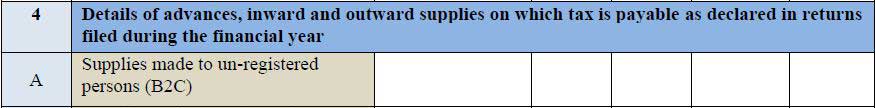

Here you can read what details are to be entered in table 4a, table 4b, table 4c, table 4d, table 4e of GSTR 9 annual return, and more. Also, this will help you to understand the correct details to be filled in these tables. Further, the below list includes complete details of table 4 of GSTR 9 annual return and its sub-tables only.

Table 4A

In table 4a of GSTR 9, the aggregate value of supplies made to consumers and unregistered persons on which tax has been paid shall be declared. These include details of supplies made through E-Commerce operators. Also, this has to be declared as net of credit notes or debit notes issued in this regard.

Advertisement

Further, Table 5, and Table 7 along with particular amendments in Table 9 and Table 10 of FORM GSTR-1 Return may be used for filling up these details.

Table 4B

In table 4b Taxpayer needs to enter the aggregate value of supplies made to registered persons on which tax has been paid. At the same time, these will include supplies made by E-Commerce operators. On the other hand, these will not include supplies on which tax is to be paid by the recipient on the reverse charge basis under the existing law.

Further, details of debit and credit notes are to be mentioned separately in GSTR 9. One can take the data from table 4A and Table 4C of FORM GSTR-1 for filling up these details.

Table 4C

In table 4C, the Taxpayer needs to enter the aggregate value of exports (except supplies to SEZs) on which tax has been paid. Also, table 6A of FORM GSTR-1 may be used for filling up these details.

Table 4D

Table 4D is to enter the aggregate value of supplies to SEZs on which tax has been paid shall be declared here. One can take the data from table 6B of GSTR-1 may be used for filling up these details.

Table 4E

Table 4E is to enter the aggregate value of supplies in the nature of deemed exports on which tax has been paid. Also, table 6C of FORM GSTR-1 may be used for filling up these details.

Table 4F

Here the taxpayer needs to enter the details of all unadjusted advances. Unadjusted advance means the advance which has been received and tax has been paid but the invoice has not been issued in the current year. Similarly, table 11A of FORM GSTR-1 may be used for filling up these details.

Table 4G

In table 4G, you need to enter the Aggregate value of all inward supplies on which tax is to be paid by the recipient on a reverse charge basis. This is including advances and net of credit and debit notes.

Further, this shall include supplies received from registered persons and unregistered persons on which tax is levied on a reverse charge basis. Also, this shall include the aggregate value of all imports of services. For filling these, table 3.1(d) of FORM GSTR-3B may be used.

Table 4I

In table 4I, you need to enter the aggregate value of credit notes issued in respect of B to B supplies (4B), exports (4C), supplies to SEZs (4D), and deemed exports (4E). Similarly, table 9B of FORM GSTR-1 may be used for filling up these details.

Table 4J

The Aggregate value of debit notes issued in respect of B to B supplies (4B), exports (4C), supplies to SEZs (4D), and deemed exports (4E) shall be declared here. Further, table 9B of FORM GSTR-1 may be used for filling up these details.

Table 4K & 4L

Here you need to enter the details of amendments made to B to B supplies (4B). Besides this exports (4C), supplies to SEZs (4D) and deemed exports (4E), credit notes (4I), debit notes (4J), and refund vouchers shall be declared.

One may use data from table 9A and Table 9C of FORM GSTR-1 for filling up these details.

Also, you may read: