What is Invoice Furnishing Facility (IFF) in GST?. The Invoice Furnishing Facility (IFF) is a facility provided to quarterly taxpayers. Thus, these taxpayers have to file outward supply details in the first two months of the quarter (M1 and M2). This feature is similar to the GSTR-1 return. However, it will allow only to file the details for the following tables:

- 4A, 4B, 4C, 6B, 6C – B2B Receipts

- 9B – Credit / Debit Notes (Registered)

- 9A – Revised B2B Receipts

- D. 9C – Revised Credit / Debit Notes (Registered)

Invoice furnishing facility in GST portal

The invoice furnishing facility(IFF) is now available in the GST portal. Thus, the quarterly taxpayers can upload the invoices for the month of January 2021 and then of February 2021.

How to file iff in GST?

Here are the quick steps that needs to be followed to file IFF in GST portal.

- Login and Navigate to the IFF page

- Enter the Details in Various Tables

- Generate the GSTR-1/ IFF Summary

- Preview IFF

- Acknowledge and Submit GSTR-1/IFF to freeze data

- File GSTR-1/ IFF with DSC/ EVC

1. Login and Navigate to IFF page

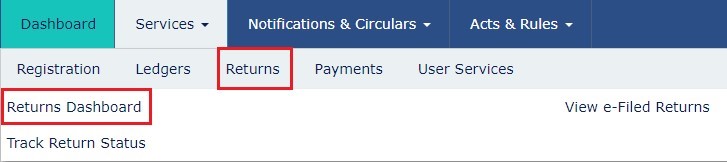

1. Visit www.gst.gov.in URL. Login to the GST Portal. Click the Services > Returns > Returns Dashboard command.

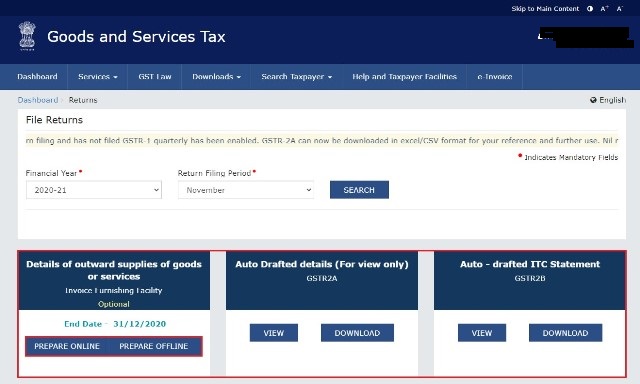

2. Select the FY & Return Filing Period. Click the SEARCH button.

2. Enter Details in Various Tables

On the Invoice Furnishing Facility block, click on the PREPARE ONLINE button, in case you prefer to prepare it online. Otherwise, you can click on PREPARE OFFLINE button. Fill in the details like B2B & BC2 invoices.

3. Generate the summary

After you finish entering all the details scroll down to the bottom of the IFF – Details of outward supplies of goods or services page. Click on the GENERATE IFF SUMMARY button. This is to include the auto drafted details pending for action from recipients. Once, the summary is generated you may proceed to see the preview.

4. Preview IFF Summary

You can preview the details here before proceeding to lock the details. In case there are any errors, you can correct them at this stage.

5. Acknowledge and Submit IFF

Select the acknowledgment checkbox. Click on submit button. This process will lock your uploaded records.

6. File GSTR-1/ IFF with DSC/ EVC

Now you are ready to file your IFF by using DSC or EVC. Click on below button to learn more about filing iff by using DSC or EVC.

Last date to file IFF in GST

The quarterly taxpayers have to file IFF on or before the 13th of the next month. If the taxpayer does not file it by the 13th, such invoices can be uploading the subsequent month. However, such invoices will not appear in GSTR 2A of the Recipient in the first month of the quarter.

IFF in GST offline tool

You can use the GST offline tool to prepare iff details in offline mode. Prepare JSON file and upload it on the GST portal.

How to download iff offline Tool?

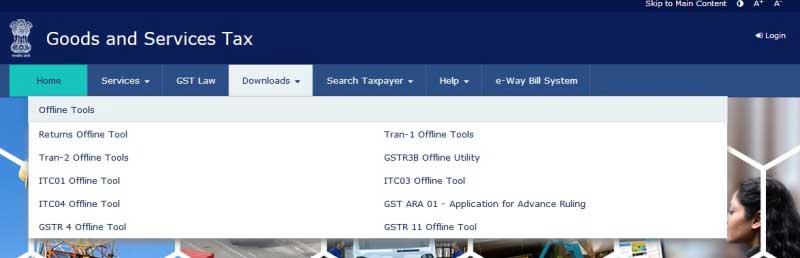

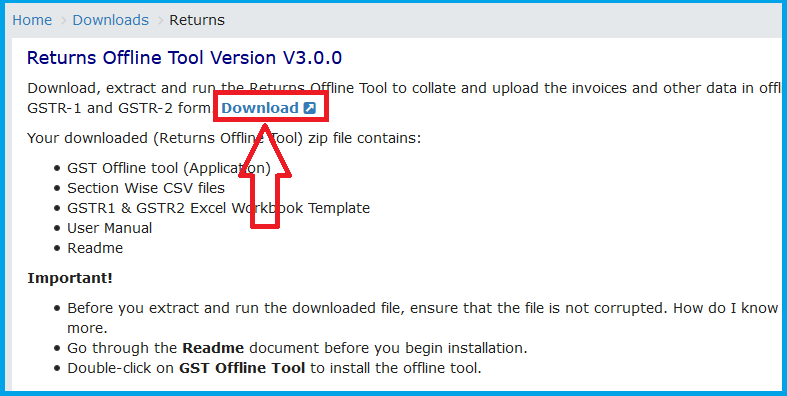

- Visit the GST portal at www.gst.gov.in. Click on Downloads >> offline Tools >> Returns offline Tool.

2. Above steps will open below screen.

3. Click on the Download button to download the offline tool. Learn more on how to install downloaded GST offline tool. Preparation of Invoice furnishing facility(IFF) in offline mode is similar to preparing GSTR 1 offline.

Similar Articles

Meaning of QRMP Scheme under GST

The QRMP scheme is quarterly return filing and making monthly payment scheme under GST. more

Payment method in QRMP Scheme

The tax payment under the QRMP scheme can be made through Fixed Sum Method & Self-Assessment Method. more

GST Webinar or QRMP Scheme

Check out the latest webinar videos on the QRMP scheme organized by the GSTN team. These videos will help you to understand the scheme in detail. more

Latest news updates on QRMP

The QRMP scheme is implemented in January 2021. Thus, the taxpayer needs to file IFF starting from these months. Check out our home page to see the latest updates on the Invoice furnishing facility and IFF news updates. more