The GSTR 2 return is no longer available for filing on the GST portal. The GST council has canceled this return long back. Therefore, taxpayers are not required to file this return. However, you can see the past format and details to file in this section.

Instructions –

1. Terms used:

a. GSTIN: Goods and Services Tax Identification Number

b. UIN: Unique Identity Number

c. UQC: Unit Quantity Code

d. HSN: Harmonized System of Nomenclature

e. POS: Place of Supply (Respective State)

f. B to B: From one registered person to another registered person

g. B to C: From registered person to unregistered person

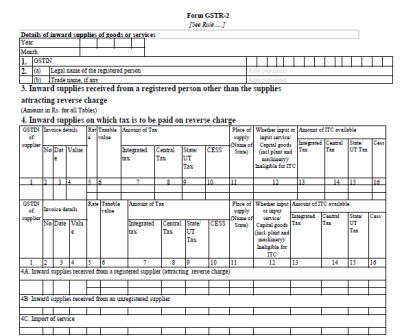

2. Table 3& 4 to capture information of:

(i) Invoice-level inward supply information, rate-wise, pertaining to the tax period reported by supplier in GSTR-1 to be made available in GSTR-2 based on auto-populated details received in GSTR-2A;

(ii) Table 3 to capture inward supplies other than those attracting reverse charge and Table 4 to capture inward supplies attracting reverse charge;

(iii) The recipient taxpayer has the following option to act on the auto populated information:

a. Accept,

b. Reject,

c. Modify (if information provided by supplier is incorrect), or

d. Keep the transaction pending for action (if goods or services have not been received)

(iv) After taking the action, recipient taxpayer will have to mention whether he is eligible to avail credit or not and if he is eligible to avail credit, then the amount of eligible credit against the tax mentioned in the invoice needs to be filed;

(v) The recipient taxpayer can also add invoices (not uploaded by the counterparty supplier) if he is in possession of invoices and have received the goods or services;

(vi) Table 4A to be auto populated;

(vii) In case of invoices added by recipient tax payer, Place of Supply (PoS) to be captured always except in case of supplies received from registered person, where it is required only if the same is different from the location of the recipient;

(viii) Recipient will have the option to accept invoices auto populated as well as add invoices, pertaining to reverse charge only when the time of supply arises in terms of section 12 or 13 of the Act; and

(ix) Recipient tax payer is required to declare in Column No. 12 whether the inward supplies

are inputs or input services or capital goods (including plant and machinery).

3. Details relating to import of Goods/Capital Goods from outside India as well as supplied by an

SEZ Unit to be reported rate-wise by recipient tax payer in Table 5.

4. Recipient to provide for Bill of Entry information including six digits port code and seven digits bill of entry number.

5. Taxable Value in Table 5 means assessable value for customs purposes on which IGST is computed (IGST is levied on value plus specified customs duties). In case of imports, the GSTIN would be of recipient tax payer.

6. Table 6 to capture amendment of information, rate-wise, provided in earlier tax periods in Table 3, 4 and 5 as well as original/ amended information of debit or credit note. GSTIN not to be provided in case of export transactions.

7. Table 7 captures information on a gross value level.

8. An option similar to Table 3 is not available in case of Table 8 and the credit as distributed by ISD (whether eligible or ineligible) will be made available to the recipient unit and it will be required to re-determine the eligibility as well as the amount eligible as ITC.

9. TDS and TCS credit would be auto-populated in Table 9. Sales return and Net value columns are not applicable in case of tax deducted at source in Table 9.

10. The eligible credit from Table 3, Table 4 & Table 8 relating to inward supplies to be populated in the Electronic Credit Ledger on submission of its return in Form GSTR-3.

11. Recipient can claim less ITC on an invoice depending on its use i.e. whether for business purpose or non-business purpose.

12. Information of advance paid pertaining to reverse charge supplies and the tax paid on it including adjustments against invoices issued should be reported in Table 10.

13. Table 12 to capture additional liability due to mismatch as well as reduction in output liability due to rectification of mismatch on account of filing of GSTR-3 of the immediately preceding tax period.

14. Reporting criteria of HSN will be same as reported in GSTR-1.

FAQ on GSTR 2

Question 1. Can I Keep Invoices pending added by Supplier in GSTR 2 return ?

- Click the Supplier’s GSTIN link under Supplier Details column and you will see a list of invoice line items under the “Uploaded by Supplier” tab.

- Select the checkbox for the invoice and click the PENDING button.

- A success message is displayed that the invoice is in pending state and status changes to “PENDING”. You can take action on this invoice in next tax periods.

Question 2: What has to be fed in table 3,4A of GSTR – 2 return?

Table 3,4A of GSTR 2 is kept to add/edit details of inward supplies from registered person including supplies attracting reverse charge received from such registered persons.

You can either edit, accept, delete or keep the invoices in pending state, which are added by the supplier.

Question 3: How to Modify Invoices added by Supplier in GSTR 2 return?

- Click the Supplier’s GSTIN link under Supplier Details column and you will see a list of invoice line items under the “Uploaded by Supplier” tab.

- Click the Edit button at the end of right hand side corner.

- Edit the invoice details and click the SAVE button. You would be able to edit Total invoice value, Taxable value for various tax rates and ITC eligibility and amount. You cannot modify other details as the recipient of invoice. In case, other filled fields need change, you can reject the invoice and ask supplier to do the amendment in the said invoice.

Question 4: How to Reject Invoices added by Supplier in GSTR 2 return?

- Click the Supplier’s GSTIN link under Supplier Details column and you will see a list of invoice line items under the “Uploaded by Supplier” tab.

- Select the checkbox for the invoice and click the REJECT button.

- A success message is displayed that the invoice is rejected and status changes to “REJECTED”. Please note that Your rejection shall be communicated to supplier through GSTR-1/1A for acceptance/rejection upon filing of GSTR-2.

Question 5: What is the definition of inward supplies under GST?

The inward supplies include all inward supplies of goods and/ or services, including inward supplies of services and goods on which the tax is payable on reverse charge basis