In the modern fast running world, the Mobile phone plays a very important role in everyone’s life. Thus, this device is used by millions of people for personal and business use. Hence, it becomes very important to know the mobile bills & rate of GST on the mobile phone. Thus, the more the GST tax, the more the price of phone & accessories.

Rate of GST On Mobile Phone

Prior to March 2020, the rate of GST on mobile phones was 12%. However, from April 1, 2020, the GST on mobile phones has been increased to 18%. Thus, if your mobile phone’s basic price is Rs. 10,000/-, you have to pay Rs. 1800/- as a GST Tax. Thus the final amount of your phone becomes Rs. 11800/-

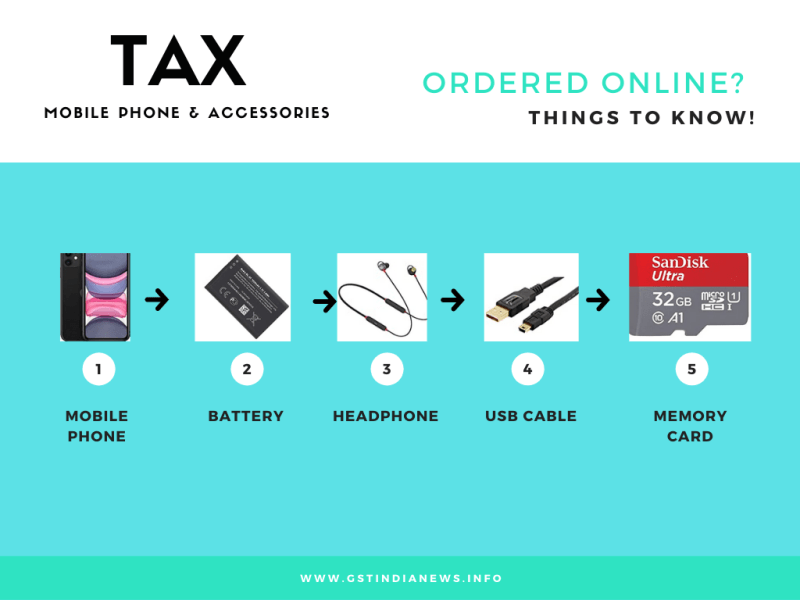

GST on Mobile Accessories

The mobile phone comes with various accessories like an electrical charger, Earphone, battery, and other spare parts. Thus, the GST on mobile accessories also now comes under 18% GST bracket. Hence, if you buy a mobile accessory from your local shop they will charge you CGST 9% + SGST 9%. Similarly, if you buy it through online stores like Amazon they will charge IGST @18%.

Read about T Mobile Esim Service

Mobile Recharge and Bills

The GST on mobile recharge is 18%. This is applicable even for postpaid mobile bills you receive from VI, BSNL, Reliance, etc. Therefore, your get your recharge value after deducting 18% GST from the total recharge amount.

Input Tax Credit

Is input tax credit on mobile phones eligible? People ask this question frequently especially the business stakeholders. There is no straight answer to this question. Let us understand this in detail.

According to the GST ACT, an input tax credit is available on, anything that used for the furtherance of business. That means if you are buying the mobile phone for a business purpose then the input tax credit is allowable.

In order to get the benefit of the input tax credit on such mobile phone, you need to have a valid GST invoice with Tax breakup.

Read more about GST Invoice Rules

If you are buying any phone or accessory and if you do not have a valid B2B invoice, the ITC is not allowable. Many times businesses people purchase mobile phones online through the e-commerce portal. Recently we noticed that Amazon is selling mobile phones with no ITC availability.

How to identify a product with a GST Invoice from Amazon?

Here is how to identify the product you want to purchase from Amazon with GST Invoice. Amazon does not issue a GST invoice for every purchase you make. Hence, Identify the GST invoice through the below steps.

- Select the GST invoice under Invoice in the search filter menu, when viewing search results.

- you can find GST inclusive and exclusive prices on the product detail page.

- If GST credit is unavailable for your product you will see “GST credit not available.”

- The Products which have GST invoice and GST credit available will see a GST invoice badge. It is visible next to the seller name on the product detail page, and also on the offer listings page.

Frequently Asked Questions

18% GST

18%

Yes, if you have valid GST Invoice and purchased for business purpose.

18%

18%.