We explain to you in a very easy language on how to become a successful GST practitioner. This will be very useful for you, especially if you are new in GST and wants to become a GST practitioner. Thus, as a GST practitioner, you can perform many activities on behalf of your client. Hence, this article will guide the entire process of the GST practitioner exam, registration, syllabus, meaning, and benefits. Let us see in detail below.

Table of Contents

- Meaning of GST Practitioner >>Advantages >>Certification

- Registration >>Cancel registration

- Examination >>Online Examination Application >>Guidelines for Exam

- Assistance

Who is a GST practitioner?

The GST Practitioner is one type of online consultancy service provider to the taxpayer through online mode. Also, the GSTN allows GST Practitioners to enroll as a registered GST practitioner through its common portal and issues GST Practitioner certificate after submission of application. Similarly, the GST Practitioner can perform the following activities after login into the GST portal.

Advantages of GST practitioner registration

1. View the online list of the engaged taxpayer’s in your account.

2. Accept /Reject taxpayer application as a consultant to the taxpayer.

3. Can make changes in the profile of Taxpayer, Place of business, contact, and other business information. However, the GST practitioner can only save this information and cannot submit. Thus, he has to instruct the taxpayer to submit the changed application.

4.Furnish details of outward and inward supplies

5. Furnish monthly, quarterly, annual or final return for the taxpayer.

6. Make a deposit for credit into the electronic cash ledger of the taxpayer.

7. File an application for a claim for refund of taxes.

8.Can file an application for amendment for cancellation of GST registration.

9. GST practitioners can furnish information for the generation of E waybill.

10. Furnish information details of challan in Form GST ITC -04

11. He can file an application for amendment or cancellation of GST enrollment under Rule 58

12. File an intimation to pay tax under composition scheme or withdraw from the scheme.

Besides the above services GST Practitioner can also offer offline services like, he can help the taxpayer to generate e waybill for various movements of goods. Also, he can provide help on issuing of tax invoices, Delivery challan, a procedure for GST registration, cancellation and GST updates.

These are the major advantages of GST practitioner registration. Keep visiting GST India News for the latest updates on GST Practitioners in India.

GST practitioner Certification

There are two steps involved in overall GST Practitioner certification.

a) The first step is to apply for GST registration through the online GST portal or GST Suvidha providers centers. After successful registration, you get a GST Practitioner Certificate. Also, this is called the GST Enrolment number.

b) The second step is to pass the examination to retain the validity of the GST Practitioner Certificate. As per GST law, NACIN is the official authority to conduct the GST practitioner exam. Read here more about NACIN: Govt Appoints NACIN As Authority To Conduct GST Practitioner Examination.

If registered GST practitioner does not qualify in the GST practitioner examination then the registration certificate stands to be canceled or not valid. Check here our article on the GST Practitioner Pattern, Syllabus, and Paper of the Examination.

GST Practitioner Registration

The first step is to register yourself as a GST practitioner to practice as a GST consultant. Therefore, please go throw below conditions, eligibility and documentation before proceeding for Online Registration.

Registration Eligibility

In order to apply for GST practitioner Registration, the person should meet the following requirements:

- He must be a citizen of India

- Person of sound mind

- Not adjudicated as insolvent

- Not convicted by a competent court

Qualifications for Registration

Here is the list of qualifications required to apply for GST practitioner Registration. Thus, a person who meets any one of the following qualifications may apply for GST practitioner Registration.

- A retired officer of the Commercial Tax Department of any State Government.

- A retired officer of the Central Board of Excise and Customs, Department of Revenue, Government of India, who, during his service under the Government, had worked in a post not lower than the rank of a Group-B gazetted officer for a period of not less than two years.

- A person who has enrolled as a sales tax practitioner or tax return preparer under the existing law for a period of not less than five years.

- A person who passes a graduate or postgraduate degree or its equivalent examination having a degree in Commerce, Law, Banking including Higher Auditing, or Business Administration or Business Management from any Indian University established by any law for the time being in force.

- The person having degree examination of any Foreign University recognized by any Indian University as equivalent to the degree examination mentioned in sub-clause (i)

- A person having any other examination notified by the Government, on the recommendation of the Council, for this purpose.

- Passed any of the following examinations, namely:-

- The final examination of the Institute of Chartered Accountants of India; or

- The final examination of the Institute of Cost Accountants of India; or

- The final examination of the Institute of Company Secretaries of India.

Documents required for Registration

Following is the list of Documents required at the time of Registration as GST Practitioner

- Photo of Applicant in JPG format with a maximum size of 100kb

- Proof of Professional Address (Any One) from below – JPG/PDF < = 100KB

- Any other Certificate / document issued by Government– JPG/PDF < = 100KB

- Any other Certificate or record from Govt department– JPG/PDF < = 100KB

- Consent Letter– JPG/PDF < = 100KB

- Electricity Bill– JPG/PDF < = 100KB

- Legal ownership document– JPG/PDF < = 1MB

- Municipal Khata Copy– JPG/PDF < = 100KB

- Property Tax Receipt– JPG/PDF < = 100KB

- Rent / Lease agreement– JPG/PDF < = 2 MB

- Rent receipt with NOC (In case of no/expired agreement) – JPG/PDF < = 1 MB

- SEZ Approval Order– JPG/PDF < = 1.024 MB

- Proof of qualifying degree, Degree certificate in JPG/PDF format not more than 100kb

- Proof of designation of the post held at the time of retirement* (Applicable for Retired Govt Officials only). Needs to upload Pension Certificate used by AG Office or LPC, in JPG/PDF format not more than 1 MB

GST practitioner Registration online Procedure

Procedure Chart

PART A

- Visit GST Portal at https://www.gst.gov.in

2. Click on the REGISTER NOW link. Alternatively, you may also click Services > Registration > New Registration option.

3. The New Registration page will be displayed. Select the New Registration option.

4. In the “I am a” drop-down list, select the GST Practitioner as the type of taxpayer.

5. Under the State/UT and District drop-down list, select the state for which registration is required

6. Enter the legal name, in the Name of the GST Practitioner field as per PAN Card.

7. Enter the PAN number in the PAN field.

8. Thereafter, the Legal Name of the GST Practitioner and PAN will be validated against the CBDT database.

9. Enter the email address of the Primary Authorized Signatory, in the Email Address field.

10. Enter the valid Indian mobile number of the Primary Authorized Signatory, in the Mobile Number field,

11. In the Type, the characters you see in the image below field, enter the captcha text and proceed.

12. Enter the OTP details received on mobile and email id.

13.. Click the PROCEED button.

14. The system generated 15-digit Temporary Reference Number (TRN) will be displayed. Also, you will receive the TRN acknowledgment information on your e-mail address.

PART B

Click Services > Registration > New Registration option and select the Temporary Reference Number (TRN) radio button to log in using the TRN.

Follow the below steps to fill part B

1. In the Temporary Reference Number (TRN) field, enter the TRN generated and Captcha.

2. Click the PROCEED button. Enter the OTP received on mobile and email.

3. The My Saved Application page will be displayed. Under the Action column, click the Edit icon to modify.

1. PART-B of the form has four sections that must be filled sequentially. The first section is General Details. Enter all the details and click SAVE AND CONTINUE at the bottom of the screen.

a) Under Enrolling Authority, select the radio button Centre or State/UT

b) Under enrolment sought as, please select an option from the dropdown given.

c) Enter the name of your University.

d) Select your year of passing.

e) Enter the name of the Qualifying Degree for enrolment as a GST Practitioner.

f) Select the document type from the dropdown given, Under Proof of Qualifying Degree for enrolment as a GST Practitioner.

g) Upload the documents in PDF or JPEG formats.

h) click on SAVE AND CONTINUE to move to the next section.

2. The second section is the Applicant Details.

a) Select your date of birth.

b) Enter your first, middle, and last name (the first name is mandatory).

c) Select your gender.

d) If you wish to use E-Sign or EVC, enter your Aadhaar Number.

e) Enter all the details and upload your photograph.

f) Upload your photograph in JPEG format (file size should not exceed 100 KB)

g) Once you have entered all the details and uploaded the photograph, click SAVE AND CONTINUE to move on to the next section.

3. The third section is the Professional Address.

a) Enter the address with the correct PIN Code. State and District will be auto-populated from PART-A of the form.

b) Select the appropriate proof of professional address from the dropdown menu.

c) Upload the selected proof of professional address in JPEG or PDF format with a file size not exceeding 1 MB.

d) Once all the details are entered and the document is successfully uploaded, click SAVE AND CONTINUE to go to the final section.

4. The fourth and last section is the Verification page.

a) Check the check-box with the verification statement.

b) Enter the place.

c) You may choose now to submit the form using DSC, E-Sign or EVC. (Note: For E-Sign and EVC you must update your Aadhaar number in the Applicant Details section)

You will receive the acknowledgment in the next 15 minutes on the registered e-mail address and mobile phone number.

Afterward, you can track the status of your application using the Services > Registration >Track Application Status command.

How to Cancel GST practitioner registration?

A GST practitioner can cancel his registration by sending an online request in Form GST PCT 06 at the GST portal.

Thereafter, the commissioner or an officer authorized by him may issue an order in Form GST PCT 07 to cancel the GST practitioner Registration

Examination of GST practitioner

NACIN will conduct the GST practitioner examination as and when notified by the government. Thus, every GST practitioner must qualify with a minimum score to continue as a GST practitioner.

Further, the National Academy of Customs, Indirect Taxes and Narcotics (NACIN) has been authorized to conduct an examination for confirmation of enrollment of Goods and Services Tax Practitioners (GSTPs). This is in terms of the sub-rule (3) of rule 83 of the Central Goods and Services Tax Rules, 2017, vide Notification No. 24/2018-Central Tax dated 28.5.2018.

GST Practioner Examination Date

The next GST practitioner Examination will be held on 12.12.2019.

The Goods and Services Tax Practitioners (GSTPs) enrolled on the GST Network under sub-rule (2) of Rule 83 and covered by clause (b) of sub-rule (1) of Rule 83, i.e. those meeting the eligibility criteria of having enrolled as sales tax practitioners or tax return preparer under the existing law for a period not less than five years, are required to pass the said examination before 31.12.2019 in terms of Notification no. 03/2019-Central Tax dated 29.01.2019.

Further, the NACIN said the candidates who do not appear and pass the examination scheduled on 12.12.2019 will not be given another chance. Read the press release.

The registration portal will open on 22nd November 2019 and remain active till 05th December 2019. The GST practitioner examination fee will be Rs. 500/- at the time of registration. The exam will start from 11.00 hrs to 13.30 hrs.

The validity of GST practitioner certificate/Registration

As per GST rules no person shall be eligible to remain enrolled as GST practitioner unless he passes the above examination.

Further, he must pass the said exam within 30 months from the date of his enrollment as a GST practitioner. In case the person does not meet the above conditions, the certificate will stand as invalid or canceled.

Who can apply for the GST practitioner Examination?

The Goods and Service Tax practitioners(GSTPs) can apply for examination whose enrollment on GST Network was approved.

Fees of the examination

The applicants are required to make online payment of the examination fee of Rs. 500/- at the time of registration for this exam.

Pattern and Syllabus of the Examination

Here is the syllabus of the GST practitioner Exam. The candidate needs to prepare thoroughly to pass the GST practitioner exam.

PAPER: GST Law & Procedures:

The time allowed: 2 hours and 30 minutes

Number of Multiple Choice Questions: 100

Language of Questions: English and Hindi

Maximum marks: 200

Qualifying marks: 100

No negative marking

GST Practitioner Exam Syllabus

1. Central Goods and Services Tax Act, 2017

2. Integrated Goods and Services Tax Act, 2017

3. State Goods and Services Tax Acts, 2017

4. Union Territory Goods and Services Tax Act, 2017

5. Goods and Services Tax (Compensation to States) Act, 2017

6. Central Goods and Services Tax Rules, 2017

7. Integrated Goods and Services Tax Rules, 2017

8. All-State Goods and Services Tax Rules, 2017

9. Notifications, Circulars, and orders issued from time to time

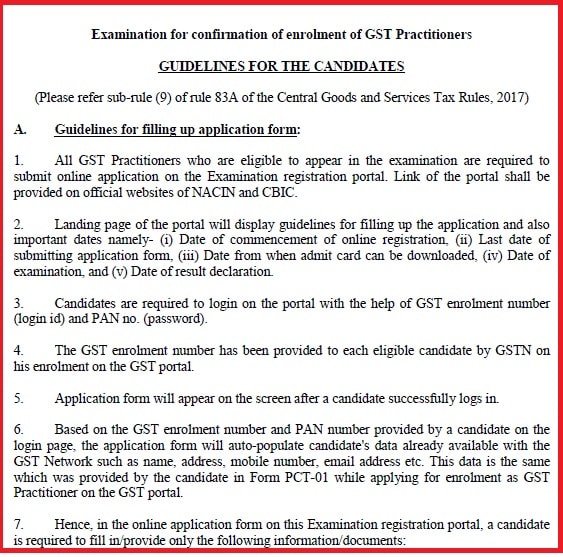

Online Examination Application filing Instructions

Please read carefully the following instructions for filling up an online examination application form. The government has issued these guidelines on 22.11.2019. Therefore, the candidate must follow the below steps to submit the online GST practitioner exam form.

Step 1

1. All GST Practitioners who are eligible to appear in the examination are required to submit an online application on the Examination registration portal. The link of the portal shall be provided on the official websites of NACIN and CBIC.

2. The landing page of the portal will display guidelines for filling up the application and also important dates namely-

(i) Date of commencement of online registration,

(ii) Last date of submitting an application form,

(iii) Date from when admit card can be downloaded,

(iv) Date of examination, and

(v) Date of result declaration.

3. Candidates are required to log in on the portal with the help of the GST enrolment number (login id) and PAN no. (password).

4. The GST enrolment number has been provided to each eligible candidate by GSTN on his enrolment on the GST portal.

5. The application form will appear on the screen after a candidate successfully logs in.

Step 2

6. Based on the GST enrolment number and PAN number provided by a candidate on the login page, the application form will auto-populate candidate’s data already available with the GST Network such as name, address, mobile number, email address, etc.

This data is the same which was provided by the candidate in Form PCT-01 while applying for enrolment as GST Practitioner on the GST portal.

Step 3

7. Hence, in the online application form on this Examination registration portal, a candidate is required to fill in/provide only the following information/documents:

- Three choices of test centers (stations) from the drop-down menu,

- Softcopy of passport size photograph (File Type JPG, JPEG, PNG of Size 20 to 60 KB),

- Softcopy of signatures (File Type JPG, JPEG, PNG of Size 10 to 30 KB), and

iv) Whether the candidate falls under the category ‘person with disability’

8. The candidates will be prompted to fill in three choices from a list of test centers (stations). To the extent possible, the center will be allocated to a candidate according to the choices indicated by him.

Step 4

9. Once a candidate submits the completed application form on the registration portal, he will be prompted to pay the examination fee online.

10. On completion of online fee payment, the candidate will be guided to access ‘Candidate’s Dashboard’ from where the submitted application, as well as Admit Card, can be downloaded. Similarly, the scorecard will be made available for download on the same Dashboard.

11. A mock test of 15-20 questions will also be available on the Candidate’s Dashboard.

Guidelines for appearing in the Examination

Reporting

1. Candidates are advised to report at the Examination Centre one and a half hours before the scheduled examination time. Thus, the gate will be closed fifteen minutes before the commencement of examination after which no candidate shall be allowed to enter the examination venue.

Identity Card

2. Entry in the examination hall will be allowed on production of printout of Admit Card and a valid identity document in original {Aadhar, PAN Card, Driving License, EPIC (Electoral Photo ID Card) or Passport}.

Prohibited items

3. PROHIBITED ITEMS, such as watches, books, pens, pencil, paper, chits, magazines, electronic gadgets (mobile phones, Bluetooth devices, headphones, pen/buttonhole cameras, scanner, calculator, storage devices, etc.) are STRICTLY NOT ALLOWED in the examination hall.

Facilities

4. Each candidate shall be provided with complete examination infrastructure including hardware (a desktop computer) loaded with examination software.

5. Before the start of the test, a candidate will be required to enter the Roll No. (Roll no. displayed in Admit Card) and password (PAN no.) to start the test.

Commencement of Examination

6. On designated time, the question paper shall be made available on the computer screen of the candidates.

7. The test will be in Computer Based mode in a secure environment such that while the test is taken, access to all possible web resources i.e. browsing chatting, etc. will be blocked from the computer of the candidates as well as any other computer peripherals such as printers. Similarly, functions like “Copy-Paste” will be disabled in the question paper page appearing in the test.

8. For answering a question, the candidate has to click on the correct / most appropriate option from the given answer choices.

9. Pen/pencil for rough work will be provided in the examination hall. Rough work needs to be done on the backside of the Admit card. No separate rough sheet will be provided to the candidates.

10. Electronic watch (timer) will be available on the computer screen allotted to the candidates.

11. It is reiterated that Candidates should not bring Bags and prohibited/valuable items as mentioned above to the examination venue as arrangements for the safe custody of such items cannot be assured.

Unfair Practices

12. Candidates must not indulge in the use of unfair means or practices. An illustrative list of use of unfair means or practices by a person is as below:

- Obtaining support for his candidature by any means;

- Impersonating;

- Submitting fabricated documents;

- Resorting to any unfair means or practices in connection with the examination or in connection with the result of the examination;

- Found in possession of any paper, book, note or any other material, the use of which is not permitted in the examination center;

- Communicating with others or exchanging calculators, chits, papers, etc. (on which something is written);

- Misbehaving in the examination center in any manner;

- Tampering with the hardware and/or software deployed; and

- Attempting to commit or, as the case may be, to abet in the commission of all or any of the acts specified in the foregoing clauses.

Resorting to unfair means or practices shall be considered as a serious offense. If any candidate is or has been found to be indulging use of unfair means or practices, his candidature will be canceled and he will be disqualified for the examination.

13. Candidates shall maintain silence in the examination venue. Any conversation or gesticulating or disturbance or attempt to change seats/admit cards in the Examination Hall shall be deemed as the use of unfair means.

14. Candidates are not allowed to leave the examination hall until completion of the test and handing over the Admit Card to the Invigilator.

15. Candidates are not allowed under any circumstances to go out of the hall in the first thirty minutes even on completion/submission of the paper.

16. The question papers shall be in English and in Hindi. In case of any discrepancy, the English version will prevail.

17. Smoking and eating are strictly prohibited in the examination hall.

Post-examination representation and its disposal Guidelines

1. Any candidate, not satisfied with his result may send a representation to Assistant / Deputy Director (Examination), National Academy of Customs, Indirect Taxes and Narcotics, NACIN Complex, Sector-29, Faridabad-121008, clearly specifying the reasons of representation, within seven days of declaration of results on NACIN website.

2. If the representation requires re-evaluation, it shall be entertained only in cases where a candidate has failed the examination. In such a case, the representation shall be sent along with the re-evaluation fee in the form of a Demand draft of Rs. 200/- in favor of PAO, CBEC, payable at New Delhi.

3. NACIN shall inform the result of representation to the candidate, preferably within one month of receipt of the representation.

Assistance

- For Technical Queries Call: – 022-6250 7718 (Timing From 10:00 AM to 05:00 PM Monday to Saturday)

- Email: nacinsep18@onlineregistrationform.org

- For Eligibility, Queries Call:: – 0129-2504612 (Timing From 10:00 AM to 05:00 PM Monday to Friday on working days and hours only)

- Email: gstp.nacin@gmail.com

What is The Process and fee of GST practitioner

hello, Mr. Vijay, There is no fee to register as GST practitioner. One needs to visit gst portal and apply for GST registration by selecting type as I am “GST practitioner”.

After getting registration one needs to pass the examination as stated above. Fees are applicable only for exam.

For those GST practitioners who enrolled after 24.09.2018, one more examination will be held in the month of December 2018. Date of examination will be announced in due course.

Dear Sir, any update it the Dec 2018 exam too is only for the Tax Practitioners who are practicing for 5 years?

Hello Naresh, December examination date is not yet declared. We will update it on our home page headline section as soon as the government declares it. There is no such condition of 5 years concept in GST rules.

Hi sir I am ranjini sir I am completed BBM course and I have interested in practitioner how can do it sir

Hello Ranjini

you need to register yourself as GST practitioner on GST portal. Thereafter you need to pass examination of GST Practitioner..please go through our articles in this regard. please see our article on this https://gstindianews.info/gst-practitioner-registration-online-procedure/

Hi Sir

I am wotking in a company and can i take GSTP for doing part time & Saturday & Sonday..?

hello Ramesh,

Yes you can apply for registration if you meet the eligibility as per GST rules. Minimum graduation is required. read more.. https://gstindianews.info/gst-practitioner-process-and-procedure/

Sir,

I enrolled graduate based gstp registration in gst.gov.in December.2017.

June,2019 gstp exam allowed or not.

yes you can. you need to apply for examination

Dear Sir

I applied for Registration as GST Practitioner on 11.10.2019 till date it shows “Pending for Processing”.

How much time required for approval. shall I qualify for Examination without approval.

Hi Surya, In my opinion you will not qualify unless your registration is successful. kindly contact their customer care to know the reason for pending process.

When is the next exam for gstp sir in 2020 or 2021 ?

Hello Jebisha, The exam dates are not yet announced. We will notify our users as soon the department publish it.

regards

Is any second chance is given after 2 years of enrollment ,in his life time ?

Hello Mr. Balaji,

Now, according to the sub-rule (3) of rule 83, the GST practitioner needs to pass the examination within 30 months(2.5 years) to keep the registration valid. Also, examination attempts can be made any number of times during this period. According to my opinion, in your case, the GST practitioner can apply cancel/surrender the registration and re-apply for fresh registration.

Regards

Sir, I am Shahidh, I have completed B.Com and working in a company. I have interested in practitioner. What is the professional address proof I should attach. I am living along with my parents in flat & my parents are owner of this flat

hi

you have to mention your place of practice address.

regards