The Central Board of Direct Taxes(CBDT), is going to validate UDIN with ICAI while submitting the Tax Audit Report. In this regard, the board issued a press release on 26th November 2020. Thus, quoting UDIN for chartered accountants becomes compulsory.

Further, it said the Chartered Accountants of India have made it mandatory to generate UDIN for every type of certificate/tax audit report. Also, applicable for other attestations made by ICAI members from the ICAI website i.e www.icai.org. This has reference to their Gazette Notification dated August 2, 2019.

Importance of UDIN verification

The above process was introduced to identify non-CAs and the issuance of fake certificates by such Chartered Accountants. In this regard, the Income Tax e-Filing Portal completes its integration with the ICAI portal for the validation of UDIN generation. Thus, it will now validate the Certified/attested Documents issued by the Chartered Accountants.

Earlier, in this regard, the Income Tax e-Filing Portal made it compulsory to quote UDIN from 27th April 2020. This includes certified/attested documents as per the Income Tax Act 1961.

Therefore, the board says the verification process on the ICAI portal will remove fake or inaccurate tax audit reports.

Tax Audit Report Submission without UDIN

The board also clarifies that, If the Chartered Accountant is not able to generate UDIN while submitting the audit report/certificate, then the Income-tax e-filing portal will permit them to submit such reports. However, they need to update the UDIN within 15 days for such submission. If they do not update the UDIN, the submission of such a tax audit report/certificate will be invalid.

Frequently Asked Questions

Unique Document Identification Number

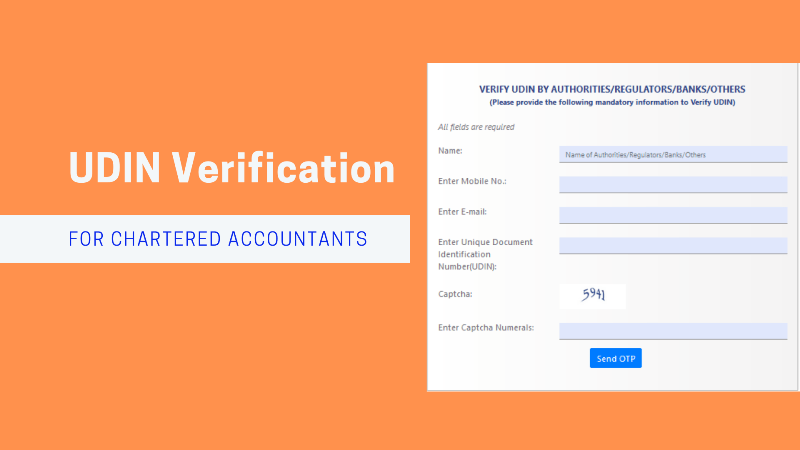

Visit https://udin.icai.org/search-udin >> Fill in the details >> Click on the “send OTP” button.

Within 15 days from the date of submission of the Tax audit report.

From 1st July 2019.

UDIN can be revoked at any time, after mentioning the reason for justification for such revocation.