What is a reverse charge mechanism in GST?. In General, the supplier of goods or services or both pays tax to the government. But there are some services or trade transactions where the government cannot ask the supplier to pay tax. For eg. in the case of exporters exporting goods or services from foreign countries to India. The Indian government cannot ask the exporting country to pay tax to sell the goods or services to India. Learn more about RCM under GST from the below sections.

Main Topics

- Meaning >>Types

- Self Invoicing >> List of Services >> List of Goods

- Class of Registered persons >> Latest updates >> History of RCM

- Capital Goods >> FAQ

Therefore Reverse charge means the liability to pay tax is on the recipient of the supply of goods or services instead of the supplier of such goods or services.

In other words, it is opposite the

Further, the GST Council has provided categories of supply of goods/services under tax shall be payable on the reverse charge basis. Such tax shall be payable by the recipient of such goods or services or both as per provisions of law.

As per the GST law if an UN-registered person supplies taxable goods or services or both to a registered taxable person, then the receiver of goods is liable to pay tax on such supplies.

On the other hand, whenever a registered person purchases goods or receives services from an unregistered supplier, he needs to pay GST on a

Self Invoice under GST

According to the CGST section 9(4), the registered person shall pay the tax on a reverse charge basis on receipt of goods or services received from the UN-registered person.

Further, as per section 31(3)(f), a registered person is liable to pay tax as per the above section, shall issue a self invoice for goods or services received. however, a consolidated invoice can be generated at the end of the month for such receipts.

You may download the RCM Invoice Format from this link. This Self Invoicing format can be used to raise a self invoice as per the above sections in GST.

Reverse Charge List of Services

The below type of services supplied by the supplier shall be paid by the recipient of services on a reverse charge basis. This complete list is applicable for RCM if the supplier and recipient are registered under GST.

However, if the recipient receives the services from an unregistered person then he shall follow the list of “Classes of Registered persons” for RCM applicability.

| Sl. No | Category of Supply of Services | Supplier of service | Recipient of Service |

| (1) | (2) | (3) | (4) |

A person located in a non-taxable territory

| 1 | Any service supplied by any person who is located in non-taxable territory to any person other than the non-taxable online recipient. | Applicable to any person located in a non-taxable territory | Any person located in the taxable territory other than the non-taxable online recipient |

Goods Transport Agency

| 2 | Supply of Services by a goods transport agency (GTA) in respect of transportation of goods by road to: (a) any factory registered under or governed by the Factories Act, 1948(63 of 1948); or (b) any society registered under the Societies Registration Act, 1860 (21 of 1860) or under any other law for the time being in force in any part of India; or (c) or any co-operative society established by or under any law; or (d) or any person registered under the Central Goods and Services Tax Act or the Integrated Goods and Services Tax Act or the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act; or (e) the anybody corporate established, by or under any law; or (f) they any partnership firm whether registered or not under any law including association of persons; or (g) any casual taxable person. | Goods Transport Agency (GTA) | (a) The any factory registered under or governed by the Factories Act, 1948(63 of 1948); or (b) any society registered under the Societies Registration Act, 1860 (21 of 1860) or under any other law for the time being in force in any part of India; or (c) any co-operative society established by or under any law; or (d) To be paid by any person registered under the Central Goods and Services Tax Act or the Integrated Goods and Services Tax Act or the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act; or (e) By anybody corporate established, by or under any law; or (f) By any partnership firm whether registered or not under any law including association of persons; or (g) any casual taxable person; located in the taxable territory. |

Individual advocate

| 3 | Services provided by an individual advocate including a senior advocate or firm of advocates by way of legal services, directly or indirectly.Explanation.-“legal service” means any service provided in relation to advice, consultancy or assistance in any branch of law, in any manner and includes representational services before any court, tribunal or authority | An individual advocate including a senior advocate or firm of advocates. | Any business entity located in the taxable territory. |

Arbitral Tribunal

| 4 | Services supplied by an arbitral tribunal to a business entity. | An arbitral tribunal. | Any business entity located in the taxable territory. |

Sponsorship services

| 5 | Services provided by way of sponsorship to any body corporate or partnership firm. | Any person | Any body corporate or partnership firm located in the taxable territory. |

Government Related Services

| 6 | Services supplied by the Central Government, State Government, Union territory or local authority to a business entity excluding, – (1) renting of immovable property, and (2) services specified below- (i) services by the Department of Posts by way of speed post, express parcel post, life insurance, and agency services provided to a person other than Central Government, State Government or Union territory or local authority; (ii) services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport; (iii) transport of goods or passengers. | Central Government, State Government, Union territory or local authority | Any business entity located in the taxable territory. |

Director or Body corporate

| 7 | Services supplied by a director of a company or a body corporate to the said company or the body corporate. | A director of a company or a body corporate | The company or a body corporate located in the taxable territory. |

Insurance Agent

| 8 | Services supplied by an insurance agent to any person carrying on insurance business. | An insurance agent | Any person carrying on insurance business, located in the taxable territory. |

Recovery agent

| 9 | Services supplied by a recovery agent to a banking company or a financial institution or a non-banking financial company. | A recovery agent | A banking company or a financial institution or a non-banking financial company, located in the taxable territory. |

Artist Related

| 10 | Supply of services by a music composer, photographer, artist, or the like by way of transfer or permitting the use or enjoyment of a copyright covered under clause (a) of sub-section (1) of section 13 of the Copyright Act, 1957 relating to original dramatic, musical or artistic works toa music company, producer or the like. | Music composer, photographer, artist, or the like | The music company, producer or the like, located in the taxable territory.” |

Author category

| 11 | Supply of services by an author, music composer, photographer, artist or the like by way of transfer or permitting the use or enjoyment of a copyright covered under clause (a) of sub-section (1) of section 13 of the Copyright Act, 1957 relating to original literary, dramatic, musical or artistic works to a publisher, music company, producer or the like. | Author or music composer, photographer, artist, or the like | Publisher, music company, producer, or the like, located in the taxable territory. |

Author II

| 12 | Supply of services by an author by way of transfer or permitting the use or enjoyment of a copyright covered under clause (a) of sub-section (1) of section 13 of the Copyright Act, 1957 relating to original literary works to a publisher. | Author | Publisher located in the taxable territory: Provided that nothing contained in this entry shall apply where, -(i) the author has taken registration under the Central Goods and Services Tax Act, 2017 (12 of 2017), and filed a declaration, in the form at Annexure I, within the time limit prescribed therein, with the jurisdictional CGST or SGST commissioner, as the case may be, that he exercises the option to pay central tax on the service specified in column (2), under forwarding charge in accordance with Section 9 (1) of the Central Goods and Service Tax Act,2017under forward charge, and to comply with all the provisions of Central Goods and Service Tax Act, 2017 (12 of 2017) as they apply to a person liable for paying the tax in relation to the supply of any goods or services or both and that he shall not withdraw the said option within a period of 1 year from the date of exercising such option; (ii) the author makes a declaration, as prescribed in Annexure II on the invoice issued by him in Form GST Inv-I to the publisher. ”; |

Non-taxable Territory

| 13 | Services supplied by a person located in non-taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India. | A person located in non-taxable territory | Importer, as defined in clause (26) of section 2 of the Customs Act, 1962(52 of 1962), is located in the taxable territory. |

Renting Motor vehicle

| 14 | Services provided by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient, provided to a body corporate. | Any person, other than a body corporate who supplies the service to a body corporate and does not issue an invoice charging central tax at the rate of 6 percent to the service recipient. | Any body corporate located in the taxable territory.”. [Ref. Not. 29/2019-CT ( dated 31.12.2019 and Circular F.No 354/189/2019-TRU] |

- Suppliers of service by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient have an option to pay GST either at 5% with limited ITC (of input services in the same line of business) or 12% with full ITC

- Supply, when provided by suppliers paying GST 5% to corporate entities, was placed under RCM w e f 01 10 2019

Ref. Notification No. 29/2019 CT ( dated 31.12.2019 and Circular No. 130/2019 dt.31.12.2019.

Clarificatory amendment applicable w.e.f 01.10.2019

Thus, Reverse charge mechanism shall be applicable on the service by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient only if the supplier fulfills all the following conditions :

- is other than a body corporate

- does not issue an invoice charging GST 12% from the service recipient and

- supplies the service to a body corporate

Lending of Securities

| 15 | Services of lending of securities under Securities Lending Scheme, 1997 (“Scheme”) of Securities and Exchange Board of India (“SEBI”), as amended. | Lender i.e. a person who deposits the securities registered in his name or in the name of any other person duly authorized on his behalf with an approved intermediary for the purpose of lending under the Scheme of SEBI | Borrower i.e. a person who borrows the securities under the Scheme through an approved intermediary of SEBI.”. |

- Notification No. 13/2017- Central Tax (Rate) dt.28.06.2017

- Notification No. 07/2019-Central Tax(Rate) dated: 29.03.2019

- Notification No.22/2019-CentralTax (Rate) date 30.09.2019

- Notification No.29/2019-CentralTax (Rate) date. 31.12.2019

Reverse Charge List of Goods

Here is the list of reverse charge services under GST. The Recipient of these services shall pay the tax on the RCM basis.

| Tariff item, sub-heading,

heading or Chapter | Description of supply of Goods | Supplier of goods | Recipient of supply |

| (1) | (2) | (3) | (4) |

| 0801 | Cashew nuts, not shelled or peeled | Agriculturist | Any registered person |

| 1404 90 10 | Bidi wrapper leaves (tendu) | Agriculturist | Any registered person |

| 2401 | Tobacco leaves | Agriculturist | Any registered person |

| 5004 to 5006 | Silk yarn | Any person who manufactures silk yarn from raw silk or silkworm cocoons for the supply of silk yarn | Any registered person |

| – | Supply of lottery. | State Government, Union Territory, or any local authority | Lottery distributor or selling agent. Explanation.- For the purposes of this entry, lottery distributor or selling agent has the same meaning as assigned to it in clause (c) of Rule 2 of the Lotteries (Regulation) Rules, 2010, made under the provisions of subsection 1 of section 11 of the Lotteries (Regulations) Act, 1998 (17 of 1998). |

Classes of Registered persons

Here is the list of classes of registered persons liable to pay GST on a reverse charge basis as per CGST Section 9(4) from 01.04.2019. Thus, it is applicable to those registered recipients who purchase goods or services or both from an UN-registered person.

In the case of Real Estate

Ref. Notification no. 07/2019-Central Tax(Rate) dt.29.03.2019.

| Category of supply of goods and services | Recipient of goods and services |

| Supply of such goods and services or both [other than services by way of grant of development rights, long term lease of land (against upfront payment in the form of premium, salami, development charges, etc.) or FSI (including additional FSI)] which constitute the shortfall from the minimum value of goods or services or both required to be purchased by a promoter for construction of project, in a financial year (or part of the financial year till the date of issuance of completion certificate or first occupation, whichever is earlier) as prescribed in notification No. 11/ 2017-Central Tax (Rate), dated 28th June 2017, at items (i), (ia), (ib), (ic) and (id)against serial number3in the Table, published in Gazette of India vide G.S.R. No. 690, dated 28th June 2017, as amended. | Promoter. |

| Cement falling in chapter heading 2523 in the first schedule to the Customs Tariff Act, 1975 (51 of 1975)which constitute the shortfall from the minimum value of goods or services or both required to be purchased by a promoter for construction of project, in a financial year (or part of the financial year till the date of issuance of completion certificate or first occupation, whichever is earlier) as prescribed in notification No. 11/ 2017-Central Tax (Rate), dated 28th June 2017, at items (i), (ia), (ib), (ic) and(id) against serial number3in the Table, published in Gazette of India vide G.S.R. No.690, dated28thJune, 2017, as amended. | Promoter. |

| Capital goods falling under any chapter in the first schedule to the Customs Tariff Act, 1975 (51 of 1975)supplied to a promoter for construction of a project on which tax is payable or paid at the rate prescribed for items (i), (ia), (ib), (ic) and (id)against serial number 3 in the Table, in notification No. 11/ 2017-Central Tax (Rate), dated 28th June 2017, published in Gazette of India vide G.S.R. No. 690, dated 28th June 2017, as amended. | Promoter |

Types of Reverse charge Mechanism

There are two types of Reverse charge applicability on the receiver of

1. Supplies Received from Registered person by a registered person – As per section 9(3)

As per the CGST

The receiver need not have to pay tax on all types of goods or services received from the taxable person. He needs to pay the GST only if he receives goods (from the defined category of goods) or services( from the defined category of services).

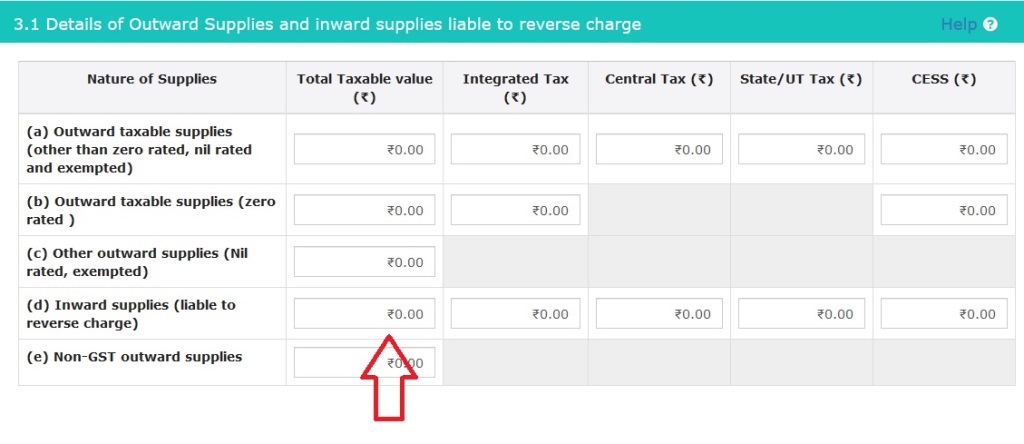

a) Where to show inward supplies received from Registered person in GSTR 3B Return as per reverse charge mechanism?

These types of supplies shall be entered in column “(d) Inward supplies (liable to reverse charge)” under Tile 3.1 – Tax on Outward and Reverse charge inward supplies. (see below)

2. Supplies Received from UN-registered person by a Registered person- As per section 9(4)

As per CGST

a) How to show inward supplies received from Un-Registered person in GSTR 3B Return as per reverse charge mechanism?

These are also to be shown as above.

b) Where to show inward supplies received from Un-Registered person in GSTR 1 Return as per reverse charge mechanism?

All the Inward Supplies from a

Latest update on RCM

The reverse charge mechanism is applicable to the Real estate sector from 01.04.2019 on the basis of a

In this regard, the government has issued notification vide no. 07/2019-Central Tax(Rate) dated 29.03.2019. According to this notification, the promoter will have to pay tax on the reverse charge basis, if he procures material from an UN-registered dealer. This is subject to the below conditions:

- As per Notification no.3/2019 and 7/2019 and Annexure III of 3/2019, The promoter shall make total purchases of at least 80% from a registered dealer. However, it excludes the purchase of capital goods, TDR, FSI, high-speed diesel, electricity, motor spirit, etc.

- Thus, if a promoter procures material less than 80% from a registered person, then he must pay the difference amount on reverse charge basis up to the extent of the shortfall.

- The rate of tax applicable to such shortfall is 18% on goods and services except for cement.

- In the case of Cement purchase, the rate of tax will be 28%.

History of Reverse Charge Mechanism

29.03.2019: Certain category of services notified to be taxed under Reverse Charge Mechanism from 01.04.2019, under section 9(4) i.e purchase from UN-registered person for real estate sector vide notification no. 07/2019-Central Tax(Rate) dt.29.03.2019. Thus, RCM is applicable to the services mentioned in the above notification.

29.01.2019: Cancelled Notification no. 8/2017-Central Tax(Rate) dt.28.06.2017. This has reference to Notification No.01/2019–Central Tax(Rate) date 29.01.2019.

06.08.2018: Further postponed the exemption from 30.9.2018 till 30.09.2019 vide Notification No. 22/2018 – Central Tax (Rate) dt.06.08.2018.

29.06.2018: Further postponed the exemption from 30.6.2018 till 30.09.2018 vide Notification No. 12/2018 – Central Tax (Rate) dt.29.06.2018.

23.03.2018: Further postponed the exemption from 31.3.2018 till 30.06.2018 vide Notification No. 10/2018 – Central Tax (Rate) dt.23.03.2018

13.10.2017: Notification No. 38/2017 –Central Tax (Rate) date: 13.10.2017 has been issued to postpone the exemption of RCM as per subsection 9(4) till 31.03.2018. Thus, no need to pay RCM from 13.10.2017 till 31.03.2018 irrespective of inward supplies received from the unregistered persons. However, this exemption will not apply to govt. entities who deduct TDS.

28.06.2017: notification issued saying that exemption to RCM under section 9(4) is applicable only to the recipient of goods or services or both where the aggregate value is less than 5 thousand rupees per day.

Thus, All those who are receiving goods or services or both, receive RCM supplies of more than 5 thousand rupees shall pay tax under RCM. It is to be noted that the value is to be accounted, for any or all of the suppliers for such receipts per day. This has reference to Notification No.8/2017-Central Tax(Rate) dt.28.06.2017.

Initial Implementation

28.06.2019: Section 9 with sub-section 3 & 4 brought into force from 01.07.2019 vide Notification No. 9/2017 –Central Ta dt.28.06.2017. Thus, subsection 3 deals with the receipt of supplies from Registered persons. Whereas subsection 4 deals with receipt from the un-registered person.

Capital Goods purchase for Real Estate

The criteria of 80% of purchases are not applicable to the purchase of capital goods. Thus, 100

However, if the promoter purchases from an unregistered dealer then he shall pay the entire tax on a reverse charge basis.

How to report Purchases from unregistered person attracting RCM?

All the purchases from an unregistered person, which are subject to reverse charge, for which the recipient’s issues a tax invoice are to be reported in GSTR-2 (and not in GSTR-1).

Frequently Asked Questions

The recipient of goods or services is liable to pay tax under RCM.

The recipient shall not report such inward receipts in GSTR 1 Return, where he raises a self invoice and pay tax as per reverse charge mechanism. He needs to show such entries in GSTR 2 return.

The

One shall report such ITC of Revere charge in Table 4 of GSTR 3B.

A Recipient of goods or services shall avail Input tax credit on the basis of self invoices raised by himself under revere charge.

The Self invoice shall be prepared as per the standard GST Invoice format.https://gstindianews.info/gst-tax-invoice-free-download/