The Central Board of Indirect and Direct Taxes issued a long waited notification regarding Interest payment. The taxpayer needs to pay the interest @ 18% on delayed payment of GST. However, most often it was argued that whether the taxpayer needs to pay the interest on gross liability or on net tax liability.

The gross tax liability is an liability, which is payable without deducting input tax credit. where as net tax liability is to be paid after reducing available input tax credit.

In this regard, the 39th GST Council meeting decided to charge interest on net tax liability w.e.f 01.07.2017. Thus, the 1st provision was inserted in subsection 1 of section 50 of CGST ACT 2017. The said provision was not implemented immediately.

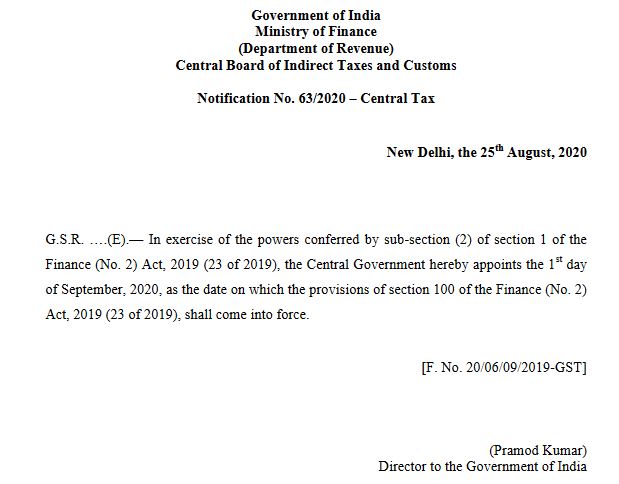

However, now this provision has come into force w.e.f from 01.09.2020 only, vide Notification No. 63/2020–Central Tax dt.25.08.2020. Therefore, according to the notification, the interest on net tax liability will be applicable only w.e.f 01st September 2020. Similarly, for the past period, i.e from 01.07.2017 till 31st August 2020 the interest is applicable to the gross tax liability.

Looking at the negative reactions on the twitter handle, the CBIC issued a press release on 26.08.2020 stating the recoveries of the past period will not be made. Here is the notification and press release issued in this regard.

Therefore, the taxpayers are now worried that they will still get the notices for the past period as the press release does not give the instructions to the officers to do so. Here are some of the tweeter reactions to the government’s decision.