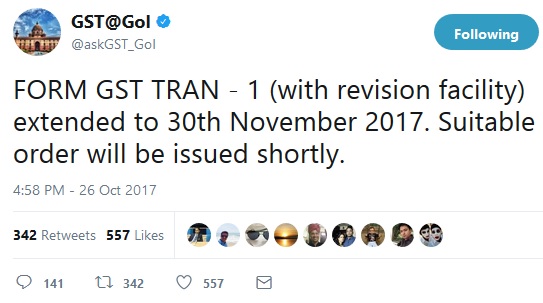

On 26th October 2017, the Official Twitter handle GST@GoI tweeted “FORM GST TRAN – 1 (with revision facility) extended to 30th November 2017. Suitable order will be issued shortly.” which extends the date of filing for TRAN 1 now.

Therefore now assesses can claim credit of transitional stock in the Goods and Services till 30th November 2017. However, the official notification is still awaited on this tweet. But it is very much sure that it extends the date of filing for TRAN 1 till Nov 30.

Many assess were looking at the possibilities to revise the form, so that they can add/modify/delete the entries later. But there is no such provision on the portal to do such activities later, However different tables of transition forms can be furnished at different points of time till the stipulated last date.

Please see our previous article to understand Key issues and resolution in filing TRAN 1(click here). Alternatively, you may also read the manual on the GST portal to fill TRAN 1 and see the possible errors pop out on the screen and resolutions for such errors. (Click here).

If you like this article which extends the date of filing for TRAN 1, kindly subscribe to our post to receive the latest updates on GST.

Input Tax Credit Related Articles

On how many products we can claim Input tax Credit?

Learn how many products or services on which the taxpayers can claim an input tax credit in the GST system. Is it on all items the recipient purchase? or there are limitations? more

What is GST input tax credit time limit?

Know what is the maximum time limit within the recipient of goods or services can claim the input tax credit. What happens if input tax credit availed after the lapse of the given limit. more

GST Login India

Know everything about GST portal login. Learn how you can log in immediately after submission of the GST registration application. Know how you can get a login user-id and password. more

How to make payment of GST?

The taxpayer has to deposit GST payments on a monthly basis. Making an online payment is very easy. Learn here the simple steps for making an online GST payment. more