Introduction: The GST payment is a payment of taxes made to the government charged on the sale of goods or services or both for the given period. You may learn more about various Taxes from here. Thus, the supplier can make the GST payment online through Net banking, debit card, credit card, and even on the bank’s counter.

Similarly, the supplier can pay such taxes on or before the GST payment due date. After going through this article you will learn how to create a GST payment challan, track the GST payment status, download the challan, etc. Let us see them one by one below:

Main Topics

- Payment Due Date > Payment Process Video

- Payment status >> Generate Challan

- Online Payment >> Offline Payment >> Authorized Banks

- Frequently Asked Questions

GST Payment Due Date

The GST payment due date in India is 20 days from the end of any tax liability period. Similarly, the Tax period can be a month or quarter for which the taxpayer has to make a GST payment. Thus, the GST payment date is the date on which you file your GSTR 3B Return.

The last date to file GSTR 3B is the 20th of next month. You may check the GSTR 3b filing date to know the GST payment date. On the other hand, for the persons registered under the composition scheme, the GST payment due date will be 18 days after the end of the quarter.

Further, the GSTR-3B or GSTR-4 return can be filed only after payment of Goods and Service Tax. However, the GSTR-1 return can be filed without payment of GST. Let us see some more questions regarding the GST payment due date and related questions.

Video of GST Payment Process by GSTN

GST Payment online through NEFT/RTGS

You can make GST online payment through payment mode as e-payment and then by choosing the NEFT/RTGS facility. Let us discuss the procedure in the pre-login mode. you may follow the same steps after login also.

1.First of all Visit the www.gst.gov.in portal

2. Click on Services > Payments > Create Challan

3. Fill in your GSTIN/UIN/TRPID/TMPID

4. Enter Captcha letters as shown in the image

5. Then click to proceed

6. Fill in the Tax liability details in the appropriate fields.

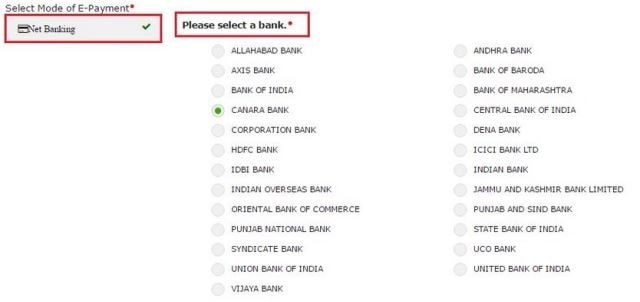

7. Select E-Payment as a payment mode

8. Click on GENERATE CHALLAN

9. Enter the OPT received on the registered mobile number.

10. Click to proceed

11. Select the mode of E-payment as NEFT/RTGS

11. In the Remitting Bank drop-down sub-menu, select the name of the remitting bank.

12. Click to “Make Payment”

You will be now directed to the Net Banking page of the selected Bank. The payment amount will be shown at the Bank’s website.

After the successful payment, you will be re-directed to the GST Portal where the transaction status will be displayed. Also, the payment receipt is displayed. Thus, to view the receipt, click the View Receipt link.

Linking Payment if not credited in Cash ledger

Once you receive the Unique Transaction Number (UTR) on your registered e-mail or mobile number, you can link the UTR with the NEFT/RTGS CPIN on the GST Portal.

- Go to Challan History and click the CPIN link.

- Enter the UTR and link it with the NEFT/RTGS payment.

- The Status of the payment will be updated on the GST Portal after confirmation from the Bank.

- The payment will be updated in the Electronic Cash Ledger in respective minor/major heads.

You may see the below video to link your payments.

GST Payment Status Checking

You need to have GSTIN and CPIN numbers to track the status of the GST payment. Thus, you can not check the GST payment status without CPIN. If you do not have the CPIN you may have to approach your bank. Follow the below simple steps to check your payment status.

1. visit https://www.gst.gov.in/ website. The GST portal home page gets open.

2. Click on the Services> Payments > Track Payment Status command.

3. Enter your GSTIN in the GSTIN field.

3. Enter your GSTIN in the GSTIN field.

4. Enter your CPIN, In the Enter CPIN field.

5. Enter the captcha text.

6. Click on the TRACK STATUS button.

You will see the payment status on the screen. To view the challan, click the VIEW CHALLAN button.

However, If you see the status of Challan is FAILED / NOT PAID and the mode selected is E-Payment then do the following”

- Click on the VIEW CHALLAN button

- select the Bank

- Terms and Conditions

- Click on the MAKE PAYMENT button to make the Payment again for the Failed or Not Paid challan.

If the Payment status is PAID, then the VIEW RECEIPT button will be enabled and you can view the receipt and also download the receipt after clicking on the VIEW RECEIPT button.

List of GST Payment Status

1. Initiated – If there is no intimation has been received from Bank

2. Paid – CIN received by taxpayer and status update on the portal as PAID

3. Not Paid – default status visible after challan generation

4. Failed – Transaction Failure of any online transaction initiated by the taxpayer.

5. Paid at tax Office – When the taxpayer makes payment at Commercial Tax Office counter.

6. Awaiting Bank Confirmation – In the case of Internet Banking (Maker-Checker) till the time Checker authenticates your transaction

7. Awaiting Bank Clearance – you get the message when Instrument (cheque/DD) is deposited in case of Over The Counter mode

8. Expired – There is No payment initiated within 15 days of generation of a particular challan

9. Cheque/DD Dishonored – When the Instrument is dishonored due to insufficient funds or any other reason

10. Transaction Failed – On failure of an online transaction initiated through Internet Banking or Credit Card/Debit Card.

11. MoE Reversal – Memorandum of Error not in favor of taxpayer for the said payment.

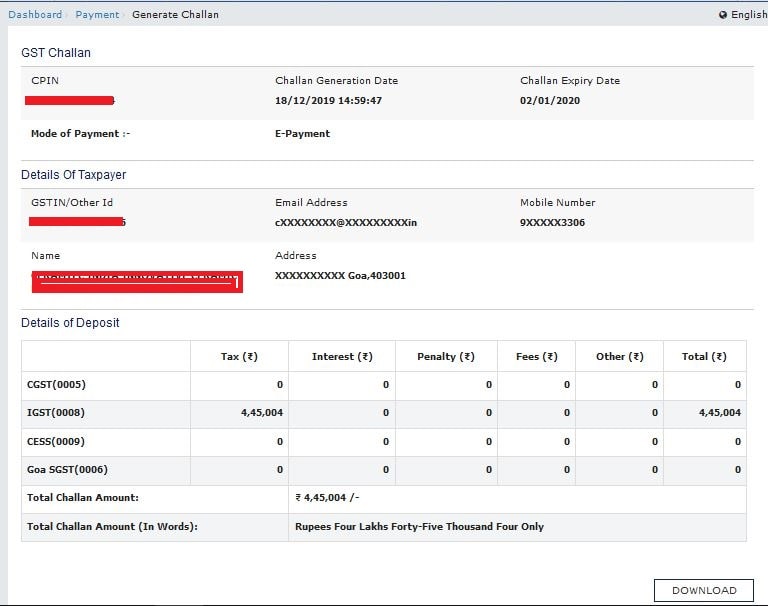

GST Payment Challan Generation

How to Generate GST Payment Challan – Step by Step procedure

In order to make a GST payment against your liabilities, follow the below-given procedure to generate an online GST Payment Challan. Also, you need not have to log in to the GST portal to generate the GST payment challan.

- Visit www.gst.gov.in

- Click Services from the main menu > Payments >Create Challan

- Create a challan on the page that will open. Fill in your GSTIN/UIN/TMPID

- Enter the Captcha letters and click to proceed

- Enter payment details like type of payment (IGST/CGST/SGST etc) Under Tax Liability Details.

- Click & Select type of Payment mode

- Click THE Generate Challan button.

- Enter the OTP received on GST registered mobile and click to proceed.

- The challan is generated.

You may also download generated challan by clicking the download button at the bottom.

GST Payment in offline mode

Learn how to make GST payments in offline mode. Thus, here is the detailed step-by-step procedure is given for making the GST Payment. Thus, you can make GST payments in offline mode by choosing an “Over the counter” option under payment mode. Let us discuss the procedure in the pre-login mode. Similarly, you may follow the same steps after login also.

- First of all Visit www.gst.gov.in

- Click on Services > Payments > Create Challan

- Fill in your GSTIN/UIN/TRPID/TMPID

- Enter Captcha letters as shown in the image

- Then click to proceed

- Fill in the Tax liability details in the appropriate fields.

- Choose to Select “Over the Counter” as payment modes

- Then select the Name of Bank where cash or instrument to be deposited.

- Finally, select the type of instrument as Cash/ Cheque/ Demand Draft.

- Click to Generate Challan

- Enter the OTP sent on your registered mobile number.

- Click Proceed.

- The Challan is generated.

- Take the print out of the Challan and visit your selected Bank. Also, Mandate form will be generated simultaneously. You shall pay using Cheque through your account with the selected Bank/ Branch. You can also pay using the account debit facility. The said transaction will be processed by the Bank and RBI shall confirm the same within 2 hours.

- The Status of the payment will be updated on the GST Portal after confirmation from the Bank.

Authorized Bank for GST Payment

A) Here is the complete list of Authorized Banks for “Net Banking” and “Over the Counter” Payment Options.

| Sr .no. | Name of Bank |

| 1 | ALLAHABAD BANK |

| 2 | ANDHRA BANK |

| 3 | BANK OF BARODA |

| 4 | DENA BANK |

| 5 | BANK OF INDIA |

| 6 | CENTRAL BANK OF INDIA |

| 7 | CANARA BANK |

| 8 | CORPORATION BANK |

| 9 | HDFC BANK |

| 10 | IDBI BANK |

| 11 | ICICI BANK LTD |

| 12 | INDIAN BANK |

| 13 | INDIAN OVERSEAS BANK |

| 14 | BANK OF MAHARASHTRA |

| 15 | ORIENTAL BANK OF COMMERCE |

| 16 | J & K Bank |

| 17 | PUNJAB AND SIND BANK |

| 18 | PUNJAB NATIONAL BANK |

| 19 | STATE BANK OF INDIA |

| 20 | SYNDICATE BANK |

| 21 | UNION BANK OF INDIA |

| 22 | UCO BANK |

| 23 | UNITED BANK OF INDIA |

| 24 | AXIS BANK |

| 25 | VIJAYA BANK |

B) List of Authorized Payment gateways for CC/DC Payment

| Sr. NO. | Name of Bank |

| 1 | AXIS BANK |

| 2 | BANK OF BARODA |

| 3 | HDFC BANK |

| 4 | ICICI BANK LTD |

| 5 | IDBI BANK |

| 6 | INDIAN OVERSEAS BANK |

| 7 | PUNJAB NATIONAL BANK |

| 8 | STATE BANK OF INDIA |

Find a complete list of Authorized Banks for “Net Banking” and “Over the Counter” Payment Options. On the other hand, you can also find here a List of Authorized Payment gateways for CC/DC Payment. You can choose from any Authorized bank for GST Payment from the above list. Thus, these banks are authorized to collect the payment on behalf of GST and pay to the government.

Frequently Asked Questions

Question 1. What are the types of GST Payments compulsory in the GST regime?

Answer 1. In GST, for any intra-state supply, the taxes paid goes to Central GST (CGST) central government account). On the other hand, state / UT GST (SGST is going to account with the concerned state account).

Secondly, For any interstate supply, the taxes paid are an integrated GST. This is a combination of CGST and SGST components.

In addition, some categories of registered individuals will be required to pay the tax to the government account. This is called Tax deducted at source (TDS) Tax Collected at Source ( TCS). Also, In addition, wherever applicable, interest, fines, fees, and any other payments will also be required to be paid.

Question 2. Who is liable to make GST Payment?

Answer 2. In general, the supplier of goods or services is liable to pay GST. However, in specified cases like imports and other notified supplies, the liability may be cast on the recipient under the reverse charge mechanism.

Further, in some notified cases of intra-state supply of services, the liability to pay GST may be cast on e-commerce operators through which such services are supplied.

Also, Government Departments making payments to vendors above a specified limit [2.5 lakh under one contract as per S.51(1)(d)] is required to deduct tax (TDS) and E-commerce operators are required to collect tax (TCS) on the net value [i.e. aggregate value of taxable supplies of goods and/or services but excluding such value of services on which the operator is made liable to pay GST under Section 9(5) of the CGST Act, 2017] of supplies made through them and deposit it with the Government.

Question 3. When does the liability to pay GST arises?

Answer 3. Liability to pay arises at the time of supply of Goods as explained in Section 12 and at the time of supply of services as explained in Section 13.

The time is generally the earliest of one of the three events, namely receiving payment, issuance of invoice or completion of supply. Different situations envisaged and different tax points have been explained in the aforesaid sections.

Question 4. What are the main features of the GST payment process?

Answer 4. The payment processes under the GST Act(s) have the following features:

- Electronically generated challan from GSTN Common Portal in all modes of payment and no use of manually prepared challan;

- Facilitation for the tax payer by providing hassle-free, anytime, anywhere mode of payment of tax;

- The Convenience of making payment online;

- Logical tax collection data in electronic format;

- Faster remittance of tax revenue to the Government Account;

- Paperless transactions;

- Speedy Accounting and reporting;

- Electronic reconciliation of all receipts;

- Simplified procedure for banks

- Warehousing of Digital Challan.

Question 5. How can payment be done?

Answer 5. Payment can be done by the following methods:

(i) Through debit of Credit Ledger of the taxpayer maintained on the Common Portal – ONLY Tax can be paid. Interest, Penalty, and Fees cannot be paid by debit in the credit ledger. Taxpayers shall be allowed to take credit of taxes paid on inputs (input tax credit) and utilize the same for payment of output tax.

However, no input tax credit on account of CGST shall be utilized towards payment of SGST and vice versa. The credit of IGST would be permitted to be utilized for payment of IGST, CGST, and SGST in that order. Read here to know the latest GST set-off rules in GSTR 3B.

(ii) In cash by debit in the Cash Ledger of the taxpayer maintained on the Common Portal. Money can be deposited in the Cash Ledger by different modes, namely, E-Payment (Internet Banking, Credit Card, Debit Card); Real Time Gross Settlement (RTGS)/ National Electronic Fund Transfer (NEFT); Over the Counter Payment in branches of Banks Authorized to accept the deposit of GST.

Question 6. When is a payment of taxes to be made by the Supplier?

Answer 6. Payment of taxes by the normal taxpayer is to be done on a monthly basis by the 20th of the succeeding month. Cash payments will be first deposited in the Cash Ledger and the taxpayer shall debit the ledger while making payment in the monthly returns and shall reflect the relevant debit entry number in his return.

As mentioned earlier, payment can also be debited from the Credit Ledger. Payment of taxes for the month of March shall be paid by the 20th of April. Composition taxpayers will need to pay tax on a quarterly basis.

Question 7. Whether time limit for payment of tax can be extended or paid in monthly installments?

Answer 7. No, this is not permitted in the case of self-assessed liability. In other cases, the competent authority has been empowered to extend the time period or allow payment in installments. (Section 80 of the CGST/SGST Act).

Question 8. What happens if the taxable person files the return but does not make payment of tax?

Answer 8. In such cases, the return is not considered a valid return. Section 2(117) defines a valid return to mean a return furnished under sub-section (1) of section 39 on which self-assessed tax has been paid in full.

It is only the valid return that would be used for allowing input tax credit (ITC) to the recipient. In other words, unless the supplier has paid the entire self-assessed tax and filed his return and the recipient has filed his return, the ITC of the recipient would not be confirmed.

Question 9. Which date is considered as the date of deposit of the tax dues – Date of presentation of cheque or Date of payment or Date of credit of amount in the account of government?

Answer 9. It is the date of credit to the Government account.

Question 10. What are E-Ledgers?

Answer 10. Electronic Ledgers or E-Ledgers are statements of cash and input tax credit in respect of each registered taxpayer. In addition, each taxpayer shall also have an electronic tax liability register. Once a taxpayer is registered on Common Portal (GSTN), two e-ledgers (Cash &Input Tax Credit ledger) and an electronic tax liability register will be automatically opened and displayed on his dashboard at all times.

Question 11. What is a tax liability register?

Answer 11. Tax Liability Register will reflect the total tax liability of a taxpayer (after netting) for the particular month.

Question 12. What is Cash Ledger?

Answer 12. The cash ledger will reflect all deposits made in cash, and TDS/TCS made on account of the taxpayer. The information will be reflected on a real-time basis. This ledger can be used for making any payment on account of GST.

Question 13. What is an ITC Ledger?

Answer 13. Input Tax Credit as self-assessed in monthly returns will be reflected in the ITC Ledger. The credit in this ledger can be used to make payment of TAX ONLY and not other amounts such as interest, penalty, fees, etc.

Question 14. What is the linkage between GSTN and the authorized Banks?

Answer 14. There will be a real-time two-way linkage between the GSTN and the Core Banking Solution (CBS) of the Bank. CPIN is automatically routed to the Bank via electronic string for verification and receiving payment and a challan identification number (CIN) is automatically sent by the Bank to the Common Portal confirming payment receipt. No manual intervention will be involved in the process by anyone including the bank cashier or teller or the taxpayer.

Question 15. Can a taxpayer generate challan in multiple sittings?

Answer 14. Yes, a taxpayer can partially fill in the challan form and temporarily “save” the challan for completion at a later stage. A saved challan can be “edited” before finalization. After the tax payer has finalized the challan, he will generate the challan, for use of payment of taxes. The remitter will have the option of printing the challan for his record.

Question 16. Can a challan generated online be modified?

Answer 16. No. After logging into the GSTN portal for the generation of challan, payment particulars have to be fed in by the taxpayer or his authorized person. He can save the challan midway for future updation. However once the challan is finalized and CPIN generated, no further changes can be made to it by the taxpayer.

Question 17. Is there a validity period of challan?

Answer 17. Yes, a challan will be valid for fifteen days after its generation and thereafter it will be purged from the System. However, the taxpayer can generate another challan at his convenience.

Question 18. What is a CPIN?

Answer 18. CPIN stands for Common Portal Identification Number (CPIN) given at the time of generation of challan. It is a 14-digit unique number to identify the challan. As stated above, the CPIN remains valid for a period of 15 days.

Question 19. What is a CIN and what is its relevance?

Answer 19. CIN stands for Challan Identification Number. It is a 17-digit number that is 14-digit CPIN plus 3-digit Bank Code. CIN is generated by the authorized banks/ Reserve Bank of India (RBI) when payment is actually received by such authorized banks or RBI and credited in the relevant government account held with them. It is an indication that the payment has been realized and credited to the appropriate government account. CIN is communicated by the authorized bank to the taxpayer as well as to GSTN.

Question 20. What is the sequence of payment of tax where that taxpayer has liabilities for previous months also?

Answer 20. Section 49(8) prescribes an order of payment where the taxpayer has tax liability beyond the current return period. In such a situation, the order of payment to be followed is, First self-assessed tax and other dues for the previous period; thereafter self-assessed tax and other

dues for the current period; and thereafter any other amounts payable including any confirmed demands under section 73 or 74. This sequence has to be mandatorily followed.

Question 21. What does the expression “Other dues” referred to above mean?

Answer 21. The expression “other dues” means interest, penalty, fee, or any other amount payable under the Act or the rules made thereunder.

Question 22. What is an E-FPB?

Answer 22. E-FPB stands for Electronic Focal Point Branch. These are branches of Authorized banks that are authorized to collect payment of GST. Each authorized bank will nominate only one branch as its E-FPB for pan India Transactions. The E-FPB will have to open accounts under each major head for all governments.

A total of 38 accounts (one each for CGST, IGST, and one each for SGST for each State/UT Govt.) will have to be opened. Any amount received by such E-FPB towards GST will be credited to the appropriate account held by such E-FPB. For NEFT/RTGS Transactions, RBI will act as E-FPB.

Question 23. What is TDS?

Answer 23. TDS stands for Tax Deducted at Source (TDS). As per section 51, this provision is meant for Government and Government undertakings and other notified entities making contractual payments where the total value of such supply under a contract exceeds Rs. 2.5 Lakhs to suppliers. While making any payments under such contracts, the concerned Government/authority shall deduct 1% of the total payment made and remit it into the appropriate GST account.

Question 24. How will the Supplier account for this TDS? while filing his return?

Answer 24. Any amount shown as TDS will be reflected in the electronic cash ledger of the concerned supplier. He can utilize this amount towards discharging his liability towards tax, interest fees, and any other amount.

Question 25. How will the TDS Deductor account for such TDS?

Answer 25. TDS Deductor will account for such TDS in the following ways:

- Such deductors need to get compulsorily registered under section 24 of the CGST/SGST Act.

- They need to remit such TDS collected by the 10th day of the month succeeding the month in which TDS was collected and reported in GSTR 7.

- The amount deposited as TDS will be reflected in the electronic cash ledger of the supplier.

- They need to issue a certificate of such TDS to the deductee within 5 days of deducting TDS failing which fees of Rs. 100 per day subject to a maximum of Rs. 5000/- will be payable by such deductor.

Question 26. What is Tax Collected at Source (TCS)?

Answer 26. This provision is applicable only for E-Commerce operators under section 52 of the CGST/SGST Act. Every E-Commerce Operator, not being an agent, needs to withhold an amount calculated at the rate not exceeding one percent of the “net value of taxable supplies” made through it where the consideration with respect to such supplies is to be collected by the operator.

Such withheld amount is to be deposited by such an E-Commerce Operator to the appropriate GST account by the 10th of the next month. The amount deposited as TCS will be reflected in the electronic cash ledger of the supplier.

Question 27. What does the expression “Net value of taxable supplies” mean?

Answer 27. The expression “net value of taxable supplies” means the aggregate value of taxable supplies of goods or services, other than services notified under Section 9(5), made during any month by all registered taxable persons through the operator reduced by the aggregate value of taxable supplies returned to the suppliers during the said month.

Question 28. Is the pre-registration of credit card necessary in the GSTN portal for the GST payment?

Answer 28. Yes. The taxpayer would be required to pre-register his credit card, from which the tax payment is intended, with the Common Portal maintained on GSTN. GSTN may also attempt to put in a system with banks in getting the credit card verified by taking a confirmation from the credit card service provider. The payments using credit cards can, therefore, be allowed without any monetary limit to facilitate ease of doing business.

Quick Answers on GST payment

20th of the next month. For eg., January 2020 payment must be made on or before the 20th of February 2020.

1. Generate the Challan on the GST portal.

2. Select the mode of payment

3. Click on the “Make payment” button Read more..

1. Visit the GST portal

2. Click the Services > Payments > Create Challan

3. Enter the GSTIN

4. Generate the challan

5. Select the bank > Click on Make Payment. Read more…

Except for composition dealers, the GST payment shall be made on a monthly basis.

State Bank of India, HDFC Bank, Union Bank of India, Central Bank of India, Bank of India, and many more…

You can generate GST challan by yourself on the www.gst.gov.in website. Also, you can approach a Chartered Account or GST consultant.

Go to GST portal > Services > Payments > Create Challan > Enter GSTIN (if not logged in) > Fill in taxes > Select mode of payment and Proceed.

www.gst.gov.in.in

Select your bank as SBI while choosing the banks from the list.

yes

The GST payment can not be made offline. Hence, online payment is compulsory.

Select your bank type as Kotak, if available in the list while choosing the bank.

The tax liability of the previous month shall be paid in the next month on the 20th day i.e while filing GSTR 3B.