The e way bill system for inter-State movement of goods across the country is being introduced from 01 st April 2018. Few E Way Bill examples are as below to help Consignor and Transporter.

12 E Way Bill Movement Examples

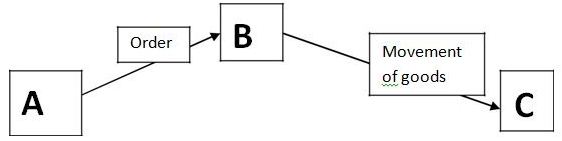

1. Situation: -Consider a situation where a consignor is required to move goods from City X to City Z. He appoints Transporter A for the movement of his goods. Transporter A moves the goods from City X to City Y. For completing the movement of goods i.e. from City Y to City Z, Transporter A now hands over the goods to Transporter B.

Thereafter, the goods are moved to the destination i.e. from City Y to City Z by Transporter B. How would the e-way bill be generated in such situations?

Clarification: -It is clarified that in such a scenario, only one e-way bill would be required. PART A of FORM GST EWB-01 can be filled by the consignor and then the e-way bill will be assigned by the consignor to Transporter A. Transporter A will fill the vehicle details, etc. in PART B of FORM GST EWB- 01a nd will move the goods from City X to City Y.

On reaching City Y, Transporter A will assign the said e-way bill to Transporter B. Thereafter, Transporter B will be able to update the details of PART B of FORM GST EWB-01. Transporter B will fill in the details of his vehicle

and move the goods from City Y to City Z.

2. Situation: – Consider a situation where a Consignor hands over his goods for transportation on Friday to the transporter. But, the assigned transporter starts the movement of goods on Monday. How would the validity

of e-way bill be calculated in such situations?

Clarification: -It is clarified that the validity period of the e-way bill starts only after the details in PART B of FORM GST EWB-01 are updated by the transporter for the first time.

In the given situation, the Consignor can fill the details in PART-A of FORM GST EWB-01 on Friday and handover his goods to the transporter. When the transporter is ready to move the goods, he can fill the PART B of FORM GST EWB-01 i.e. the assigned transporter can fill the details in PART B of FORM GST EWB-01 on Monday and the validity period of the e-way bill will start from Monday.

3. Situation: – Mr. A sent goods for job work process worth Rs 45,000/- from Maharashtra to UP, whether E way bill is required to generate?

Clarification.:- In the case of interstate movement(one state to another state) of goods for job work process, it is mandatory to generate E way bill irrespective of the amount. Therefore in this case E way bill needs to generate for the movement of goods.

4. Situation: – A transporter vehicle contains 2 consignments based on 2 invoices. Invoice 1 for Rs 55,000/, and invoice 2 for Rs 45,000/-. How many E Way Bill (EWB) will be generated by the consignor.

Clarification.:- E Way Bill will be generated at Invoice level if the invoice value exceeds Rs. 50,000/-. Therefore in this case E Way Bill will be generated for Invoice no 1 only.

5. Situation: – Mr. B sent Handicraft goods worth Rs 42,000/- from Indore to Ludhiana Punjab. Whether E way bill needs to generate?

Clarification.:- In the case of the movement of handicraft goods, it is mandatory to generate EWB irrespective of the amount. Therefore in this case E Way Bill needs to generate.

6. Situation: – Mr. Rajesh (Delhi) sent goods to his transporter (Haryana) for further transportation. Transporter’s place is 9km far from ram’s office, whether E way bill needs to generate?

Clarification.:- Yes. Secondly, there is NO exemption for filing Part B of E way bill, because the exemption of filling Part B is when movement is taking place within the state i.e. E way bill including Part B is need-ed irrespective of distance is movement is inter-state.

7. Situation: – Mr. Abhishek from Punjab sent goods to his transporter in Punjab only for further transportation. Transporter’s place is 9km far from Abhishek’s premises. Whether E Way Bill needs to generate?

Clarification.:- Yes, E waybill needs to be generated but there is an exemption for filing Part B of E way bill if the distance of supplier and transporter is less than 10km and movement causes within the state.

8. Situation: – Mr. Rajan filled and generated E waybill at 4.00 pm on 2nd April 2018. After a generation of E-way bill, Mr. Rajan finds one mistake in E way bill. By what time he can cancel and regenerate the new E way bill?

Clarification.:- In case of a mistake in the E-way bill supplier or any other person can cancel and regenerate the E waybill within 24 hours of the issue. Therefore Mr. Rajan must cancel it up to 3.59 pm on 3rd April 2018.

9. Situation: – Mr. Mahesh has generated E way bill for transporting goods from Goa to Kerala (distance 690 km appx) on 1st April 2018. What is the validity of EWB?

Clarification.:- E way bill valid for 1 day up to 200 km of distance and it will increase 1 day each when distance increased by 200 km or part thereof. Therefore in this case E way bill is valid up to 7 days(For 600 km 6 days and for another 90 km another 1 day).

10. Situation: – Mr. Mohit (Consignor) generated EWB on 1st April 2018 at 4.00 pm. By what time Mr. Sajan (Consignee) is liable to accept E way bill?

Clarification.:- E Waybill can be accept-ed or reject-ed by the recipient up to 72 hrs of issue. Otherwise, it will be deemed as accepted. Therefore Mr. Sajan can accept up to 3.59 pm on 4th April 2018.

11. Situation: – Multiple invoices generated on the same customer and goods supplied on the same truck. Is a Single E waybill or multiple E way bills required?

Clarification.:- No e waybill is required if the value of the goods in an individual consignment is less than Rs. 50,000/-. Even if the total value of all such consignments is more than Rs. 50,000/- in a single-vehicle.

12. Situation: – Mr. Prakash (Consignor) sent goods worth Rs 1,30,000 from a hand Rickshaw from Margao to Verna (distance 13km appx). Whether the E-way bill needs to generate by Mr.Prakash?

Clarification.:- E Way Bill will be generated only for motorized vehicles. Therefore in this case no need to generate E way bill because the rikshaw is the nonmotorized vehicle under GST Rules.

Keep visiting GST India News for the latest updates on E Way Bill Movement Examples with examples.