If you are looking for GST CMP 08 format for composition dealer then you are in the right place. This article contains all about this form. Similarly, you can download the pdf format of this form for your reference.

The GST CMP 08 is a quarterly summary of self-assessed tax, which is payable by composition dealer under GST.

The CMP 08 form is applicable to the taxpayer, who is registered as a composition dealer through form GSTR REG 1 or CMP 02.

The GST CMP 08 is to be filed on

1. A taxpayer must be registered as Composition Dealer with valid GSTIN

2. The taxpayer must have a valid User ID and password to log

3. He/she must have valid & non-expired/non-revoked digital signature (DSC)

4. Also, Taxpayer must have filed all the applicable GST CMP 08 returns for the previous quarter(s).

You can file nil GST CMP

Yes, Filing of Form GST CMP 08 is mandatory, even if there are no self-assessed liabilities.

Good News, there is no late fees for delay in filing of form GST CMP-08.

You can not amend CMP 08 once it is filed.

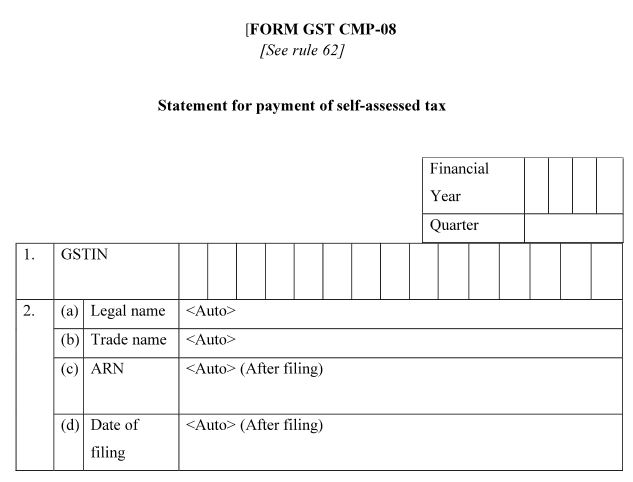

Download GST CMP 08 Format

There is no excel utility/format of GST CMP 08. Therefore, the taxpayer has to file it through online mode only. However, you may download the pdf format by clicking on below download button.

How to file GST CMP-08 Online with tax liability?

- Go to www.gst.gov.in website

- Log in with your user name and password

- Click the Services > Returns > Returns Dashboard

- Click the PREPARE ONLINE button for the required period

- Enter details in Table 3 and click on ‘SAVE’

- Click on PROCEED TO FILE to make payment and file the return.

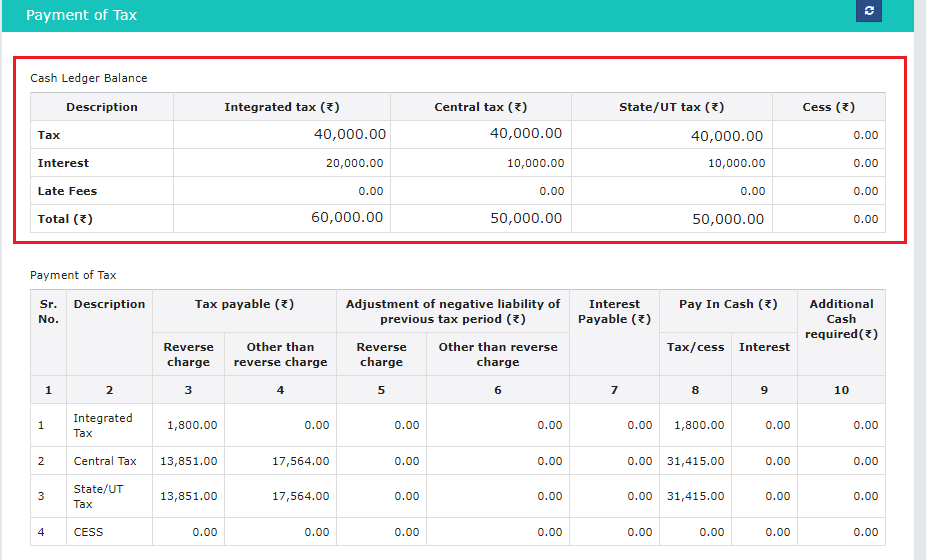

- Utilize the cash balance to set off the liabilities and click on File GST CMP 08.

How to File NIL CMP 08?

- In case of Nil GST CMP 08 filing, select the checkbox for File Nil GST CMP 08.

- The System will directly take you to File GST 08 with EVC or DSC.

Online Filing Instructions

The liabilities of CMP 08 form, be paid only through cash and not through ITC. This is because a composition dealer can not avail Input tax credit under GST law.

Further, GST CMP-08 is to be filed by composition dealer for all applicable quarters effective from 2019-20 i.e. Apr 2019-Jun 2019.