The GST effect on real estate in India can be seen from the date of its implementation. It is now more than one year of GST real estate and its impact of GST on the real estate sector. Thus, the GST on real estate in India plays a very important role in the construction sector.

Further GST on real estate purchase makes a huge difference for affordable house buyers and non-affordable housing communities. Similarly, the real estate under GST impacts the overall purchase of houses, commercial offices, and other business constructions.

What is affordable housing rule?

An affordable house under GST is a residential house/flat of carpet area of up to 90 sqm. The Residential house or flat must be located in non-metropolitan cities/towns.

The residential house/flat for metropolitan cities, the carpet area must be 60 sqm. Further the value of these residential houses or flat should be up to Rs. 45 lacs for both metropolitan and non-metropolitan cities.

GST in Real Estate for Affordable Housing

The 34th GST Council Meeting Clears Transition Process for Construction of houses. The 34th GST Council meeting held on 19th March 2019 at New Delhi to discuss GST on real estate in India. The council discussed how to implement the recommendations made in its 33rd meeting.

The council in its 33rd meeting recommended lowering the GST rate @1% for affordable houses and 5% for non-affordable construction of houses. Here is how to implement the transition process to apply the GST rate and Input tax credit.

| GST on Non-affordable(Premium) Housing project | Rate of Tax | GST on affordable housing projects | Rate of Tax |

| Till 31st March 2019 (With ITC) | 12% | Till 31st March 2019 (With ITC) | 8% |

| From 01st April 2019 (Without ITC) | 5% | From 01st April 2019 (Without ITC) | 1% |

Tax rates for ongoing housing projects

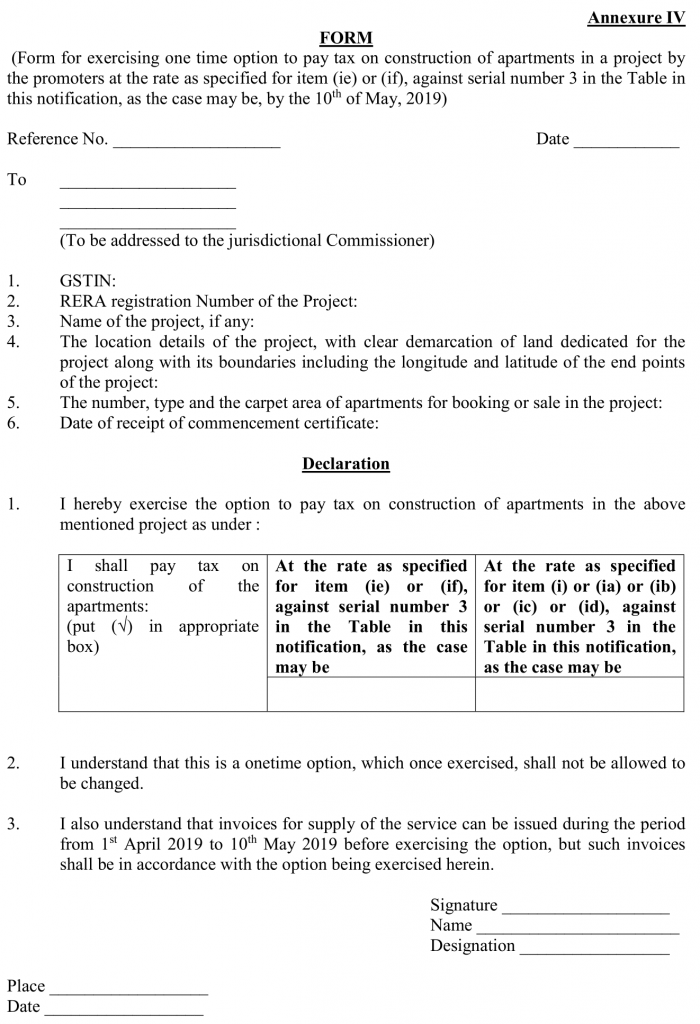

According to the GST council’s decision, promoters will get one time option to pay tax at the old rate. Thus, the GST rate of 8% and 12% will be applicable to avail ITC. The first condition is that the construction of such a building and its bookings must have started before 01.04.2019.

Secondly, the promoter shall opt for this option within a given time. However, the new tax rates will be applicable, if he fails to exercise this option before the end of such a time frame.

The last date is extended from 10th May to 20th May 2019 vide notification no. 10/2019-Central Tax ,dt. 11-05-2019.

To opt for old rates, the promoter shall apply the option in the below format and submit it to the jurisdiction commissioner manually before the above date.

GST Rates to New Construction Projects

The new GST rates will be applicable to new projects and on ongoing projects for the above options will be as follows:

GST Rate @ 1% without an Input tax credit: The new GST Rate@ 1% on the construction of affordable houses will be available for:

- To all houses which meet the definition of affordable houses.

- Affordable houses that get construct on ongoing projects under the existing central and state housing schemes are presently eligible for a concessional rate of 8% GST (after 1/3rd land abatement).

GST Rate @ 5% without an Input tax credit: The new GST Rate @5% will be applicable for construction of a house in below cases:

(a) All houses which are not affordable houses in ongoing projects whether booked prior to or after 01.04.2019. However, if the houses are booked prior to 01.04.2019, the new rate shall be available on installments payable on or after 01.04.2019.

(b) All houses which are not affordable houses in new projects.

(c) commercial apartments such as offices, shops, etc. in a residential real estate project (RREP), where the carpet area of commercial apartments is less than or equal to 15% of the total carpet area of all apartments.

Conditions for New GST Rates

The new tax rates shall be available subject to following conditions,-

- The input tax credit shall not be available

- 80% of inputs and input services (other than capital goods, TDR/ JDA, FSI, long term lease (premiums)) needs to be purchased from registered persons.

- 18% Tax shall be payable on the RCM basis if less than 80% inputs and input services purchased on the above items.

However, Tax on cement shall be payable @ 28% under RCM if purchased from the unregistered person. Further on capital goods, it is payable on the RCM basis as per existing rates.

Input Tax credit on ongoing projects

Here are the ITC transition guidelines for the real estate developers who are going to opt for New GST Rates from 01.04.2019.

The Ongoing projects of buildings where construction and booking started before 01.04.2019 but do not get complete before 31st March 2019 shall transition the ITC as per the below method.

The ITC transition formula approved by the GST Council for residential projects, taken to meet the percentage of construction ITC has been taken to reach ITC for the entire project from 01.04.2019.

Based on the percentage of flats booking and percentage of the invoice, ITC eligibility is determined.

In this way, the transition will be done on a pro-Rata basis on the basis of a simple formula, such as in the proportion of the booking of the flat and the invoices made for booked flats are available under certain safeguards.

A transition of ITC on mixed Projects

The mixed project transition will allow ITC on PRO-RATA basis in proportion to the commercial area of the commercial part of the ongoing projects (after which tax will be 12% with ITC after 12.2016).

Further, the GST council said the ITC rules will be amended to provide more clarity on the monthly and final determination of ITC in real estate projects and its reversal.

The change will clearly provide the process for availing the input tax credit in relation to commercial units so that builders will able to continue availing input tax credits in a mixed project.

Notifications for GST in Real Estate

Here is the list of GST notifications for GST on real estate 2019 issued in this regard. You can download these notifications in pdf format. Thus, it includes GST on real estate services notifications.

| CGST Notification No. 08/2019-Central Tax (Rate) ,dt. 29-03-2019 | To amend notification No. 1/2017- Central Tax (Rate |

| CGST Notification no. 07/2019-Central Tax (Rate) ,dt. 29-03-2019 | To notify certain services to be taxed under RCM under section 9(4) of the CGST Act as recommended by GST Council for real estate sector. |

| CGST Notification no. 06/2019-Central Tax (Rate) ,dt. 29-03-2019 | To notify a certain class of persons for the |

| CGST Notification No. 05/2019-Central Tax (Rate) ,dt. 29-03-2019 | Amendment of previous notification No. 13/2017- Central Tax (Rate). To specify services to be taxed under the Reverse Charge Mechanism (RCM) as recommended by |

| CGST Notification no. 04/2019-Central Tax (Rate) ,dt. 29-03-2019 | Amendment |

| CGST Notification no. 03/2019-Central Tax (Rate) ,dt. 29-03-2019 | Amendment of notification No. 11/2017- Central Tax (Rate). This is to notify CGST rates of various services as recommended by GST Council for real estate sector. |

GST on Real Estate updates

24.02.2019: On Sunday, the GST council said that the Real estate sector is among the largest revenue contributors to the national GDP.

Similarly, they provide employment opportunities to larger numbers of people in the country.

The Government aims to have “Housing for All by 2022”. Also, every citizen shall have a house and the urban areas shall be free of slums by this period.

There is information on the slowdown in the real estate sector and low purchase of under-construction houses by the people.

Therefore, in order to boost the residential segment of the real estate sector, GST Council recommends below suggestions in its 33rd GST Council meeting on 24.02.2019.

GST Rate on residential properties

The Council Recommends levying 5% GST without ITC on residential properties outside the affordable segment. This will be applicable from 01.04.2019

Metropolitan Cities for Real Estate

According to the GST law, Metropolitan Cities will be:

- Bengaluru

- Chennai

- Delhi NCR (limited to Delhi, Noida, Greater Noida Ghaziabad

- Gurgaon, Faridabad)

- Hyderabad

- Kolkata and Mumbai (the whole of MMR).

GST exemption on TDR/ JDA, long term lease (premium), FSI

According to the council meeting recommendations, Intermediate tax on development right, such as TDR, JDA, lease (premium), FSI will get exemption, only for such residential property on which GST is payable.

Further, the council said officers of the committee will work out the details of the scheme in due course of time . Thereafter, the GST council will approve them in the upcoming meetings.

Advantages of reduced GST

The new GST tax rate to be applicable from 01.04.2019 will have the following advantages on real estate:-

- The buyer of the house will get a fair price and affordable housing gets very attractive with GST @ 1%.

- The interest of the buyer/consumer will get protected. Also, ITC benefits not being passed to them shall become a non-issue.

- The cash flow issue for the real estate sector is addressed by the exemption of GST on development rights, long term lease (premium), FSI, etc.

- There will be better pricing due to the removal of unutilized ITC costs at the end of the project.

- Tax structure and tax compliance will become simple for builders.

Real Estate and composition scheme

According to Tax experts, composition schemes may look attractive. However, one needs to do a deep study to find whether a reduced GST rate of 5 percent is better or not.

This is because the GST council has put the condition that 5% is without the input tax benefit. Therefore, we need to see how GST on real estate transactions will impact the price of houses and other constructions.

Therefore, one has to see that, is it a better option of a standard rate of 12 percent with full input tax credit than that of 5%? without ITC.

However, Builders are still hoping that the government will allow an input tax credit on under-construction residential properties even after reducing the GST rate to five percent from 12%.

At present, GST is charged at an effective rate of 12 percent on premium housing. Similarly, the GST rate of eight percent is levied on affordable housing on payments made for under-construction property or ready-to-move-in flats. This is where completion certificate has not been issued at the time of sale.

Currently, GST is not charged on buyers of real estate properties for which completion certificate has been issued at the time of its sale.

GST on Construction of Residential Apartments

There are two types of residential apartments under GST for the real estate sector. The first one is affordable housing or residential apartment and the other one is non-affordable housing.

The GST rate on affordable housing is 1% without ITC on the total amount.

Whereas the GST rate on non-affordable housing is 5% without ITC on total amount or consideration. The GST rate on these houses or apartments is to be levied after the deduction of the value of the

The above rates are applicable from 01st April 2019 and are applicable to the

However, the promoter has the option to pay the taxes with old rates where projects started before 01.04.2019. Similarly, he can avail ITC on these old taxes paid. In case he chooses to pay with old rates then he must pass on the benefit of ITC availed to its buyers. Read top questions on GST for Real Estate in the year 2019.

The FAQ on Real Estate

The GST rate on affordable housing properties is 1% without ITC from 01.04.2019.

It is 5% Without ITC from 01.04.2019

Check out the above latest decisions of the 33rd Council meeting on GST Real estate.

yes its 5% & 1% without Input Tax credit.

It should meet the conditions of affordable housing as above.

Whether “under-construction houses” include the house being constructed on own plot through GST registered Contractor. Appointed a contractor to construct the building on my owned plot in April 2019, am I eligible to avail the benefit of GST rate of 5% (with or without ITC claim).

Hello Mr. Joshi

According to my opinion The new effective rates of 1% and 5% without ITC are applicable to the apartments booked by the land owner promoter in an ongoing project as well as a new project which commences on or after 01-04-2019. The land owner promoter shall be entitled to ITC in respect of tax charged to him by the developer promoter on construction of such apartments. However, the land owner promoter shall not be entitled to avail ITC on any other services or goods used by him.

I hope this is helpful..