What is E way bill for Citizens ?

If the person carrying the goods on behalf of supplier or receiver then he needs to obtain e way bill from these parties. Secondly, if the person is moving the goods for his own consumption then also he may get an e way bill from the above parties. Alternatively he himself can enroll and log in on the e way bill portal as the citizen and generate the e-way bill for movement of these goods.

How to Register online for Generating E Way Bill for Citizens?

Here is the step by step guide to register online for Generating E way Bill for citizens.

1) Visit https://ewaybillgst.gov.in E way bill portal

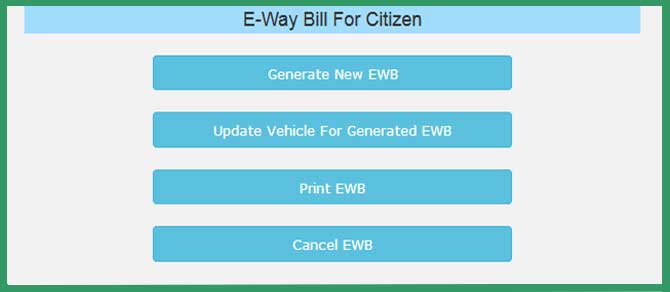

2) Click on “E Way bill for Citizens” as shown below

3) Click on “Generate New EWB” Button

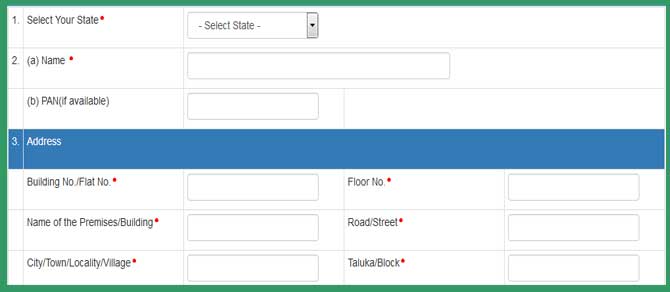

4) Now you will see “Application for Enrollment of Citizens ” Window. Enter all the required details in the below form.

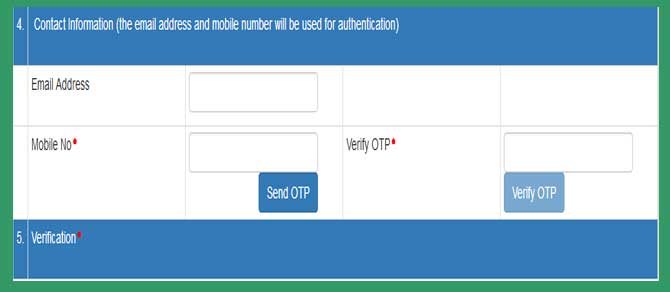

5) Thereafter fill in ” Contact Information (the email address and mobile number will be used for authentication)” details.

6) After Entering mobile number click on verity OTP. you will receive OTP on the given number. Enter the OTP received in the verify OTP field and click on verity OTP Button.

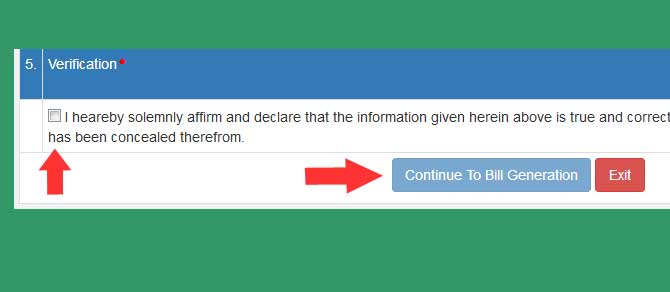

7) Click to accept the declaration for the information entered above. Click on “Continue to Bill Generation” Button to Generate New E way bill for Citizens .

8) Finish. You may click on below link to generate new e way bill process.

E way bill for citizens option is very useful when the supplier does not issue e way bill. This facility enables any citizen of India to generate e way bill by going on e way bill portal. Also, There is no advance registration required to generate e way bill for citizen. Registration can be done at the time of generating e way bill itself.

However, it is true that is an additional burden on the citizen, in case the supplier does not issue e way bill. Therefore the person carrying any material, whose value is more than 50,000 thousand rupees shall ask for e way bill from the supplier.