The Atal Pension Yojana(APY) is a scheme of the Central Government of India. The scheme provides a guaranteed fixed sum of money to the citizens of India after attaining the age of 60 years. The money is directly getting credited, every month to the bank of the subscriber’s account. Secondly, the scheme is available for all states of India, irrespective of the Political Party in the power. Below are the 6 benefits of the Atal pension yojana with details, forms, chart, online process, age limit, and eligibility.

Benefits of the Atal Pension Yojana Scheme

Knowing the benefits of any scheme or investment is very important before starting to invest your hard-earned money. Thus, here is the list of top benefits of the Atal pension yojana scheme in India, that you must read before applying.

1. Guarantee of Return: The returns on the contribution shown in the below section are assumed returns. Thus, in case there is a shortfall of realized return as compared to the assumed return, then the shortfall is funded by the Government.

On the other hand, if the actual returns are higher than the assumed return, then you may get more benefits from this scheme.

2. Guaranteed Minimum Pension Amount: The minimum monthly returns ie. Rs. 1000 – Rs. 5000/- is guaranteed by the government upon attaining the age of 60 years. Therefore, there is no risk that you will lose your invested money over a period of time.

3. No Reduction in pension after the death of the subscriber: In the case of the death of the subscriber, the spouse is eligible to receive the same amount of returns as received by the subscriber. Thus, there is no shortfall of returns in case of the existence or demise of the subscriber.

4. Income Tax benefit: The applicant can claim a deduction up to Rs. 50,000/- from the taxable income. This is allowed as per section 80CCD of the Income Tax Act, 1961. On the other hand, the income earned from the investment is exempted from tax calculation.

5. Ease of contribution: The subscriber can increase or reduce the contribution amount during the period of contribution. Thus, if you are looking to get more income you may increase your contribution. Similarly, if you are unable to proceed with payment of the previously chosen contribution, you may apply to reduce the contribution.

6. Maturity benefit to Spouse: In case the subscriber’s death takes place, the spouse is eligible to receive the monthly pension. In the case of the demise of both persons, the total accumulated wealth is given to the nominee.

See Interest rate calculator on Investment

Details of the APY scheme

There are five types of plans under which a person can get a monthly return of a fixed amount as below:

- 1000/- Monthly

- 2000/- Monthly

- 3000/- Monthly

- 4000/- Monthly

- 5000/- Monthly

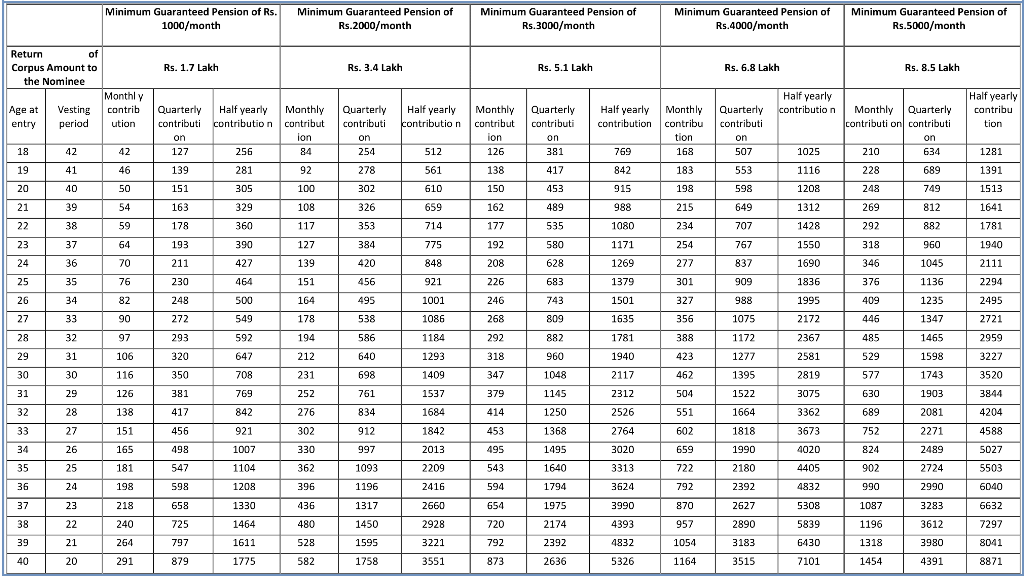

In order, to receive the above monthly returns, a person has to make a contribution as shown in the below chart. Since the scheme is as good as a type of investment. Therefore, the early you invest, the more you will earn and your principal amount of investment will also be less.

Any person aged 18 to 40 years can apply for this scheme. Therefore, as we said above, if you start investing from the age of 18, you will invest less and earn more as compared to the age of 40. You can see these details in the below chart.

Atal pension yojana chart

Check the below chart to see the agewise monthly, quarterly, and half-yearly contributions. You can also see the maturity amount available to the nominee in case of the death of the subscriber.

How to choose the best plan from the chart?

- know your current age?

- Decide How much you can invest on monthly basis?

- How much monthly return you are looking for, after 60 years?

Let us understand this with an example

Case 1: Assume that your current age is 18 years and you are looking for Rs. 5000/- monthly after 60 years. So, you will be investing Rs. 210/-(monthly), for the next 40 years. In this case, your total investment will be Rs. 1,05,840/- of 40 years.

Case 2: Assume that your current age is 40 years and you are also looking for Rs. 5000/- monthly after 60 years. So, you will have to invest Rs. 1,454/- for 20 years. In this case, your total investment will be Rs. 3,48,960/-.

Therefore, in case 2, you will have to invest Rs. 243,120/- extra as compared to case 1. Hence, it’s very important to start investing at an early age as possible.

Forms Download

Download the various forms related to the Atal pension yojana in pdf format.

Eligibility

In order to be eligible for Atal Pension Yojana(scheme), the following requirements are mandatory.

- The person should be a citizen of India

- The age limit for applying is 18- 40 years

- Must have savings account in Bank or in the Post office

- Aadhar Card

How to apply for the Atal Pension yojana?

In, order to apply for the Atal pension yojana, you have to contact your bank or post office, where you have opened a savings bank account. Your bank will assist you in filling out the necessary form and providing the documents.

Once, they open your account the monthly contribution will be deducted automatically from your savings account.

Online application process

If you have access to your internet banking, you can log in to your account, locate e-services and apply online.

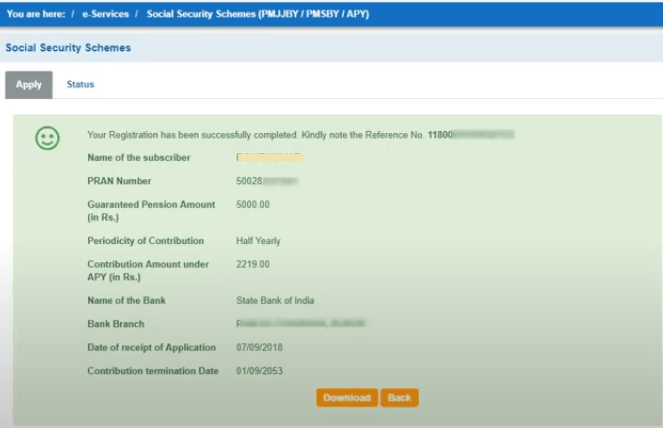

After completing the registration process, the bank will create a separate account under your main saving account. Thereafter, the money will be deposited to your Atal pension account after deducting from your savings account.

Online steps for applying for Atal Pension Yojana in SBI

Follow the below steps to apply for the Atal pension yojana account online through the internet banking of SBI.

Time needed: 15 minutes

- Visit at https://www.onlinesbi.com/

- Click on Personal Banking >> Continue to login

- Enter your login details and click “Login”

- Click on E-services

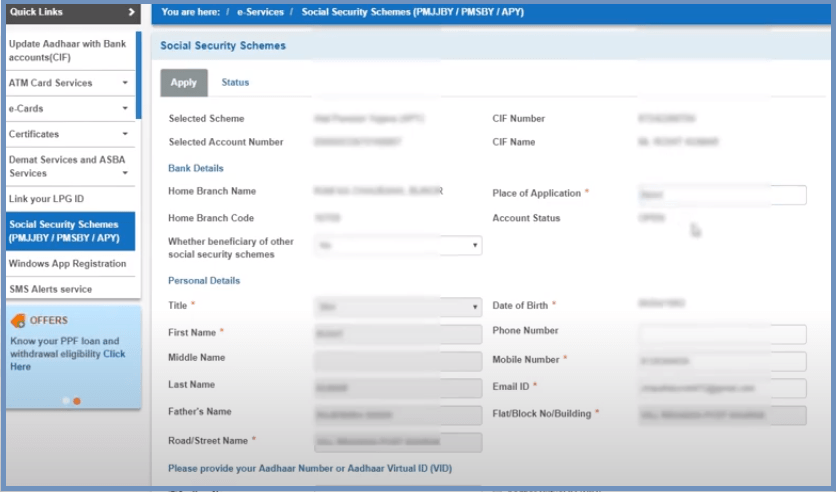

- Tap on “Social Security Schemes (PMJJBY / PMSBY / APY)”

- Select from dropdown: APY >> Saving Account number >> CIF number

You can also check the status of your existing account on this page

- Press the “Submit” button

- Fill in the details

Here you will have to fill all the mandatory personal and account-related information

- The successful message will be displayed on your screen

Top News updates on Pension Yojana

19.11.2022: The total Subscribers of the Atal pension yojana is 4.67 (In Crore) as of 31.10.2022. It is to note that w.ef. 1st October 2022, any citizen who is or has been an income-tax payer, shall not be eligible to join APY.

FAQ Atal Pension Yojana

The Atal Pension Yojana(APY) is a pension scheme for citizens of India. It is focused on the unorganized sector workers.

18 – 40 years

Call Centre: 1800 110 069

Crossed 4.01 crore as of March 2022

The APY scheme was launched on 9th May 2015 by Hon’ble Prime Minister Shri Narendra Modi