Investors looking to stay ahead of the game will want to keep a close eye on Rama Steel’s share price trends and predictions. This comprehensive analysis provides the latest insights into the company’s financial performance, market trends, and potential risks and opportunities, helping investors make informed decisions about their investments.

Overview of Rama Steel’s Share Price Performance.

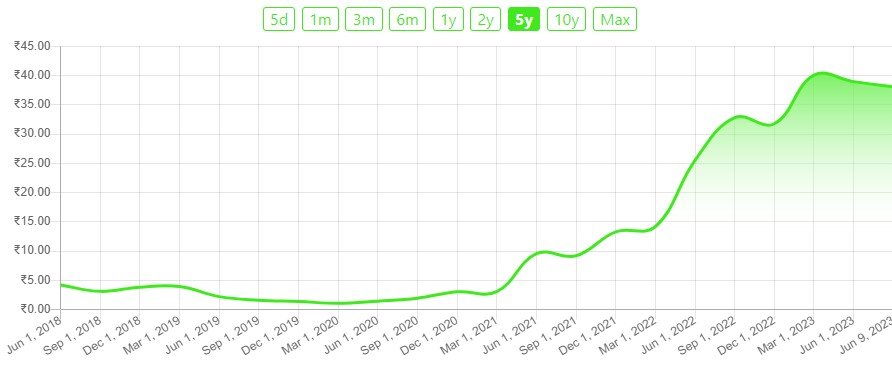

Rama Steel’s share price has been on a rollercoaster ride over the past year, with significant fluctuations in response to market trends and company performance. Despite some challenges, the company has managed to maintain a relatively stable share price, with some analysts predicting a potential uptick in the near future. However, investors should remain cautious and closely monitor the company’s financial performance and market trends before making any investment decisions. The below chart shows 5 years growth chart of Rama Steel Tubes Limited.

Factors Affecting Rama Steel’s Share Price.

Rama Steel’s share price is influenced by a variety of factors, including the overall performance of the steel industry, the company’s financial performance, and global economic trends. Other factors that can impact the share price include changes in government policies, fluctuations in currency exchange rates, and geopolitical events. Investors should carefully consider all of these factors before making any investment decisions.

Technical Analysis of Rama Steel’s Share Price.

Technical analysis is a method used by investors to evaluate securities based on statistical trends and market activity. When it comes to Rama Steel’s share price, technical analysis can provide valuable insights into the stock’s performance. By analyzing charts and indicators such as moving averages, relative strength index (RSI), and Bollinger Bands, investors can identify trends and potential buying or selling opportunities. However, it’s important to remember that technical analysis is just one tool in the investor’s toolbox and should be used in conjunction with fundamental analysis and other research methods.

Fundamental Analysis of Rama Steel’s Financials.

In addition to technical analysis, it’s important to also consider fundamental analysis when evaluating Rama Steel’s share price. This involves examining the company’s financial statements, management team, industry trends, and other factors that could impact its performance. By analyzing key financial ratios such as earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE), investors can gain a better understanding of the company’s financial health and growth potential. It’s important to conduct thorough research and analysis before making any investment decisions.

Predictions and Recommendations for Rama Steel’s Share Price.

Based on our analysis of Rama Steel’s share price trends and fundamental factors, we predict that the company’s stock will continue to perform well in the coming months. With a strong management team, solid financials, and a growing industry, Rama Steel is well-positioned for growth. We recommend that investors consider adding Rama Steel to their portfolio, but as always, it’s important to conduct your own research and analysis before making any investment decisions.