About Calamity and Flood Cess: The decision to levy flood cess under GST is taken in 32nd GST council meeting. Thus, It is decided in this meeting that 1%

This will be called as calamity cess and will be charged over and above GST. Similarly, the main purpose to levy calamity cess is to provide reconstruction, rehabilitation and compensation needs which arose due to massive floods occurred in August 2018.

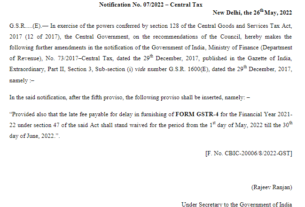

Notification to impose calamity cess

The power to impose calamity cess has flowed from Article 279(A) (4) (F) of the constitution. The particular clause reads

GST Rate on Calamity Cess

- Goods taxed at the rate of 1.5% = 0.25% Cess

- Goods taxed at the rate of 6%, 9% and 14% = 1% Cess

- All Services under Kerala GST= 1% Cess

How long the Calamity Cess will be charged

The calamity cess will be levied for two years i.e from 01.07.2019 to 30.06.2021. Therefore, this will be applicable from 01st July 2019 within the state of Kerala only.

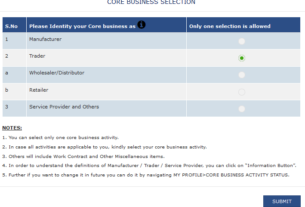

How calamity cess will be levied

The cess will be leviable only on the supplies made within the state by registered dealers to un-registered person. This is as per section 15 of CGST Act. Thus, this will have t

Further, Calamity cess will not be applicable on items that are taxable at 5% or below t

A Cess of 0.25 % will be chargeable on gold, silver and platinum ornaments, precious stones, imitation jewelry, diamonds, and other items, that fall in the fifth schedule of the GST rates.

Further, Input tax credit is allowed on the cess paid by the registered dealer to unregistered end consumers. Also, Refund concept is not applicable under this rule.

Who shall not charge calamity cess

The composition scheme dealers are not required to charge calamity cess on their supplies.

Kerala flood Cess Return

The GST registered person shall file a Separate monthly return in form KFC-A along with GSTR-3B. The return to be filed on www.keralataxes.gov.in website. However, the t