The delivery challan format is useful for various purposes. Thus, every business that needs to send goods without an invoice can send the material on the delivery challan. Similarly, the delivery challan serves as proof of material delivered to the customer after taking acknowledgment receipt. Therefore, even in GST, the delivery challan is necessary for performing various activities.

Here you can download the delivery Challan format in Excel and Word. Thus, you can download and prepare your own delivery challan and send goods for job work for further processing.

However, if you are sending taxable goods, you must make the GST Tax invoice and show the GST amount payable on such goods. On the other hand, you may send the material on a simple delivery challan where the goods are not taxable. Therefore, you may download the Regular delivery challan and job work challan format from our below sections.

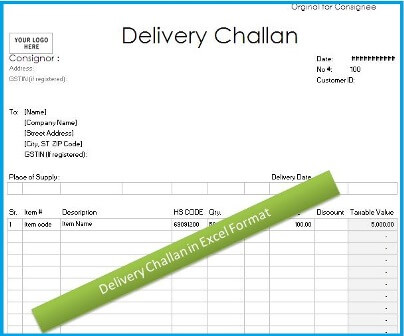

Delivery Challan Format in Excel

You may click on the below button to download the regular delivery format in excel for day to days use. Here is the list of situations where you may want to issue a delivery challan.

- Supply of goods on an approval basis

- Goods supplied for job work i.e for further processing.

- Inter-company or Go-down transfer purpose

- Supply of semi-finished goods from one department to another

However, this is not an exhaustive list. Thus, there may many other situations you may want to issue a delivery challan.

Delivery Challan Format in Word

You may download a similar delivery challan format in word also. Thus, below is the Microsoft Word format of D.C. Similarly, you can use the word format where you can not use the excel format.

Why Delivery Challan is used?

According to the GST law, the tax invoice should be generated when taxable material is taken out. Here the taxable material is the material, which is produced by using raw material on which input tax credit is availed. Therefore, according to the law, the supplier needs to generate a Tax invoice and supply the goods to the customer. Thereafter, the supplier shall pay these taxes involved in such Tax Invoices generated.

However, there are various scenarios when the material is not taken out for sale. Hence, the tax invoice can not be generated. Below is the situation when the material can be taken on delivery challan instead of GST invoice.

1. Transport of Goods for Job work

Under GST the goods for job work can be sent on the delivery challan. However, these goods must be returned back to the principal supplier after processing.

2. Transportation from one Warehouse to Another

The goods can be transported from one warehouse to another warehouse for various purposes. Therefore, the trading and manufacturing unit may do internal transfers on the delivery challan.

3. Supply of Liquid Gas

The supply of liquid gas can be transported on the delivery challan. This can be done only when the quantity of liquid gas is not known at the time of removal from the place of business of the supplier.

4. Transportation other then supply

If there is sufficient reason proving the material is not for supply/sale, the delivery challan shall be issued.

5. Goods Sent on Trial Basis

The tax-paid goods can be sent on delivery challan for trial purposes. For example, if the manufacturer wants to send a few samples to the customer, he may reverse the proportionate input tax credit availed on raw material and send it to the customer.

6. Exhibition Material

The tax-paid material can be moved on delivery challan for exhibition/seminar purposes.

7. Single shipment in multiple Vehicles

There may be a single invoice for one piece of machinery. However, it can not be transported in one vehicle. Therefore, the supplier can raise a single invoice for such material and deliver it in multiple vehicles. This is possible by dismantling the machine. However, every vehicle shall carry the delivery challan having the reference of Tax Invoice.

Contents of Delivery Challan

- The delivery challan shall have a date and continuous serial number

- Name, address, and GST Number of the consigner, if registered

- HSN Code and description of goods

- Quantity of Goods

- The taxable value of material

- Tax rate and tax amount – central tax, State tax, integrated tax, Union territory tax, or cess, when the transportation is made for supply to the consignee.

- Place of supply, in case of inter-State transportation

- Signature

How to make delivery challan in Tally Prime?

Create the voucher type as “Delivery challan” under Voucher types in tally prime, if already not done. Here is how to do it.

- From the Gateway of tally click on “Alter” >> Voucher type.

- If you do not see the “delivery note” in the list, Click on “Create”.

Now follow the below steps to generate delivery challan in tally prime.

Time needed: 2 minutes

- From the Gateway of tally prime, Click “Vouchers”

- From your right-hand side, click on “Other Vouchers”

Alternatively you may also press F10 >>ALT + F8 key

- Click on “Delivery Challan/Note”

- Fill in the necessary details and print the delivery.

You may change the heading and other details of the challan by clicking on the configuration option while printing.

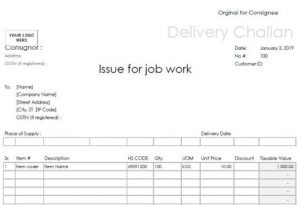

Job Work Challan under GST

Download the issue for job work challan under GST and send your goods for job work for further processing. This issue for the job work challan format is prepared as per GST rules. You can download this issue for job work challan format in GST in excel and add further details if required. Also, you can convert issues for job work challan format in word.

The Issue for job work Challan format in excel free download

GST Job work delivery challan format should be issued in triplicate. An Original and duplicate copy shall be given to the job worker. Click here to read the complete job work issue procedure under GST.

Further, you can use the above delivery challan format for job work under GST in India. Also, this GST job workS challan format is very useful for sending any type of goods for job work.

Secondly, this job work challan format under GST in excel will help to maintain A record for filing GSTR 4 Return. Also, you can convert this job work challan format under GST in pdf format. To convert this in pdf format, open this file in excel and save it as pdf.

Material Issue after job work challan

Download issue after the job work challan under GST and send goods back to the principal after processing. This issue after the job work challan format is prepared as per GST rules. You can download this issue after the job work challan format in GST in excel and add further details if required. Also, you can convert issues after job work challan format in word.

Issue after job work challan format in excel

GST issue after job work delivery challan format should be issued in triplicate. An original and duplicate copy shall be given to the principal supplier of goods. Click here for a complete Issue after the job work procedure under GST to send material back to the principal supplier.

Challan Related Questions

The delivery challan in GST is a document used to supply the material without raising GST Invoice.

1. From the gateway of Tally,> Click on the “Inventory Vouchers”

2. Click on the “Delivery Note” tab on the right-hand side or Click the F8 key

3. Enter the Party A/C Name and fill in the item details

4. Save the voucher and print it.

According to the GST law, the taxpayer shall raise the tax invoice to send the taxable material on which the tax is payable to the government. However, the delivery challan can be used to send non-taxable material like Exhibition material, Internal consumable items on which ITC is not availed, line sale items, etc.

The delivery challan does not contain tax details to be paid to the government. Thus, it can be used only to transfer and send the material where no tax component is involved. Similarly, The supplier can not ask the customer to make the payment on the basis of the delivery challan.

On the other hand, an Invoice is a permissible document for declaring the tax payment and getting payments from the customer against the said material supplied.

If the value of the consignment is more than Rs.50,000/e-way bill compulsory.

yes

You may also read:

Job Work SAC and HSN Codes in India

Check out the job work SAC codes under GST. You can also find the GST rates of these SAC codes with descriptions of service. more

E way bill for job work

Learn why e waybill is required for sending material for job work. Know why and how to generate e way bill job work purpose. more

GST Bill Format Download in Excel

Now you can download the free GST bill format in excel for offline use. The format is prepared considering the GST rules. Also, you can customize this bill as per your requirement. more

E Invoice in GST

Electronic invoicing has become compulsory in India from 01st April 2021 for a turnover of more than 50crores. Learn the concept of e-invoicing and how you can generate e-invoice in India. more