The EPF (Employee Provident Fund) is a retirement savings plan offered by most employers in India. You can contribute up to 15% of your salary to the fund, which is then invested in various financial instruments such as stocks, bonds, mutual funds, etc. Once you retire, you get back the amount contributed plus interest.

In case you are wondering what the EPF withdrawal facility is, here is a brief description from the EPFO website: “The Employee Provident Fund (EPF) is a social security scheme which provides provident fund benefits to every employee registered under the EPF Act,

About Employers Provident Fund Organisation

EPFO is one of the largest social security organizations in the world in terms of the number of account holders and volume of financial transactions that it carries out. Thus, at present, it maintains 24.77 crore accounts (Annual Report 2019-20) belonging to its members.

The Employees’ Provident Fund came into existence on 15 November 1951 by the promulgation of the Employees’ Provident Fund Ordinance. Thereafter, the Government replaced it with the Employees Provident Fund Act, of 1952.

The Employees’ Provident Fund Bill was introduced in Parliament in the year 1952. It was a Bill to provide a Provident Fund for Employees in Factories and other Establishments.

Further, this Act is now said as the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952. Similarly, this Act extends to the whole of India.

The Central Board of Trustees, Employees’ Provident Fund, consisting of representatives of Government (Both Central and State), Employers, and Employees looks into the ACT and scheme framing policies.

Types of EPF Accounts

The EPF account has two types of accounts – one for regular contributions and the other for lump sum contributions. Regular contributions are deducted from your pay every month and are added to your EPF account. Lump sum contributions are paid once at the beginning of the year and are credited to your EPF account immediately.

EPF Withdrawal Process

Withdrawing your money from an EPFO account is easy. All you need is your Aadhaar number and your bank details.

Time needed: 1 hour and 5 minutes

Steps to apply for EPF withdrawal online

- Go to the EPFO website.

- Log into your EPFO account by entering your UAN and password

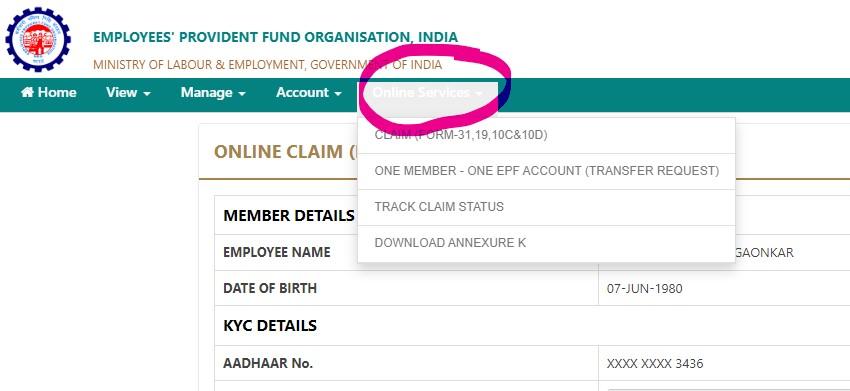

- Click on ‘Online Claim Form’ under the ‘Online Services tab

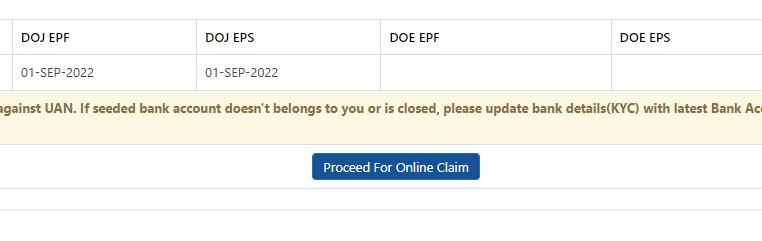

You may have to verify the bank account number if you are not able to proceed with the claim process.

- Click on Proceed for Online claim button

- Select I want to apply for Advance

In the claim form, under the ‘I want to apply’ tab, select the claim you require i.e. Full EPF withdrawal, EPF Part Withdrawal (Loan/Advance), or Pension Withdrawal. If the member is not eligible for any service like PF withdrawal or pension withdrawal due to service criteria, that option will not be shown in the drop-down menu.

- Click on the certificate and submit your application

You may be asked to submit scanned documents for the purpose for which you have filled the form. The employer has to approve the withdrawal request and only then you will get the money in your bank account. It usually takes 15-20 days for the money to be credited to the bank account.

How to check epf balance online?

Tips for Withdrawal EPF

You should not withdraw your EPF amount unless there is an emergency of funds. This is because EPF is providing more than an 8% yearly rate of interest on the total contribution. This means you are getting a compounded rate of interest every year which multiplies your available fund with EPFO.

For eg., if you have a 5 lakhs amount in your account as of 30th November 2022, then after one year you will get a credit of 40,500/- interest in your account, just for holding this amount. The interest is calculated by considering the 8.1% rate of interest.

What are the different statuses of epf claims?

In India, the Employees’ Provident Fund Organization (EPFO) manages the Employee Provident Fund (EPF), which is a retirement savings scheme for employees. When an employee wishes to withdraw or transfer their EPF amount, they need to submit a claim to the EPFO. Here are the different statuses of an EPF claim:

- Received: This status indicates that the EPF claim form and relevant documents have been received by the EPFO. The claim is in the initial stage of processing.

- Under Process: Once the claim is received, it goes through the processing stage where EPFO officials verify the information provided and authenticate the claim documents. During this stage, the claim status may show as “Under Process.”

- Approved: If the EPFO finds that the claim is in order and meets all the required criteria, it approves the claim. The status changes to “Approved,” indicating that the claim has been processed successfully, and the funds will be disbursed shortly.

- Rejected: If the EPFO finds discrepancies or issues with the claim application, it may reject the claim. Reasons for rejection could include incorrect information, insufficient documentation, or non-compliance with EPF rules and regulations. The status will be updated to “Rejected,” and the reasons for rejection may be communicated to the applicant.

- Settled: This status indicates that the EPF claim has been settled, and the funds have been disbursed to the applicant’s bank account or transferred to another EPF account, depending on the type of claim (withdrawal or transfer).

- Pending: In some cases, the EPF claim may be pending due to various reasons such as incomplete documentation, verification issues, or discrepancies in the application. The status will be shown as “Pending” until the issues are resolved, and the claim is processed further.

It’s essential for EPF members to regularly check the status of their EPF claims through the EPFO’s online portal or mobile app. This helps them stay informed about the progress of their claim and take any necessary actions if there are delays or issues. If there are any discrepancies or concerns regarding the claim status, members can contact the EPFO helpline or visit their local EPF office for assistance.

Frequently Asked Questions

Yes, you can withdraw your EPF online through your UAN website.

EPFO allows the withdrawal of 75% of the EPF corpus only after 1 month of unemployment. The remaining 25% can be transferred to a new EPF account after gaining new employment. 100% can be withdrawn after 2 months of unemployment.

Yes, you can withdraw with certain limitations.

Yes, this is possible now.

On the EPF you get compounded interest, therefore it is not advisable to withdraw until you get a good rate of interest.