What is GSTR 8 Return and Who needs to file it?

GSTR 8 Return is a statement of Tax collection at source (TCS). However, form GSTR 8 is meant for eCommerce operators registered under GST. Thus, it contains the details of taxable outward supplies made by such eCommerce operators.

For instance, it includes the details of supplies made by other suppliers through these eCommerce operators. Also, besides details of taxable supplies, it includes the amount of consideration collected by such e-commerce operators through such activities. Therefore, by going through this article you will come to know what is GSTR 8 Return Online filing Procedure on GST portal.

According to the GST law Form GSTR 8 is to be filed by:

- Every E-commerce Operator who are registered under GST laws.

- Such type of eCommerce operators needs to file GSTR 8, who are required to collect TCS on outward supplies of goods and services.

- Transactions which are effected through the e-commerce Portal made by taxable persons registered with it needs to file GSTR 8 Return.

Is it compulsory to file GSTR 8 Return

Filing of GSTR 8 for every period is not compulsory. E-commerce operators need to file compulsory GSTR 8 for a tax period only in the following situations:

- They collect any TDS amount during such period

- They have to amend any details of previous return filed by themselves.

- In case of any details rejected by the supplier of table 4 for the said period.

How to discharge/pay TCS liability?

One can discharge TCS liability through electronic cash ledger only.

How do I offset my liabilities while filing GSTR 8?

You can offset your liabilities by clicking on the 6, 7. Tile( Payment of Tax). On one hand, if your Electronic Cash Ledger is having less amount than that of your liability than you need to deposit additional cash. On the other hand, to deposit more cash in your electronic cash ledger you can create challan and pay it through internet banking.

If you have more cash than that of your liability in your electronic cash ledger than you need not have to deposit more cash.

When to file GSTR 8 Return and when its last date

The due date for filing a GSTR-8 return for a particular tax period is the 10th day of the succeeding month. However, The government may change this date by issuing a notification in this regard. Please see our GSTR 8 Return Online filing Procedure steps to file your GST return before the last date.

What is the late fee for GSTR 8 Return?

At present, there is no late fee for the filing of form GSTR-8 beyond the due date. However, interest will be applicable in case of delay in paying TCS liability beyond the due date.

How to Amend TCS details in Table 4

The taxpayer cannot amend details of TCS in table 4 of Form GSTR 8 once the counterparty accepts the said details. Also, taxpayers cannot modify the TCS details the second time.

Therefore, amendment of TCS details in Table 4 is allowable only once in case original TCS details has not been accepted by the supplier in TDS/TCS credit table. Also, if the same has been rejected by the supplier. After the amendment, these details will go back to the supplier.

Once the supplier accepts the TCS details, then E-commerce Operator’s can make any changes from his end.

How to Download GSTR 8 pdf format

You may download the pdf format of GSTR 8 for offline use by clicking on this link. Please note that this format is only for reference purpose and you cannot file it online or offline.

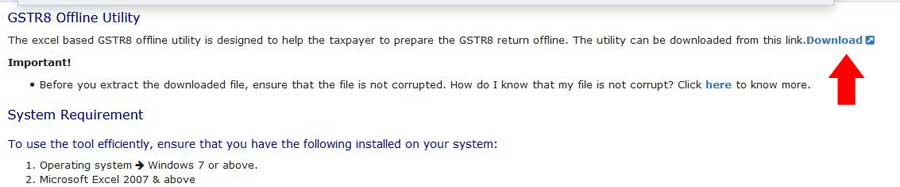

How to Download GSTR 8 Excel format or offline utility

1.To Download Visit www.gst.gov.in

2. Go to Downloads > Offline tools > GSTR 8 Offline tool > Click Download button

3. Extract the downloaded folder.

4. Open the extracted GSTR_8_Offline_Utility.xlsm file

Various Tables of GSTR 8

There are three Tables of GSTR-8 return namely 3 TCS, 4 Amend and Suppliers Master.

What are the features of GSTR 8 offline Excel tool

The Offline tool has following features in ‘Home’

- Open Downloaded GSTR8 JSON File: This option is to import records from a downloaded JSON file. Once the import file is successful the details would be populated to respective table wise worksheets.

- Generate JSON File to Upload: This option is to generate JSON file to upload GSTR-8 return details prepared by using offline on GST portal.

- Open downloaded error JSON file: Similarly, This option is to open a file downloaded from the GST portal from the ‘Processed with error’ link.

The downloaded zipped folder contains two JSON files. You need to Unzip the file and use this button to open both the JSON files together in a single click by selecting both the files.

However, after successful import of both the files with both the details processed with errors and successfully will be populated to respective table wise worksheets.

- Get Summary: This option will generate an aggregate summary of every sheet.

Offline excel tool has following features in ‘3.TCS and 4.Amend’ sheets.

- Action: By using this feature, the records can either be added or deleted accordingly.

- Validate Sheet: This is useful to Validate the data entered in the respective worksheet of this offline excel Tool. Similarly, successful validation will be notified to Taxpayer via pop-up while on the failure of validation the cells that fail validation will be marked in Red color.

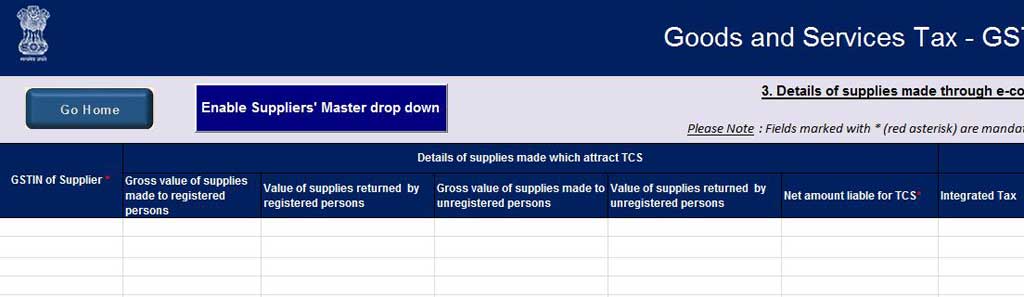

- Enable suppliers’ Master drop down: Supplier master drop down facility will be available in ‘GSTIN of Deductee’ field, GSTIN of deductee. This can be selected from the drop-down list.

Disable suppliers’ Master drop down: This option facilitates to Add GSTIN manually or copy and paste the details from any other source.

The process flow of GSTR-8 return by using offline excel tool :

- First Validate the details populated in each sheet using ‘validate’ button option.

- After that, Generate JSON using ‘Generate JSON File to Upload’ option

- Finally, Upload the generated JSON on GST Portal.

How to fill GSTR 8 tables by using the offline utility in Excel

a)Table 3TCS: Details of supplies made through e-commerce operator (TCS).

Here you need to enter details like The total gross value of outward supplies made to the registered and unregistered person. Similarly, the gross value of supplies returned by the unregistered and registered receiver.

Further, you need to enter the Net amount liable for TCS, Integrated tax or Central tax and State/UT tax as applicable. Similarly, you may add or delete entries but if you delete the entries then it will delete the entries from JSON file also.

b)Table 4 Amend:

Here you need to enter the original financial year, original tax period and GSTIN of supplier for which tax is collected in the earlier return period. Also, you need to enter the Gross value of outward supplies made to the registered and unregistered person. The gross value of supplies returned by the registered and unregistered receiver.

Further, you also need to enter net amount liable for TCS, Integrated tax or Enter Central tax and Enter State/UT tax. Similarly, you will Add or Delete Action for adding or deleting the records.

If you select Action as a ‘Delete’ then the system will remove those entries from the GST portal after uploading the JSON file.

c)Supplier Master Table:

Enter here Supplier’s GSTIN, the Legal name of the supplier (this field is not mandatory) and the Legal name of the supplier (this field is not mandatory). Learn what is GSTR 8 Return Online filing Procedure on gst portal through our below step by step guide.

Offline Filing Instructions

- Filing of GSTR 8 return can take place only on GST portal, which means you can only generate JSON file in offline mode.

- One needs to do Remaining activities like making payment and offset liability only on GST portal.

- you can not enter a negative value in the offline utility

- you may enter decimal values but the value will be round off.

- Also, One can not enter multiple GSTIN in a single row.

- The offline utility works best on Windows 7 and on higher versions.

- One can not use this offline utility on a mobile phone. You need to use a desktop or laptop pc only.

- Do not change the extension name of JSON file which generates after clicking on generate JSON button.

Click to see a Video of GSTR 8 Return Filing with offline excel tool for more instructions and details.

How to file GSTR 8 Return Online on GST Portal

Here we explain GSTR 8 Return Online filing Procedure on GST portal. After going through these steps you will able to file your GSTR 8 return with ease.

ECommerce operators with less than or equal to 500 entries per table can use this online facility for filing GSTR 8. However, Where the entries are more than 500 than you need to use the above offline excel utility.

Here is the step by step guide on GSTR 8 Return Online filing Procedure.

1. Visit www.gst.gov.in URL in your browser.

2. Login to the GST Portal with your username and password.

3. Click on the Services tab> Returns > Returns Dashboard command.

4. The File Returns page will flash on the screen. Select the Financial Year & Return Filing Period (Month) for which you want to file the GSTR 8 return.

5. Click on the SEARCH button.

6. The File Returns page will come to the screen.

7. Before Proceeding, please read the important message in the box carefully.

8. In the GSTR-8 tile, click the PREPARE ONLINE button to enter the details manually on GST portal.

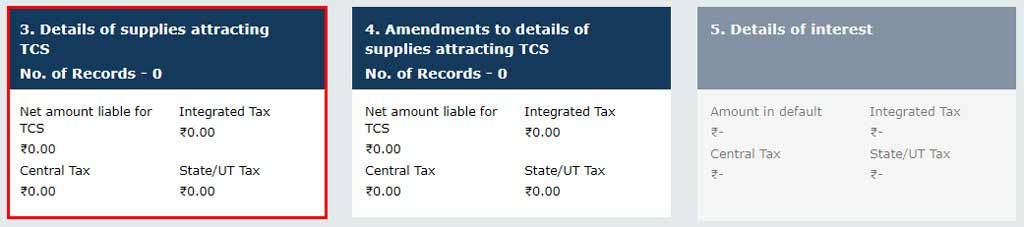

9. Enter the details in various tiles same as in the offline utility.

10. After entering all the details, click the PREVIEW DRAFT GSTR8 button. This action will download the draft Summary page of Form GSTR-8 for your review.

We recommended that you download this Summary page and review the summary of entries made in different sections carefully. Further, the PDF file which generates will bear watermark of the draft before you File the GSTR 8 return.

11. Once you are sure about the correctness of all details, Click the PROCEED TO FILE button.

12. Once the status of Form GSTR-8 return is Ready to File, 5. Details of Interest and 6, 7. Payment of Tax tile will get enabled.

13. Finally, offset the liabilities as said above and file your GSTR 8 Return by using DSC or EVC.