20.09.2021: The 45th GST council meeting was held on 16th September 2021 in Lukhnow. The meeting was held under the chairmanship of the Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman. The decisions that came out from the 45th GST council meetings look to be taxpayer-friendly. The major Goods news for taxpayers that we believe is “Interest will be applicable on ineligible ITC utilized” and not on ITC availed. Therefore, if a taxpayer has only availed of the ITC and never utilized it for discharging the payment, then there is no need to pay interest on that portion. The taxpayer can simply reverse the ineligible ITC without interest.

Secondly, the rate of interest is also reduced from 24% to 18% w.e.f 01.07.2017. Therefore, if anyone is reversing the ITC that has been utilized already, he/she needs to pay 18% interest instead of 24% in past.

On the other hand, there is bad news for consumers who order food online. The 45th Council meeting took a decision to charge tax on E-Commerce Operators who are transporting passengers through motor vehicles. Also, now online food delivery companies like Zomato and Swiggy are under the GST bracket. Therefore, online food ordering will become costlier.

Further, the council recommends revising the GST rates of various items. The rate revision applies to covid related drugs, revision of inverted duty structure, exemption services, specified renewable energy, etc. Below are the topic-wise recommendations.

Concessional GST Rate Extension

GST Council provides a further extension of concessional GST Rate for Covid related items from 30th September to 31st December 2021 for the below items.

- Amphotericin B -nil

- Remdesivir – 5%

- Tocilizumab -nil

- Anti-coagulants like Heparin – 5%

- Itolizumab – 5%

- Posaconazole – 5%

- Infliximab- 5%

- Favipiravir- 5%

- Casirivimab & Imdevimab – 5%

- 2-Deoxy-D-Glucose – 5%

- Bamlanivimab & Etesevimab – 5%

GST Rate Revision on Existing items

| S. No. | Description | From | To |

| 1 | Retro fitment kits for vehicles used by the disabled | Appl. rate | 5% |

| 2 | Fortified Rice Kernels for schemes like ICDS etc. | 18% | 5% |

| 3 | Medicine Keytruda for treatment of cancer | 12% | 5% |

| 4 | Biodiesel supplied to OMCs for blending with Diesel | 12% | 5% |

| 5 | Ores and concentrates of metals such as iron, copper, aluminum, zinc, and few others | 5% | 18% |

| 6 | Specified Renewable Energy Devices and parts | 5% | 12% |

| 7 | Cartons, boxes, bags, packing containers of paper, etc. | 12%/18% | 18% |

| 8 | Waste and scrap of polyurethanes and other plastics | 5% | 18% |

| 9 | All kinds of pens | 12%/18% | 18% |

| 10 | Railway parts, locomotives & other goods in Chapter 86 | 12% | 18% |

| 11 | Miscellaneous goods of paper like cards, catalog, printed material (Chapter 49 of tariff) | 12% | 18% |

| 12 | IGST on import of medicines for personal use, namely – i. Zolgensma for Spinal Muscular Atrophy ii. Viltepso for Duchenne Muscular Dystrophy – iii. Other medicines used in the treatment of muscular atrophy are recommended by the Ministry of Health and Family Welfare and the Department of Pharmaceuticals. | 12% | Nil |

| 13 | IGST exemption on goods supplied at Indo-Bangladesh Border haats | Appl. rate | Nil |

| 14 | Unintended waste generated during the production of the fish meal except for Fish Oil | Nil (for the period 1.7.2017 to 30.9.2019) |

GST Rates revision on Exisiting Services

| No. | Description | From | To |

| 1 | Validity of GST exemption on the transport of goods by vessel and air from India to outside India is extended up to 30.9.2022. | – | Nil |

| 2 | Services by way of grant of National Permit to goods carriages on payment of a fee | 18% | Nil |

| 3 | Skill Training for which Government bears 75% or more of the expenditure [ presently exemption applies only if Govt funds 100%]. | 18% | Nil |

| 4 | Services related to AFC Women’s Asia Cup 2022. | 18% | Nil |

| 5 | Licensing services/ the right to broadcast and show original films, sound recordings, Radio and Television programs [ to bring parity between distribution and licensing services] | 12% | 18% |

| 6 | Printing and reproduction services of recorded media where content is supplied by the publisher (to bring it on parity with Colour printing of images from film or digital media) | 12% | 18% |

| 7 | Exemption on leasing of rolling stock by IRFC to Indian Railways withdrawn. | ||

| 8 | E-Commerce Operators are being made liable to pay tax on the following services provided through them: | ||

| i. transport of passengers, by any type of motor vehicles through it [w.e.f. 1st January 2022] | |||

| ii. restaurant services provided through it with some exceptions [w.e.f. 1st January 2022] | |||

| 9 | Relaxations in conditions for IGST exemption relating to the import of goods on the lease. |

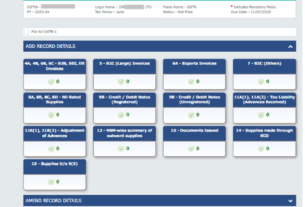

GST Return Related Decisions

- Taxpayers whose annual aggregate turnover in the preceding financial year is above Rs. 5 crores shall furnish ITC-04 once in six months. Whereas Taxpayers whose annual aggregate turnover in the preceding financial year is up to Rs. 5 crores shall furnish ITC-04 annually.

- 18% Interest on ineligible ITC instead of 24%. Also, it is chargeble only if it is utilized.

- Taxpayer will able to transfer the unutilized credit balance of CGST and IGS within same PAN entity. No need to ask for credit refund.

- W.e.f. 01.01.2021, the date of issuance of debit note shall determine the relevant financial year for the purpose of section 16(4) of CGST Act, 2017.

- No need to caryy hard copy of tax invoice in cases where invoice has been generated by the supplier in the manner prescribed under rule 48(4) of the CGST Rules, 2017;

- Only those goods which are actually subjected to export duty i.e., on which some export duty has to be paid at the time of export, will be covered under the restriction imposed under section 54(3) of CGST Act, 2017 from availment of refund of accumulated ITC.

Decisions of GST compliances

- Aadhaar authentication registration is must to be eligible for refund claim and application for revocation of cancellation of registration.

- Late fee for delayed filing of FORM GSTR-1 is going to autpopulate in FORM GSTR-3B.

- GST Refund willl be credited in the bank account, which is linked with same PAN on which registration has been obtained under GST.

- From 01.01.2022, taxpayers will not able to file GSTR 1, without filing GSTR 3B of previous month.

- There will be Restricstions to avail input tax credit on debit notes and invoices when it does not appear in FORM GSTR-1/ IFF.

Conclusion

We at GST India News belives that these decisions will definitely help small taxpayers who did not file their past return and paid GST. Also, it will benefit to whom those who have erroneously availed wrong Input tax credit but not utilized for some reason. Also, GST rate revisions on the above medical-related products will benefit the general public during the covid situation.

Further, the GST council again decides not to bring the petroleum products under GST at this point in time. It is a known fact that the individual states of India receive the major revenue from petrolium products. Thus, the direct revenues go into the state Goveremnmetns treasury instead of Central Govt. Treasury.

However, the consumer wants the petroleum products to come under GST. As far as the share of revenue to the state is concerned, the government panel needs to put a system in place so that, actual revenues go to the states only. This step will bring transparency and will have the proper price control. So, the council has put a situation like let us wait and see in future.

The above recommendations will come into effect as soon the CBDT issues the necessary notifications and circulars.

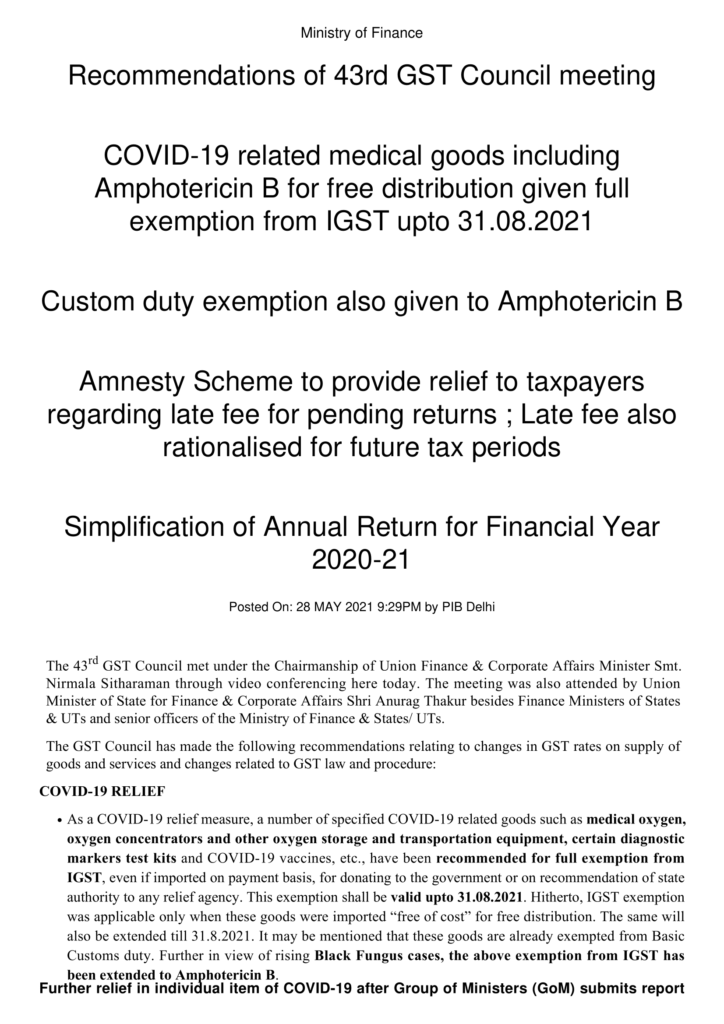

43rd GST Council Meeting Recommendations

28.05.2021: The 43rd GST council meeting was held today at 11 am in Delhi through Video conferencing. The final decisions of this meeting will be announced by Smt. Nirmala Sitharaman at 7.00 pm through a press conference. Check out the latest news and updates on the GST council meeting decisions. One can expect the outcome of the amnesty scheme extension, covid relaxations, and much more with the press release. Watch below the live outcomes of today’s Council meeting.

Press Release of Council Meeting

TOP 6 Expectations From 43rd GST Council Meeting

17.05.2021: The next GST Council meeting to be held on 28th May 2021 through video conferencing this month. This meeting is going to happen after a long time i.e after 7 months, as the last meeting was held on 05th October 2020. The decision to conduct a meeting was announced on the official Twitter handle of Smt. Nirmala Sitharaman on May 15, 2021. However, there is no agenda that has been announced yet for the meeting. Here is the official tweet in this regard.

You can get to read the final decisions of the 43rd GST council meeting on 28th May 2021. Also, you will able to download the press release in pdf format. Similarly, the live video of press conference will be available at 7pm on 28th May.

Stakeholders Expectations from 43rd Council Meeting

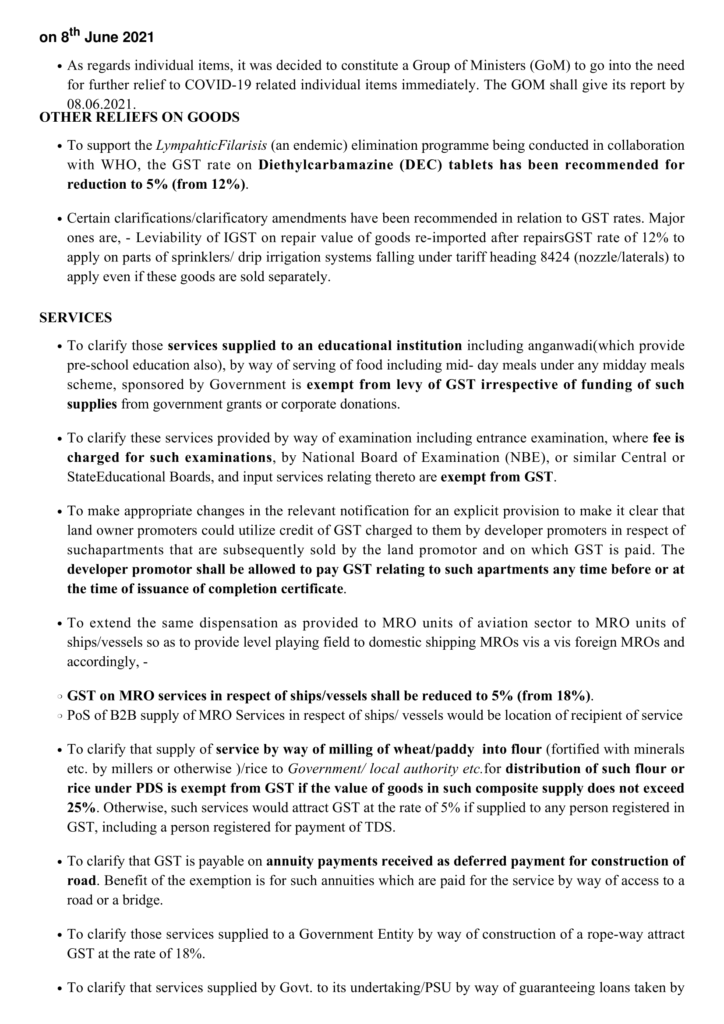

Recently the government has issued various notifications giving Covid Relaxations on GST compliances. Also, it has given Custom tax exemptions on the import of Covid related material. However, the stakeholders are expecting further relief due to Covid Pandemic situations in the country. Here is the comprehensive list of such expectations from Taxpayers, Chartered Accountants, and others associations coming under GST.

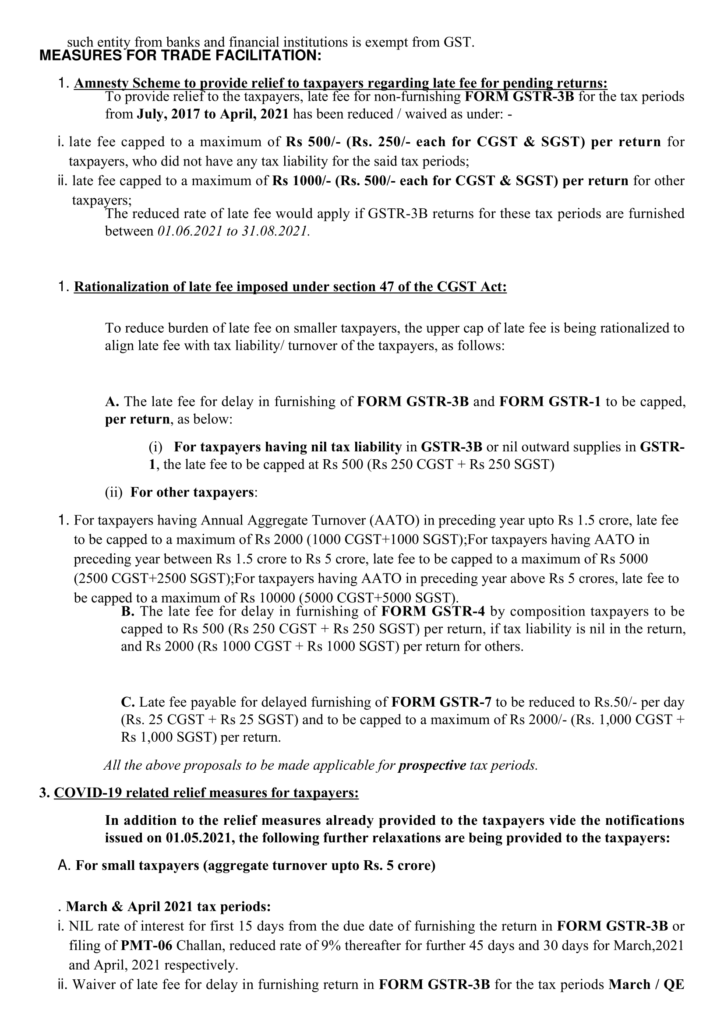

1. GST Amnesty Scheme

It is noticed that tweeter is running GST Amnesty Scheme hashtags like #GSTAmnesty, #GSTAmnestySchemewithITC, #GstLateFees500. This is to push the Government to introduce such a scheme so that the past late fees and interest can be waived. Earlier, the government has introduced the “Sabka Vishwas Scheme” to close the pending matters of Central Excise and Service Tax.

2. Extension of Due Dates of GST Returns

It is seen that many taxpayers could not file their GST returns on the due date because of the second wave of Covid running in the country. Theretofore, further relaxation on late fees and interest waivers is expected.

3. Seamless ITC by removing Section 16(4), 16(2)aa & 36(4)

The GST law comes with certain restrictions on availing input tax credit. Thus, the taxpayer can not utilize the input tax credit as and when required as per his convenience. Therefore, a certain part of stakeholders suggests the government remove few sections of the ACT, which puts such restrictions.

4. Inverted Duty Structure

According to the source of Zeebiz, there is a need for duty correction in sectors like fertilizer, steel utensils, solar modules, tractors, tyres, electrical transformers, and more. An inverted duty structure is a situation where the GST rate is higher on inputs and the output tax is low. Thus, the taxpayer pays more tax and can not utilize the full input tax credit to discharge the tax liability.

5. Revision of GST Rates

The council may reduce the GST rates especially on the items that are being used for Covid related services. Also, it is known from the sources that the council may reduce the tax rates on two-wheelers and bring natural gas into the current Tax system.

6. Compensation Shortfall to States

The GST council may recommend issuing further relief to various states by providing GST compensation to help in dealing with Covid’s situation.

These are the 6 points expectations from the 43rd GST council meeting. you can read the final decisions and outcomes of this meeting on 28th May 2021. The GST council may recommend extending the amnesty scheme 2021 for a further period. Don’t forget to see the live press conference to be held at 7 pm by the Finance minister.

Similar Related Articles

Date wise summary of GST Meetings

Check out the date-wise GST council meetings held since 2017. Also, see when the next GST council is scheduled to be held. Know how many GST council meetings held to date and more

Subscribe GST News

Subscribe to Newsletters and receive our regular latest updates on Goods and Service Tax in India. Do not miss out the timely GST compliance’s and avoid paying late fees, interest, penalties, etc. more

GST Rates on Household Items

Know how much GST is charged on Curd, Lassi, Butter Milk, wheat, rice, milk powder, spices, etc. Also, check out the revised rates on electronic items, covid related items, and more.

GST Extensions in Covid

Read the latest notifications issued giving various extensions in GST return filing, waiver of late fees, and interests. Also, know the amendments made in CGST rules. more