What is GST Set off means?

In Goods and service Tax system taxpayer has to pay the tax to the government on a

The first one is to deposit the payment in the bank and you get credit in your cash ledger. This ledger balance can be debited to pay the required tax payment.

Secondly, the taxpayer can claim the input tax credit on the various purchases he makes during the period. This input tax credit(ITC) gets credited in his credit ledger. Therefore, the taxpayer can utilize this credit to pay the taxes against supplies made. Hence, utilization of cash and input tax credit towards payment of GST Tax is called set off.

What are GST set off rules?

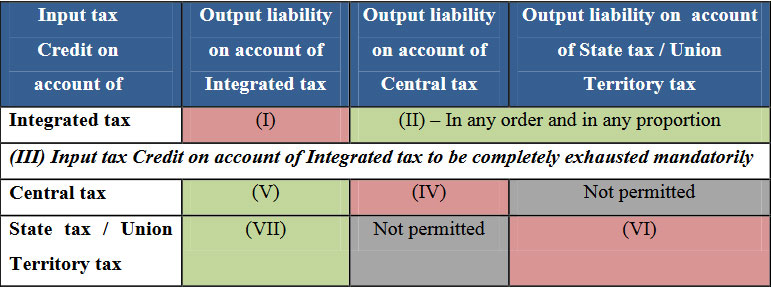

There are certain rules and conditions for utilizing this cash and credit balances under GST. This new gst set off rules will be applicable to set off GST in the nearby future. Therefore, the taxpayer must follow this gst set off order while utilizing available input tax credit. Here is the complete chart showing, how to set off the Input Tax credit for GST payment.

Let us understand gst set off rules with chart in more detail.

- (I) At the first, you shall utilize the complete (Integrated Goods and Service Tax) IGST input tax credit available to setoff IGST output liability on account of integrated tax on outward supplies.

For eg. suppose you have a liability of Rs.1 lakh and you have IGST ITC = Rs. 1.25 lakh. Here you need to set off all Rs. 1lakh liability from IGST balance only.

- (II) After utilizing (I) you must utilize the balance of IGST ITC to sett of the liability of CGST.

- (III) After utilizing (I) and (III) you must utilize the balance of IGST ITC to sett of the liability of SGST or UTGST(Union Territory Goods and Service Tax.

- (IV and (V) – After utilizing all your available IGST input tax credit, you can utilize CGST ITC to set off the liability of IGST and CGST only. You can not use CGST ITC to set off the SGST or UTGST liability.

- (VI) and VII) – The input tax credit of SGST or UTGST can be utilized for payment of IGST and SGST or UTGST Only. One can not use SGST/UTGST ITC for making payment of CGST.

Limitations to set off Input Tax Credit

The government has put restrictions to use the input tax credit available in the Credit ledger. These limitations restrict the taxpayer to utilize full input tax credit. This is applicable from 01st January 2021 vide notification No. 94/2020-Central Tax DT. 22.12.2020.

Therefore, according to this rule, the taxpayer shall not use more than 99% Input tax credit to set off the total tax liability. In other words, 1% tax liability must be set off from the cash ledger.

For eg. The total liability is Rs. 10 lakh for the month of January 2021. The taxpayer can utilize RS. 99,000/- from ITC ledger. Balance Rs. 1000/- must be utilized from the Cash ledger to pay the total tax liability.

GST set off example with chart

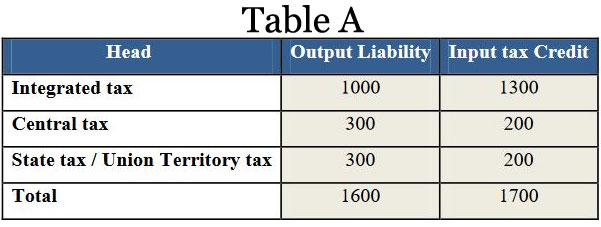

- Table A is the example of tax liability and input tax credit in hand for any given period.

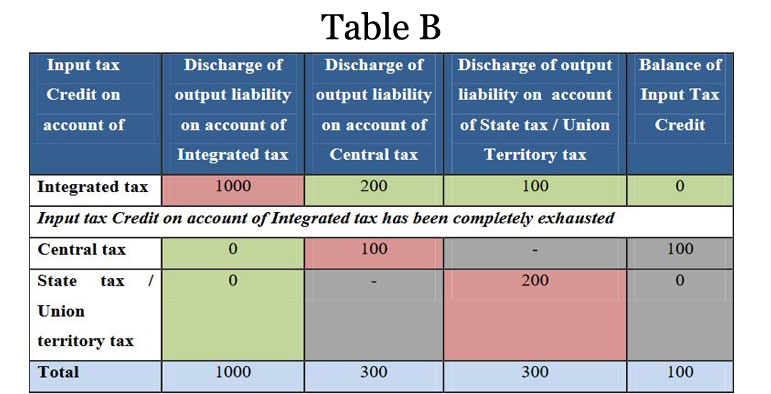

- Table B shows, how the set off can take place as your Option No. 1

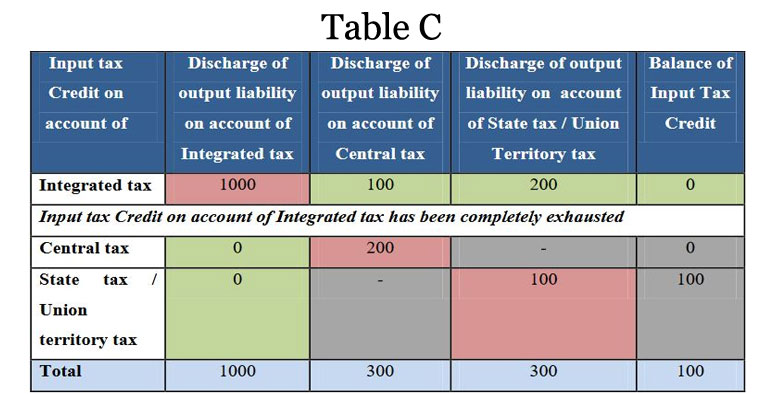

- Table C shows, how the set off can take place as your Option No. 2. You can choose either table B or table C to utilize the Input Tax credit.

As of now, GST common portal supports only, the order of utilization of input tax credit as in the past i.e as per section 49A and 49B of CGST Act. Therefore, the taxpayer may continue to utilize their input tax credit as per the old method

How to set off liability from Cash Ledger?

You shall deposit the cash in particular ledger while generating online challan only. For eg., if you need to pay the liability against IGST outward supplies, then you should make the payment under IGST head. Cash ledger will get credit as per the amount fed in the GST challan payment. Later, you can debit this particular head to set off the liability from the cash ledger.

Procedure to set off ITC in GST Return

The ITC set off to be done in GSTR 3B return. GSTR 3B is a monthly summary and every taxpayer has to file it by 20th of succeeding month.

Before filing GSTR 3B filing you have to calculate how much tax is payable and how much ITC you have. This enables you to know, how much set off can be done from the Input tax credit ledger. Because balance you need to pay through your Cash ledger. Thus, You can do gst set off calculation in excel prior to beginning filing of GSTR 3B.

GST portal is automatically suggesting possible set off options based on the GST rules. Thus, you need to have to worry much about gst set off order. However, one can change this set off order and edit the suggested figures.

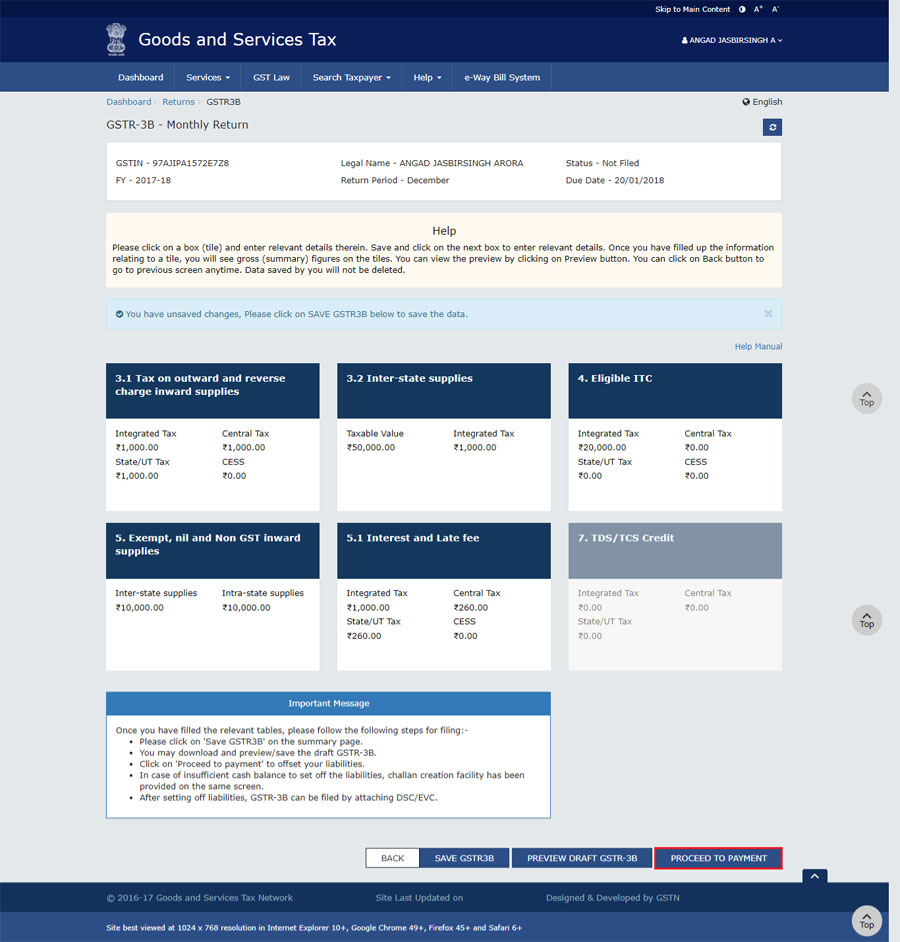

We are going to show you the actual set off of ITC on GST portal. In other words, you will see the actual format of setting off input tax credit on

So lets begin !

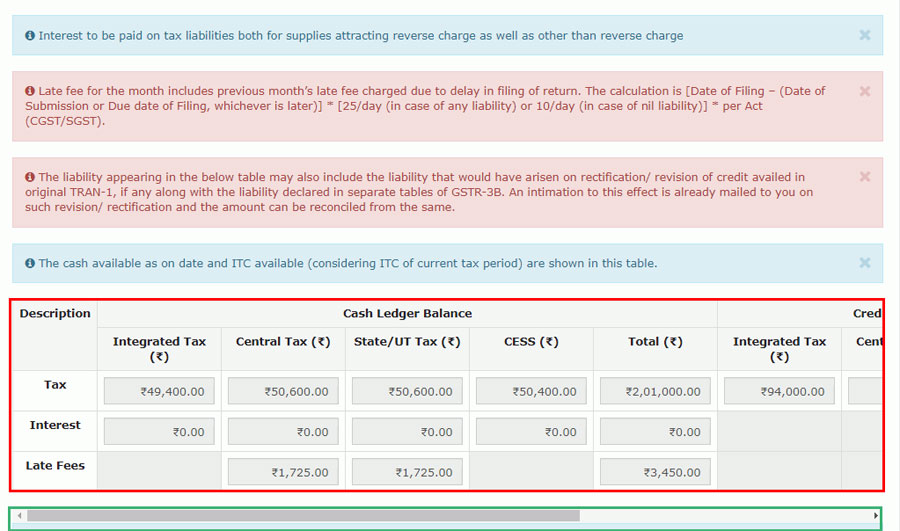

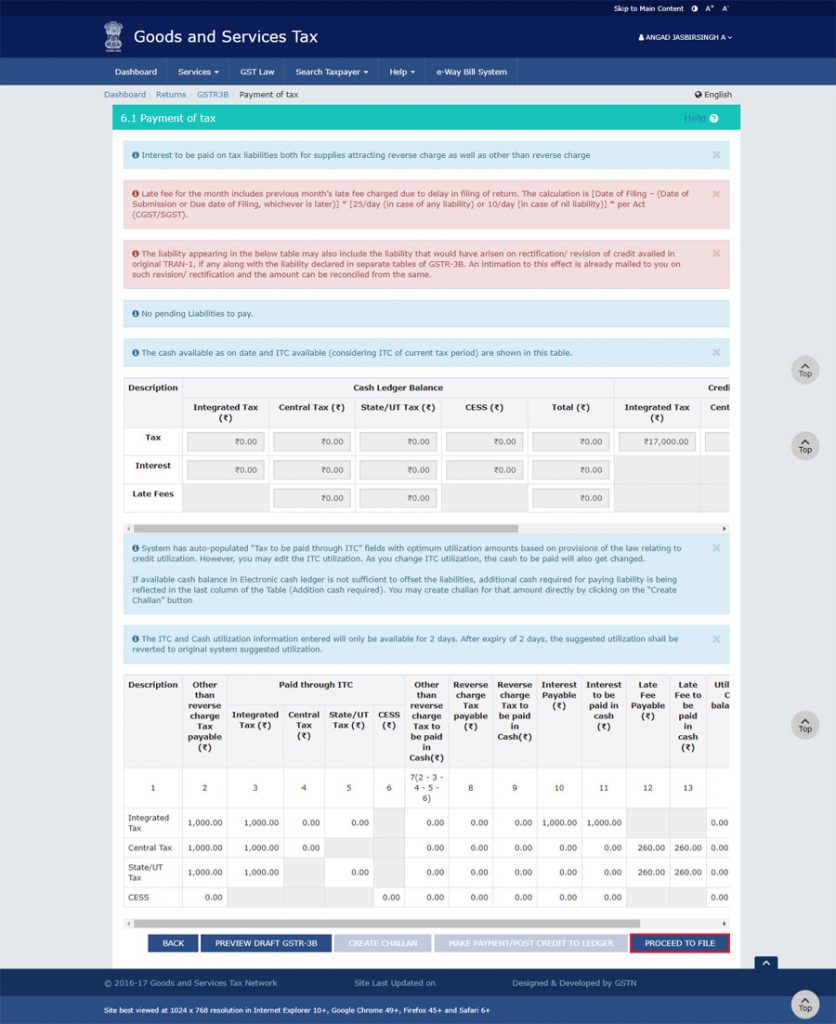

1.Once you click “Proceed to payment” button in GSTR 3B, you will see below cash ledger and credit ledger balances on your screen.

2. Above picture gives you the available balance in your cash ledger. This includes integrated tax, central tax, state or Territory tax, cess, etc.

3. Besides that, you can see see the interest and late fees available which you have deposited by creating GST challan on GST portal.

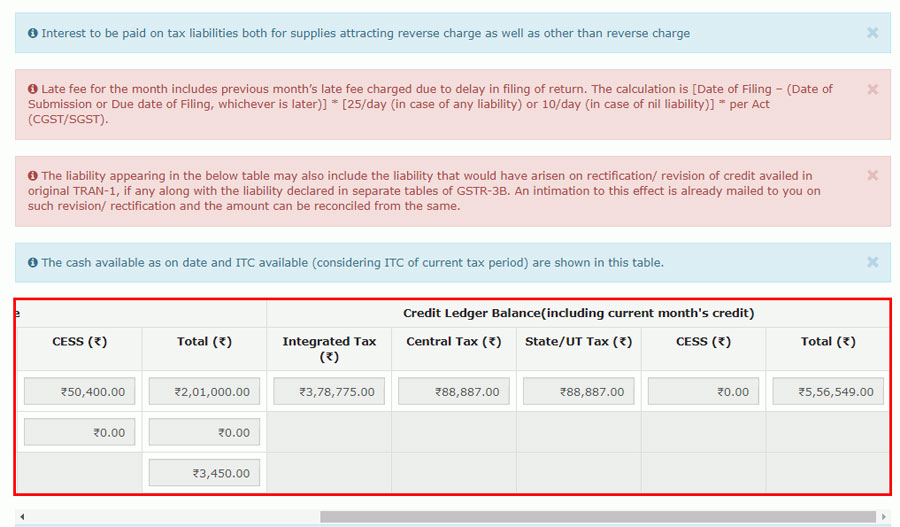

4. Similarly, the

5. Based on the available balance,

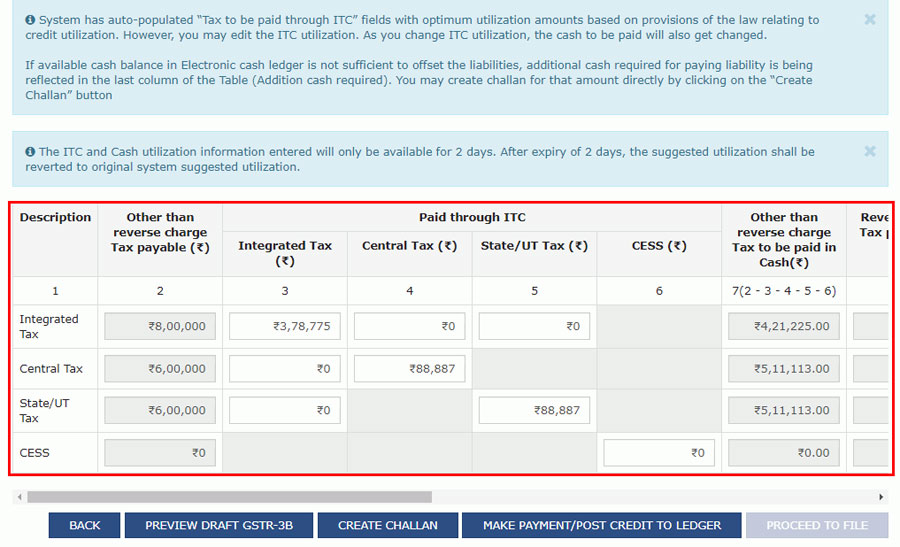

6. This may be useful when you think the ITC is available but not sure whether to utilize it or not. Therefore there may be cases where you do not want to set off the ITC suggested by the s

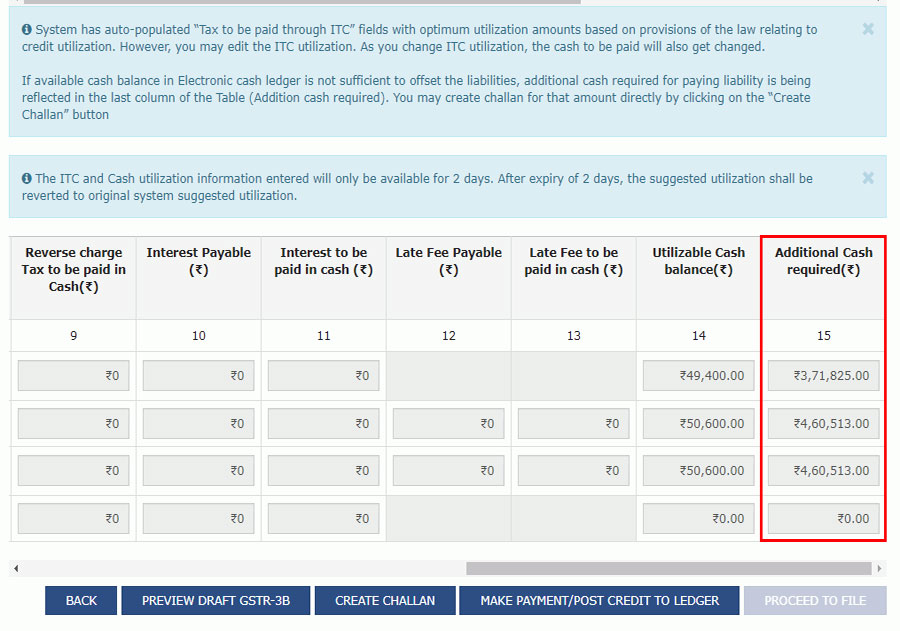

7. Further, if the ITC is not sufficient then you will have to click on the Create challan to deposit the cash. Thereafter, you need to click on “make payment/post credit to ledger” to update the ledgers with the latest balance. The System will show you the cash balance required as shown in the below picture.

8. Without setting off the liability you will not able to file this return. Thus, once you meet your liability with the required cash and credit balance and set off the figures completely the “proceed to file ” button will be activated.

GST set off entry in Tally ERP 9

If you are looking for how to pass GST set off entry in tally

Thus, if you are exporting

We have given this gst set off formula as per the latest notification as specified in gst set off rules block. You may also refer to the Related article at

Overview

This is the overview of Circular No. 98/17/2019-GST dt.23.04.2019 providing clarification on input tax credit set off rules.

Past Structure

The section, 49 was amended to insert

However, the taxpayer faces issues to bring into effect section 49A. This is because as per section 49A, the order of utilization of Input tax credit of IGST in a particular order. Thus,

Current Structure:

Rule 88A is inserted in CGST Rules 2017 in the

Important Links