If you’re new to trading options on the Nifty 50, it can be overwhelming to navigate the option chain. But understanding how it works is crucial to making informed trading decisions. This beginner’s guide will break down the basics of the Nifty 50 option chain and help you get started.

What is the Nifty 50 Option Chain?

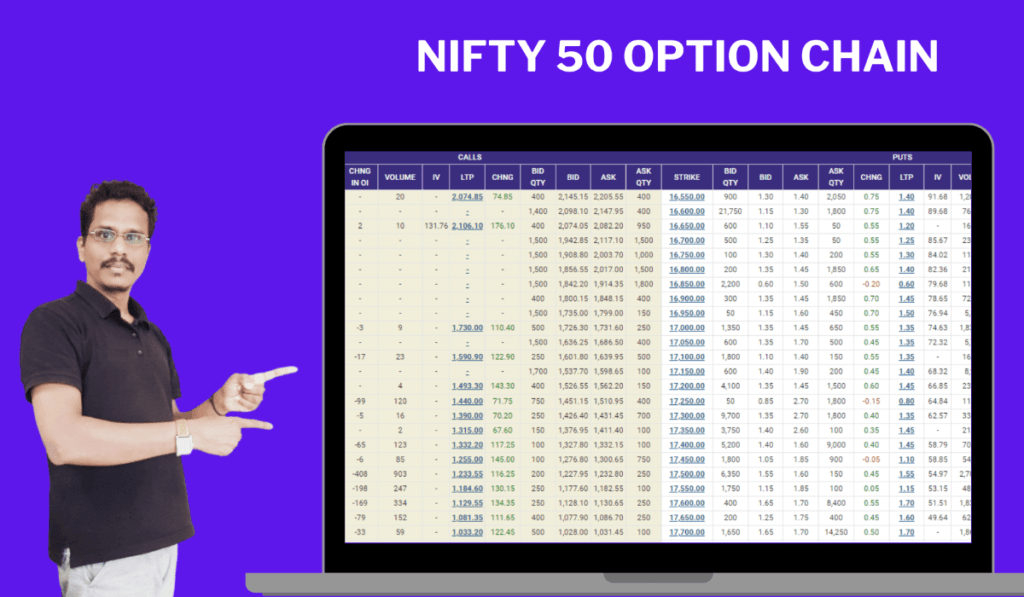

The Nifty 50 Option Chain is a tool used by traders to view and analyze the available options contracts for the Nifty 50 index. It displays all the available strike prices and expiration dates for call and put options, allowing traders to see the current market prices and make informed trading decisions. The option chain is a crucial tool for options traders, as it provides valuable information about the market and helps them to manage their risk.

Understanding the Call and Put Options.

Before diving into the Nifty 50 Option Chain, it’s important to understand the two types of options available: call options and put options. A call option gives the buyer the right, but not the obligation, to buy the underlying asset at a specific price (strike price) on or before a specific date (expiration date). A put option gives the buyer the right, but not the obligation, to sell the underlying asset at a specific price (strike price) on or before a specific date (expiration date). Understanding the difference between these two types of options is crucial for making informed trading decisions.

How to Read the Options Chain.

The option chain is a table that displays all available options for a particular stock or index. It includes information such as the strike price, expiration date, and option type (call or put). To read the option chain, start by identifying the underlying asset (in this case, the Nifty 50 index). Then, look for the strike price and expiration date that align with your trading strategy. Finally, consider the bid and ask prices for each option to determine the best entry and exit points for your trade.

Factors Affecting Option Prices.

There are several factors that can affect the price of options on the Nifty 50. These include the current price of the underlying asset, the strike price, the time until expiration, and the volatility of the market. As these factors change, so too will the price of the options. It’s important to keep these factors in mind when making trading decisions and to regularly monitor the option chain for any changes.

Tips for Trading the Nifty 50 Option Chain.

Trading options on the Nifty 50 can be a lucrative investment strategy, but it’s important to approach it with caution and a solid understanding of the option chain. One tip for successful trading is to keep an eye on the implied volatility of the market, as this can greatly impact the price of options. Additionally, it’s important to have a clear exit strategy in place and not let emotions drive your trading decisions. With careful research and a disciplined approach, trading the Nifty option chain can be a profitable venture.

Nifty 50 Option Chain Trading Strategies for Profit

If you’re interested in trading the Nifty option chain, it’s important to have a solid understanding of the market and the best strategies to use. This guide will provide you with the information you need to start making profitable trades, including tips on analyzing market trends, managing risk, and maximizing your profits.

Basic Option Trading Strategies.

Before diving into the Nifty option chain, it’s important to have a solid understanding of basic option trading strategies. These include buying call options, buying put options, selling call options, and selling put options. Each strategy has its own risks and rewards, so it’s important to do your research and choose the strategy that best fits your trading goals and risk tolerance. Additionally, it’s important to have a solid understanding of technical analysis and market trends in order to make informed trading decisions.

Advanced Option Trading Strategies.

Once you have a solid understanding of basic option trading strategies, you can start exploring more advanced techniques for trading the Nifty option chain. These may include strategies such as straddles, strangles, iron condors, and butterfly spreads. These strategies involve more complex combinations of buying and selling options and can be used to profit from a wider range of market conditions. However, they also come with higher risks and require a deeper understanding of market trends and technical analysis. It’s important to thoroughly research and practice these strategies before implementing them in your trading.

Risk Management Techniques.

Risk management is a crucial aspect of successful trading, especially when it comes to more complex strategies like those used in Nifty option chain trading. One effective technique is to set stop-loss orders, which automatically close out a position if it reaches a certain price point. This can help limit potential losses and protect your investment. Another technique is to diversify your portfolio, spreading your investments across multiple options and strategies to minimize risk. It’s also important to stay up-to-date on market news and trends and to have a solid understanding of technical analysis to make informed trading decisions.

Tips for Successful Trading.

Successful trading requires a combination of knowledge, strategy, and discipline. One important tip is to always have a plan in place before entering a trade, including setting clear entry and exit points and determining your risk tolerance. It’s also important to stay disciplined and avoid emotional trading decisions, such as chasing losses or holding onto losing positions for too long. Additionally, staying informed about market news and trends can help you make more informed trading decisions and adjust your strategies as needed.

Nifty 50 Option Chain vs. Nifty 50 Futures: What’s the Difference?

If you’re interested in trading on the Indian stock market, you may have come across the terms Nifty 50 option chain and Nifty 50 futures. While both involve trading on the Nifty 50 index, there are some key differences to be aware of. This article will help you understand the distinctions between the two and make an informed decision about which one is right for you.

Understanding Nifty 50 Option Chain and Nifty 50 Futures.

The Nifty 50 option chain and Nifty 50 futures are both derivatives of the Nifty 50 index, which is a benchmark index of the National Stock Exchange of India. The main difference between the two is that the Nifty option chain gives the buyer the right, but not the obligation, to buy or sell the underlying asset at a predetermined price and time, while Nifty 50 futures obligate the buyer to buy or sell the underlying asset at a predetermined price and time. Understanding the differences between the two can help you make an informed decision about which one is right for your trading strategy.

Key Differences Between Nifty Option Chain and Nifty 50 Futures.

The key difference between the Nifty 50 option chain and Nifty 50 futures lies in the level of obligation for the buyer. With the Nifty option chain, the buyer has the right, but not the obligation, to buy or sell the underlying asset at a predetermined price and time. This gives the buyer more flexibility and control over their trading strategy. On the other hand, Nifty 50 futures obligate the buyer to buy or sell the underlying asset at a predetermined price and time, which can limit their flexibility and increase their risk. Understanding these differences is crucial for making informed decisions about your trading strategy.

Advantages and Disadvantages of Nifty Option Chain and Nifty 50 Futures.

Both the Nifty 50 option chain and Nifty 50 futures have their own advantages and disadvantages. The nifty option chain offers more flexibility and control over trading strategies, as the buyer has the right but not the obligation to buy or sell the underlying asset. This can limit risk and provide more opportunities for profit. However, Nifty 50 futures obligate the buyer to buy or sell the underlying asset, which can limit flexibility but also provide more certainty in trading outcomes. It’s important to weigh these factors and consider your own trading goals and risk tolerance when deciding which option is best for you.

How to Choose Between Nifty Option Chain and Nifty 50 Futures.

Choosing between the Nifty 50 option chain and Nifty 50 futures depends on your trading goals and risk tolerance. If you want more flexibility and control over your trading strategies, the Nifty option chain may be the better choice. However, if you prefer more certainty in trading outcomes, Nifty 50 futures may be the way to go. It’s important to consider the advantages and disadvantages of each option and weigh them against your own preferences and goals before making a decision.

Tips for Trading Nifty 50 Option Chain and Nifty 50 Futures.

When trading the Nifty 50 option chain or Nifty 50 futures, it’s important to have a solid understanding of the underlying market and the factors that can impact it. This includes keeping up with news and events that can affect the stock market, as well as monitoring technical indicators and market trends. Additionally, it’s important to have a clear trading plan and risk management strategy in place to help minimize losses and maximize profits. Finally, it’s important to stay disciplined and avoid making emotional decisions based on short-term market fluctuations.