a cost accountant in certifying reconciliation statement:

There are apprehensions that the chartered accountant or cost accountant may go beyond the books of account in their recommendations under FORM GSTR-9C.

The GST Act is clear in this regard. With respect to the reconciliation statement, their role is limited to reconciling the values declared in annual return (FORM GSTR-9) with the audited annual accounts of the taxpayer.

Turnover for eligibility of filing of reconciliation statement:

It may be noted that the aggregate turnover i.e. the turnover of all the registrations having the same Permanent Account Number is to be used for determining the requirement of filing of reconciliation statement.

Therefore, if there are two registrations in two different States on the same PAN, say State A (with a turnover of Rs. 1.2 Crore) and State B (with a turnover of Rs. 1 Crore) they are both required to file reconciliation statements individually for their registrations since their aggregate turnover is greater than Rs. 2 Crore.

The aggregate turnover for this purpose shall be reckoned for the period July 2017 to March 2018.

Treatment of Credit Notes / Debit Notes issued during FY 2018-19 for FY 2017-18:

It may be noted that no credit note which has a tax implication can be issued after the month of September 2018 for any supply pertaining to FY 2017-18; a financial/commercial credit note can, however, be issued.

If the credit or debit note for any supply was issued and declared in returns of FY 2018-19 and the provision for the same has been made in the books of accounts for FY 2017-18, the same shall be declared in Pt. V of the annual return.

Many taxpayers have also represented that there is no provision in Pt. II of the reconciliation statement for adjustment in turnover in lieu of debit notes issued during FY 2018-19 although provision for the same was made in the books of accounts for FY 2017-18. In such cases, they may adjust the same in Table 5O of the reconciliation statement in FORM GSTR-9C.

Duplication of information in Table 6B and 6H:

Many taxpayers have represented about duplication of information in Table 6B and 6H of the annual return. It may be noted that the label in Table 6H clearly states that information declared in Table 6H is exclusive of Table 6B. Therefore, information of such input tax credit is to be declared in one of the rows only.

Reconciliation of input tax credit availed on expenses:

Table 14 of the reconciliation statement calls for reconciliation of input tax credit availed on expenses with input tax credit declared in the annual return.

It may be noted that only those expenses are to be reconciled where input tax credit has been availed. Further, the list of expenses given in Table 14 is a representative list of heads under which input tax credit may have been availed. The taxpayer has the option to add any head of expenses.

All the taxpayers are requested to file their Annual Return (FORM GSTR-9 / FORM GSTR-9A) and Reconciliation Statement (FORM GSTR-9C) well before the last date of filing, e. 31st August 2019.

Read to know: https://127.0.0.1:1585 dsc error and solutions in 5 steps.

Latest News & Update

10.10.2020: The board has issued a press release to provide GSTR 9 Clarification on certain tables. It is noticed that Tables 4, 5, 6, and 7 auto-populates the data of FY 2017-18 including FY 2018-19 while filing the GSTR 9 of FY 2018-2019.

However, the information pertaining to FY 2017-18 is already submitted by the taxpayer. Also, there is no mechanism to show the split-up of two years of data in GSTR 9 of FY 2018-2019.

Hence, it is clarified that the taxpayer needs to report only the values pertaining to Financial Year 2018-19 & ignore the value of FY 2017-18.

Similarly, it is also clarified that no adverse view will be taken on the taxpayers who have already filed the GSTR 9 with these variations. This has reference to the press release dt. 09th October 2020.

Frequently Asked Questions

Question 1: How to file gstr 9 offline?

Answer 1: Download offline utility from the gst portal >> Fill in the details >> Generate Json File >> Upload on GST portal > Sign with DSC/EVC.

Question 2: How to reconcile gstr 9?

Answer 2: Reconcile the taxes payable and paid as per the books and returns filed. Reconcile the input tax credit availed and available in GSTR 2A.

Question 3: How to download gstr 9 JSON file?

Answer: Log in to the GST portal > Click “Annual Return” from the Dashboard >> Select Period >> Prepare offline. Now click on the “Generate JSON file to download” button. Click back after some time > The download link will appear below the above button.

Question 4: How to download gstr 9 pdf and excel file?

Answer 4: Navigate to GSTR 9 filing Screen > Click the links to download pdf and excel files.

Question 5: How to file gstr 9 nil return?

Answer 5: Click on annual return filing > Select period >> Prepare Online>> Select “Yes” to choose nil return filing.

Question 6: how to file gstr 9 annual return online?

Answer 6: Click on the “Prepare Online” button and fill in the details online.

Question 7: How to prepare gstr 9 in tally?

Answer 7: The tally ERP 9 automatically generates a system computed summary for GSTR 9 filing. However, it does not generate a JSON file of GSTR 9 to upload on the GST portal.

Question 8. How to submit gstr 9?

Answer 8: After entering all the necessary data, you can click on submit button to lock the return.

Questions 9. How to download gstr 9 offline form?

Answer 9: Go to GST portal>> Click on download >> Click on GSTR 9 >> GSTR 9 offline excel form will download on your computer.

Question 10: How to file gstr 9 in pdf?

Answer 10: You can not file GSTR 9 in pdf format.

Question 11: How to file gstr 9 in Tamil?

Answer 11: Click here to view the video.

Question 12: how to file gstr 9 in Hindi?

Answer 12: Click here to view the video.

Question 13: how to file gstr 9 annual return in English?

Answer 13: Here is the video link in English.

Question 14: how to file gstr 9 in Telugu?

Answer 14: View it from here(video)

Related Topics:

GSTR 9 Extension notification

Check out the GSTR -9 extension for FY 2022-23. Know the GST annual return due date extension for FY 2020-21.

GSTR 9C format in Excel Format

Know the GSTR 9C limit for FY 2022-23 before initiating the filing of the GSTR 9C reconciliation statement.

File GSTR 9 Annual Return

Learn how to file GSTR 9, understand the format, and know the applicability. Read more about the filing of the GST Annual return.

How make voluntary payment in GST?

Find out how to deposit money under GST on a voluntary basis. This is helpful while paying the liability at the time of filing GSTR 9. Know more about DRC 03 making payment.

very good format