The GSTR 5 is a return to be filed by all the Non- Resident Taxpayers in case they don’t wish to avail ITC (Input Tax Credit) on local purchase. However, if they want to avail ITC on local procurement, it will be required to register as a normal taxpayer and file Form GSTR-1/ 3B as a normal/casual taxpayer.

Further, the Non- Resident Taxpayers need to file GSTR 5 return for the period for which they have obtained registration. However, they must file it within a period of seven days after the date of the expiry of registration.

In case, the registration period is for more than one month, monthly return (s) would be filed by 20th of the month succeeding the tax period and thereafter return for the remaining period would be filed within a period of seven days.

GSTR 5 Return Due Date

The GSTR 5 return shall be filed on a monthly basis. Thus, the GSTR 5 return is due for filing on the 20th of the succeeding month.

GSTR 5 Due Date Extension

14.04.2020: The last date of filing GSTR 5 return is extended till 30th June 2020, for the month of March, April and May 2020.

Non Resident Taxable Persons to file GSTR 5 Return by 11th December 2017

30.11.2017: Non-Resident Taxable Persons should file GSTR 5 & GSTR 5A Returns by 11th December 2017 and 15th December respectively. The GSTR 5 Return should be filed by Non-Resident Taxable person every month.

GSTR 5A Return should be filed by Non-Resident Foreign Taxpayers who have come for a short period to make supplies in India to file by providing information online or through database access retrieval service.

How to file GSTR 5 Return?

GSTR 5 Return should be filed by Non Resident Taxable person every month. This return should be available on GST portal under Returns Dashboard. There is no offline utility yet for this GST Return. kindly go through below instructions before proceeding entering data online for this return.

Instructions:-

1. Terms used:

a. GSTIN: Goods and Services Tax Identification Number

b. UIN:Unique Identity Number

c. UQC: Unit Quantity Code

d. HSN:Harmonized System of Nomenclature

e. POS: Place of Supply (Respective State)

f. B to B: From one registered person to another registered person

g. B to C: From registered person to unregistered person

2. GSTR-5 is applicable to non-resident taxable person and it is a monthly return.

3. The details in GSTR-5 should be furnished by 20thof the month succeeding the relevant tax period or within 7 days from the last date of the registration whichever is earlier or Please click here to know the current filing date.

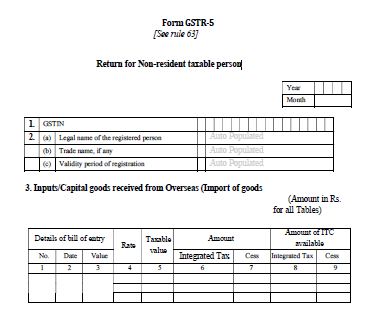

4. Table 3 consists of details of import of goods, bill of entry wise and taxpayer has to specify the amount of ITC eligible on such import of goods.

5. Recipient to provide for Bill of Entry information including six digits port code and seven digits bill of entry number.

6. Table 4 consists of amendment of import of goods which are declared in the returns of earlier tax period.

7. Invoice-level information, rate-wise, pertaining to the tax period separately for goods and services should be reported as under:

i.For all B to B supplies (whether inter-State or intra-State), invoice level details should be uploaded in Table 5;

ii. For all inter-state B to C supplies, where invoice value is more than Rs. 2,50,000/- (B to C Large) invoice level detail to be provided in Table 6; and

iii. For all B to C supplies (whether inter-State or intra-State) where invoice value is up to Rs. 2,50,000/ – State-wise summary of supplies shall be filed in Table 7.

8. Table 8 consists of amendments in respect of –

i. B2B outward supplies declared in the previous tax period;

ii. “B2C inter-State invoices where invoice value is more than 2.5 lakhs” reported in the previous tax period; and

iii. Original Debit and credit note details and its amendments.

9. Table 9 covers the Amendments in respect of B2C outward supplies other than inter-

10. Table 10 consists of tax liability on account of outward supplies declared in the current tax period and negative ITC on account of amendment to import of goods in the current tax period.

On submission of GSTR-5, System shall compute the tax liability and ITC will be posted to the respective ledgers.

Short Answers on GSTR 5 & 5A

The Non-Resident Taxpayer who does not want to avail ITC shall file GSTR 5 return on a monthly basis.

The Online Information and Database Access or Retrieval (OIDAR) services provider shall file GSTR 5A. The return is of the services provided to un-registered person or customers, from a place outside India to a person in India.