Many times the customer asks for a Proforma Invoice(PI) for making advance payment to the supplier. Thus, it is a document prepared by the supplier on his customer, specifying the goods/services details with the amount to be paid to the supplier. Therefore, here you can download the proforma invoice format in excel and word.

Further, the PI is similar to the General Invoice. However, it is not the final invoice as per the Taxation rules. For eg. in GST, you need to prepare a final invoice when you supply the goods or services or both. However, you can send a PI in advance to receive the payment from the customer. Thereafter, you can make a final GST Invoice and send it to the customer.

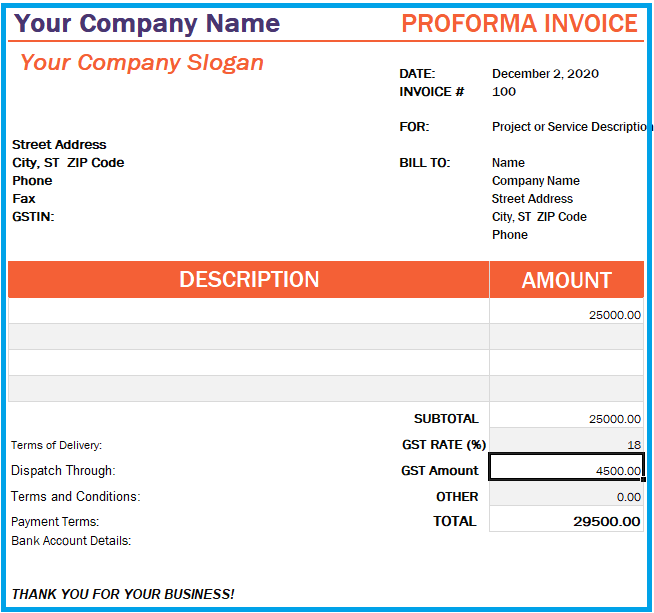

Proforma Invoice format In Excel

Here is the proforma invoice format in an excel file. You can use the default format and fill in your details and forward it to the customer. On the other hand, you may customize this invoice completely as per your requirements.

Proforma Invoice format in Word

As like excel format, you can also download the proforma invoice format in a word file. Also, you can use this template to edit in Microsoft word software. Thus, you can fill in your invoice details and send the document via email for getting the payments from your customer.

Download in PDF Format

Similar to excel and word formats you can download the pdf format of the PI from the below option. However, you may not able to edit the pdf template. Hence, we request you to either download the excel or word template to make the changes in the below format.

How to make Proforma Invoice in Tally?

Time needed: 5 minutes

Step by step Process

- Click on “Order Voucher” from the Gateway of Tally

- Click on “Sales order” from the left menu

- Enter the customer and item details

- Save the Voucher

- Click on “Print” button

- Click on “Configure” or press F12 key

- Change the Tile of Document as “Proforma Invoice”

- Now you can print the Voucher as Proforma Invoice.

Follow the same process to export/email the voucher directly from the tally software.

What is the difference between PI and invoice?

The supplier prepares the PI to receive the payment in advance. For eg., the supplier may agree to ship the material only after receipt of payment in advance from the customer. Since this is a two-way transaction, it is better to make the documentation like PI for sending the payment request and accepting the same.

Whereas, the supplier prepares the Invoice at the time of supplying the material or goods. Thus, the Invoice is the final document prepared by the supplier for his customer to receive the entire invoice amount.

Change in GST Rate after Receiving Payment in Advance

If there is an increase in the Tax Rate after receipt of Advance, against the PI, then the same can be included while preparing the final invoice.

Proforma Invoice vs Quotation

The supplier sends the PI for advance payment. Whereas he sends the quotation to offer the prices of various items/services to the customer.

Frequently Asked Questions

You can create a voucher in SAP as a PI and send it to the customer for asking advance payment.

The customer requires a document against which he can make payment to the supplier in advance.

Yes, you can issue a PI with GST to the customer.

Yes, it can be served as a legal document.