In order to make the process easy GST Return filing and user-friendly, the Government of India has provided an online portal for every taxpayer. The official GST portal simplifies the process, but you need to register your company under this system. Below are the simple steps, through which you can check your GST registration status.

You can proceed with the online application and complete the registration online. Once done, it takes 10-15 days to register your online application. In the meantime, you can check the status of GST registration using your Application Reference Number (ARN) on the GST official portal.

How to check the GST registration status?

Time needed: 2 minutes

- Go to the GST official portal at https://www.gst.gov.in/

- Now, proceed to the “Services” >> “Registration”

- Click on the “Registration” to get below 3 options:

“New Registration”, “Track Application Status”, and “Application for Filing Clarifications”

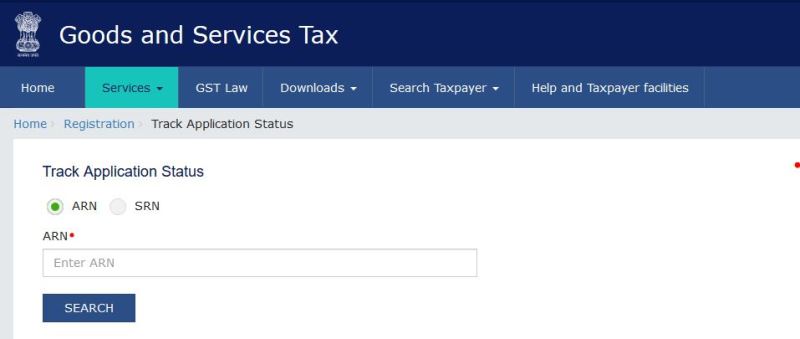

- Click “Track Application Status” and enter your ARN number in the given space

- Type the captcha code in the next step and click on the “search” button.

If you enter the right ARN code without any spaces or any other typo error, within seconds you will receive your online GST registration status on the screen.

GST registration status pending

See the solution, If you see the GST registration status pending for processing ever after 15 days. The applicant sees this error after filing an application for core amendment.

Since the application is for core amendment, it requires the approval of the Jurisdictional Officer. Thus, If the application has not been disposed of even after 15 working days, kindly contact your Jurisdictional Officer. This may be applicable in the case of the new GST registration application. You can search the details of the Jurisdictional Officer by clicking on Dash board> Services> User Services > Contact.

What is pending clarification in GST?

The applicant will see the application status as Pending for Clarification. This happens when the notice for seeking additional clarification is issued by the Tax Officer. Therefore, the applicant shall read the notice and upload the clarification for the raised issues.

Frequently Asked Questions

The status shows whether the GST registration is Active or canceled. Also, the status can be pending for processing, if the registration is new.

Go to www.gst.gov.in > Click on search taxpayer > Search by entering the GST or PAN number of other parties.

You can use third-party tools to search the status by name.

It means the GST registration is canceled for the given GST number.

The GST registration status can be checked by any person who has internet connectivity. It does not require a login to the GST portal.