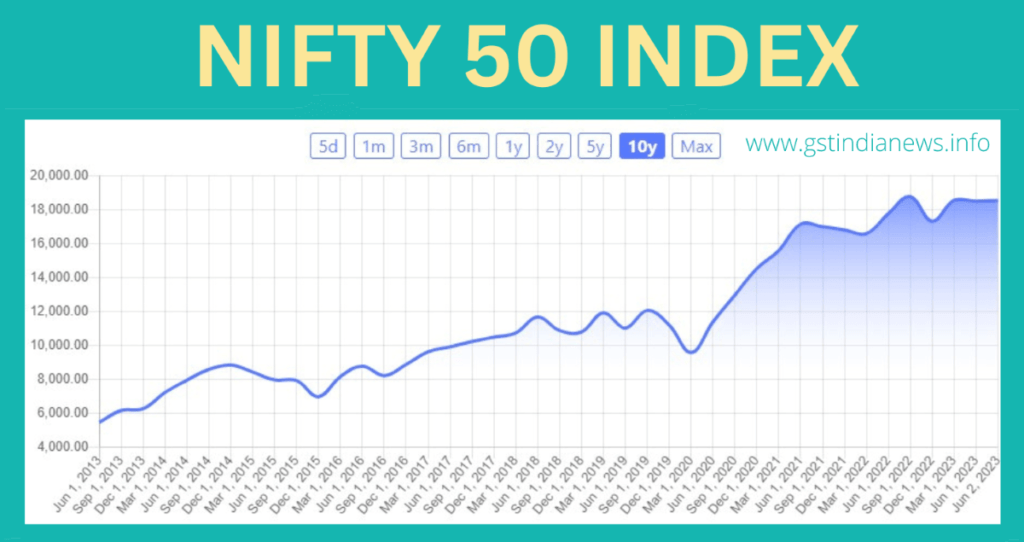

The Nifty 50 is a stock market index that is widely used as a benchmark for the Indian equity market. It tracks the performance of 50 large-cap companies listed on the National Stock Exchange of India (NSE). If you are Investor or Trader you must check the Nifty 50 share price today to understand the market trends. Thus, you can see the below Nifty 50 chart to understand whether the market is going upward or downward.

Thus, Nifty 50 is a stock market index that represents the performance of 50 large-cap companies listed on the National Stock Exchange of India (NSE). Below you can see the Nifty 50 companies list. These companies are chosen based on their market capitalization, liquidity, and other factors. The Nifty 50 is widely used as a benchmark for the Indian equity market and is considered a reliable indicator of the overall health of the Indian economy.

Nifty 50 Today’s Chart

How to Use the Nifty 50 Chart for Stock Market Analysis

The Nifty 50 chart is a popular tool used by investors to analyze the stock market and identify trends. This comprehensive guide will teach you how to use the Nifty 50 chart effectively, including how to read the chart, interpret data, and make informed investment decisions. Whether you’re a seasoned investor or just starting out, this guide will help you navigate the complex world of stock market analysis.

Understanding the components of the Nifty 50.

The Nifty 50 is made up of 50 large-cap stocks that are actively traded on the National Stock Exchange of India (NSE). These stocks are chosen based on their market capitalization, liquidity, and other factors. The Nifty 50 is considered a benchmark index for the Indian stock market and is used by investors to track the performance of the market as a whole. Understanding the components of the Nifty 50 is essential for effective stock market analysis.

Analyzing trends and patterns in the Nifty 50 chart.

One of the key benefits of using the Nifty 50 chart for stock market analysis is the ability to identify trends and patterns. By analyzing the movement of the index over time, investors can gain insights into the overall direction of the market and make informed decisions about buying and selling stocks. Some common trends to look for include upward or downward trends, support and resistance levels, and chart patterns such as head and shoulders or double tops. It’s important to use technical analysis tools and indicators in conjunction with the Nifty 50 chart to get a complete picture of market trends and make informed investment decisions.

Using technical indicators to supplement your analysis.

While the Nifty 50 chart is a powerful tool for analyzing the stock market, it’s important to use technical indicators to supplement your analysis. These indicators can provide additional insights into market trends and help you make more informed investment decisions. Some common technical indicators include moving averages, relative strength index (RSI), and stochastic oscillators. By using these indicators in conjunction with the Nifty 50 chart, you can get a more complete picture of market trends and make more informed investment decisions.

Making informed investment decisions based on your analysis.

The Nifty 50 chart is a valuable tool for analyzing the stock market, but it’s important to remember that it’s just one piece of the puzzle. To make informed investment decisions, you should also consider other factors such as company financials, industry trends, and global economic conditions. By combining your analysis of the Nifty 50 chart with other sources of information, you can make more informed investment decisions and increase your chances of success in the stock market.

How is the Nifty 50 calculated?

The Nifty 50 is calculated using a free-float market capitalization-weighted methodology, which means that the index is calculated based on the total market value of the shares of the 50 companies in the index, adjusted for the proportion of shares that are available for trading in the market. This methodology ensures that the index reflects the true market value of the companies in the index, rather than just their total market capitalization. The index is reviewed and rebalanced twice a year to ensure that it remains representative of the Indian equity market.

What are the benefits of investing in the Nifty 50?

Investing in the Nifty 50 can provide several benefits for investors. Firstly, it offers exposure to a diversified portfolio of 50 large-cap Indian companies, which can help to reduce the risk of investing in individual stocks. Secondly, the index has a proven track record of delivering strong long-term returns, making it an attractive investment option for those looking to grow their wealth over time. Finally, the Nifty 50 is highly liquid, meaning that investors can easily buy and sell shares in the index, making it a convenient investment option for those looking to trade frequently.

What are the risks of investing in the Nifty 50?

While investing in the Nifty 50 can offer many benefits, it is important to understand the potential risks involved. Like any investment, the value of the Nifty 50 can fluctuate based on market conditions and economic factors. Additionally, investing in an index means that you are investing in a group of companies, which can be impacted by individual company performance and industry trends. It is important to do your research and understand the potential risks before investing in the Nifty 50 or any other investment option.

How can you invest in the Nifty 50?

Investing in the Nifty 50 can be done through various channels, including mutual funds, exchange-traded funds (ETFs), and index funds. These investment options allow you to invest in the Nifty 50 without having to purchase individual stocks. It is important to research and compare the fees and performance of different investment options before making a decision. Additionally, it is recommended to consult with a financial advisor to determine if investing in the Nifty 50 aligns with your investment goals and risk tolerance.

Nifty 50 Companies List

The Nifty 50 companies list is a group of 50 blue-chip stocks that were popular investments in the 1960s and 1970s. These companies were known for their stability and growth potential, and their inclusion on the list was seen as a mark of prestige. Today, the Nifty 50 list has evolved, but its impact on the stock market and investing strategies remain significant. Below is the list of Nifty 50 companies. Learn more about the history and legacy of the Nifty 50 companies list. The list was last updated on 02-Jun-2023.

| Sr.no. | Symbol | % Change 365 days |

|---|---|---|

| 1 | TATASTEEL | -0.14 |

| 2 | COALINDIA | 17.5 |

| 3 | ICICIBANK | 24.37 |

| 4 | TATAMOTORS | 20.38 |

| 5 | HINDALCO | -1.05 |

| 6 | AXISBANK | 34.06 |

| 7 | SBIN | 24.44 |

| 8 | INFY | -10.76 |

| 9 | ONGC | 2.6 |

| 10 | ITC | 61.74 |

| 11 | HDFCBANK | 14.99 |

| 12 | RELIANCE | -6.46 |

| 13 | NTPC | 11.22 |

| 14 | BHARTIARTL | 19.19 |

| 15 | ADANIPORTS | -0.66 |

| 16 | ADANIENT | 15.87 |

| 17 | POWERGRID | 1.66 |

| 18 | HDFC | 13.6 |

| 19 | SUNPHARMA | 17.69 |

| 20 | KOTAKBANK | 3.48 |

| 21 | BPCL | 11.83 |

| 22 | JSWSTEEL | 21.83 |

| 23 | HDFCLIFE | -4.11 |

| 24 | WIPRO | -13.51 |

| 25 | M&M | 25.93 |

| 26 | HEROMOTOCO | 1.55 |

| 27 | TCS | -0.93 |

| 28 | INDUSINDBK | 38.97 |

| 29 | TECHM | -2.25 |

| 30 | HINDUNILVR | 16.87 |

| 31 | LT | 33.97 |

| 32 | HCLTECH | 12.18 |

| 33 | APOLLOHOSP | 25.4 |

| 34 | UPL | -13.06 |

| 35 | BAJAJFINSV | -88.49 |

| 36 | TITAN | 28.65 |

| 37 | CIPLA | -1.91 |

| 38 | EICHERMOT | 34.07 |

| 39 | ASIANPAINT | 13.61 |

| 40 | SBILIFE | 4.77 |

| 41 | TATACONSUM | 4.28 |

| 42 | BAJFINANCE | 17.14 |

| 43 | BAJAJ-AUTO | 24.82 |

| 44 | GRASIM | 18.51 |

| 45 | DRREDDY | 5.4 |

| 46 | DIVISLAB | -0.84 |

| 47 | MARUTI | 17.49 |

| 48 | BRITANNIA | 30.52 |

| 49 | ULTRACEMCO | 31.25 |

| 50 | NESTLEIND | 26.87 |

Check out the Tata Steel Price Today at NSE

The origins of the Nifty 50 list.

The Nifty 50 list was first created in the early 1960s by Morgan Guaranty Trust Company, a predecessor of JPMorgan Chase. The list was made up of 50 blue-chip stocks that were considered to be the best long-term investments. These companies were known for their stability, growth potential, and high-quality management teams. The Nifty 50 list quickly became popular with investors and was seen as a mark of prestige for companies included on the list.

The impact of the Nifty 50 on the stock market.

The Nifty 50 had a significant impact on the stock market, particularly in the 1970s. Many investors believed that the companies on the list were invincible and poured money into them, driving up their stock prices to unsustainable levels. When the stock market crashed in 1973-74, many of the Nifty 50 companies saw their stock prices plummet, leading to significant losses for investors. Despite this, the Nifty 50 remains an important part of stock market history and continues to influence investment strategies today.

The downfall of the Nifty 50 companies.

The Nifty 50 companies list was not immune to the economic downturn of the 1970s. As investors poured money into these companies, their stock prices became overvalued and unsustainable. When the stock market crashed in 1973-74, many of the Nifty 50 companies saw their stock prices plummet, leading to significant losses for investors. This event marked the end of the Nifty 50 era and a shift towards more diversified investment strategies. However, the impact of the Nifty 50 on the stock market and investment strategies continues to be felt today.

The legacy of the Nifty 50 list.

Despite its downfall in the 1970s, the Nifty 50 companies list left a lasting legacy on the stock market. It introduced the concept of investing in high-growth, blue-chip companies and popularized the idea of buying and holding stocks for the long term. The Nifty 50 also paved the way for index funds and passive investing, which have become increasingly popular in recent years. Today, the Nifty 50 companies list may no longer exist, but its impact on the investment world lives on.

The relevance of the Nifty 50 in today’s market.

While the Nifty 50 companies list may no longer exist, its impact on the investment world is still felt today. The concept of investing in high-growth, blue-chip companies and holding stocks for the long term is still popular among investors. Additionally, the rise of index funds and passive investing can be traced back to the Nifty 50’s influence. Even though the list may be a thing of the past, its legacy continues to shape the way we invest in the stock market today.

Frequently Asked Questions

You can choose the ETF by looking at its performance.

Top 50 Companies