Credit notes and debit notes play a very important role in day-to-day sales and purchase transactions. Here you will learn the credit note meaning and the debit note rules under GST. Also, you can download the credit note format in excel and word. Understand the difference between a debit note and a credit note with simple steps. Know the basic rules for the creation of credit notes and debit notes in GST.

Further, you can download credit note format in excel and word from the below tables. These formats will serve as a sample with rules under GST.

Beyond this, you will learn how to pass credit note entry in tally ERP. You will see how to use a credit note shortcut key in tally ERP 9.

Table of Contents

- Introduction

- What is Credit Note > GST Credit Note > Debit/Credit Note Rules

- Treatment in GST > Credit Note Excel Format > Word Format

- Credit Note Entry in Tally > When to issue

- What is Debit Note >> GST Debit Note > Excel Format

- Word Format > Tally Entry > Debit Note Example

- When to issue > Cn vs DN > Pre GST Supply

- Latest Update > Similar Links

What is a Credit note?

A credit note is a commercial document issued by a seller to a buyer. The Credit notes act as a Source document for the Sales return in Accounting Journal. In other words, the credit note serves as evidence for

The credit note can contain the lists of the products, quantities, and agreed prices for goods or services. The seller issues a

The supplier may issue a credit note in the case of damaged goods, errors, or allowances. Also, it can be issued in respect of the previously issued invoice. The Credit note will reduce the amount the buyer has to pay. A credit note contains the references of the original Invoice and sometimes it may state the reason for the

Similarly, the supplier can send a credit note to his customer, if the goods are incomplete, not in good condition, or not as per specification. A Customer may receive a credit note from his supplier, if the customer paid too much money, or had been overcharged.

Credit Note under GST

1. You need to issue a credit note if the tax invoice has been issued earlier against material returned back by the customer. A Tax Invoice shall meet the requirements of Section 31(1) of CGST Act/State GST Act for the supply of goods and under Section 31(2) for the supply of services subject to Rule 1 of Invoice Rules. The invoice has to be issued by a registered supplier for supplies to Registered/Unregistered customers.

2. The Taxpayer/supplier can issue Credit Notes under Section 34(1) to the recipient in the below situations. Also, the credit note issuer must have valid GST registration.

i) Taxable value or tax in the GST Invoice is excess

ii) Supplier receives the goods back from the customer.

iii) Goods or services or both supplied are found to be deficient. The Deficiency of the supply of goods or services is too opaque or vague a reason to justify. Sufficient documentary evidence has to be built up before such credit notes are allowed.

However, the

Further, as per section 34(2), a person who issues a credit note for a sales return shall declare the details of such credit note in the monthly return. Also, the tax liability should be adjusted accordingly.

Thus, if the recipient returns the goods against any tax invoice the supplier can reduce the tax liability by raising a credit note.

Rules of Credit note and Debit Note under GST

The Taxpayer needs to prepare credit notes and debit notes as per CGST Section 34. Similarly, one needs to follow the below CGST rules as per Chapter VI, Sr.no. 53, 1(A). However, if you do not have valid GST registration then you may ignore the below rules and prepare your debit note or credit as per accounting rules to serve the purpose.

Here is the list of rules that shall be applicable while preparing a Credit note or Debit note under GST.

(a) One must specify, the Name, address, and Goods and Services Tax Identification Number of the supplier.

(b)The Nature of the document i.e Debit note or credit note

(c)The document shall have a consecutive serial number not exceeding sixteen characters. This can be in one or multiple series. Similarly, it may contain alphabets or numerals or special characters-hyphen or dash and slash symbolized as “-” and “/” respectively. Also, any combination thereof, unique for a financial year can be included.

(d)The date of issue of the document

(e)One must specify the name, address & Goods and Services Tax Identification Number, or Unique Identity Number of the recipient. No need to specify this information if the recipient is UN-registered

(f)Name and address of the recipient and the address of delivery, along with the name of State and its code.

(g)A serial number(s) and date(s) of the corresponding tax invoice(s) or, as the case may be, the

(h)A value of taxable supply of goods or services, rate of tax(GST), and the amount of the tax credited or, as the case may be, debited to the recipient.

(i)A debit note/credit note must have the signature or digital signature of the supplier or his authorized representative.

Credit/Debit Note Treatment in GST

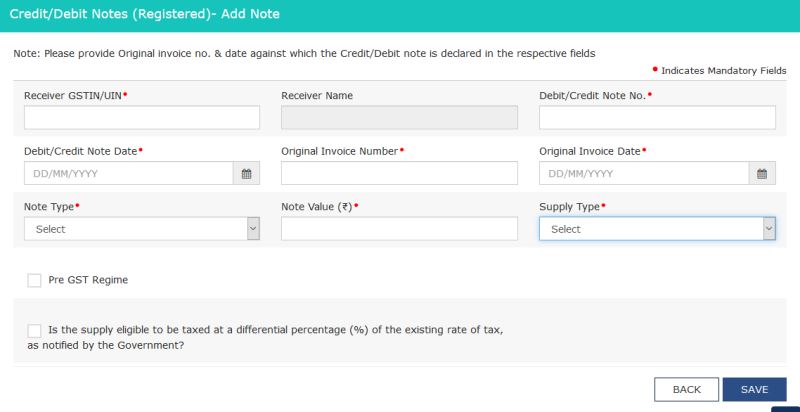

The taxpayer needs to show the entries of credit/debit notes raised by him in GSTR1 & GSTR 3B Returns. In order to show the details of the Credit/debit note in GSTR 1, follow the below steps.

- Open the Tile “9B – Credit / Debit Notes (Registered)“. Select this option only if the supplies were made under B2B transactions. Otherwise, select “9B – Credit / Debit Notes (Unregistered)” if either is not registered in GST for B2C transactions only.

- Click on Add Details

- Provide the details of Credit note or Debit note.

- Click to save the Entry.

Follow the below steps to show the entries in GSTR 3B Return

- Since GSTR 3B is a summary return, you can adjust the turnover by deducting the credit note entries(sales Return).

- Similarly, you need to increase the turnover if you raise a debit note(purchase return) in GSTR 3B.

Note: The debit/credit note raised beside sales/purchase returns shall be also be counted as a part of turnover in GSTR 3B.

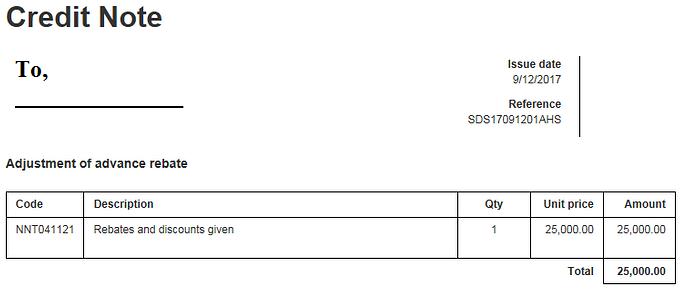

Credit note format in Excel

You can now download credit notes in excel format to use them under GST. This credit note in excel format is prepared as per GST rules. Therefore, you can directly use it without any need for modification.

However, this credit note template does not have the right protection, so you can modify it further, if necessary. Thus you can use these formats to issue general credit notes rather than only GST credit notes. We have customized these formats at CGST/SGST Level, IGST level, Item level, etc. Thus, you can click on the below button to download these various formats to suit your needs.

| Regular (General Purpose) | Download |

| CGST + IGST Breakup | Download |

| IGST wise Breakup | Download |

| Item Level wise | Download |

Credit note format in word

| Regular (General Purpose) | Download |

| CGST + IGST Breakup | Download |

| IGST wise Breakup | Download |

| Item Level wise | Download |

You can easily create the above Excel formats into Word format. Here is how to do it. Download the above excel format, customize them as per your need, if necessary.

How to do credit note entry in Tally

You can enter a Credit Note in voucher or Invoice mode in tally. You need to enable the feature in F11: Accounting or Inventory features in Tally.

● To use credit notes in Voucher mode you need to enable the feature in F11: Accounting Features – Use debit and credit notes.

● To make the entry in Invoice mode enable the option F11: Accounting Features – Record credit notes in invoice mode.

How To go to Credit Note Entry Screen?

- Go to Gateway of Tally > Accounting Vouchers.

- Click on Ctrl+F8: Credit Note on the Button Bar or press Ctrl+F8.

You can toggle between voucher and Invoice mode by clicking Ctrl+V on the voucher creation screen.

You can now Pass an entry for goods sold returned from Customer X:

When to issue a credit note?

A Credit or a debit note serves the purpose of accounting adjustment to settle the correct amount of value and tax for any invoice already issued in the same or earlier period. GSTR 1 is to capture information of all debit/credit note(s) issued by a registered person.

What is a Debit note?

According to Wikipedia, a debit note is a commercial document issued by the buyer or receiver of goods or services or both. Thus a buyer issues a debit note to a seller. By raising a debit note, the buyer debits the ledger of a supplier with him. Most of the time a buyer raises a debit note to make purchase returns to the supplier of goods.

Further, the seller also may issue a debit to a seller of goods or services, in

Debit notes are generally used in business-to-business transactions(B2B).

What is a debit note under GST?

Debit note under GST has a similar meaning as like General accounting Debit note. However, one must consider some rules while preparing a debit note debit under. Therefore, if a debit note is not prepared as per GST rules and it will not be a valid debit note. Therefore, the

Further, you must report debit note entries in GST returns. Thus GST is payable on the debit note, which you may be raising on your supplier besides purchase returns. However, in case of purchase returns the supplier shall book credit notes in his system. On the other hand, the receiver shall book debit in his system.

In order to nullify both debit note and credit note transactions both parties shall report these transactions in GST returns.

Debit note format in excel

| Regular (General Purpose) | Download |

| CGST + IGST Breakup | Download |

| IGST wise Breakup | Download |

| Item Level wise | Download |

Debit note format in word

| Regular (General Purpose) | Download |

| CGST + IGST Breakup | Download |

| IGST wise Breakup | Download |

| Item Level wise | Download |

How to do debit note entry in tally

Here are the simple steps to pass debit note entry in tally ERP.

You must enable the option to use the debit note in tally, if already not enabled. See below how to enable it.

- Go to Gateway of Tally, press F11 – Shortcut for Company Features

- Select, Accounting Features.

- Under Invoicing Option, set the option Use debit/credit notes to YES.

- Set YES for: Use invoice mode for debit notes

Steps to Pass a debit note entry in Tally.ERP9:

- Go to “Accounting Vouchers” from Gateway of Tally.ERP 9

- Select debit note from the left-hand bar or press CTRL + F9.

- Start Entering the details of the debit note.

- Click yes after passing the entry for saving the entry you made.

Debit note Examples under GST

- One can issue a debit note when the taxable value in the Original invoice is less than the actual taxable value.

- Tax on the invoice is erroneously put as less th

a n that of actual tax payable.

When to issue Debit Note

As per Section 34(3) of CGST Act 2017- a Debit note may be issued by the registered person who has supplied goods or services to the recipient where:

- Taxable value or tax charged on the tax invoice issued is found to be less than the taxable value or tax payable.

- The detail of Debit note shall be declared in the return for the month during which debit note is issued and tax liability shall be adjusted accordingly.

- The debit note shall include a supplementary invoice subject to Rule 6 of Revised Invoice Rules 2017. Be careful to mention all the particulars as prescribed in this Rule on all the Credit Notes or Debit Notes. These are mandatory particulars and no deviation should be done.

Credit Note vs Debit Note

Credit note and Debit are both like two sides of one coin. They play different roles for your business. Therefore, distinguishing them both is very important. One must understand them very clearly to make them usable.

On one hand, you may issue credit notes when you want to give credit to your supplier or customer. Whereas, on the other hand, you can issue a debit note if you want to debit your supplier or customer account in your books.

You are owing to your party when you issue a credit note. In other words, are crediting your party’s accounting ledger with the specific amount mentioned on the credit note.

Whereas you are liable to pay or deduct your party’s accounting ledger with the debit note amount.

Goods Supplied in the Pre-GST period – returned in post GST period

(a) When such goods are returned on or after 01.07.2017 but on or before 31.12.2017, a refund of tax so paid can be applied by the registered supplier under the old law.

(b) When such goods are returned after 31.12.2017, no refund of tax so paid shall be given to the supplier under the old law. [Refer Section 142 (1) of the CGST Act.

Does a taxpayer need to report the credit/debit notes to the consumer separately?

No. In case of supplies to consumers are to be reported in a consolidated manner (intra-state supplies to consumers and inter-state supplies of invoice value less than INR 2.5 lakhs), the credit/debit notes are not required to be reported separately. Such supplies have to be reported in a consolidated manner net off the values of credit and debit notes.

Credit/debit note from unregistered supplier

How will the credit/debit note from unregistered suppliers be reported to GSTN and ITC claimed in the same?

Like invoices, credit/debit notes on behalf of unregistered persons will be given by registered persons only. Therefore, a registered person shall raise the debit/credit note on the unregistered supplier and report it in GSTR 1 return and GSTR 3b.

Latest Update on Credit/Debit Note

17.09.2020: Now, the taxpayer need not require to enter the invoice details while entering the debit/credit note in GSTR 1. Thus, the taxpayer can enter a single debit/credit note against multiple invoices. However, One has to enter note supply types as Regular, SEZ, DE, Export, etc.

Similarly, now the taxpayer can enter the details of these types of notes even without taxable value. However, it is applicable only if such notes are issued for the difference in the tax rate. Also, these changes are applicable to the amendment of Credit/debit notes.

Further, the above changes are applicable to the refund module also. Therefore, the applicant can now report credit notes or debit notes in application statements without mentioning the related invoice number. However, the taxpayer must select the document type from a drop-down list of invoices/debit notes/ credit notes.

Invoice of November 2018-19. Can I issue a debit note against this invoice in FY 2020-2021 on GST portal? because client hold my payment of this invoice of FY18-19 . Please solve my query.

Hi, Your concept is not related to debit/credit note. Notes should be issued to adjust taxes/prices/material return. Therefore, if the amount is huge you should go legal.

However, if the client has not paid to you within 180 days, then he can not avail the itc as per the cgst rules. if he availed also , he must reverse it with interest now. For future shipments i would suggest you to take blank cheque from the customers on whom you doubt of payment receipt before making shipment. I hope this helps

regards