The CBIC has extended the period until 31.01.2024 for reporting the opening balance of ITC reversal. Therefore, In order to facilitate the taxpayers in correct and accurate reporting of ITC reversal and reclaim thereof and to avoid clerical mistakes, a new ledger namely Electronic Credit and Re-claimed Statement was introduced on the GST portal.

This statement was made available to help the taxpayers in tracking their ITC that has been reversed in Table 4B(2) and thereafter re-claimed in Table 4D(1) and 4A(5). Kindly click here for the detailed advisory provided earlier.

Now to facilitate taxpayers further, opportunity to declare opening balance for ITC reversal in the statement has been extended till 31st January, 2024.

Kindly note that after declaring the opening balance for ITC reversal, only three amendment opportunities post the declaration will be provided to correct declared opening balance in case of any mistakes or inaccuracies in reporting.

Facility to amend declared opening balance for ITC reversal will be available till 29th February, 2024.

Reporting Cumulative Opening Balance of ITC Reg

Through CBIC Notification number 14/2022, dated July 5, 2022, amendments were introduced to the GSTR-3B return format and notable changes have been made to Table 4.

An Advisory was issued to all taxpayer with an Obligation to Report Cumulative Opening Balances i.e., Report cumulative ITC that has been reversed earlier and has not yet been reclaimed as of specified date as opening balance in ECRRS. (Electronic Credit Reversal and Re-claimed Statement”) within the provided time limit up to 30.11.2023 only.

Thus, the Department did received several trade representations to reopen the option to enter the cumulative opening balance, accordingly one more opportunity was provided for very limited period (might be four to five days) and any reclaim at later date will not be allowed.

On this background, if you have not reported the opening balance earlier, you are hereby intimated to keep ready the cumulative opening balance (since JULY-2017) amount to be reported and advised to report the opening balance of reclaimable ITC immediately as and when enabled.

Therefore, the facility is now enabled and the option of facility to report in OB in Electronic Credit reversal re-claim statement is now open. It will remain open till 31/12/2023 only. You are hereby informed to start correcting OB entry as detailed below.

Action Required from Taxpayers

- Reconcile between GSTR 3B vs GSTR 2B vs Books

- List out the ITC Reversals reported in GSTR 3B as of specified return period.

- Identify the reclaimable ITC as of 01-August-2023.

- Reconcile with GSTR 2B and books.

- Make sure reclaimable ITC is eligible to claim as on reporting date.

Where there is ineligible ITC, it is to be reversed in 4B (1)

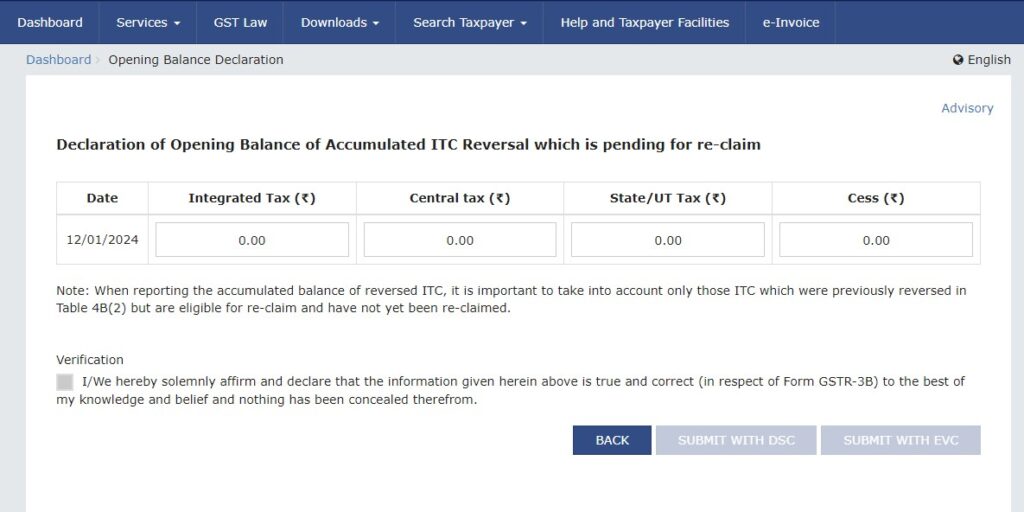

Navigation path at GST portal to report ITC reversal balance:

Dashboard >> Services >>Ledger >>Electronic Credit Reversal and Re-claimed Statement.

The opening balance that has been reported or amended by the taxpayers shall be credited to the “Electronic Credit Reversal and Re-claimed Statement”.

This statement will be used to validate the taxpayer’s ITC Re- claimed amount in Table 4A (5) & 4D (1) of form GSTR-3B.

Where there is ineligible ITC, it is to be reversed in 4B (1)