03.05.2021: In view of the Covid situation and increasing challenges faced by the taxpayers in fulfilling the statutory and regulatory compliance in GST, the Government has issued various notifications for the taxpayers. The relaxations include extensions of GST Return filing dates, waivers of late fees, and reductions in interest payment. Here are more details of such relaxations.

1.Reduction in rate of interest:

Lower rates of interest in lieu of the normal rate of interest of 18% per annum for the delay in tax payments have been prescribed in the following cases-

- For registered persons having aggregate turnover more than Rs. 5 Crore: A lower rate of interest of 9% for the first 15 days from the due date of payment of tax and 18 percent thereafter, for the tax payable for tax periods March 2021 and April 2021, payable in April 2021 and May 2021 respectively, has been notified.

- For registered persons having aggregate turnover up to Rs. 5 Crore: Nil rate of interest for the first 15 days from the due date of payment of tax, 9 per cent for the next 15 days, and 18 per cent thereafter, for both normal taxpayers and those under QRMP scheme, for the tax payable for the periods March 2021 and April 2021, payable in April 2021 and May 2021 respectively, has been notified.

- For registered persons who have opted to pay tax under the Composition scheme: NILrate of interest for the first 15 days from the due date of payment of tax and 9 percent for the next 15 days, and 18 percent thereafter has been notified for the tax payable for the quarter ending 31st March 2021, payable in April 2021.

2.Waiver of late fee

- For registered persons having aggregate turnover above Rs. 5 Crore: Late fee waived for 15 days in respect of returns in FORM GSTR-3B furnished beyond the due date for tax periods March 2021 and April 2021, due in April 2021 and May 2021 respectively;

- For registered persons having aggregate turnover up to Rs. 5 Crore: Late fee waived for 30 days in respect of the returns in FORM GSTR-3B furnished beyond the due date for tax periods March 2021 and April 2021 (for taxpayers filing monthly returns) due in April 2021 and May 2021 respectively / and for period Jan-March, 2021 (for taxpayers filing quarterly returns under QRMP scheme) due in April 2021.

Extension of due date of filing GSTR-1, IFF, GSTR-4 and ITC-04

- Due date of filing FORM GSTR-1 and IFF for the month of April (due in May) has been extended by 15 days.

- Due date of filing FORM GSTR-4 for FY 2020-21 has been extended from 30th April, 2021 to 31st May, 2021.

- The due date of furnishing FORM ITC-04 for the Jan-March, 2021 quarter has been extended from 25th April 2021 to 31st May 2021.

Certain amendments in CGST Rules:

- Relaxation in availing of ITC: Rule 36(4) i.e. 105% cap on availment of ITC in FORM GSTR-3B to be applicable on a cumulative basis for period April and May 2021, to be applied in the return for tax period May 2021. Otherwise, rule 36(4) is applicable for each tax period.

- The filing of GSTR-3B and GSTR-1/ IFF by companies using electronic verification code has already been enabled for the period from 27.04.2021 to 31.05.2021.

- Extension in statutory time limits under section 168A of the CGST Act: Time limit for completion of various actions, by any authority or by any person, under the GST Act, which falls during the period from 15th April 2021 to 30th May 2021, has been extended up to 31st May 2021, subject to some exceptions as specified in the notification.

Read Notifications for above Covid 19 Relaxations.

GST Relaxations During Lock-down: 16 Point Summary

30.06.2020: Read the 16 Points summary of GST Compliance during Lock-down period in India. In this regard, the CBIC has issued two circulars, to clarify the treatment of certain transactions. This has reference to Circular no. 136/06/2020-GST, dated 03.04.2020 & 137/07/2020-GST dt.13.04.2020. Here is the summary of these circulars. You may read the related notifications from the GST Notification and Circular page.

Quickly Jump To:

- Introduction

- Advance Received >> Goods Returned >> LUT Validity

- TDS payment >> GST Refund >> Composite Dealers

- GSTR 3B Extension >> Low rate of Interest >> Interest Calculation

- Nil Interest >> GSTR 1 Extension >> Input Tax Credit

- E Way bill >> ISD/NON-Resident >> E-commerce Operator

- Other Compliances >> Important Links

1. Advance Received From Contract Service

a) A cash advance is received by a supplier for a Service contract which later got canceled. On the other hand, the supplier has issued the Invoice before the supply of service and paid the GST. Thus, Whether the supplier shall claim a refund of tax paid or adjust his tax liability in his returns?

Answer 1: The supplier is required to issue a “credit note” in terms of section 34 of the CGST Act. Further, he shall declare such credit note details in the return for that particular month. Similarly, the tax liability shall be adjusted in the return subject to conditions of section 34 of the CGST Act. Thus, there is no need to file a separate refund claim.

However, a person can file a refund claim under “Excess payment of tax, when there is no output tax liability. Thus, the refund claim, if any can be applied” through FORM GST RFD-01.

b) In another scenario, an advance is received by a supplier for a Service contract that got canceled. Similarly, the supplier has issued a receipt voucher and paid the GST on such advance received. Therefore, Whether the supplier can claim a refund of tax paid on advance or adjust the tax liability in his returns?

Answer b: In this case, if the invoice has been issued as per section 31 (2), he needs to issue a “refund voucher”. Refer section 31 (3) (e) of the CGST Act read with rule 51 of the CGST Rules. On the other hand, he can also apply for a refund by filing GST RFD 01 online.

2. Goods Returned by the Recipient

Goods returned by the recipient to the supplier, which were supplied by raising the tax invoice. Thus, whether the supplier can claim a refund of tax paid or shall adjust his tax liability in his returns?

Answer 2: In this case, the supplier needs to issue a “credit note” as per section 34 of the CGST Act. Similarly, he shall declare the details of such credit notes while filing the particular month’s return.

Further, the tax liability shall be adjusted in the return as per the conditions of section 34. Thus, there is no need to file a separate refund claim in such a case.

However, if there is no output liability against which a credit note can be adjusted, registered persons may file a refund claim under “Excess payment of tax, if any” through GST RFD-01.

3. Letter of undertaking Expired on 31.03.2020

The Letter of Undertaking (LUT) furnished for the purposes of zero-rated supplies was expired on 31.03.2020. Therefore, whether a registered person can still make a zero-rated supply on such LUT and ask a refund later?. On the contrary, does he have to make supplies on payment of IGST and claim a refund thereon?

Answer 3: According to the Notification No. 37/2017-Central Tax, dated 04.10.2017, it requires LUT to be furnished for a financial year. However, as per notification No. 35/2020, Central Tax dated 03.04.2020, where the requirement under the GST Law for furnishing of any report, document, return, statement or such other record falls during between the period from 20.03.2020 to 29.06.2020, has been extended till 30.06.2020.

Therefore, as per the Notification No. 35/2020-Central Tax, the time limit for filing of LUT for the year 2020-21 stands extended till 30.06.2020. Thus, the taxpayer can continue to make the supply without payment of tax under LUT. However, the FORM GST RFD-11 for 2020-21 must be furnished on or before 30.06.2020. Similarly, the taxpayers may quote the reference no of the LUT for the year 2019-20 in the relevant documents.

4. TDS deduction and payment

While making the payment to the recipient, an amount of 1% was deducted as per section 51 i. e. Tax Deducted at Source (TDS). Whether the date of deposit of such payment has also been extended vide notification N. 35/2020-Central Tax dated 03.04.2020?

Answer 4: As per notification No. 35/2020-Central Tax dated 03.04.2020, compliances falls during the period from 20.03.2020 to 29.06.2020, has been extended till 30.06.2020.

Therefore, the last date fo GSTR-7 with the deposit of tax deducted for the said period is extended till 30.06.2020. Thus, there is no interest under section 50 shall be leviable if tax is deposited by 30.06.2020.

5. Time Limit to make GST Refund Application

According to section 54 (1), a person is required to make the GST refund application before the expiry of two years. However, If in a particular case, the date for making an application for refund expires on 31.03.2020, can such a person make an application for a refund before 29.07.2020?

Answer 5: As per notification No. 56/2020-Central Tax dated 27.06.2020, where the timeline for any compliance falls during the period from 20.03.2020 to 30.08.2020, has been extended till 31.08.2020.

Accordingly, the last date for filing the GST refund application falling during the said period is extended till 31.08.2020 or 15 days whichever is later. Refer Notification No. 46/2020 – Central Tax dt.09.06.2020.

6. Relaxation to Composite Dealers due to Covid 19

What are the measures taken for taxpayers falling under section 10 or those availing the option to pay tax under the notification No. 02/2019–Central Tax (Rate), dated the 7th March 2019?

Answer 6: The said class of taxpayers are allowed as per the notification No.34/2020-Central Tax, dated 03.04.2020. This is to:

(i)File the details of payment of self-assessed tax in GST CMP-08 for the quarter ended January to March 2020 by 07.07.2020; and

(ii) File the return in FORM GSTR-4 for the financial year 2019-20 by 15.07.2020.

Further, in addition to the above, taxpayers opting for the composition scheme for the financial year 2020-21, are allowed, as per the notification No.30/2020-Central Tax, dated 03.04.2020. This is to:

(i) file, an intimation in FORM GST CMP-02by 30.06.2020; and

(ii) furnish the statement in FORM GST ITC-03 till 31.07.2020.

7. GSTR 3B Due Date Extension due to COVID 19

Whether the due date of filing FORM GSTR-3B for the months of February, March, and April 2020 has been extended?

Answer 7 : 1. The last dates for filing GSTR-3B for the months of February, March, and April 2020 have not been extended through any of the notifications referred to in para 2 above.

2. However, according to to the notification No.31/2020-Central Tax, dated 03.04.2020, NIL rate of interest for first 15 days after the due date (20th day of next month) is applicable for filing return in GSTR-3B. The returns filed thereafter a reduced rate of interest@ 9% will be applicable for those registered persons whose aggregate turnover in the preceding financial year is above Rs. 5 Crore.

Similarly, for those registered persons having turnover up to Rs. 5 Crore in the preceding financial year, the NIL rate of interest has also been notified.

3. Further, as per the notification No.32/2020-Central Tax, dated 03.04.2020, Government has waived the late fees for delay in filing the return in FORM GSTR-3B for the months of February, March, and April, 2020.

Similarly, the lower rate of interest and waiver of a late fee willl be available, only if due tax is paid by filing return in FORM GSTR-3B by the date(s) as specified in the Notification.

8. Reduced Rate of Interest on GST payment due to COVID 19

What are the conditions for availing the lower rate of interest for the months of February to April 2020?. This is for a registered person whose aggregate turnover in the preceding financial year is above Rs. 5 Crore.

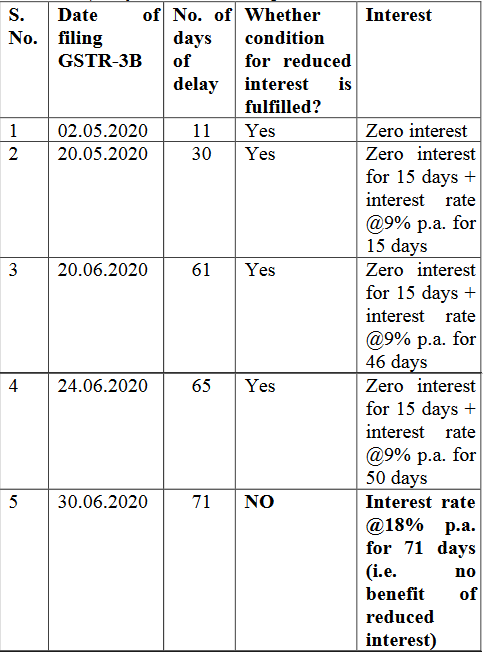

Answer 8: 1. As per the clarification at sl.no.(2) above, the due date for filing the return remains unchanged. Thus, the due date is the 20th day of such succeeding a month. However, the rate of interest has been notified as Nil for the first 15 days from the due date. Thereafter, 9 percent per rate of interest per annum will be applicable, for the said months.

2. The lower rate of interest is subject to the condition that the registered person must furnish the returns in GSTR-3B on or before the 24th day of June 2020.

3. In case the returns in GSTR 3B for the said months are not furnished on or before the 24th day of June 2020 then interest at 18% per annum shall be payable from the due date of return, till the date on which the return is filed. In addition, a regular late fee shall also be leviable for such delay along with liability for penalty.

9. Interest Calculation in the above scenario

How to calculate the interest for late payment of tax for the months of February, March, and April 2020?. Please clarify it for those taxpayers, whose aggregate turnover in the preceding financial year is above Rs. 5 Crore.

Answer 9: 1. As per the above clarification, the rate of interest is Nil for the first 15 days from the due date. Thereafter, 9 percent interest per annum will be applicable for the said months. The same is explained through the below illustration.

Illustration:- Calculation of interest for late filing of return for the month of March 2020. Here the due date of filing is taken as 20.04.2020.

10. Interest for Turnover up to Rs. 5 Crore

What conditions are applicable for availing the NIL rate of interest for the months of February to April 2020. [Where Aggregate turnover in the preceding financial year is up to Rs. 5 Crore?]

Answer 10: 1. As per the above clarification at sl.no. (2) above, the due date for filing the return remains unchanged. Similarly, the rate of interest is Nil for the said months.

2. The conditions for availing the NIL rate of interest is that the taxpayer must file the GSTR 3B on or before the date as mentioned in the notification No.31/2020-Central Tax, dated 03.04.2020.

3. In case the return for the said months is not filed on or before the date mentioned in the notification then interest at 18% per annum shall be charged from the due date of return, till the date on which the return is filed as explained in the illustration at sl.no (4) above, against entry 5. Further, in addition, a regular late fee shall also be leviable for such delay along with liability for penalty.

11. GSTR 1 Due date Extension Due to COVID 19

Whether the due date of GSTR-1 has been extended for the months of February, March and April 2020?

Answer 11: According to the provisions of section 128 of the CGST Act, in terms of notification No. 33/2020- Central Tax, dated 03.04.2020, late fee leviable under section 47 has been waived for the delay in filing GSTR-1 under Section 37, for the tax periods March 2020, April 2020, May 2020 and quarter ending 31st March 2020. However, this is only applicable if filed on or before the 30th day of June 2020. Read Late Fees Waiver updates as on 30.06.2020.

12. Input Tax credit Restriction not > 10% applicability during Lock Down

Whether restriction under rule 36(4) of the CGST Rules will apply during the lockdown period?

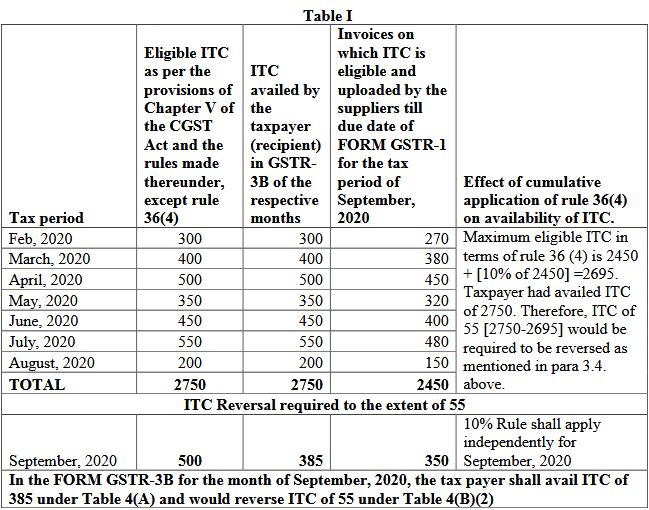

Answer 12: The restrictions will not be applicable as per notification No. 30/2020- Central Tax, dated 03.04.2020. Thus, it is not applicable only for the months of February, March, April, May, June, July and August 2020.

However, the said condition shall be applicable cumulatively for the said period, in GSTR-3B of September 2020. Thus, the GSTR 3B of September 2020 shall be filed with a cumulative adjustment of the ITC for these months.

Further, in this regard, the circular has also been issued on 09th October 2020 having ref. no. 142/12/2020-GST. Thus, according to this circular, taxpayers are advised to verify the details of invoices uploaded by their suppliers for the periods of February to August 2020. Also, the taxpayers shall verify such details in GSTR-2A till the due date of filing GSTR-1 for the month of September 2020.

The taxpayer shall reconcile the ITC availed and available in GSTR 2A for the above given period. Thus, the cumulative amount of ITC availed for the said months in FORM GSTR-3B should not exceed 110% of the cumulative value at the time of filing GSTR-1 for the month of September, 2020.

In other words, the cumulative ITC availed from February to August shall not exceed 110% than that of available in GSTR 2A for these months.

However, if the taxpayer has availed access ITC, then he/she shall reverse it with 24% interest per day. Here is the example table explaining this concept.

13. E way bill Expiry during lock down period

What will be the status of e-way bills which are already expired during the lockdown period?

Answer 13: The e-way bill generated on or before 24th March 2020 and whose validity has expired on or after 20th March, 2020 has been further extended till 30th June 2020. This has reference to the CGST notification No.35/2020-Central Tax, dated 03.04.2020; Notification No.40/2020 –Central Tax dt.05.05.2020 and Notification No. 47/2020 – Central Tax dt.09.06.2020.

14. Extension of Returns for ISD and Non-Resident Taxable persons

Which are the measures taken for taxpayers who are required to deduct tax at source under section 51, Input Service Distributors and Non-resident Taxable persons?

Answer 14: The said class of taxpayers are allowed to file the respective returns specified in sub-sections (3), (4) and (5) of section 39. This is for the months of March 2020 to May 2020 on or before the 30th day of June 2020. Refer notification No.35/2020-Central Tax, dated 03.04.2020,

15. GSTR 8 Filing Extension for E-commerce operators

Which are the measures taken for taxpayers who are required to collect tax at source under CGST Section 52?

Answer 15: These class of taxpayers are allowed to file the statement specified in section 52, for the months of March 2020 to May 2020 on or before the 30.06.2020. Kindly refer the CGST notification No.35/2020-Central Tax, dated 03.04.2020.

16. Extension of other Compliances during lock down period

What is the time limit for compliances that are falling during the lock-down period announced by the Government? What should the taxpayer do?

Answer 16: The compliances fall during the period from 20.03.2020 to 30.08.2020 are extended till 31.08.2020. However, there are few exceptions where this extension is not applicable. Kindly refer the Notification No.55/2020-Central Tax, dated 27.06.2020 for more details.

This is the list of 16 Points of GST Compliances to be followed from the month of February till May 2020. Similarly, you may check out our home page to see the latest GST News & updates in India. Also, see the GST return dates chart to know the extension of return filing, if any.

Frequently Asked Questions

yes. The e way bills expiring from 20.03 to 15.04 is extended till 31st May 2020.

Yes, the due date of these returns for FY 2018-19 is extended till 30th September 2020.

The due date is extended by another 15 days from its actual due date. Read more.

Yes. you can file it through EVC from 21st day of April, 2020 to the 30th day of June, 2020.