A mutual fund is an investment vehicle that pools money from many investors into a single account. The goal is to provide a steady stream of income for retirement or other goals.

What Are Mutual Funds?

A mutual fund is a type of investment company that pools money from investors and invests it into securities such as stocks, bonds, and real estate. It’s similar to a 401(k) plan at work, except instead of being managed by a company, it’s managed by professional money managers who use sophisticated strategies to make sure that the fund earns a return above inflation.

Mutual funds are not for everyone, but if you invest wisely, you can build wealth over time. The key is to do your research and make sure that you pick a good fund.

Mutual funds are regulated by the Security and Exchange Board of India (SEBI) and must follow strict rules, which means they some protection to investors.

Read Top benefits of Atal Pension Yojana

How To Manage Your Investments?

There are two main types of mutual funds: open-end and closed-end. Open-ended funds allow new investors to buy shares at any time. Closed-end funds only sell shares when the fund reaches its target price.

Types Of Mutual Funds

Open-end funds are more flexible than closed-end funds because they can raise capital whenever they need it. This means that they can invest in stocks, bonds, commodities, real estate, and other assets. However, open-end funds tend to charge higher fees than closed-end funds.

Closed-end funds are less risky than open-end funds because they are limited by how much money they can raise. If the market goes up, closed-end funds will not be able to raise as much money as open-end funds.

Why Should I Invest In Mutual Fund?

Mutual funds are a great way to invest in the stock market. They are an investment that is managed by a professional fund manager and can be used by anyone.

If you invest in a mutual fund, you’ll own shares of companies that other people own. This means that when the market goes up, everyone wins because more money will go to shareholders. And when the market goes down, everyone loses because less money will go to shareholders than would have been invested in the stock market.

Mutual funds provide good returns, which makes them an attractive option for many investors. The downside of mutual funds is that they require a certain minimum investment and the investor is not allowed to take his money out until it’s been in the fund for at least one year.

An investment in a mutual fund is one of the most popular ways to invest. It’s a way to diversify your investments and spread the risk. Mutual funds are also easy to purchase and sell, which is why they are so popular with individual investors.

Read Interest Rates on Investments

Which is the best mutual fund for investment?

Below is the list of the top 10 best performed, Direct mutual funds in the last 5 years as of 17.05.2022. These are equity mutual funds with 5 Crisil rank as of date. The list includes ELSS, Multi cap funds, Midcap funds, focused, and contra funds. It is to note that ELSS funds have minimum 3 years locking period. This means you cannot withdraw or sell these funds within 3 years of their investment.

1. Quant Tax Plan – Direct Plan – GrowthELSS

The Quant Tax Plan is a Direct Plan-Growth ELSS fund. This mutual has given a 21% return per annum for 5 years. Similarly, the Absolute Returns come to 163.22% till 17.05.2022. Thus, the fund has made your investment more than double in 5 years. This is despite the market being down since October 2021.

The fund has below top stocks in its Portfolio:

- Adani Enterprises Ltd.

- Vedanta Ltd.

- Ruchi Soya Industries Ltd.

- Adani Ports And Special Economic Zone Ltd.

- State Bank Of India

- ICICI Bank Ltd.

- Larsen & Toubro Ltd.

- ITC Limited

- Coal India Ltd.

- Indian Hotels Company Limited

2. Quant Active Fund – Growth Multi-Cap Fund

The Quant Active Fund – Direct Plan – GrowthMulti Cap Fund has given a 21% annualized return in the last 5 years. The absolute return is 158.51% return.

3. Quant Mid Cap Fund – GrowthMid Cap Fund

The Quant Mid Cap Fund – Direct Plan – GrowthMid Cap Fund has given a 19% annualized return in the last 5 years. The absolute return is 142.40% return.

4. PGIM India Midcap Opportunities Fund – GrowthMid Cap Fund

The PGIM India Midcap Opportunities Fund – GrowthMid Cap Fund has given a 17% annualized return in the last 5 years. The absolute return is 118.99% return.

5. IIFL Focused Equity Fund – GrowthFocused Fund

The IIFL Focused Equity Fund – Direct Plan – GrowthFocused Fund has given a 15% annualized return in the last 5 years. The absolute return is 103.28% return.

6. BOI AXA Tax Advantage Fund -GrowthELSS

The BOI AXA Tax Advantage Fund -GrowthELSS has given a 15.19% annualized return in the last 5 years. The absolute return is 102.88% return.

7. PGIM India Flexi Cap Fund – GrowthFlexi Cap Fund

The PGIM India Flexi Cap Fund – Direct Plan – GrowthFlexi Cap Mutual Fund has given a 15.01% annualized return in the last 5 years. The absolute return is 101.33% return.

8. IDFC Tax Advantage (ELSS) Fund – GrowthELSS

The IDFC Tax Advantage (ELSS) Fund – Direct Plan – GrowthELSS fund has given a 13.74% annualized return in the last 5 years. The absolute return is 90.46% return.

9. Invesco India Infrastructure Fund – GrowthSectoral/Thematic

The Invesco India Infrastructure Fund – Direct Plan – GrowthSectoral/Thematic mutual fund has given a 14% annualized return in the last 5 years. The absolute return is 89.56% return.

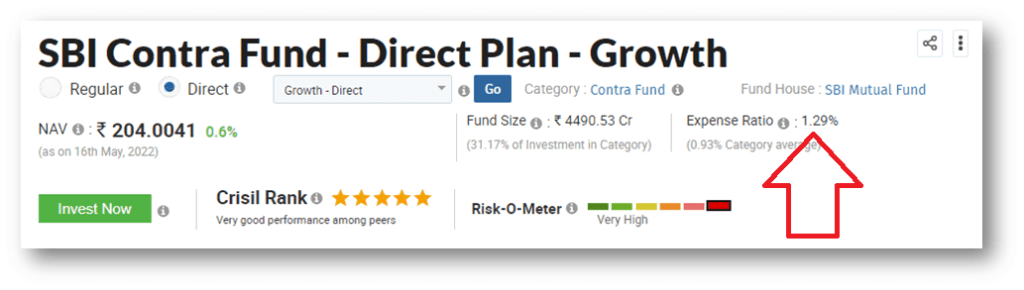

10. SBI Contra Fund – GrowthContra Fund

The SBI Contra Fund – Direct Plan – GrowthContra mutual Fund has given a 13.55% annualized return in the last 5 years. The absolute return is 88.81% return.

What is NAV for a mutual fund?

NAV stands for Net Assets Value. This is the total value of assets minus liabilities. It is calculated every day by the fund company.

How can I use it?

You can use NAV to compare the performance of different mutual fund companies. This will help you decide which one has the best investment strategy.

Why does it matter?

You need to understand the importance of NAV before you start investing. In fact, it is one of the key concepts when it comes to investing. In short, if the market is down, the NAV will come down. If you prefer to invest when the NAV is down, you may make more earnings when it goes back to its pick value.

How to calculate it?

You can use the NAV to compare different funds. If you are looking at two funds with similar investment objectives, then you should expect them to have similar NAV values. However, if one fund has more assets than another, its NAV will be higher.

What is the expense ratio of a mutual fund?

The expense ratio is the percentage of the amount that must be paid as fees each year to the asset management company. It’s important to understand this number because it will affect your returns on your investments. Thus, the lower expense ratio is the best for long-term investment.

How Do I Know If My Advisor Has Low Expenses?

One of the first things you should do when selecting a financial advisor finds out how much he charges. You can use online portals like www.moneycontrol.com to findout the expense ratios of different funds.

How To Calculate The Expense Ratio?

An expense ratio is calculated as a percentage of the total value of the fund. This includes both management fees and other expenses such as sales charges. You should also consider the tax implications when calculating the expense ratio.

There are two main ways to calculate the expense ratio. One method uses the net asset value (NAV) of the fund. Another method calculates the expense ratio based on the total market value of the fund. Both methods are used by financial advisors and brokers.

How To Start Investing In Mutual Fund?

You can buy individual stocks, bonds, or mutual funds. Buying mutual funds is one of the easiest ways to invest in the stock market. It’s also a good idea to learn how to invest in mutual funds before you decide to invest in individual stocks.

5 Ways To Start Investing In Mutual Fund

1. Set Up An Investment Plan

You should set up an investment plan before you begin investing. This will help you determine what type of mutual fund you would like to use, as well as when you’d like to make investments.

2. Research Different Types Of Funds.

There are different types of mutual funds available, each with its own benefits and drawbacks. One of the most common types of mutual funds is called a “fund of funds.” These funds invest in other funds, allowing investors to diversify their portfolios. Another type of mutual fund is called a “target date” fund. Target date funds allow investors to set a goal for when they want to retire. They also offer a variety of options so that investors can choose the right fund for them.

3. Choose A Fund That Suits You.

It’s important to find a fund that suits your needs. If you’re looking for growth, consider an aggressive growth fund. If you prefer stability, consider a balanced fund. And if you’d rather avoid market volatility, consider a value fund.

Read Why to open a PPF Account?

4. Understand The Basics Of Mutual Funds.

There are two main categories of mutual funds: equity and fixed income. Equity funds invest in stocks, while fixed-income funds invest in bonds. Both types of funds offer different benefits and risks.

5. Find Out About Fees And Expenses.

One of the biggest differences between an equity fund and a bond fund is fees and expenses. With an equity fund, investors pay a fee each year based on the total value of the investments held within the fund. This fee is usually 1% per year. On top of that, there will also be an expense ratio, which is a percentage of the investment that goes toward paying for management costs. These costs can vary widely, so make sure to check out the fund’s prospectus before investing.

Frequently Asked Questions

Small-Cap Equity Funds. However, they carry high volatility.

Any mutual fund you hold for the long term will give a moderate return.

You will earn interest on interest. For example: if you earn 16% interest in 1st year, then next year you will earn 16% interest on your previous year’s 16%. check our compound interest calculator.

It is a distribution of income of a mutual fund scheme. This may include both dividends paid by stocks and capital gains made by selling underlying stocks from the scheme portfolio.

XIRR stands for Extended internal rate of return. It is a method of calculating returns, where multiple transactions take place at various times.