Whether you’re an employee or an employer, understanding PF interest rates is important. This guide provides a detailed overview to help you make informed decisions on the Employee PF Interest rate for 2022-23.

If you’re an employee or employer in India, it’s important to understand the interest rates associated with the Provident Fund (PF). This guide will provide you with a detailed overview of PF interest rates, including how they are calculated and what factors can affect them. By understanding these important details, you can make informed decisions about your PF contributions and withdrawals.

Quick Jump

- About EPF Interest Rate

- What is PF? >>Current Interest Rate

- Interest Calculation >> PF Benefits >> Maximize Returns

- Latest News >> FAQ

What is Employee PF and how does it work?

Provident Fund (PF) is a retirement savings scheme that is mandatory for most employees in India. Both the employee and employer contribute a percentage of the employee’s salary to the PF account, which earns interest over time. The accumulated amount can be withdrawn by the employee at the time of retirement or in case of certain emergencies. The employee PF interest rate is set by the government and is subject to change every year.

What are the current Employee PF interest rates?

The current employee PF interest rate for the financial year 2022-23 is 8.15%. This rate was announced by the government in March 2023 and is applicable to all PF accounts maintained by the Employees’ Provident Fund Organisation (EPFO). It is important to note that the employee PF interest rate is compounded annually, which means that the interest earned in the previous year is added to the principal amount, and the interest for the current year is calculated on the new total. This can result in significant growth of the PF account over time.

How are PF interest rates calculated?

The Employee pf interest rate is calculated based on the balance in the account at the end of the financial year. The employee PF interest rate is determined by the government and is subject to change every year. The interest is calculated on a monthly basis and is credited to the account at the end of the financial year. As mentioned earlier, the interest is compounded annually, which means that the interest earned in the previous year is added to the principal amount, and the interest for the current year is calculated on the new total. This results in a higher interest rate and significant growth of the PF account over time.

Know the Employee PF Withdrawal process

What are the benefits of investing in PF?

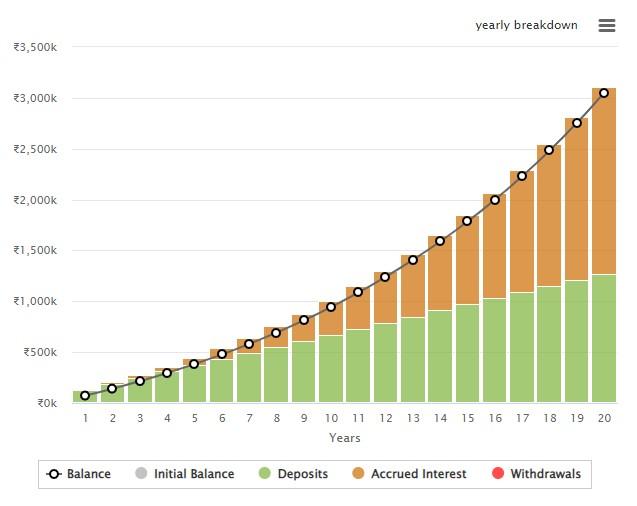

Investing in PF (Provident Fund) has several benefits. Firstly, it is a safe and secure investment option as it is backed by the government. Secondly, the employee PF interest rate offered on PF is generally higher than other fixed-income investments like fixed deposits. Thirdly, the interest earned on PF is tax-free up to a certain limit, making it a tax-efficient investment option. Additionally, PF also helps in building a retirement corpus as the funds are locked in until retirement age. Overall, investing in PF can provide long-term financial stability and security. The below table shows how your investment can grow over a period of 20 years.

In the below example, we have considered 10000 INR on any given date. Thereafter, Rs. 5000/- is considered your monthly contribution to the Employee PF fund. The rate of interest is considered 8.15% in this case. These figures will change as and when the Govt. revises the rate of interest.

| Year | Deposits & Withdrawals | Interest | Total Deposits & Withdrawals | Accrued Interest | Balance |

|---|---|---|---|---|---|

| 0 | ₹10,000.00 | – | ₹10,000.00 | – | ₹10,000.00 |

| 1 | ₹60,000.00 | ₹3,138.92 | ₹70,000.00 | ₹3,138.92 | ₹73,138.92 |

| 2 | ₹60,000.00 | ₹8,481.38 | ₹1,30,000.00 | ₹11,620.29 | ₹1,41,620.29 |

| 3 | ₹60,000.00 | ₹14,275.88 | ₹1,90,000.00 | ₹25,896.17 | ₹2,15,896.17 |

| 4 | ₹60,000.00 | ₹20,560.69 | ₹2,50,000.00 | ₹46,456.86 | ₹2,96,456.86 |

| 5 | ₹60,000.00 | ₹27,377.28 | ₹3,10,000.00 | ₹73,834.14 | ₹3,83,834.14 |

| 6 | ₹60,000.00 | ₹34,770.65 | ₹3,70,000.00 | ₹1,08,604.79 | ₹4,78,604.79 |

| 7 | ₹60,000.00 | ₹42,789.61 | ₹4,30,000.00 | ₹1,51,394.40 | ₹5,81,394.40 |

| 8 | ₹60,000.00 | ₹51,487.08 | ₹4,90,000.00 | ₹2,02,881.48 | ₹6,92,881.48 |

| 9 | ₹60,000.00 | ₹60,920.49 | ₹5,50,000.00 | ₹2,63,801.97 | ₹8,13,801.97 |

| 10 | ₹60,000.00 | ₹71,152.10 | ₹6,10,000.00 | ₹3,34,954.07 | ₹9,44,954.07 |

| 11 | ₹60,000.00 | ₹82,249.45 | ₹6,70,000.00 | ₹4,17,203.51 | ₹10,87,203.51 |

| 12 | ₹60,000.00 | ₹94,285.79 | ₹7,30,000.00 | ₹5,11,489.31 | ₹12,41,489.31 |

| 13 | ₹60,000.00 | ₹1,07,340.58 | ₹7,90,000.00 | ₹6,18,829.89 | ₹14,08,829.89 |

| 14 | ₹60,000.00 | ₹1,21,500.00 | ₹8,50,000.00 | ₹7,40,329.89 | ₹15,90,329.89 |

| 15 | ₹60,000.00 | ₹1,36,857.50 | ₹9,10,000.00 | ₹8,77,187.39 | ₹17,87,187.39 |

| 16 | ₹60,000.00 | ₹1,53,514.47 | ₹9,70,000.00 | ₹10,30,701.87 | ₹20,00,701.87 |

| 17 | ₹60,000.00 | ₹1,71,580.86 | ₹10,30,000.00 | ₹12,02,282.73 | ₹22,32,282.73 |

| 18 | ₹60,000.00 | ₹1,91,175.93 | ₹10,90,000.00 | ₹13,93,458.66 | ₹24,83,458.66 |

| 19 | ₹60,000.00 | ₹2,12,429.01 | ₹11,50,000.00 | ₹16,05,887.67 | ₹27,55,887.67 |

| 20 | ₹60,000.00 | ₹2,35,480.42 | ₹12,10,000.00 | ₹18,41,368.09 | ₹30,51,368.09 |

Thus, the table shows you will earn an interest of Rs. 18,41,368.09 after 20 years. You can clearly see in the below graph how your contribution has grown up over a period of 20 years.

See How to check the EPF Balance on Mobile Phone

How can you maximize your PF returns?

Maximizing your PF returns requires a thorough understanding of the employee PF interest rate offered and the various options available. One way to maximize your returns is to opt for a higher contribution towards your PF account. This will not only increase your savings but also result in higher interest earnings. Additionally, you can also consider investing in other investment options like equity mutual funds or fixed deposits to diversify your portfolio and potentially earn higher returns. It is important to consult with a financial advisor to determine the best investment strategy for your individual needs and goals.

Latest News on EPF

28.03.2023: The decision to revise the EPF interest rate for FY 2022-23 is taken on 28.03.2023. Thus, the board has recommended an 8.15 % annual rate of interest to be credited on EPF accumulations in members’ accounts for the financial year 2022-23.

Read Why you should open PPF Account?

Frequently Asked Questions

How much interest is in PF in India?

8.15% for FY 2022-23

By end of March every year.

Ensure you are checking the interest at the month end of March. If you still do not see the interest credited, kindly contact the EPF office.