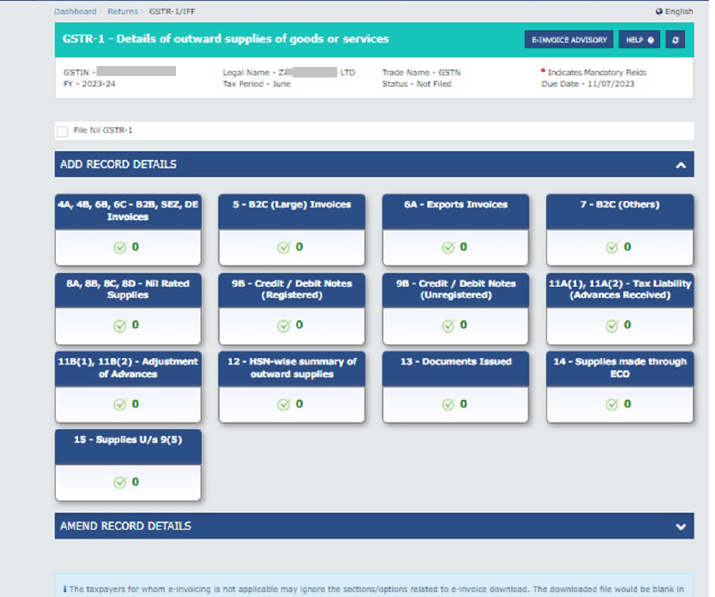

Table 14 and 15 Introduction in GSTR 1- IFF : Filing for 2024

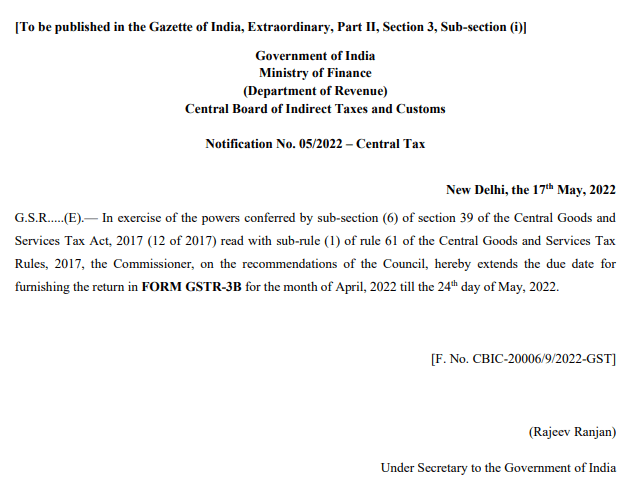

The CBIC has introduced the table 14 and 15 for Ecommerce operators or those who are liable to pay tax under Section 9(5) of the GST Act in GSTR 1. So, as per Notification No. 26/2022 – Central Tax dated 26th December 2022 two new tables Table 14 and Table 15 were added in GSTR-1 […]

Continue Reading