Learn How to Generate e way Bill in GST Portal. This is a simple guide explaining e way bill generation process to print an e way bill generated on the E way bill portal. After reading this you will learn how to generate bulk e way bill by using the offline tool. Also, you will read the e way bill applicability under GST in India. On the other hand, e way bill for job work is also part of this page.

Index

- Requirements > When Require > Applicability

- E way bill Parts

- Multiple Invoicing

- Online Generation Process

- FAQ

Introduction

The GST e-way bill is an electronic document required for the movement of goods worth over Rs. 50,000 within a state or between states in India. It was introduced as part of the Goods and Services Tax (GST) regime to facilitate the seamless movement of goods and to prevent tax evasion.

Key points about the GST e-way bill system:

- Applicability: The e-way bill is required for the movement of goods in a vehicle, by road, air, or ship. It applies to both inter-state and intra-state movement of goods.

- Generation: The e-way bill can be generated online through the official portal (ewaybillgst.gov.in) or through SMS. It requires details such as invoice number, value of goods, vehicle number, etc.

- Validity: The validity of an e-way bill depends on the distance that the goods are expected to travel. For a distance of fewer than 100 km, the e-way bill is valid for a day. For every additional 100 km or part thereof, it is valid for an additional day.

- Exemptions: There are certain exceptions to the requirement of e-way bills, such as goods transported by a non-motorized conveyance, specified goods transported by a carrier, etc.

- Enforcement: The e-way bill system is enforced by tax authorities to ensure compliance with GST regulations. Non-compliance can lead to penalties and seizure of goods.

- Cancellation and Updating: E-way bills can be cancelled within 24 hours of generation. They can also be updated with changes such as vehicle number or transporter details.

- Monitoring: Tax authorities can monitor the movement of goods in real-time through the e-way bill system, which helps in preventing tax evasion and ensuring the proper documentation of goods movement.

Overall, the e-way bill system under GST has streamlined the process of transporting goods and has increased transparency in the movement of goods across India.

Requirements to Generate e waybill

It is necessary that the person shall be registered on the common portal http://ewaybill.nic.in to generate e way bill on e way portal before generating e way bill.

Further, the documents required to generate e way bill are like Invoice, Bill of sale, Delivery challan and Transporter ID who is transporting the goods with transport document number or the vehicle number in which the goods are transported. These are the basic requirements to generate e waybill on the common portal.

When e way bill is required?

The government has made mandatory eway bill applicability for inter-state movement of goods from 01st April 2018. Therefore trader is required to generate e way bill when he wants to send the material outside the state.

For the Intra-state movement i.e within the state, the government said that it will get implemented in a phased manner. The dates of such implementation will be informed before June end.

Who should generate the e way bill and why?

E-way bill is to be generated by the consignor or consignee himself if the transportation is being done in own/hired conveyance or by railways by air or by Vessel.

If the goods are handed over to a transporter for transportation by road, then the transporter should generate E way bill.

Where neither the consignor nor consignee generates e way bill and the value of goods is more than Rs.50,000/- it shall be the responsibility of the transporter to generate it.

Further, it has been provided that where goods are sent by a principal located in one State to a job worker located in any other State, the e way bill shall be generated by the principal irrespective of the value of the consignment.

The details of e-way bill generated shall be made available to the recipient, if registered, on the common portal, who shall communicate his acceptance or rejection of the consignment covered by the e-way bill.

In case, the recipient does not communicate his acceptance or rejection within seventy-two hours of the details being made available to him on the common portal, it shall be deemed that he has accepted the said details.

E way bill applicability

Taxpayers are required to generate e way bills only if below conditions are met.

- E way bill generation is mandatory from 01st April 2018.

- One must register on E way bill portal to generate e way bill > https://ewaybillgst.gov.in

- E way bill is required to be generated only when consignment value is more or equal to Rs. 50,000/-.

This amount is the total invoice amount inclusive of the Tax amount. - No need to generate e way bill for exempted goods. Click to know here

- No e waybill is required to be generated if the value of the consignment is less then Rs. 50,000/-

- No e waybill is required to be generated even if the total value of such consignments is more then Rs. 50,000/- in a single conveyance(one vehicle). For eg. You have raised 5 invoices of Rs. 20,000/- each. Therefore your total value of all consignment will become Rs. 100,000/-. Now if you ship all these 5 consignments in one vehicle, then there is no need to generate e waybill.

- In case the movement of goods is done for job work, then the principal supplier or registered job worker has to generate e waybill.

- The supplier can authorize the transporter, courier agency or e-commerce operator to fill Par A of e way bill on his behalf.

- If the business of the place of supplier and place of business of transporter is less then 50km then part B of the e way bill is not necessary to fill up.

- The validity of e way bill is one day, up to 100km. For every 100km, it is an additional one day.

E way bill Parts

An E way bill contains two parts- Part A & Part B

Part A to be furnished by the person who is causing movement of goods of consignment value exceeding Rs.50,000/- and part B (transport details) to be furnished by the person who is transporting the goods.

Where the goods are transported by a registered person-whether as consignor or recipient, the said person shall have to generate the e way bill by furnishing information in part B on the GST common portal.

E way bill for multiple Invoices

- The registered person shall generate multiple e way bill for multiple invoices.

- The person can not generate a single e way bill for multiple invoices.

- The transporter can generate a consolidated e way bill of multiple e way bills generated by the registered person.

E way bill generation process

THE Online E way bill generation process is very easy. we have explained here detailed steps to generate e way bill. As you know every movement of goods whose consignment value is more than or equal to 50,000 INR must generate and carry e waybill.

If your invoice value or consignment value is less then 50,0000 INR then you may or may not generate e way bill. Thus, there is no issue if you generate e way bill where the consignment value is less then fifty thousand rupees.

Also, note that e waybill shall be generated only for the supply of goods movement and not for the supply of services. Please follow the below process to generate e way bill on GST e way bill Portal.

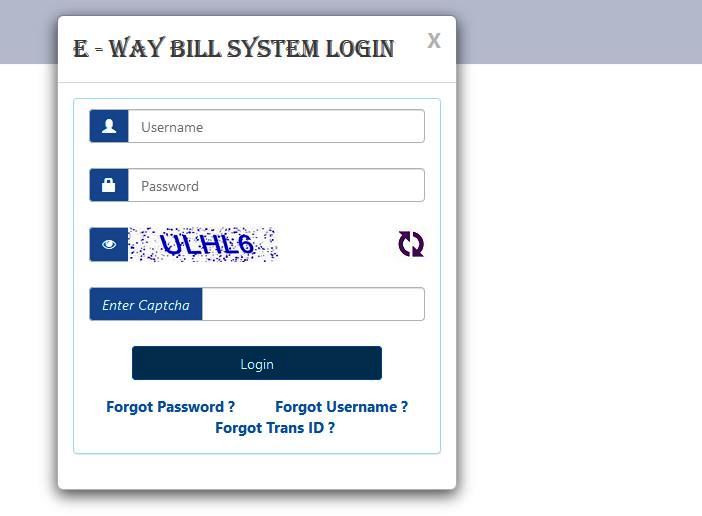

1. Log on to the portal

1] Open website

2] Similarly, enter the captcha code and click LOGIN.

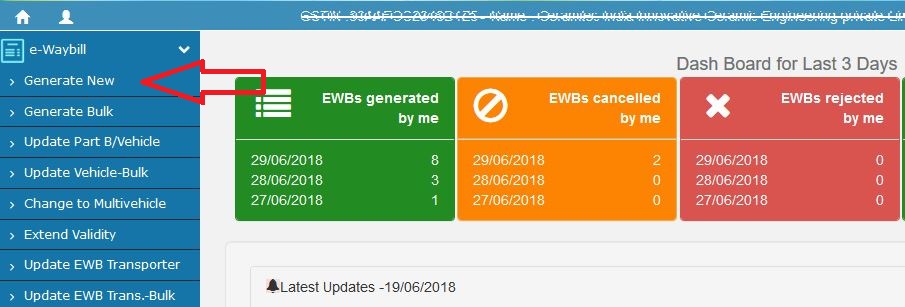

3] Once you log in the portal, click Eway Bill > Generate New on the top left-hand side.

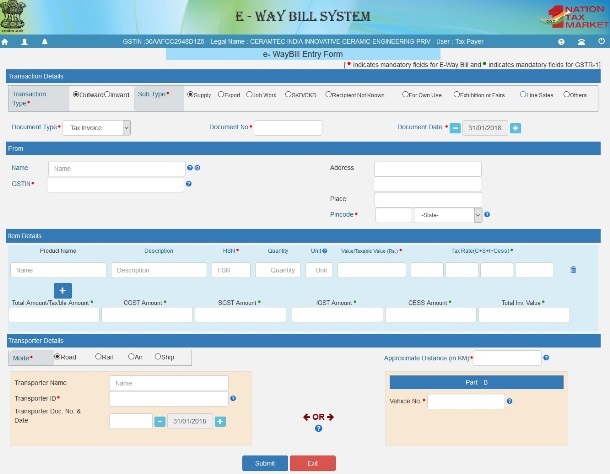

2. Transaction Types

1] Select Outward for Dispatch of Goods (Outward movement).

2] Select Inward for Inward of Goods.

3. Sub Types

1] First of all, Select Supply for Domestic Supply- Finished Goods Invoices, Raw material invoices, Scrap Invoices, Vendor rejection invoices, coil sale invoices, etc.

2] Select “Export” to generate e way bill for export purpose.

3] Secondly Select Job work if goods sent for job work. If you want to send some raw material or semi-finished goods for further processing you need to generate e way bill for job work purpose.

4. Select SKD/CKD option to generate e way bill for this purpose.

What is SKD OR CKD in e way bill ?. Well, the answer is SKD stands for Semi Knocked Down vehicle and CKD stands for the Completely Knocked Down vehicle. Therefore if your goods are in this condition, you can choose this option to generate e way bill.

5] Select the “” option if you do not know the recipient of the goods.

6] Third Select For Own use if goods moved between Intercompany branch offices in the same state/other states.

7] “

5. “Line Sales” option in the E way bill.

What is line sales on e way bill portal? Line sales are the sales when you don’t know the actual recipient at the time of taking out the goods from your go down. This includes a situation like a door to door sales.

Therefore you can move the goods on simple delivery Challan containing the details of goods, value, and tax involved. At the end of the day, you shall generate Tax invoice for such types of goods which are sold during the day and inward the remaining goods back to your store.

9] Finally Select Others for remaining situations when you can not choose from the above options.

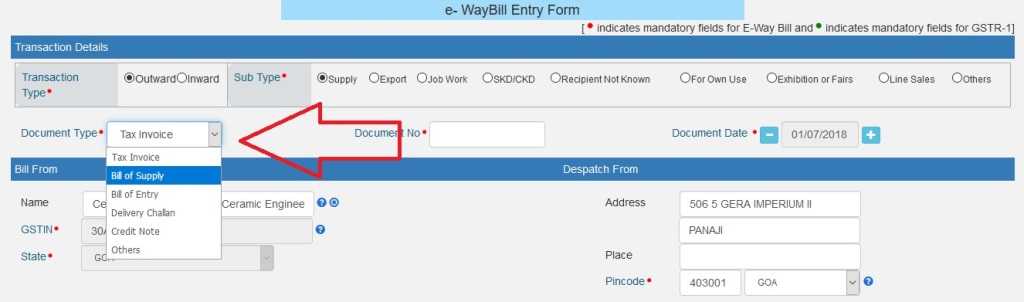

6. Document Type

1] Select “Tax Invoice” for Supply- Regular Invoices, Scrap Invoices, Vendor rejection invoices, etc.

2] “Bill of supply”. This option is for Composition dealers who do not generate tax invoices. Therefore they shall generate a bill of supply in lieu of tax invoice and generate e waybill on the basis of the bill of supply.

3] Bill of Entry option can be used when goods to be moved from custom house/ clearinghouse agent to your factory godown or premises.

4] Select “Delivery Challan” – When Goods are being sent for job work, issued to vendors and for other purposes.

5] “Others”. Choose this option if your situation is different from the above situations.

7. Document No. and Document Date

1] Enter the Invoice/ Challan No. and its date basis on the above documents.

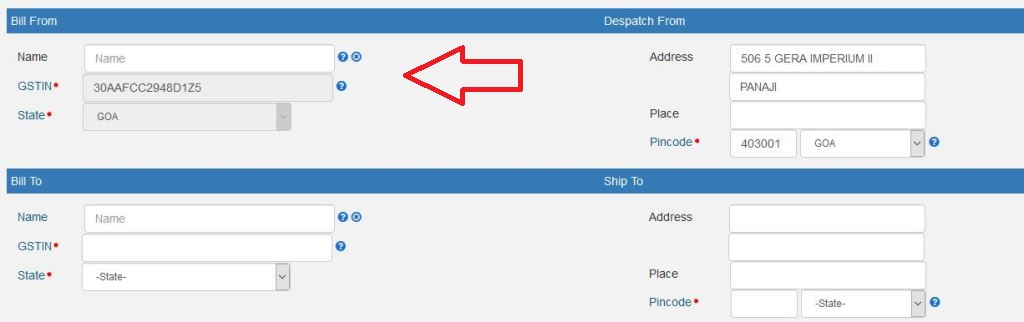

8. Bill From Details

1] In the case of Outward supply, From Details of the supplier should be entered.

2] Enter the details of the branch, if done from the branch.

3] In case of dispatch is from some other GST registered premises of supplier then Write the details of such place of business.

9. Dispatch From Details

1] Enter address details from where dispatch is taking place. There may be situations wherein your billing address is from a different place and the actual movement is taking from another place. Therefore you have the option here to enter an actual address from where goods are getting dispatched.

10. Bill To Details

1] If goods are being sent to GST registered person, enter his GST Number. The name and address will come automatically.

2] If goods are being sent to GST Unregistered person. Enter the name and address of the recipient (Mention URP in the GSTIN field if Consignee is Unregistered).

11. Ship To Details

1] Here now you have the option to enter ship to address if this is different from bill to address.

12. Item Details

1] Enter the item details, HSN Code, Quantity, Unit, Taxable Value, and Tax Rates(These details come from the Tax Invoice/ Challan).

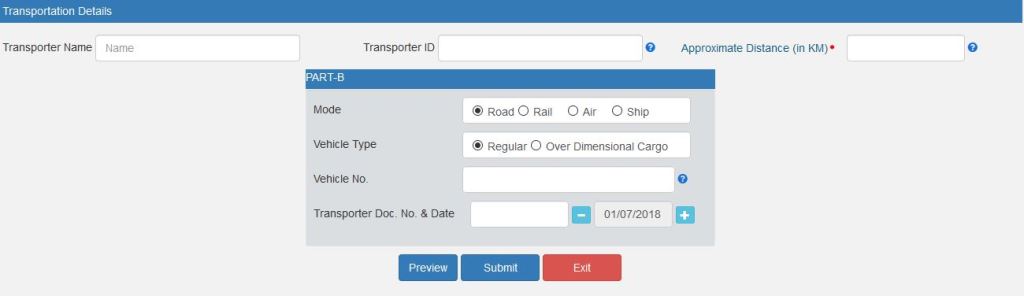

13. Transporter Details

1] Enter the mode of transportation- By road, rail, air or ship.

2] Furthermore enter the Transporter Name and Transporter GST No. or Transporter ID created by Transporter on the Eway Bill site.

3] Enter the Transport Document No. (GR No.) and Date.

4] Also Enter approx. distance in KMS (Based on this, the validity of the E way bill is determined).

5] Finally Enter Vehicle No. Note: The e Way Bill will not be valid for the movement of the goods without the vehicle entry in the e way bill form.

6]Click Submit.

14. The E way Bill print has been generated – Click Print at the end to take a print out of e waybill.

We hope now you can generate e way bill online with the help of these simple and easy steps. If you still face issues or need any sort of clarification, kindly leave your comment and we will try to resolve it.

Now Generate e way bill on GST portal through a simple process. In other words, make e way bill online easily with the help of this guide. Also, print e way bill for the smooth movement of goods from one place to another. Similarly, look at the below video to see the visuals of e way bill generation on the e way bill portal.

About E way bill for job work process

Every taxable person who is registered under GST shall generate an e way bill for sending goods for job work. Similarly, he must generate e way bill while receiving the goods back from job workers premises irrespective of consignment value.

Thus, if the job worker does not generate e way bill for sending goods back to the principal then the transporter has to generate e way bill for such consignment. This rule is applicable for supplies taking place within the state and inter-state supply.

Further, the E way bill must be generated by the principal where the handicraft goods are transported from one State or Union territory to another State or Union territory. This is applicable even a person is exempted from the requirement of obtaining registration under e way bill.

E Way bill Generation Answers

1. Enter the E way bill required details while making an Invoice or purchase entry.

2. Click on Export

3. Select for E way bill Generation option

4. Select type of File as JSON

5. Import the JSON file by choosing the bulk upload option on the E way bill portal.

6. Click to generate e way bill.

1. Go to e way bill portal > Login with your credentials

2. Click on Generate New

3. Select the supply type as “Exhibition or Fairs ” under transaction details.

4. Enter the details and Submit to generate e way bill

1. Select the supply type as option Inward/outward

2. Select the document type as “Delivery challan”

Please note that the delivery challan option is available for specific supply types only.

You can use E way bill for citizen option to generate e way bill without GST number.

The courier companies can use the consolidated e way bill generation facility.

what is HSN code for services (Pandal Shamiyana).

We have SAC code, but it is not applicable in eway bill

So can I use the HSN for the meterial for this purpose

Hi,

In my opinion, you can use 9963 SAC to generate e waybill. Besides this, you should also add the HSN of goods taken for pandal or shamiana.

regards