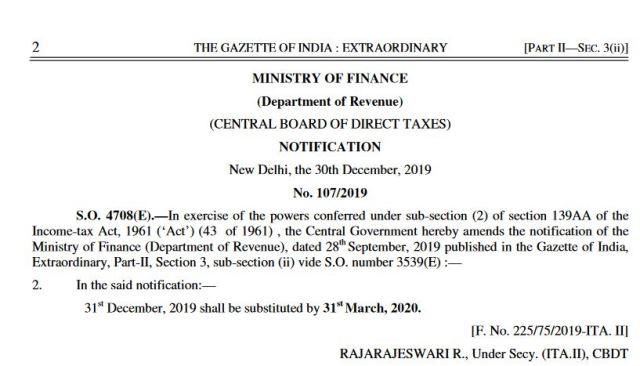

CBDT Notifies Income Tax Return Forms for the Assessment Year 2024-25 well in advance

The Central Board of Direct Taxes (CBDT) vide Notification No. 19 of 2024 dated 31.01.2024, has notified Income-tax Return Forms (ITR Form) – 2, 3 and 5 for the Assessment Year (A.Y.) 2024-25. Further, vide Notification No. 16 of 2024 dated 24.01.2024, ITR Form-6 has been notified for the A.Y. 2024-25. Earlier, ITR-1 and ITR-4 […]

Continue Reading