NACIN To Conduct GST Practitioner Examination

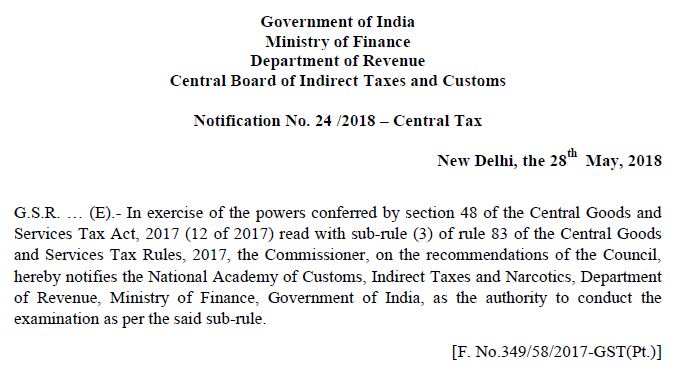

On the recommendations of the GST Council, the government notifies the National Academy of Customs (NACIN), Indirect Taxes and Narcotics, Department of Revenue, Ministry of Finance, Government of India, as the authority to conduct the Examination for GST Practitioners.

The said notification has reference no. 24 /2018 – Central Tax dtd.28.05.2018. The notification issued as per the section 48 of the central goods and service tax 2017 with sub rule (3) of rule 83 of central goods And service tax rules 2017.

As per rule (3) of rule 83 No person enrolled as a goods and services tax practitioner shall be eligible to remain enrolled unless he passes such examination conducted at such periods and by such authority.

Also, no person to whom the provisions of clause (b) of sub-rule (1) apply shall be eligible to remain enrolled unless he passes the said examination within a period of one year from the appointed date.

GST Practitioner Related Links

GST Practitioners Examination and Registration

Learn when GST practitioner’s examinations are held under Goods and Service Tax. Also, read the advantages, registration, and eligibility rules for GST practitioners.

GST Rules for Practitioner Exam

The CGST Rules 2017 has laid down the required rules for appearing Goods and service Tax practitioner. know more about pattern and syllabus.

Latest News on GST Practitioner

You may subscribe to News letter to receive the latest news and updates on GST practitioner and examination.

What is gst suvidha center?

Read to know who are GST suvidha providers and their functions under GST. Also, see the list of GST suvidha kendra.

SIR I HAVE ENROLLED AS GST PRACTIONER ON 12-09-2018 BUT NOT GIVEN ANY EXAM

CAN I GIVE EXAM FOR GSTP NOW

Hello,

you have to pass the examination within 2.5 years to keep the enrollment valid.

Ref: https://gstindianews.info/gst-practitioner-exam-syllabus-date/#examination

regards