01.08.2022: The IT department has set New benchmark by recording of over 72.42 lakh (7.24m) ITRs filed on a single day. Thus, about 5.83 crore ITRs filed till 31st July, 2022.

The growth of ITR filing peaked on July 31, 2022 (due date for salaried taxpayers and other non-tax audit matters) with over 72.42 lakh ITRs filed in a single day i.e. July 31, 2022.

The total ITRs filed for 22-23 till July 31, 2022 are around 5.83 crores. The e-filing portal also set other benchmarks on July 31, 2022, which include – Highest per second rate of ITR filing: 570 (4:29:30 pm), Highest per minute rate of ITR filing: 9573 (7 pm) :44 pm) ), and the highest hourly rate of ITR filing: 5,17,030, between 5 pm and 6 pm.

The initial pace of e-filing was relatively slow, with the first 10 million ITRs filed for assessment year 22-23 only up to July 7, 2022. With around 2.48 crore ITRs filed till July 22, 2022, there was a slight increase in momentum.

The government announced that there would be no extension of the due date, there was an increase in ITR filing and 3 crore ITRs were filed till July 25, 2022.

Till the end of the day on July 31, 2022, 72.42 lakh ITRs were filed, breaking all previous records (maximum 49 lakh ITRs in 2019). In the month of July, 2022 alone, more than 5.13 crore ITRs have been filed.

Of the 5.83 crore ITRs filed for AY 2022-23, 50% are ITR-1 (2.93 crore), 11.5% ITR-2 (67 lakh), 10.9% ITR-3 (63.35 lakh), 26%. ITR-4 (1.54 crores), ITR-5 to 7 (5.5 lakhs). The number of ITRs filed during working hours (9 am to 6 pm) from July 7, 2022 to July 31, 2022 is around 3.31 crore, which is 58.77% of the total ITRs filed.

Of these, more than 47% have been filed using online ITR forms on the ITR portal and the rest have been uploaded using ITRs generated from offline software utilities.

A large number of taxpayers do their due diligence by comparing their income figures by viewing their Annual Information Statement (AIS) and Taxpayer Information Summary (TIS).

The high rate of usage of AIS/TIS data is reflected in the fact that over 5.03 crore taxpayers viewed/downloaded their AIS.

ITR Filing Gets Further Extension For AY 2021-22

10.09.2021: The Income tax return filing due date is further extended till 31st December 2021 for Individuals and HUF. This includes salaried persons filing ITR 1 return. The said extension is provided against circular no. 17/2021 dt. 09.09.2021. It is to note that the ITR of the previous financial year should be filed in the current year. Therefore, under income tax, the previous year is called the financial year. Whereas the current year is the Assessment year. Hence, the assessment of the previous FY i.e from 01.04.2020 till 31.03.2021, will be done in the year 2021-22.

In this case, you must file your previous year’s Income tax return before 31.12.2021, in order to avoid interest for late filing. Below are other important due dates and extensions issued against the above referred circular.

1. Statement of Financial Transactions (SFT) for the Financial Year 2020-21

The Statement of Financial Transactions (SFT) are required to be filed on or before 30th June 2021

2. Statement of Reportable Account for the calendar year 2020

The Statement of Reportable Account for the calendar year 2020 is required to be filed on or before 30th June 2021

3. Return for The Deduction of Tax for the last quarter of the Financial Year 2020-21

The return of deduction of tax for the last quarter of FY 2021 needs to be filed on or before 30th June 2021

4. Form No 16 to the employee

The Certificate of Tax Deducted at Source in Form No 16, needs to be furnished to the employee by 15th July 2021.

5. TDS/TCS Book Adjustment Statement in Form No 24G

The TDS/TCS Book Adjustment Statement in Form No 24G for the month of May 2021, shall be submitted on or before 30th June 2021.

6. Statement of Deduction of Tax from contributions paid by the trustees

The Statement of Deduction of Tax from contributions paid by the trustees of an approved superannuation fund for the Financial Year 2020-21, required to be sent on or before 30th June 2021

7. Statement of Income paid or credited by an investment fund

The Statement of Income paid or credited by an investment fund to its unit holder in Form No 64D for the Previous Year 2020-21, required to be furnished on or before 30th June 2021.

8. Statement of Income paid or credited by an investment fund

The Statement of Income paid or credited by an investment fund to its unit holder in Form No 64C for the Previous Year 2020-21, required to be furnished on or before 15th July 2021.

9. Due date of Filing of Return of Income for the Assessment Year 2021-22 for Individual

The due date of filing of Income Tax Return of Income for the Assessment Year 2021-22, which is 31st July 2021 under sub-section (1) of section 139 of the Act, is extended to 31st December 2021. This is for individuals/HUF.

10. Due date of furnishing of Report of Audit

The due date of furnishing of Report of Audit under any provision of the Act for the Previous Year 2020-21, which is 30th September 2021, is further extended till 15th January 2022.

11. Due date of furnishing Report from an Accountant

The due date of furnishing Report from an Accountant by persons entering into an international transaction or specified domestic transaction under section 92E of the Act for the Previous Year 2020-21, is further extended till 31st January 2022.

12. Return filing due date under Sub-section (1) of section 139

The due date of furnishing of Return of Income for the Assessment Year 2021-22, under SUb-section (1) of section 139 of the Act, is extended to 31 st December 2021.

13. Late/revised Income Tax return for the Assessment Year 2021-22

The due date of filing of belated/revised Return of Income for the Assessment Year 2021-22, which is 31 st January 2022 under sub-section (4)/sub-section (5) of section 139 of the Act, is extended to 31st March 2022.

ITR Filing & Due Date for Tax Audit Extension AY 2020-21

Are you looking for an Extension of Income Tax Return filings ?. If yes then here can you find the latest news on income tax due dates with extensions. As per today’s press release the last date to file various Income Tax Returns are as follows.

For Assessment Year 2020-21

1. ITR Due Date for Companies

The last date to file Income Tax Returns for the Assessment Year 2020-21 for the taxpayers who need to get their accounts audited and companies is extended till 15th February 2021. This is including the partners who need to file the return as per section 139(1) of the Income Tax Act 1961.

2. ITR with International/specified domestic transactions

The last date for filing of Income Tax Returns for the Assessment Year 2020-21 for the taxpayers who need to file reports in respect of international/specified domestic transactions is further extended till 15th February 2021.

3. Income Tax Return Filing for Individuals

The last date for filing Income Tax Returns for the Assessment Year 2020-21 for the other taxpayers is further extended till 10th January 2021.

4. Filing Tax Audit Reports

The last date of filing various audit reports under the Act including tax audit report and report in respect of international/specified domestic transaction for the Assessment Year 2020-21 is further extended till 15th January 2021.

5. Vivad Se Vishwas Scheme Extension

Now the taxpayer can make a declaration under Vivad Se VishwasScheme till 31st January 2021. The previous date was 31st December 2020. Similarly, the date for the passing of orders under this scheme has been also extended to 31st January 2021.

6. Orders passing for Direct Taxes & Benami Acts

The last date for the passing of order or issuance of notice by the authorities under the Direct Taxes & Benami Acts is extended till 31st March 2021.

7. Due date for payment of self-assessment tax

In order to provide relief to small and middle-class taxpayers for payment of self-assessment tax, the government extends the due date again. Thus, the last date for payment of self-assessment tax for taxpayers whose self-assessment tax liability is up to Rs. 1 lakh gets extended till 15th February 2021.

This is applicable to the taxpayers mentioned above Sr.no. 1 and 2. Similarly, for other taxpayers at sr. no. 3 the last date stands until 10th January 2021.

Earlier, the Bombay chamber of commerce also requested the government to provide an extension of the due date of filing the return of the Income, Tax Audit Report, and Transfer Pricing Report for the Assessment Year 2020-21. Therefore considering such various requests from the stakeholders the government extended these dates.

Latest News on Tax Audit Due Date

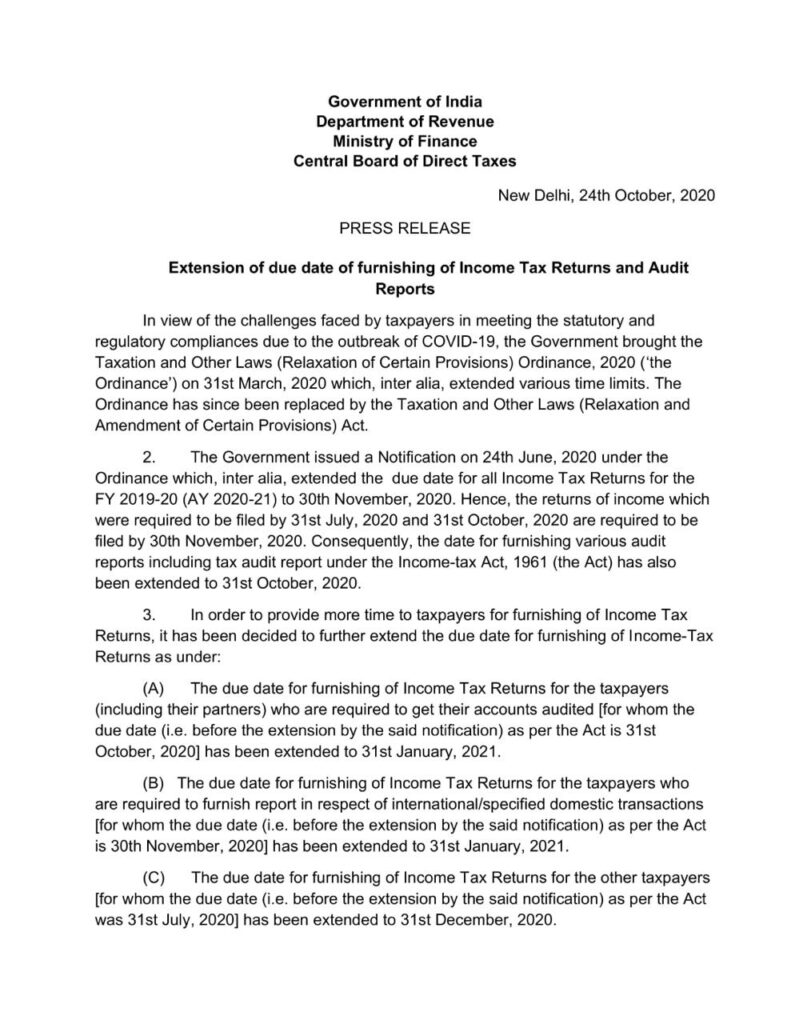

24.10.2020: Considering the constraints faced by the taxpayers due to Kovid-19, CBDT further extends the due dates for various compliance of FY 2019-2020.

- Thus, the due date for filing income tax returns for taxpayers who need an accounts audit is 31 January 2021.

- The due date for filing ITRs for taxpayers submitting reports on international/specific domestic transactions is 31 January 2021.

- ITR due date for other taxpayers is 31st December 2020.

- The date for submission of various audit reports, including tax audit reports and reports on international/specific domestic transactions, is now till 31 December 2020.

- Govt. provides further relief to small & middle-class taxpayers in the matter of payment of self-assessment tax. Thus it extends the due dates for payment of self-assessment tax. Accordingly, the due date for payment of self-assessment tax for taxpayers whose self-assessment tax liability is up to Rs. 1 lakh gets an extension till 31st January 2021 for the taxpayers mentioned in para 3(A) and para 3(B) and to 31st December 2020 for the taxpayers mentioned in para 3(C).

Here is the press release copy for more details.

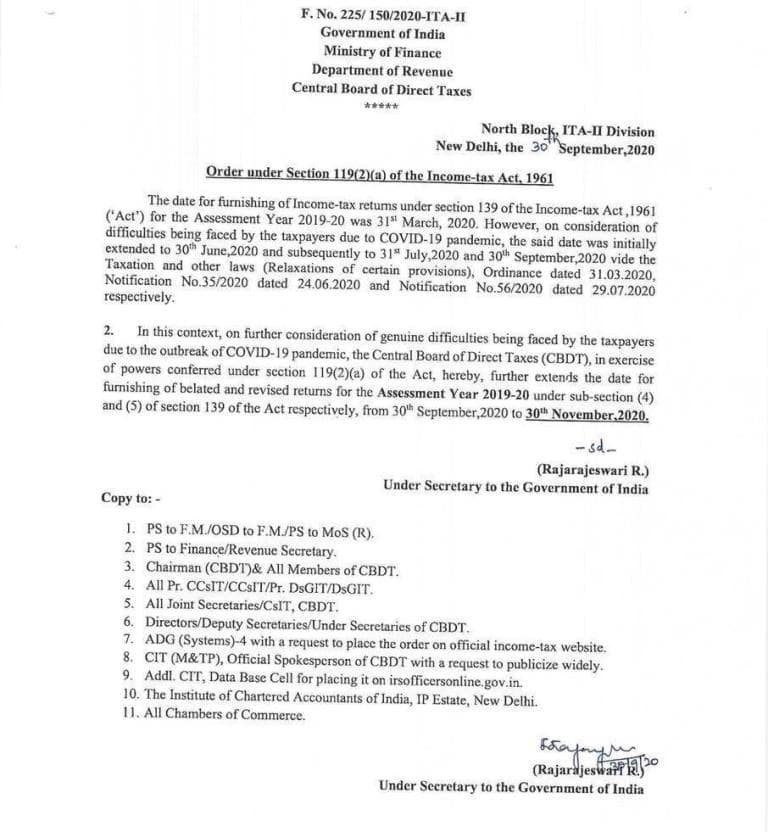

30.09.2020: The Income Tax return filing due date is now further extended till 30th November 2020 for the assessment year 2020-21. This has reference to the below notification.

Earlier, the Finance Minister, Smt. Nirmala Sitharaman had announced in a press conference held on 13.05.2020 that the due dates of all income tax returns will be extended till 30.11.2020.

Further, the Income Tax department extended the Income Tax Return filing Till 30.09.2020 in the past. This is pertaining to FY 2018-19(AY 2019-20). Also, before that, The government extended it till 31st July 2020.

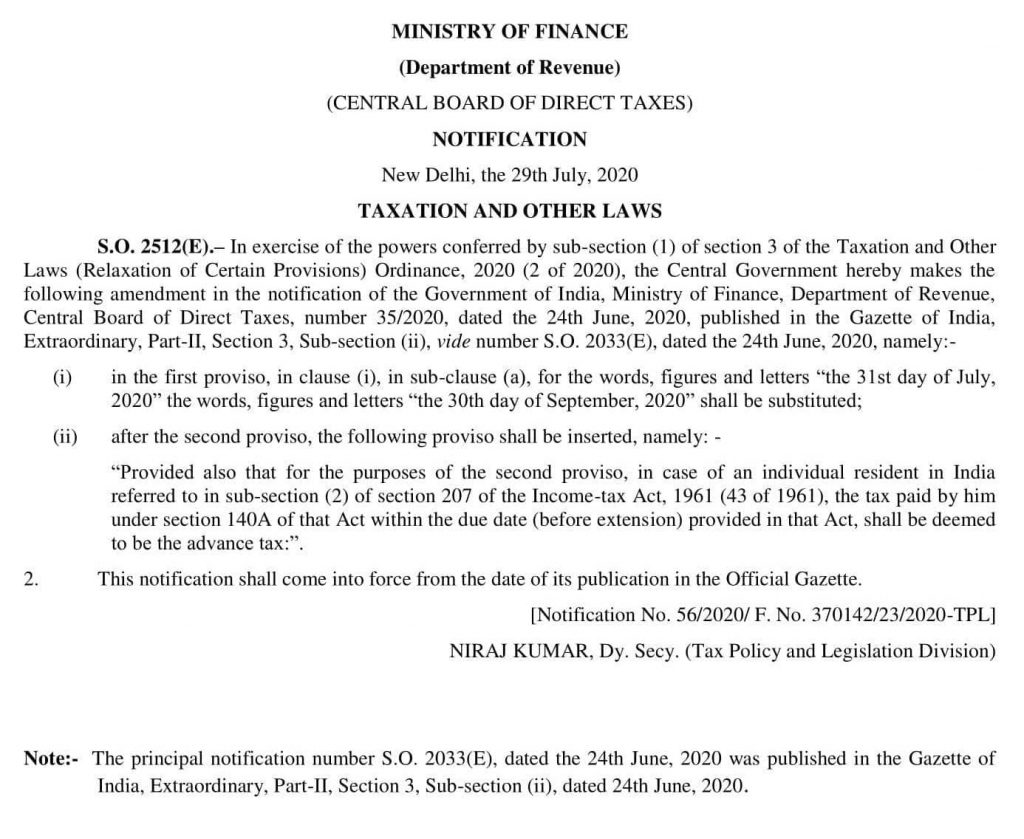

The government had taken the decision in view of the constraints due to the COVID pandemic & to further ease compliance for taxpayers. This has reference to Notification in S.O. 2512(E) dt 29th July 2020. Read the below notification for more details.

The extension is also applicable for filing Tax audit report from 31st October till 30th November 2020 as per the above notification.

Frequently Asked Questions

yes, till 10th January 2021 for Individuals.

It is 15th February 2021 for companies.

15th January 2021

Search Tags: Last date for tax audit for ay 2019-20 & extension. Latest income tax due date for tax audit & ITR filing. Know the due date of the tax audit of companies with notifications & press releases.