www.gst.gov.in is an official GST login portal of India under Goods and Service Tax. The GST portal is a single website to perform all activities related to GST in India. Thus, it includes GST registration, Filing GST Returns, GST payment, and applying for a refund.

Besides this, the taxpayer can see various other options on the Dashboard after login into www.gst.gov.in. Let us see below the features available on the GST portal website. The website can be used by millions of users at a time.

Table of Contents:

- GST Website Picture(www.gst.gov.in)

- Functions of Main Menu

- Facilities available after login

- Recent portal updates

About Online GST portal(www.gst.gov.in)

www.gst.gov.in is the official login website address of Goods and Service Tax (GST) in India. In other words, it is the GST login portal to do GST-related activities. www.gst.gov.in website is used by crores of taxpayers in India to pay the tax, file returns,s and perform other GST-related activities.

You may also search by typing www.gst.gov.in in google and you will find it on the first page. The main function of the GST online portal is to serve as an online system to perform all online activities of Goods and Service Tax.

A taxpayer can log in to the GST portal on a desktop computer, laptop, tabs, and even on mobile. The GST Portal site is responsive, therefore it fits perfectly on all screen sizes. However, it can be best viewed at 1024 x 768 resolution in Internet Explorer 10+, Google Chrome 49+, Firefox 45+, and Safari 6+.

GST Portal system Requirements

The taxpayer accessing the GST Portal must have a desktop browser like Internet Explorer 10+/ Chrome 49+ or Firefox 45+. Besides the above on browser compatibility following should not be disabled:

- The Cascading Style Sheet (CSS) – is used to render User Interface look and feel of the portal. Thus, disabling this will not provide an appropriate user experience

- Further, JavaScript – is used to provide enhanced user experience in using User Interface controls. Therefore, disabling this will not allow a user to perform any transaction in the portal.

- Lastly the Cookie – is used to store personalized information of the user. Hence, disabling this will not allow the user to log in and perform any transaction in the portal.

However, above all browser compatibility features come with the

Front Picture of GST Portal

Functions of GST portal

The front menu of the GST portal can be used to perform various activities without login into the GST portal. The taxpayer needs to require GST login credentials to perform basic functions on the GST portal. These Basic functions are:

1) Home

One can click on the Home button to return to the main page i.e gst.gov.in from anywhere on the portal.

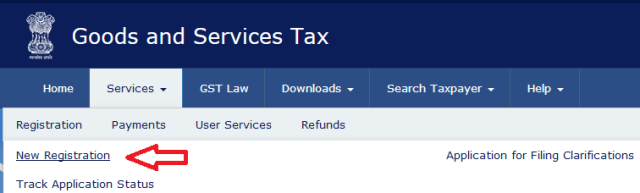

2) Services

The Services tab provides services related To:

- GST Registration,

- GST payments,

- User services

- GST Refund related Status.

Registration Menu has further three sub-menus:

a) New Registration: New Registration link allows a person to apply for GST Registration online. A person can fill in the details and submit them for get GST Registration Certificate. You may click here to know GST registration online procedure

b)Track Application Status: This link helps a person track his submitted application on the GST portal. It facilitates a person to know whether his application is successfully processed or held up for any issues.

c) Application for filing clarifications: A person can use this link to seek any clarification on filing matters.

The payment Menu has two sub Links:

a) Create challan: With the help of this link, one can generate an online GST payment challan without login into the GST portal.

b) Track payment status: you can track your payment status by clicking this link. It will show whether the payment from the bank to GST is transferred or not.

User services have five sub-links:

a)Holiday List: This will provide holiday lists for the center and state-wise too.

b)Grievance / Complaints: Taxpayers can submit the grievance for applications, payments, and electronic ledger issues. Also one can raise a complaint against the registered and unregistered person.

c)Locate GST Practitioner (GSTP): you can see nearby GST practitioners in your area.

d)Search Office Addresses: This link will help you to search the address of nearby GST jurisdiction for your business.

e)Generate User Id for Advance Ruling: This link is for applying for New Registration for Advance Ruling.

3) GST Law

The GST law link provides all about official notifications, circulars, orders, etc.

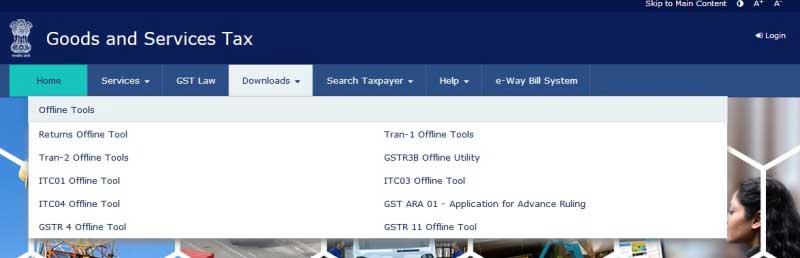

4) Downloads

The download section offers to download offline tools to file GST Returns, ITC forms, and many other statutory reporting.

Currently available offline tools are Returns offline Tools, Tran-1 Offline Tools, Tran-2 Offline Tools, and GSTR3B Offline Utility.

Further other offline tools like ITC01 Offline Tool, ITC03 Offline Tool, ITC04 Offline Tool, GST ARA 01 – Application for Advance Ruling, GSTR 4 Offline Tool, GSTR 6 Offline Tool With Amendments, and GSTR 11 Offline Tool are also available.

Similarly, Annual Returns preparation tools like GSTR 9, GSTR 9A, and GSTR 9C are also available now on www.gst.gov.in.

5) Search for Taxpayer

One can search any taxpayers by entering a few details like GST Number and all details will flash on the screen of that particular taxpayer

6) Help:

This section provides help related to registration, returns, refunds, and other various activities performed on GST Portal.

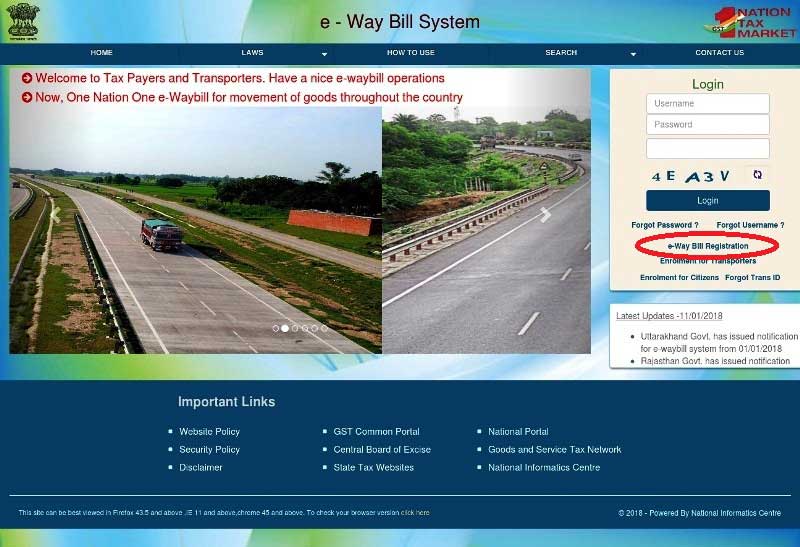

7) E-way bill System:

This link is provided to redirect to the E-way bill portal to generate e way bill for the movement of goods from one place to another. This has come into force from 01.4.2018 for the interstate movement of goods. Also, it will be used for the intra-state movement of goods in all states of India.

On the other hand, the taxpayer can perform more activities after login into the GST portal, which he gets only after acceptance of the GST Registration application.

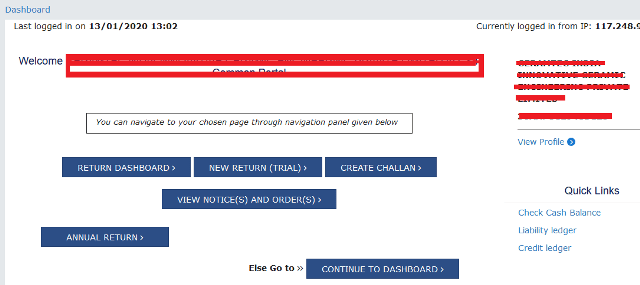

Facilities Available after login into the GST portal

Dashboard of the www.gst.gov.in

Quick links are available on the dashboard like view notices and orders. Also, you can view your profile, and check the liability register and ledger balances. Here is the screenshot of the dashboard.

Services available at www.gst.gov.in

Below additional services are available after login at www.gst.gov.in

- Registration Services:

- Amendment of Registration Core Fields

- Amendment of Registration Non–Core Fields

- Application to Opt for Composition Levy

- Application for Withdrawal from Composition Levy

- Stock intimation for opting for Composition Levy

- Application for Cancellation of Registration

2. Ledger Services:

- Cash Ledger

- Credit Ledger

- Liability Register

- Payment towards demand

3. Returns

- Returns Dashboard

- Track Return Status

- View e-Filed Returns

- ITC Forms

- Transition Forms

4. User Services

- My Saved Applications

- My Applications

- View/Download Certificates

- View Notices and Orders

- View My Submissions

- Feedback

- Grievance / Complaints

- Furnish Letter of Undertaking (LUT)

- View My Submitted LUTs

- Engage / Disengage GST Practitioner (GSTP)

- ITC02-Pending for action

- View Additional Notices/Orders

5. Refunds

- Application for Refund

- My Saved/Filed Applications

- Track Application Status

6. Downloads

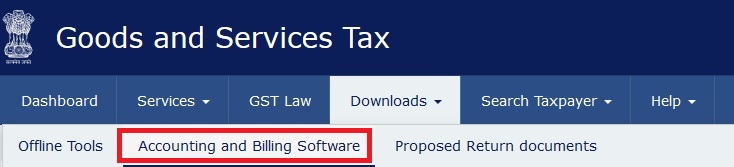

GST Billing and Account Software: To download Free GST billing software navigate to Downloads > Accounting and Billing Software option. you can view this download option only after login into the GST portal.

Recent New functionalities

1. Form GST REG – 14:

This Registration Amendment form facility is available now for UN bodies, embassies, and other notified persons. With the help of this facility, they can make changes in core fields on the GST portal.

2. Form GST APL – 01:

The Taxpayer can now file an appeal to the first appellate authority against any decision or order passed against him. Also, he needs to apply this online on the GST portal.

3. GSTR 2A Return

The GSTR 2A is now available to download in Excel format. Therefore taxpayers can now reconcile their input tax credit availed with that uploaded by the respective suppliers on the GST portal. Earlier it was available in JSON format only.

4. Final Return in Form 10

Return is available on the portal now. The taxpayer needs to file this return within three months from the date of cancellation of registration.

5. GSTR 4 Online submission

Online Submission and creation of form GSTR 4 are now available on the GST portal. In, the case of nil liability, taxpayers will not have to fill up any information and can file a nil return.

6.De linking of Various Returns

De-linking of Form GSTR 6 with Form GSTR 1 & 5 is now available. Invoices will get auto-populate in GSTR 6A return on a real-time basis. Also, the same changes are applicable to GSTR 5. On the other hand, one can also download the latest offline utility for these changes.

7. Selection of GST practitioner

The taxpayer can now select a “GST practitioner” to prepare an appeal in form APL-01. This is applicable if the taxpayer wants to file an appeal.

8. Appeal Against advance ruling

If the taxpayer is not happy with the decision given by the advance ruling authority(AAR), then now he can file an appeal against such authority.

9. Request for Rectification of mistakes by AAR

Yes, now you can send an online request to correct any mistakes in the rulings by an Advance authority.

10. Reply to Show cause notice(SCN)

Now you can reply to show cause notice If you receive it for compulsory withdrawal from the composition scheme.

11. Annual GST Returns

Annual Return GSTR 9, GSTR 9A, and GSTR 9C are now available on the GST portal. You may download GST offline tools in Excel from this page.

12. Changes in April 2020

The GSTN has made Changes in the Registration Form for TCS Taxpayers and alerts for the composition scheme. You may read more about the latest functionalities from our GST portal’s new functionalities article.

Video of GST Portal Dashboard

Below is the official video of GSTN explaining the GST portal’s Return dashboard. Thus, you can check the video for a better understanding to navigate the return dashboard.

These are the features available at www.gst.gov.in dashboard after login. We tried to cover all the available features from 2017 till the beginning of 2023. Don’t forget to subscribe to our newsletter to receive updates on new features available at www.gst.gov.in. Also, leave a comment, if you have any suggestions to improve this article.

Frequently Asked Questions on the GST portal

The GST portal is an online Goods and Service Tax website provided by the Government of India. The GST portal is used by millions of taxpayers in India to perform various GST-related activities online.

If you are newly registered under GST In India then you can follow the GST pre-login steps to check your GST registration status.

However, if you are already registered and want to know the current status of your GST number then check out our GST number search article.

Please check our article ” How to Login using Temporary Reference Number (TRN )” to know how to log into GST with TRN.

No. The ARN number is a temporary code created while enrolling for GST. Thus, the ARN number shall be used only to check the status of your GST registration application.

Yes, GST portal is accessible from anywhere in the world. please ensure that you access internet from static IP.

GST certificate PDF file download

hi please check here https://gstindianews.info/gst-registration-certificate

regards