Meaning of Deemed Export Under GST

The deemed export under GST is a type of export, where the goods are manufactured and supplied within India. However, the deemed export is allowable only to a

Further, the deemed export concept under GST is applicable only to supply of goods and not the services. Also, the deemed export is not zero-rated like the regular exports made to another country. Therefore, all supplies under this system are taxable and supplier has to make the payment for such exports. On the contrary, the supplier can not supply the goods against Letter of undertaking or the bond.

However, the supplier or the recipient can claim the refund of taxes paid towards such supplies. Therefore, in order to claim the refund of taxes paid, any one party has to file an application with certain conditions.

Supply Categories

We have seen the meaning in the above paragraph that, the deemed export is admissible only to the certain type of supplier categories. Here is the description list of such categories.

- A GST registered person, who Supplies goods against License of Advance Authorisation

- Supplier of capital goods against Export Promotion Capital Goods Authorisation by a registered person.

- Supply of goods by a GST registered person, to Export Oriented Unit(EOU)

- Lastly, the Supply of gold by a bank or Public Sector Undertaking specified in the notification No. 50/2017-Customs, dated the 30th June 2017 (as amended) against Advance Authorisation

Benefits of Deemed Export

- The most important benefit of deemed export is, either the recipient or the supplier can claim the refund of taxes paid.

- The goods get to

manufacture and supply takes place within India. - Since the refund is applicable to such supplies. Cost reduction is possible.

- Online application and Easy refund filing process

Pre supply Procedure

Following is the step by step guide procedure for deemed export under GST in India.

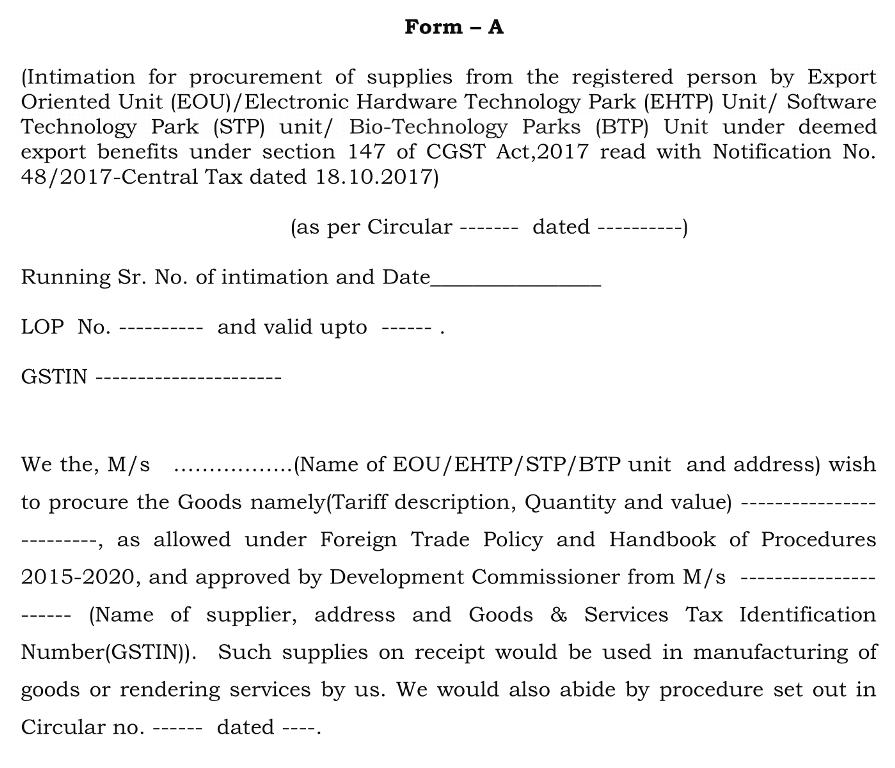

1. The recipient EOU / EHTP / STP / BTP unit shall give a prior intimation in “Form–A” to the registered supplier, the jurisdictional GST officer in charge of such registered supplier; and to its jurisdictional GST officer.

Further, Form A shall have a running serial number. Also, it shall contain the details of goods, the supplier is going to supply. Similarly, the recipient shall obtain the pre-approval of Form A and the details of the supplier from the Development Commissioner. Thus, the above process must get complete before initiating such deemed export supply.

2. Thereafter, The GST registered supplier will supply goods with a tax invoice to the recipient EOU / EHTP / STP / BTP unit.

Post supply Procedure

1. After the receipt of supplies, the EOU / EHTP / STP / BTP unit shall endorse the tax invoice. He shall send a copy of the endorsed tax invoice to the following persons.

- Registered supplier

- Jurisdictional GST officer in charge of such registered supplier

- Jurisdictional GST officer of the receiver.

2. The endorsements on the tax invoice will serve as a proof of deemed export supplies by the registered person to EOU / EHTP / STP / BTP unit.

Records Maintenance

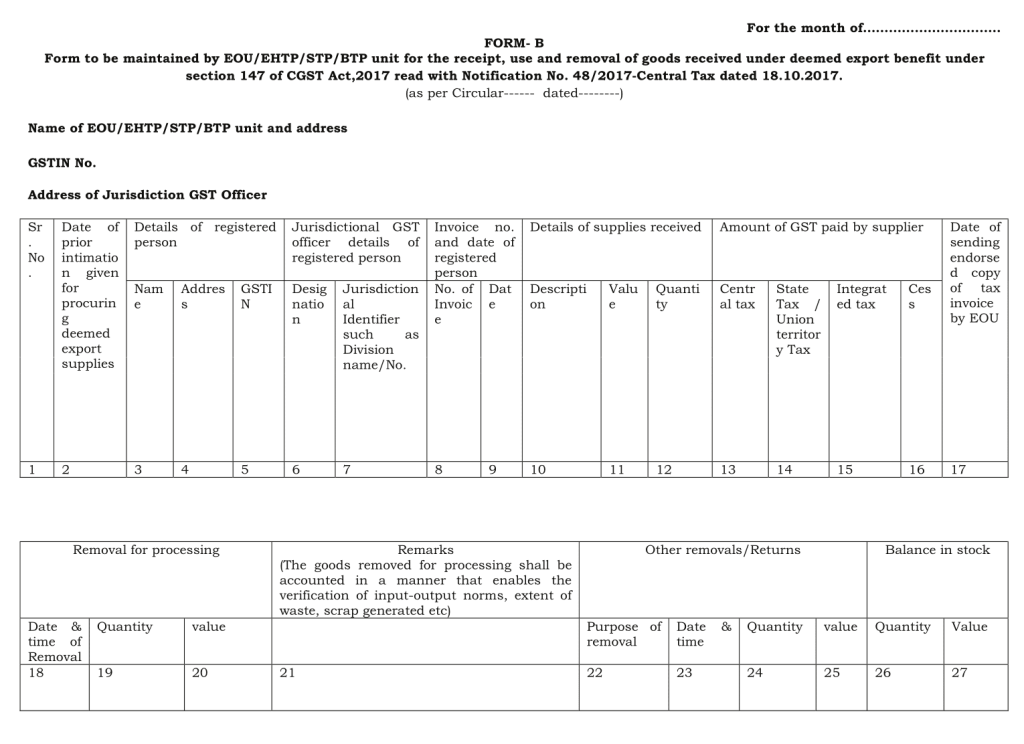

3. The recipient EOU / EHTP / STP / BTP unit must maintain records of deemed export supplies in digital form on the basis of elements exist in form B. Further, the recipient unit can include any additional data fields in addition to the elements contained in Form B. This may be the additional commercial requirements of the recipient.

4. A recipient unit needs to enter the accurate data immediately upon the receipt of goods. This condition is also applicable for utilization or removal of goods from the unit.

5. A Goods recipient shall keep all records digitally up to date, accurate and complete in all respects. This shall enable the tax officer for verification whenever there is a need. At the same time, the recipient shall provide a digital copy of form B containing all transactions to the jurisdictional GST officer. Thus, the recipient shall submit this information by the 10th of next month. He can provide this information on a CD or pen drive as per his convenience.

In other words, the supplier and the recipient shall adhere to the above procedure and safeguards in addition to the terms and conditions of the Foreign Trade Policy, 2015-20. At the same time, they shall adhere the conditions of duty exemption notification under the said policy.

Input Tax credit under Deemed export supply

The recipient of deemed export supplies can claim a refund of input tax credit availed on other inputs or input services. However, the condition is, he shall use such inputs for making the zero-rated supply of goods or services or both. Please refer rule 89(4A) of the CGST Rules, 2017 as amended vide Notification no. 75/2017-Central Tax dated 29.12.2017 (w.e.f 23.10.2017).

Further, according to Rule 96(9) of the CGST Rules, 2017 as amended vide Notification no. 75/2017-Central Tax dated 29.12.2017, the recipient cannot export on payment of integrated tax, if the supplier avails the benefit of Notification. No. 48/2017-Central Tax dated 18.10.2017.

Who can file refund application?

The recipient of goods can file an application for refund in case of deemed export supply. Similarly, the supplier also can file the refund application for deemed export supplies subject to below conditions.

a) Recipient does not avail input tax credit on such deemed export supplies.

b) Recipient furnishes an undertaking saying that the supplier may claim the deemed export supply refund.

Deemed Export Formats

Form A: It is an Intimation for procurement of supplies from the registered person by Export Oriented Unit (EOU)/Electronic Hardware Technology Park (EHTP) Unit/ Software Technology Park (STP) unit/ Bio-Technology Parks (BTP) Unit.

Form B: It is a Form to be maintained by EOU/EHTP/STP/BTP unit for the receipt, use, and removal of goods received under the deemed export benefit.

Notifications and Circulars

- Deemed exports are notified under Section 147 of the CGST/SGST Act, 2017.

- Notification no. 49/2017-Central Tax dated 18.10.2017 lays down the list of evidence which is required to be produced by the supplier of deemed export supplies for claiming the refund.

- Rule 89 of the CGST Rules, 2017 as amended against Notification No. 47/2017- Central Tax dated 18.10.2017 allows either the recipient or supplier of such supplies to claim a refund of tax paid thereon.

- Specific supply of goods is notified as deemed export supplies against Notification No. 48/2017-Central Tax dated 18.10.2017.

- Circular no. 14/14/2017-GST dated 06.11.2017 lays down the procedure and safeguards in respect of supplies to EOU / EHTP / STP / BTP units.

Frequently asked Questions

It is an authorization issued by the Director-General of Foreign Trade(DGFT) under Chapter 4 of the Foreign Trade Policy 2015-20. Thus, it is issued for import or domestic procurement of inputs on a pre-import basis for physical exports.

It is an authorization issued by the Director-General of Foreign Trade under Chapter 5 of the Foreign Trade Policy 2015-20 for import of capital goods for physical exports.

EOU is an:

a)Export Oriented Unit or;

b)Electronic Hardware Technology Park Unit or;

c)Software Technology Park Unit or;

d)Bio-Technology Park Unit approved in accordance with the provisions of Chapter 6 of the Foreign Trade Policy 2015-20.

A refund application must be filed within 2 years from the date on which the return relating to deemed export supplies to be filed electronically.

The recipient or supplier of deemed export supplies has to file an application in FORM GST RFD-01 on GST portal. Similarly, the application must accompany the statement containing the number and date of invoices along with other evidences as may be notified from time to time.